Bag in Box Market Size (2024 – 2030)

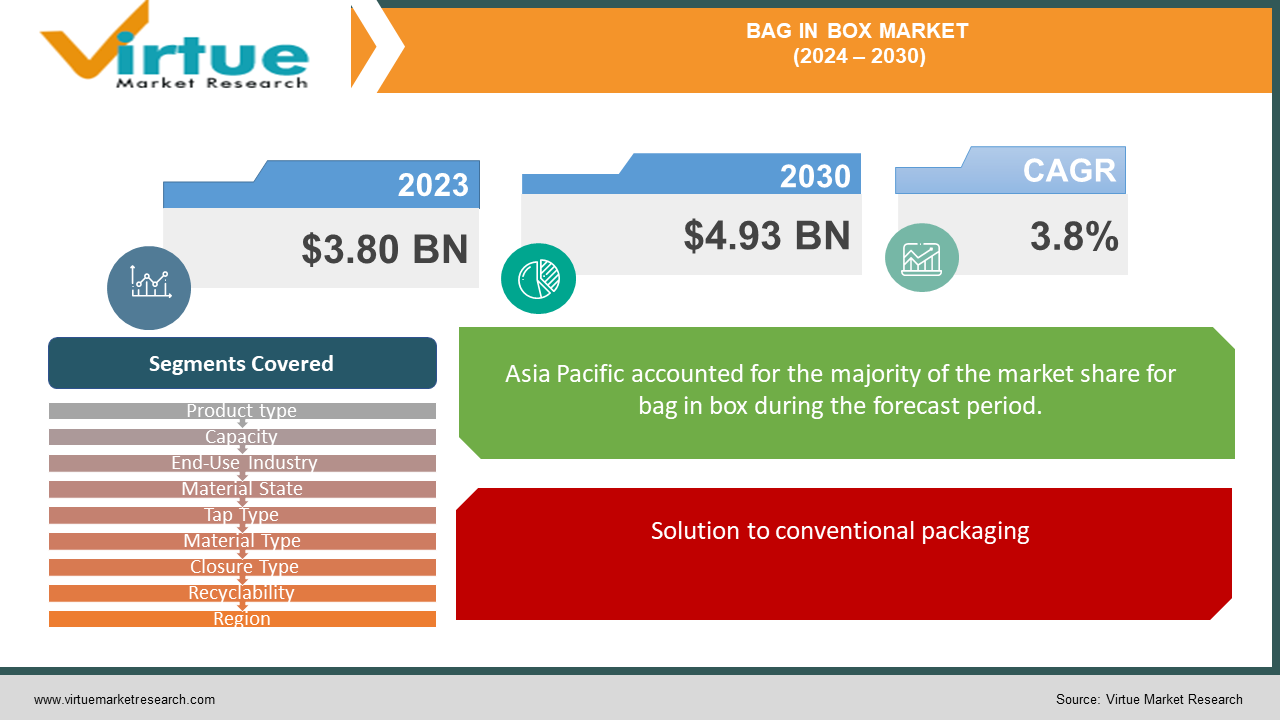

The Global Bag in Box Market was valued at USD 3.80 billion in 2023 and is projected to reach a market size of USD 4.93 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 3.8%.

Bag-in-Box containers are convenient packaging solutions that are utilized for packaging diverse commodities like food & beverages, and household and industrial liquid products. Bag-in-box containers offer additional protection during transportation and can hold and package liquids efficiently. It is light in weight and aids in lowering space during the process of storage and transportation. The demand for personalized packaging is enhancing owing to the production of novel and variety of products. Additionally, the rising trend of the use of high-quality and attractive printed packs to hold the attention of individuals has resulted in the development of the bag-in-box container market.

Key Market Insights:

-

The quality standard for food packaging in numerous nations to prevent contamination and extend the freshness of products is to propel the sales of bag-in-box containers. Enhanced demand for high-quality and bio-degradable packaging is further directing the market. Manufacturers are also emphasising intelligent packaging to stay competitive in the market.

-

Bag-in-box containers generate eight times less carbon dioxide during production than traditional types of packaging. The market for bags in boxes has strengthened as an impact of rising awareness about carbon emissions, which is supporting the usage of eco-friendly and green products. To influence production efficiency, winemakers are looking into the latest technology.

-

The substances called mineral oil aromatic hydrocarbons (MOAH) come in touch with packaged foods. As per the European Food Safety Authority, MOAH is carcinogenic (EFSA). Bag-in-box producers are initiating multilayer technology into their product portfolio to curb contamination by MOAH. Bag-in-Box is produced by a high-grade material that aids in maintaining and protecting the product's quality while not affecting the product's content.

Global Bag in Box Market Drivers:

Solution to conventional packaging

The bag-in-box packaging system was created as a restructured answer to the difficulties of packaging paste-textured and liquid food items like water, wine, sauce, syrup, juice, fats, purees, and oils. The global packaging sector has had a significant part to play in ecological remediation achievements, especially since the emergence of the E-Commerce industry. With customers and governing authorities asserting the requirement for environmentally sustainable and harmless packaging, a growing amount of packaging businesses are getting into revolutionizing types and materials of eco-friendly packaging.

Enhanced Demand for eco-friendly packaging

Packaging strengthens the product's lifetime and betters its shelf existence in addition to keeping it secure during transportation. As it is an eco-friendly packaging method that requires less plastic and more paperboard, which is readily recyclable, bag-in-box technology has earned popularity in the industry. Moreover, as it is majorly flat packaging, it takes up less room than a bottle and is hence simpler to transport. In addition, it can be utilized for packing a variety of dry and liquid products across the market, consisting of products for storing chemicals, motor oil, lubricants, wine, juices, and other fluid consumer products. For example, in May 2021, New SIOC (Ships-In-Own-Container) permitted bag-in-box packaging for liquid items was unveiled by Scholle IPN, a provider of bag-in-box and other packaging solutions. As per the coherent market insights, up to 75% more energy overall and up to 67% of carbon emissions could be preserved by this packaging.

Global Bag-in-Box Market Restraints and Challenges:

Growing consciousness about Plastic usage

Enhancing awareness about the side effects caused by plastic waste, consumers are turning to eco-friendly packaging materials. Bio-plastics are getting major attention and popularity in the industry. With increased research and development, bio-plastics are more certain to replace traditional plastic materials. Though most of the bag-in-box containers are produced of recyclable plastic materials, most of them end up being incinerated and discarded. According to the World Economic Forum, roughly only 9% of the plastic has been recycled to date of the total plastic produced to date from the 1950s.

Expensive bag-in-box and Availability of substitute

The high price of bag-in-box packaging solutions compared to traditional packaging choices is expected to lower the demand for bag-in-box, in turn, is anticipated to hinder the market development over the future period. This element is estimated to detriment the adoption of bag-in-box across numerous industrial applications and additionally restrict the market development during the future period. The escalating usage of plastic containers in the packaging of soft drinks owing to budget-friendly is expected to restrain the market strengthening of bag-in-box. Additionally, instability in the supply of raw materials that are utilized to produce bag-in-box containers is further extended to drive the market growth over the estimated period.

Global Bag-in-Box Market Opportunities:

Emerging innovations in the Food and Beverage industry

Being the largest consumer of Bag-in-box containers, the Food & Beverage industry propels the market. These containers offer a variety of advantages to the packaged item that has enhanced its consumption. Heightened shelf life, meager or zero contamination, inertness, and top mechanical strength, etc. are some of the advantages provided by bag-in-box containers that make them popular options for packaging in the food & beverage industry. In the wine industry, the bog-in-box containers have earned major traction and are anticipated to generate lucrative growth opportunities for the producers. Restaurants, hotels, and catering services choose it due to ease of managing and storage along with the saving of the original flavor.

BAG IN BOX MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.8% |

|

Segments Covered |

By Product type, Capacity, End-Use Industry, Material State, Tap Type, Material Type, Closure Type, Recyclability, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Smurfit Kappa Group, Liqui-Box Corporation, DS Smith, Scholle IPN, Amcor Ltd, Optopack Ltd., Vine Valley Ventures LLC, Parish Manufacturing Inc., CDF Corporation, Arlington Packaging (Riverside Paper Co. Inc.) |

Global Bag in Box Market Segmentation: By Product Type

-

Flexible Plastic Bags

-

Corrugated Cardboard Boxes

-

Metalized Films

-

Laminated Films

Based on Product Type, the Flexible Plastic Bags segment is predicted to hold a dominant share during the forecast period, 2024-2030. Flexible plastic packaging is defined as plastics that one can easily scrunch up into a ball owing to its flexible nature. Grocery and bread bags, snack wrappers, netted produce bags, and zipper-lock pouches are the typical items. When flexible plastic packaging is put in the curbside recycling tote, it wires itself inside the equipment resulting in shut-downs and expensive delays at the sorting facility. These materials also mix with numerous recyclable commodities which can harm the quality of recycled items.

Global Bag in Box Market Segmentation: By Capacity

-

Less than 1 litre

-

1 to 5 litres

-

6 to 10 litres

-

11 to 20 litres

-

51 to 100 litres

-

101 to 200 litres

-

201 to 300 litres

-

More than 300 litres

Based on Capacity, the 5-10 liters segment is expected to hold a dominant share during the future period. Beverage producers, food service providers, and quick-service restaurants have all installed 5-litre bag-in-boxes in dispensing systems, aiding in directing the segment's rapid expansion. The 1-litre segment is anticipated to develop at the quickest CAGR during the estimated period owing to the rise of this container for packaging wines and juices for consumer use.

Global Bag in Box Market Segmentation: By End-Use Industry

-

Food & Beverages

-

Industrial Liquids

-

Pharmaceuticals

-

Cosmetics and Personal Care

-

Others

Based on End-Use, the Food & Beverage market sector is expected to account for the greatest share throughout the forecasted period. The demand for food & beverage bag-in-box (BiB) packaging will reach the skies in the upcoming years. Manufacturers require smart bag-in-box packaging and addressing concerns to meet food industry demand. These containers minimize the carbon footprint of packaging by eight times in comparison to glass bottles. Additionally, these containers utilise 85% less plastic than inflexible containers. These forces also contribute to the market development.

Global Bag in Box Market Segmentation: By Material State

-

Semi-Liquid

-

Liquid

Semi-Liquid state products are dominating the market with them including industrial commodities such as industrial fluids and petroleum products. Moreover, household cleaners, liquid detergents, dairy products, and other items are also covered in the semi-liquid state. The semi-liquid state materials in industrial applications have a greater shelf life in comparison to liquid state products, therefore, the prior is estimated to dominate the market over the future years.

Global Bag in Box Market Segmentation: By Tap Type

-

Tap

-

Without Tap

The With-tap segment is estimated to hold a bigger market share, its usability in the Beverage industry. The Beverage segment is estimated to grow based on the ready-to-consumer rages like wines and others. Furthermore, the With-tap segment also observes use in the industrial segment for industrial liquids packaging and petroleum items packaging. Since the with-tap segment provides better properties in terms of usage across different points in the production line.

Global Bag in Box Market Segmentation: By Material Type

-

Low-Density Polyethylene (LDPE)

-

Ethylene Vinyl Alcohol (EVOH)

-

Polypropylene

-

Nylon

The ethylene vinyl alcohol segment of the market is estimated to observe stable sales in years to come on account of accelerating demand for wine worldwide. Escalating wine demand contributed to an upsurge in the number of restaurants coupled with urbanization are together pushing the development of the market.

Global Bag in Box Market Segmentation: By Closure Type

-

Twist Cap

-

Screw Cap

A Screw closure is a mechanical cap which is screwed on and off of a "finish" on any container. Either continuous threads or lugs are utilised. It must be engineered to be budget-friendly, to offer an effective seal (and barrier), to be suitable with the contents, to be easily opened by the customer, often to be re-closable, and to align with product, package, and environmental laws and regulations. Some closures require to be tamper-resistant and have child-resistant packaging properties.

Twist Cap also called crown cap is mainly applied in the United States, Canada, and Australia. This cap is pressed around screw threads instead of a flange and can be taken off by twisting the cap by hand, ignoring the need for an opener.

Global Bag in Box Market Segmentation: By Recyclability

-

Recyclable

-

Non-Recyclable

It is common nowadays to think about the circular economy, environmentally friendly, biodegradable and compostable packaging, sustainability, and so on, as consumers are gaining awareness. Indeed, this was a much-required and expected discussion in the packaging sector, particularly plastics. All these topics were ignored in the last 10-20 years, while in reality, one truly needs to dedicate the energy to finding packaging products, solutions, and materials that will lower packaging waste, reduce food waste, and better recycling rates. Therefore, Companies are coming up with various innovative Recyclable bags in Boxes.

Global Bag in Box Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia Pacific region is anticipated to lead the bag-in-box container market throughout the forecasted period. The food industry in the Asia Pacific region is huge, and it is thus a pivotal component of the region's economic strengthening possibilities. As the population of the region and disposable income are enhancing, the food & beverage industry will finally rise in the future years, therefore adding to the accelerating demand of the market.

North America is estimated to develop at an essential rate during the forecasted period. Heightening population and per capita income, as well as modifying lifestyles, are the key causes pushing the region's beverage sector expansion. Hence, with the widening end-use industry in the region, the requirement for the bag-in-box container market is estimated to grow.

COVID-19 Impact Analysis on the Global Bag in Box Market:

However, the COVID-19 epidemic has resulted in an international slowdown in the engineering, processing, and manufacture of plastics. This has been rooted in a drop in manufacturing of bag-in-box containers globally. Also, cost savings are not associated with only material as it also relies on the producing line in protecting expensive floor space, and plummeting capital deployment plus associated operations and maintenance costs. Stand-up pouches are introduced to the market as an alternative to bag-in-box, with the assistance of single VFFS machines that use minimal space on the manufacturing floor compared to the usual bag-in-box line.

Latest Trends:

-

Enhancing health consciousness is pushing demand for sanitary food and packaging solutions. The Food and Drug Administration has set stringent restrictions on packaging materials and modern food technologies with protection standards.

-

The consumption of alcoholic drinks globally is growing due to enhanced preferences for bag-in-box packaging. Producers emphasise the high-oxygen barrier and flexibility bags that can save the flavors of beverages for numerous months. Furthermore, heightened demand for surface cleansers and perfumes also propels sales.

-

Primary companies are enhancing their presence in new markets across the world. Producers are increasingly collaborating with retailers to better brand insights. Moreover, the launch of new bag-in-box designs, like pouches and combined taps, is enhancing due to the growing demand for portable packaging solutions globally.

-

The enhancing need for cost efficiency among consumers worldwide is one of the major trends in the market. It is becoming more famous for packaging liquid food products like soups, sauces, and oils, as well as non-food products like personal care items and household chemicals.

-

The manufacturers are increasingly stressing developments that offer precise offerings while recycling waste material. The industrial chemical sector is also estimated to be dedicated to market widening.

Key Players:

-

Smurfit Kappa Group

-

Liqui-Box Corporation

-

DS Smith

-

Scholle IPN

-

Amcor Ltd

-

Optopack Ltd.

-

Vine Valley Ventures LLC

-

Parish Manufacturing Inc.

-

CDF Corporation

-

Arlington Packaging (Riverside Paper Co. Inc.)

Recent Developments

-

In 2023, Smurfit Kappa Group introduced the latest recyclable bag-in-box. The specialty of this product is that it is made up of 53% recycled and renewable resources.

-

In 2022, Spadel and DS launched a 5-litre package in an octagonal shape with space for 5 litres of liquid. It constitutes flexible plastic bags and cardboard.

Chapter 1. Bag in Box Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bag in Box Market – Executive Summary

2.1 Market Size & Forecast – (2024– 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bag in Box Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bag in Box Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bag in Box Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bag in Box Market – By Product Type

6.1 Introduction/Key Findings

6.2 Flexible Plastic Bags

6.3 Corrugated Cardboard Boxes

6.4 Metalized Films

6.5 Laminated Films

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Bag in Box Market – By Capacity

7.1 Introduction/Key Findings

7.2 Less than 1 litre

7.3 1 to 5 litres

7.4 6 to 10 litres

7.5 11 to 20 litres

7.6 51 to 100 litres

7.7 101 to 200 litres

7.8 201 to 300 litres

7.9 More than 300 litres

7.10 Y-O-Y Growth trend Analysis By Capacity

7.11 Absolute $ Opportunity Analysis By Capacity, 2024-2030

Chapter 8. Bag in Box Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Food & Beverages

8.3 Industrial Liquids

8.4 Pharmaceuticals

8.5 Cosmetics and Personal Care

8.6 Others

8.7 Y-O-Y Growth trend Analysis End-Use Industry

8.8 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Bag in Box Market – By Material State

9.1 Introduction/Key Findings

9.2 Semi-Liquid

9.3 Liquid

9.4 Y-O-Y Growth trend Analysis By Material State

9.5 Absolute $ Opportunity Analysis By Enterprise Size, 2024-2030

Chapter 10. Bag in Box Market – By Tap Type

10.1 Introduction/Key Findings

10.2 Tap

10.3 Without Tap

10.4 Y-O-Y Growth trend Analysis Construction

10.5 Absolute $ Opportunity Analysis Construction, 2024-2030

Chapter 11. Bag in Box Market – By Material Type

11.1 Introduction/Key Findings

11.2 Low-Density Polyethylene (LDPE)

11.3 Ethylene Vinyl Alcohol (EVOH)

11.4 Polypropylene

11.5 Nylon

11.6 Y-O-Y Growth trend Analysis By Material Type

11.7 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 12. Bag in Box Market – By Closure Type

12.1 Introduction/Key Findings

12.2 Twist Cap

12.3 Screw Cap

12.4 Y-O-Y Growth trend Analysis By Material Type

12.5 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 13. Bag in Box Market – By Recyclability

13.1 Introduction/Key Findings

13.2 Recyclable

13.3 Non-Recyclable

13.4 Y-O-Y Growth trend Analysis By Recyclability

13.5 Absolute $ Opportunity Analysis By Recyclability, 2024-2030

Chapter 14. Bag in Box Market, By Geography – Market Size, Forecast, Trends & Insights

14.1 North America

14.1.1 By Country

14.1.1.1 U.S.A.

14.1.1.2 Canada

14.1.1.3 Mexico

14.1.2 By Product Type

14.1.1.1 By Capacity

14.1.3 By End-Use Industry

14.1.4 By Tap Type

14.1.5 Countries & Segments - Market Attractiveness Analysis

14.2 Europe

14.2.1 By Country

14.2.1.1 U.K

14.2.1.2 Germany

14.2.1.3 France

14.2.1.4 Italy

14.2.1.5 Spain

14.2.1.6 Rest of Europe

14.2.2 By Product Type

14.2.3 By Capacity

14.2.4 By End-Use Industry

14.2.5 By Material State

14.2.6 By Tap Type

14.2.7 Countries & Segments - Market Attractiveness Analysis

14.3 Asia Pacific

14.3.1 By Country

14.3.1.1 China

14.3.1.2 Japan

14.3.1.3 South Korea

14.3.1.4 India

14.3.1.5 Australia & New Zealand

14.3.1.6 Rest of Asia-Pacific

14.3.2 By Product Type

14.3.3 By Capacity

14.3.4 By End-Use Industry

14.3.5 By Material State

14.3.6 By Tap Type

14.3.7 Countries & Segments - Market Attractiveness Analysis

14.4 South America

14.4.1 By Country

14.4.1.1 Brazil

14.4.1.2 Argentina

14.4.1.3 Colombia

14.4.1.4 Chile

14.4.1.5 Rest of South America

14.4.2 By Product Type

14.4.3 By Capacity

14.4.4 By End-Use Industry

14.4.5 By Material State

14.4.6 By Tap Type

14.4.7 Countries & Segments - Market Attractiveness Analysis

14.5 Middle East & Africa

14.5.1 By Country

14.5.1.1 United Arab Emirates (UAE)

14.5.1.2 Saudi Arabia

14.5.1.3 Qatar

14.5.1.4 Israel

14.5.1.5 South Africa

14.5.1.6 Nigeria

14.5.1.7 Kenya

14.5.1.8 Egypt

14.5.1.9 Rest of MEA

14.5.2 By Product Type

14.5.3 By Capacity

14.5.4 By End-Use Industry

14.5.5 By Material State

14.5.6 By Tap Type

14.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 15. Bag in Box Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

15.1 Smurfit Kappa Group

15.2 Liqui-Box Corporation

15.3 DS Smith

15.4 Scholle IPN

15.5 Amcor Ltd

15.6 Optopack Ltd.

15.7 Vine Valley Ventures LLC

15.8 Parish Manufacturing Inc.

15.9 CDF Corporation

15.10 Arlington Packaging (Riverside Paper Co. Inc.)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Bag in Box Market was valued at USD 3.80 billion in 2023 and is projected to reach a market size of USD 4.93 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 3.8%.

The solution to conventional packaging and awareness of eco-friendly packaging is propelling the Global Bag Box Market.

The global Bag in Box Market is segmented based on Product type, Capacity, End Use, and Region.

Asia-Pacific is the most dominant region for the Global Bag Box Market.

Parish Manufacturing Inc., Schott AG, Zacros America Inc., Glenroy Inc., Fencor Packaging Group Limited, TPS Rental Systems Ltd. are a few of the key players operating in the Global Bag in Box Market.