Bacon Market Size (2025 – 2030)

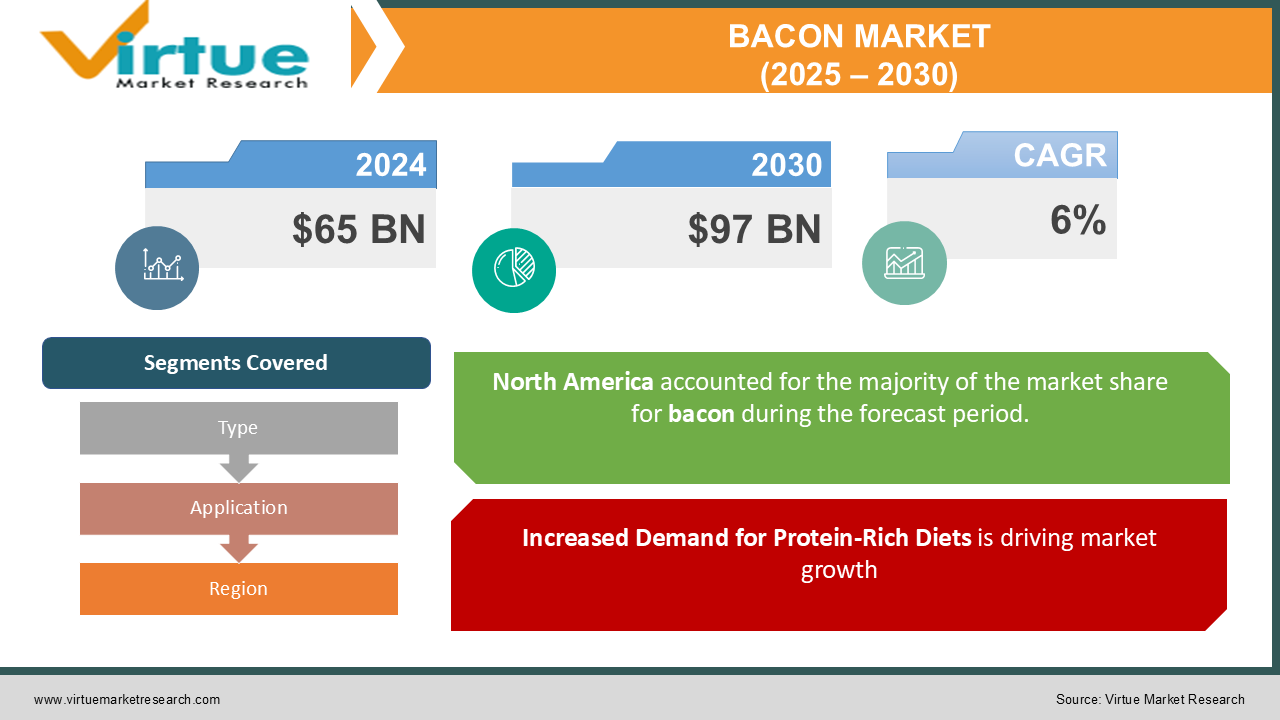

The Global Bacon Market was valued at USD 65 billion in 2024 and is projected to grow at a CAGR of 6% from 2025 to 2030. The market is expected to reach USD 97 billion by 2030.

The Bacon Market encompasses processed meat derived from pork, widely consumed as a staple breakfast item and an ingredient in various cuisines globally. This market's growth is fueled by changing consumer dietary patterns, the rising popularity of protein-rich diets, and innovations in bacon flavors and preparation methods. The shift towards premium and organic bacon products is also driving demand, especially in developed markets.

Key Market Insights

The growing popularity of high-protein diets has significantly boosted the demand for bacon as a versatile and protein-rich food option, particularly in North America and Europe.

Innovations in bacon products, such as low-sodium and nitrate-free options, cater to health-conscious consumers and are expanding the market share of premium products.

The foodservice sector represents a substantial segment, with bacon increasingly featured in fast food, gourmet dishes, and fusion cuisines.

The introduction of plant-based bacon alternatives has opened new avenues for growth, particularly among vegan and flexitarian consumers.

Rising disposable income in emerging markets, such as Asia-Pacific, is leading to increased consumption of processed meats, including bacon. Challenges such as fluctuating pork prices and growing concerns over processed meats' health effects are influencing market dynamics.

Pre-cooked and ready-to-eat bacon products are gaining traction, catering to convenience-driven consumers.

The online retail channel for bacon distribution has seen notable growth, driven by e-commerce penetration and changing consumer buying habits.

Global Bacon Market Drivers

Increased Demand for Protein-Rich Diets is driving market growth: Protein-focused dietary trends, including keto, paleo, and low-carb diets, have spurred demand for bacon as a convenient and delicious protein source. Bacon's versatility allows it to be incorporated into various meal options, making it popular among consumers. With rising health awareness, consumers are focusing on macronutrient intake, and bacon fits the profile of high-protein and high-fat food items. This shift is most noticeable in regions like North America and Europe, where such dietary trends are more prevalent. Additionally, the foodservice industry's adaptation to include bacon as a primary ingredient in menu items has driven growth, capitalizing on its widespread appeal.

Premiumization and Organic Product Offerings is driving market growth: The global market has seen a surge in demand for premium bacon products, including organic and nitrate-free variants. Consumers are increasingly willing to pay a premium for higher-quality and ethically sourced bacon, particularly in developed markets like the U.S. and the U.K. Organic bacon, which assures consumers of the absence of harmful chemicals and better animal welfare practices, has gained traction. This trend aligns with a broader shift towards sustainability and healthier consumption, with brands innovating to meet these demands. Furthermore, the rise of private-label premium offerings has intensified competition, fostering greater product innovation and quality standards.

Expanding Foodservice Sector is driving market growth: The integration of bacon into diverse cuisines and innovative dishes within the foodservice sector has significantly boosted its consumption. Restaurants, fast-food chains, and gourmet establishments are leveraging bacon's flavor profile to enhance menu items. Dishes such as bacon-wrapped appetizers, bacon-infused desserts, and specialty bacon burgers have become major draws for customers. In addition to traditional uses, bacon is being incorporated into fusion cuisines, expanding its appeal globally. The foodservice sector's recovery post-COVID-19 has also contributed to increased bacon consumption, with a focus on new and creative menu options driving consumer interest.

Global Bacon Market Challenges and Restraints

Health Concerns and Regulatory Challenges is restricting market growth: Processed meats, including bacon, face growing scrutiny due to potential links with health risks such as cardiovascular diseases and cancer. Organizations like the WHO have classified processed meats as carcinogenic, creating a negative perception among health-conscious consumers. This has led to reduced consumption in some demographics, particularly in developed nations where awareness is higher. Additionally, stringent regulatory frameworks governing food safety and labeling further complicate market dynamics. Manufacturers are pressured to innovate by offering healthier alternatives, such as low-sodium and nitrate-free bacon, to mitigate the negative impact of these challenges.

Supply Chain Vulnerabilities and Pork Price Volatility is restricting market growth: The bacon market is heavily reliant on pork as its primary raw material, making it vulnerable to fluctuations in pork prices and supply chain disruptions. Factors such as disease outbreaks in livestock (e.g., African Swine Fever) and geopolitical trade tensions can significantly impact pork availability and pricing. These disruptions affect production costs and profit margins for bacon manufacturers. Moreover, the reliance on a single raw material exposes the market to heightened risks, necessitating diversification and the adoption of alternative protein sources like plant-based bacon to ensure long-term stability and resilience.

Market Opportunities

The rising demand for plant-based and alternative protein products presents a significant opportunity in the bacon market. With increasing awareness of sustainability and health issues, consumers are seeking meat substitutes that mimic traditional flavors and textures. Plant-based bacon made from soy, pea protein, and other ingredients has gained traction among vegan and flexitarian populations. Innovations in food technology are improving these products' taste and nutritional profiles, driving their acceptance. Additionally, expanding bacon's application scope into emerging markets offers untapped growth potential. As disposable incomes rise in Asia-Pacific, South America, and the Middle East, the adoption of bacon as a regular food item is increasing. Investments in marketing campaigns to introduce bacon-based recipes and cultural adaptations are expected to expand market share in these regions. Moreover, leveraging e-commerce platforms to enhance the availability of specialty and niche bacon products globally will contribute to market expansion.

BACON MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Smithfield Foods, Tyson Foods, Hormel Foods, Oscar Mayer, Danish Crown, Applegate Farms, Maple Leaf Foods, The Very Good Food Company, Tofurky, Nestle |

Bacon Market Segmentation - By Type

-

Traditional Pork Bacon

-

Turkey Bacon

-

Plant-Based Bacon

-

Nitrate-Free Bacon

-

Other Specialty Bacon

Traditional pork bacon remains the most dominant segment, accounting for the majority of global market share due to its widespread availability, taste preference, and historical consumption patterns.

Bacon Market Segmentation - By Application

-

Household Consumption

-

Foodservice (Restaurants and Catering)

-

Retail and Packaged Foods

-

Other Applications

Foodservice applications dominate the market, as restaurants and fast-food outlets incorporate bacon into diverse menu items, catering to high-volume consumption.

Bacon Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the dominant region in the global bacon market, driven by high per capita consumption and a strong foodservice sector. The U.S. leads this market, with bacon being a staple in American breakfasts and extensively used in fast food. Increasing demand for premium and organic bacon products has also fueled market growth in the region. The well-established supply chain and innovation in bacon varieties contribute to North America's leading position in the global market.

COVID-19 Impact Analysis on the Bacon Market

The COVID-19 pandemic had a profound impact on the bacon market, particularly in the early stages when supply chains were disrupted due to lockdowns and labor shortages. Pork production facilities faced operational slowdowns, leading to temporary shortages of bacon and price hikes. Despite these challenges, consumer behavior shifted towards comfort foods, with bacon emerging as a key favorite. As many people stayed at home, household consumption of bacon increased significantly, with retail sales of packaged bacon surging. This was particularly driven by consumers stockpiling essential food items in response to the uncertainty of the pandemic. The foodservice industry, initially hard-hit by restaurant closures and reduced foot traffic, began to recover as delivery and takeaway services gained popularity. Many restaurants adapted their menus by incorporating bacon into dishes that appealed to customers' growing desire for indulgent comfort foods. Additionally, the pandemic accelerated the shift toward online grocery shopping, which had a positive effect on bacon sales through e-commerce channels. Consumers increasingly turned to digital platforms to purchase bacon products, contributing to a growth in online sales. In response to the changing market dynamics, manufacturers adapted by offering more convenient packaging options, such as smaller-sized packs, which suited the needs of homebound consumers. The pandemic also spurred a greater focus on health-oriented bacon variants, such as lower-sodium or plant-based options, to cater to evolving consumer preferences. As the market continued to adapt, bacon remained a beloved food product, navigating the challenges of the pandemic while adjusting to new consumer habits and expectations.

Latest Trends/Developments

The bacon market has experienced a significant wave of product diversification, with manufacturers introducing a variety of innovative options to cater to changing consumer preferences. Flavored bacon varieties, such as maple, peppered, and smoked, have gained popularity, offering new taste experiences for bacon lovers. Additionally, plant-based bacon has emerged as a key trend, attracting health-conscious and environmentally aware consumers. Advancements in taste and texture have made plant-based bacon a more viable alternative to traditional pork bacon, offering a satisfying option for those seeking a meat-free diet. The rise of e-commerce has had a transformative impact on bacon distribution, with online grocery stores and specialty food websites becoming increasingly popular for purchasing bacon products. Consumers now have access to a wider selection of bacon options, including niche and gourmet products, at their fingertips. This shift has changed the way consumers shop, providing greater convenience and variety. Moreover, collaborations between bacon producers and culinary experts have led to the development of exciting new products, such as bacon-inspired snacks and meal kits. These partnerships bring innovation to the market, offering consumers unique ways to incorporate bacon into their meals. Sustainability has also become a central focus within the industry, with companies embracing eco-friendly packaging and adopting sustainable farming practices. As consumer preferences continue to evolve, bacon producers are increasingly prioritizing environmental responsibility. Together, these trends demonstrate the bacon market's adaptability in meeting the needs of a changing consumer landscape. From plant-based alternatives to sustainable practices and innovative flavors, the industry is actively responding to evolving demands, ensuring bacon remains a beloved food product for years to come.

Key Players

-

Smithfield Foods

-

Tyson Foods

-

Hormel Foods

-

Oscar Mayer

-

Danish Crown

-

Applegate Farms

-

Maple Leaf Foods

-

The Very Good Food Company

-

Tofurky

-

Nestle

Chapter 1. Bacon Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bacon Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bacon Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bacon Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bacon Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bacon Market – By Type

6.1 Introduction/Key Findings

6.2 Traditional Pork Bacon

6.3 Turkey Bacon

6.4 Plant-Based Bacon

6.5 Nitrate-Free Bacon

6.6 Other Specialty Bacon

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Bacon Market – By Application

7.1 Introduction/Key Findings

7.2 Household Consumption

7.3 Foodservice (Restaurants and Catering)

7.4 Retail and Packaged Foods

7.5 Other Applications

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Bacon Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Bacon Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Smithfield Foods

9.2 Tyson Foods

9.3 Hormel Foods

9.4 Oscar Mayer

9.5 Danish Crown

9.6 Applegate Farms

9.7 Maple Leaf Foods

9.8 The Very Good Food Company

9.9 Tofurky

9.10 Nestle

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Bacon Market was valued at USD 65 billion in 2024 and is expected to reach USD 97 billion by 2030, growing at a CAGR of 6%.

Key drivers include the rising demand for protein-rich diets, premium and organic bacon product offerings, and the expanding foodservice sector.

The market is segmented by product (Traditional Pork Bacon, Turkey Bacon, Plant-Based Bacon, Nitrate-Free Bacon, and Others) and by application (Household Consumption, Foodservice, Retail, and Others).

North America is the dominant region, driven by high per capita consumption and a robust foodservice sector.

Leading players include Smithfield Foods, Tyson Foods, Hormel Foods, Oscar Mayer, Danish Crown, and others.