Baby Shampoo and Conditioner Market Size (2024 – 2030)

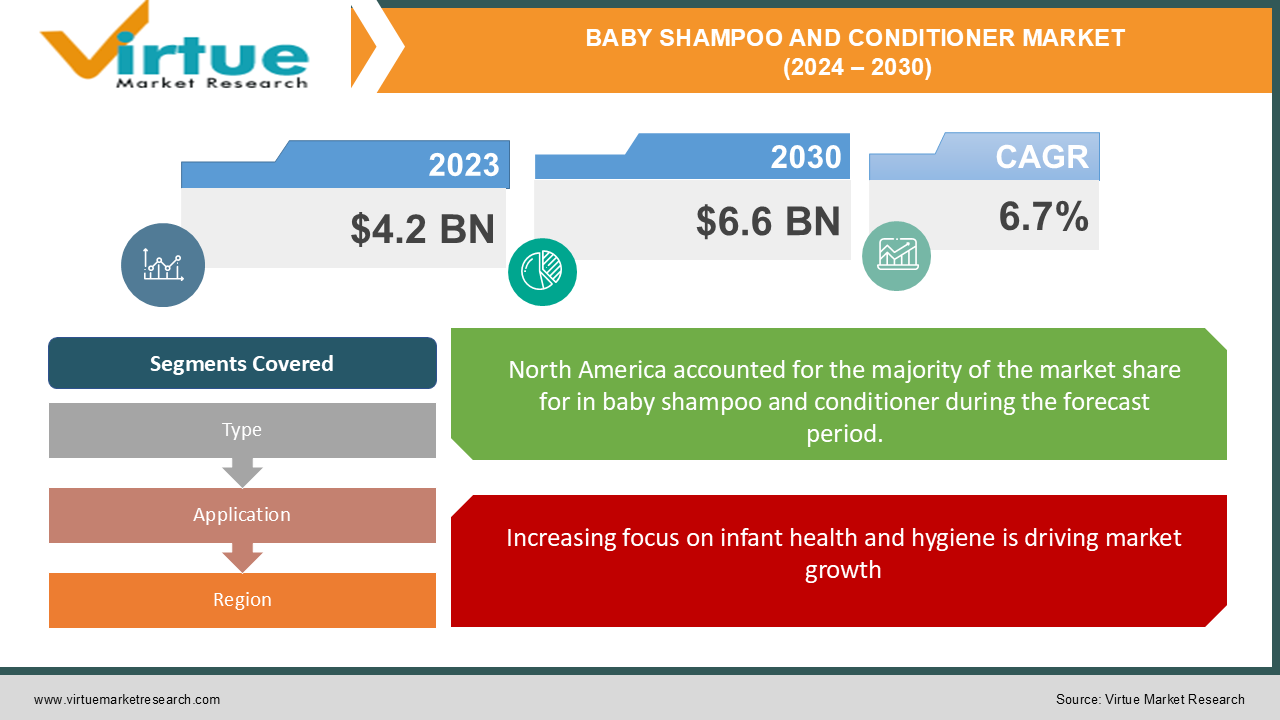

The Global Baby Shampoo and Conditioner Market was valued at USD 4.2 billion in 2023 and is expected to grow at a CAGR of 6.7% from 2024 to 2030. The market is projected to reach USD 6.6 billion by 2030.

This market focuses on shampoos and conditioners designed specifically for infants and young children, formulated to be gentle, tear-free, and hypoallergenic. Growing awareness about the importance of using specialized baby care products, along with rising parental concerns about the safety and quality of products used on children, has driven the market's expansion. The increasing preference for organic and natural ingredients and a growing middle-class population in emerging economies are further fueling demand.

Key Market Insights:

-

Organic and natural baby shampoo and conditioner will be the market with the quickest growth rate, capturing about 30% of the overall market share in 2023. This is because parents are rapidly becoming concerned with safer, nontoxic products.

-

The Asia-Pacific region especially the countries of China and India; it's one of the very fast-growing markets and is coupled with increasing disposable incomes, increased urbanization, and rising nuclear families, with an estimated CAGR of 8.5%.

-

E-commerce channels take 40% of sales in baby shampoo and conditioner globally, with the added convenience of home delivery and an increased range of available products being the preference of many parents.

-

North America still accounts for more than 35% of the market in 2023 due to higher consumer awareness, premium product availability, and brand loyalty.

Global Baby Shampoo and Conditioner Market Drivers:

Increasing focus on infant health and hygiene is driving market growth:

The increasing baby shampoo and conditioner demand may also be considerably driven by the increasing concern for infant health and hygiene, especially from the well-informed millennial and Gen Z parents. Due to this growing awareness, parents today are careful not to expose their infants to possible irritants and allergens in baby care products and choose specific items that are developed to be safe for babies. Such a transition is further encouraged by prescriptions by doctors, pediatricians, and dermatologists, as they recommend tear-free, hypoallergenic, and dermatologically tested products not too harsh on babies' sensitive skin and scalp. Added to this, through social media and parenting forums, information has spread extensively and makes parents choose between purchased products. Hence, the baby shampoo and conditioners market has mushroomed with rapid growth in sales both at the premium and mass-market levels.

Rising disposable income and demand for premium products are driving market growth:

In addition to increased incomes, changes in consumers' behavior towards premium products have been enormous among people of developing economies. Now, parents, mostly residing in cities, are willing to spend more on superior branded baby shampoos and conditioners for better safety, moisturizing properties, and superior formulations. This is particularly so in markets such as Asia-Pacific, which have witnessed accelerated economic development, leading to better disposable incomes and, therefore, improving living conditions. Premium baby products are also believed to generate more value by being certified organic, utilizing natural ingredients, and using eco-friendly packaging for an increasingly health-conscious and environmentally aware consumer. It is further noted in developed regions like North America and Europe, where rising demand for baby products free from artificial additives and synthetic fragrances, besides other harsh chemicals, is seen.

Growing e-commerce and digital marketing trends are driving market growth:

The proliferation of e-commerce platforms and the rise of digital marketing have revolutionized the baby shampoo and conditioner market, making it easier for parents to access a wide range of products from both global and local brands. E-commerce giants like Amazon, and Alibaba, and regional platforms such as Flipkart and Lazada have created a seamless shopping experience for consumers, offering home delivery, subscription models, and access to customer reviews. In addition, the COVID-19 pandemic accelerated the shift toward online shopping, with many parents opting to purchase baby care products online due to the convenience and safety of contactless delivery. Digital marketing, influencer partnerships, and social media campaigns have further amplified brand visibility, particularly among millennial parents who are active on platforms like Instagram, Facebook, and TikTok. This digital push has not only boosted sales but also provided brands with valuable consumer insights, allowing for better-targeted product offerings and personalized marketing strategies.

Global Baby Shampoo and Conditioner Market Challenges and Restraints:

Stringent regulatory requirements and safety concerns are restricting market growth:

This market presents several challenges, mainly in that the strict regulatory requirements of the market differ from region to region. This means that different countries have very strict guidelines specifying the formulation of baby care products, especially concerning chemical usage such as sulfates and parabens in shampoos and artificial fragrances within conditioners. For example, the European Union's Cosmetics Regulation (EC) No. 1223/2009 ensures strict compliance with the safety and efficacy standards of cosmetic products such as baby shampoo and baby conditioners before hitting the shelves in its markets. Likewise, the U.S. Food and Drug Administration checks on what is placed in a personal care product, and any perceived threat to safety with these products results in their being withdrawn from the market or banned outright. Maintaining such regulations often incurs a huge cost of research and development, testing, and certification on the part of manufacturers. Not to mention adverse reaction reports involving baby products, such as the problem of skin irritation or allergic reactions that utterly decimate a brand's reputation and consumer trust.

High competition and market fragmentation are restricting market growth:

The market for baby shampoo and conditioner is one of intensive competition among global giants like Johnson & Johnson and Procter & Gamble with smaller players selling organic or specialty products. That kind of market fragmentation creates price wars which are pretty hard to maintain profitable margins. More "authentic" or "natural" offerings of smaller brands also rely on their positioning, emphasizing the trend towards a larger consumer segment - green and clean-label. The innovation for larger companies would be differentiation in their offerings. It may be through improved formulations, more extensive product lines, or more sustainable packaging. This competitive landscape also makes brand loyalty an elusive concept, given the number of choices consumers face and the willingness to try new brands touted as safer or more effective. Relevance among competitors in such overcrowded markets therefore increasingly will depend upon a continued investment in marketing, product development, and customer engagement.

Market Opportunities:

This baby shampoo and conditioner market offers big growth opportunities as trends are expected to continue with the current birth rate in the regions of Asia-Pacific, Africa, and Latin America. The increasing middle-class population, characterized by rising birth rates, increases the demand for baby care products in these regions. Moreover, an increase in the number of working parents due to rapid urbanization also results in greater reliance on convenient, quality baby care products. This can be reflected by the demand for multi-functional products, such as the 2-in-1 formulas of shampoos and conditioners which save time for busy parents, yet are gentle in cleansing and moisturizing babies' skin. Growing organic, eco-friendly, and hypoallergenic product demand also presents ample opportunity for brands to enter the premium space. Brands can differentiate and compete on the safety, dermally tested nature, and certified organic nature of their products. In addition to this, D2C brands are enablers through an e-commerce platform, whereby smaller niche companies can reach a global audience and bypass some of the traditional, historical distribution channels that were used. There is also a growing interest in sustainable packaging solutions. Parents want not only to be sure that the products they buy are safe for their babies but also environmentally responsible. To be able to innovate in such areas, brands that offer recyclable or biodegradable packaging will gain a share of growing eco-conscious consumers.

BABY SHAMPOO AND CONDITIONER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Johnson & Johnson, Procter & Gamble (Pampers), The Honest Company, Aveeno Baby, Weleda, Burt's Bees Baby, Earth Mama Organics, Mustela, Babyganics, Himalaya Herbal Healthcare |

Baby Shampoo and Conditioner Market Segmentation: By Type

-

Organic Baby Shampoo and Conditioner

-

Synthetic Baby Shampoo and Conditioner

-

2-in-1 Shampoo and Conditioner

-

Tear-Free Shampoo

-

Hypoallergenic Shampoo

Organic Baby Shampoo and Conditioner is the dominant segment, accounting for over 30% of the market share in 2023, driven by increasing consumer preference for chemical-free, natural products that ensure baby safety.

Baby Shampoo and Conditioner Market Segmentation: By Application

-

Daily Use

-

Therapeutic Use (for sensitive skin, cradle cap, etc.)

-

Styling and Conditioning

Daily Use remains the most dominant segment, with parents opting for gentle, everyday cleansers for their children’s hair, representing over 50% of the market demand.

Baby Shampoo and Conditioner Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America continues to be the dominant region, accounting for more than 35% of the market share. High consumer awareness, the availability of a wide range of premium products, and the presence of key players like Johnson & Johnson, Aveeno Baby, and The Honest Company contribute to the region’s dominance. In addition, the demand for organic, clean-label baby products has further driven market growth in this region.

COVID-19 Impact Analysis on the Baby Shampoo and Conditioner Market:

The COVID-19 pandemic had a mixed impact on the Baby Shampoo and Conditioner Market. During the initial stages of the pandemic, there was a notable shift in consumer behavior as parents prioritized essential hygiene and personal care products. Sales of baby shampoos and conditioners remained relatively stable as parents continued to purchase these products to maintain their children's hygiene. However, lockdowns and disruptions in the supply chain led to challenges in product availability in some regions, especially for premium or organic products that rely on specific ingredients sourced from global markets. Moreover, the closure of physical retail stores during lockdowns prompted a surge in online shopping, with e-commerce platforms becoming the primary channel for baby care product purchases. As a result, many brands increased their digital marketing efforts and offered subscription models to retain customer loyalty during the pandemic. Post-pandemic, the market is expected to rebound further as parents continue to emphasize hygiene and safety, with a growing preference for products that are not only effective but also free from harmful chemicals and allergens.

Latest Trends/Developments:

The Baby Shampoo and Conditioner Market is witnessing several notable trends and developments. One of the most prominent trends is the increasing demand for products that are free from synthetic chemicals, artificial fragrances, and preservatives. Parents are becoming more informed about the potential risks of harmful ingredients in baby care products and are actively seeking out brands that offer "clean-label" formulations. In response, many companies are reformulating their products to exclude sulfates, parabens, and phthalates while incorporating natural, plant-based ingredients like chamomile, calendula, and aloe vera. Another emerging trend is the focus on sustainability, with brands offering eco-friendly packaging options such as recyclable, biodegradable, or refillable containers. Additionally, there is a growing interest in multi-functional products, such as 2-in-1 shampoo and conditioner or combined shampoo and body wash formulations, which offer convenience to parents while simplifying the baby care routine. Finally, gender-neutral baby care products are gaining popularity as parents seek products that cater to all children, regardless of gender, fostering inclusivity in the baby care market.

Key Players:

-

Johnson & Johnson

-

Procter & Gamble (Pampers)

-

The Honest Company

-

Aveeno Baby

-

Weleda

-

Burt's Bees Baby

-

Earth Mama Organics

-

Mustela

-

Babyganics

-

Himalaya Herbal Healthcare

Chapter 1. Baby Shampoo and Conditioner Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Baby Shampoo and Conditioner Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Baby Shampoo and Conditioner Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Baby Shampoo and Conditioner Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Baby Shampoo and Conditioner Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Baby Shampoo and Conditioner Market – By Types

6.1 Introduction/Key Findings

6.2 Organic Baby Shampoo and Conditioner

6.3 Synthetic Baby Shampoo and Conditioner

6.4 2-in-1 Shampoo and Conditioner

6.5 Tear-Free Shampoo

6.6 Hypoallergenic Shampoo

6.7 Y-O-Y Growth trend Analysis By Types

6.8 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Baby Shampoo and Conditioner Market – By Application

7.1 Introduction/Key Findings

7.2 Daily Use

7.3 Therapeutic Use (for sensitive skin, cradle cap, etc.)

7.4 Styling and Conditioning

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Baby Shampoo and Conditioner Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Baby Shampoo and Conditioner Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Johnson & Johnson

9.2 Procter & Gamble (Pampers)

9.3 The Honest Company

9.4 Aveeno Baby

9.5 Weleda

9.6 Burt's Bees Baby

9.7 Earth Mama Organics

9.8 Mustela

9.9 Babyganics

9.10 Himalaya Herbal Healthcare

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Baby Shampoo and Conditioner Market was valued at USD 4.2 billion in 2023 and is projected to reach USD 6.6 billion by 2030, growing at a CAGR of 6.7%.

Key drivers include increased focus on infant health and hygiene, rising disposable income and demand for premium products, and the growth of e-commerce and digital marketing channels.

The market is segmented by product (organic, synthetic, tear-free, hypoallergenic) and by application (daily use, therapeutic use, styling).

North America is the dominant region, holding over 35% of the market share.

Leading players include Johnson & Johnson, The Honest Company, Aveeno Baby, Mustela, and Burt's Bees Baby.