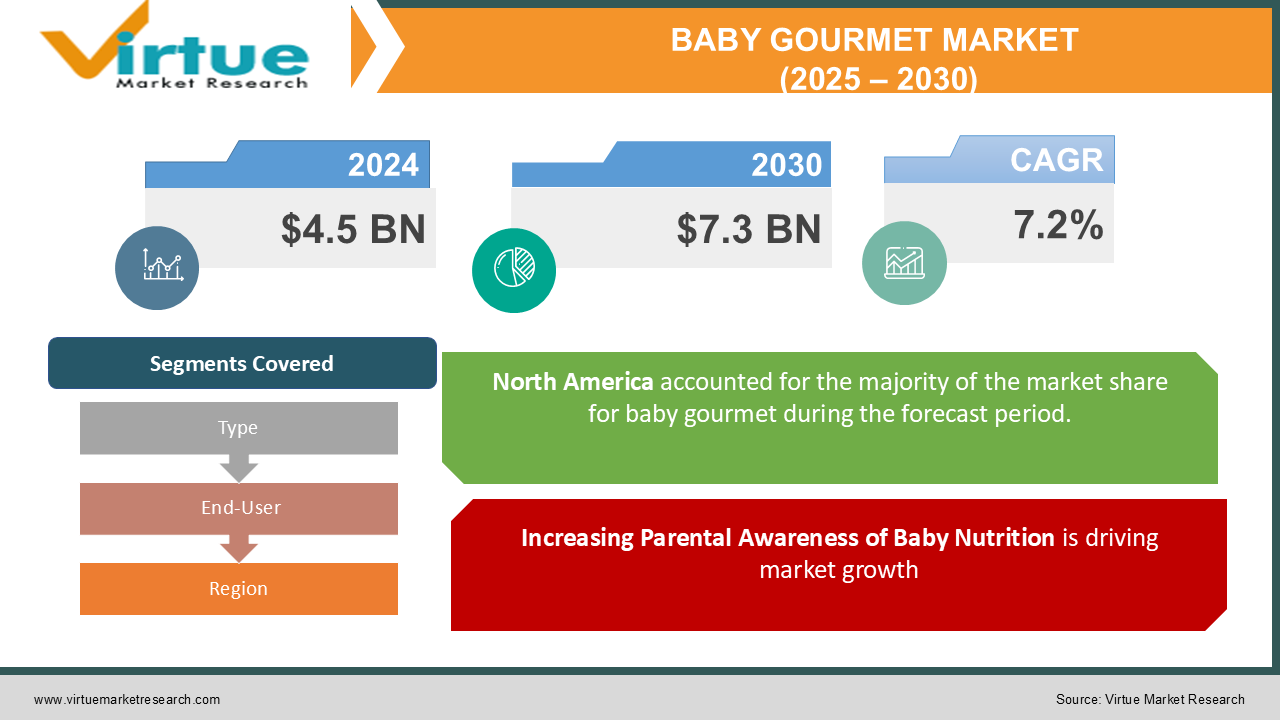

Baby Gourmet Market Size (2024 – 2030)

The Global Baby Gourmet Market was valued at USD 4.5 billion in 2024 and is projected to grow at a CAGR of 7.2% from 2025 to 2030. The market is expected to reach USD 7.3 billion by 2030.

These products cater to health-conscious parents seeking alternatives to traditional baby food options. With increasing disposable incomes, growing awareness about nutrition, and the demand for convenience in feeding, the market for baby gourmet products has expanded rapidly, particularly in developed and emerging economies.

Key Market Insights:

The baby gourmet market has witnessed substantial growth due to rising consumer awareness about organic and non-GMO food options. Organic products accounted for over 60% of market sales in 2024.

Convenience packaging innovations, such as pouches and single-serve formats, are propelling sales, accounting for nearly 45% of total packaging preferences in the market.

Asia-Pacific emerged as the fastest-growing region for baby gourmet products, with a CAGR of 8.4% between 2025 and 2030.

Supermarkets and hypermarkets remain the dominant distribution channels, contributing over 50% of total sales in 2024. However, e-commerce platforms are gaining traction with a growth rate of 12% annually.

Preference for plant-based and allergen-free baby food options has spurred the development of niche segments, with gluten-free baby gourmet foods seeing a 15% year-on-year growth.

Global Baby Gourmet Market Drivers:

Increasing Parental Awareness of Baby Nutrition is driving market growth:

Parental awareness regarding the importance of nutrition during the early stages of a child’s development has significantly influenced the baby gourmet market. With research linking early nutrition to lifelong health outcomes, parents are becoming increasingly selective about the food they provide to their infants. This has created demand for premium-quality products that are free from additives, artificial flavors, and synthetic chemicals. Baby gourmet products, which emphasize organic, farm-sourced ingredients, meet this need effectively. Additionally, campaigns by pediatric health organizations stressing balanced diets have prompted parents to adopt high-quality alternatives to conventional baby food. This heightened awareness has been further amplified by social media influencers and parent advocacy groups who highlight the benefits of gourmet baby food options, ensuring a consistent demand trajectory.

The Surge in Organic and Clean Label Trends is driving market growth:

The global shift toward organic food consumption has extended to baby food markets, with parents prioritizing products that are clean-label and environmentally sustainable. Baby gourmet products are characterized by their transparency, often featuring detailed ingredient sourcing and minimal processing on packaging. This trend aligns with the growing "farm-to-table" movement, where traceability and ethical sourcing are paramount. Consumers are willing to pay premium prices for products that assure safety, quality, and adherence to stringent health guidelines. The rise of organic certifications and eco-labels further enhances consumer trust, making baby gourmet foods a top choice for discerning parents.

Convenience and Innovation in Packaging is driving market growth:

Busy lifestyles among working parents have driven demand for convenience-oriented products in the baby food sector. Baby gourmet brands have innovated significantly, introducing easy-to-use and portable packaging formats such as resealable pouches, single-serve packs, and microwavable trays. These options not only reduce preparation time but also ensure minimal food wastage, a feature that resonates strongly with eco-conscious and cost-sensitive consumers. Additionally, the integration of QR codes and digital tools on packaging allows parents to trace product origins and read nutritional benefits, further strengthening the market's appeal.

Global Baby Gourmet Market Challenges and Restraints:

High Cost of Baby Gourmet Products is limiting market growth:

The premium pricing of baby gourmet products presents a significant challenge, particularly in price-sensitive markets. The high cost is often attributed to the organic certification processes, rigorous quality checks, and eco-friendly packaging materials used. While affluent households in developed regions can afford these products, middle-income families, especially in developing economies, may find them cost-prohibitive. Furthermore, rising inflation and supply chain disruptions have exacerbated this issue by increasing production and distribution costs. The lack of affordable alternatives within the gourmet segment limits market penetration, creating a barrier for brands aiming to expand their consumer base in emerging markets.

Limited Awareness and Accessibility in Rural Areas is restricting market growth:

Despite growing awareness of baby nutrition, rural and semi-urban areas continue to rely on traditional feeding practices due to a lack of education and limited access to premium products. Distribution challenges in remote regions, coupled with inadequate infrastructure and high transportation costs, hinder the availability of baby gourmet products. Moreover, local substitutes, which are often perceived as more affordable and culturally relevant, dominate these regions. To address this challenge, market players must invest in education campaigns, collaborations with healthcare professionals, and localized distribution networks to bridge the accessibility gap.

Market Opportunities:

The baby gourmet market holds substantial growth potential due to the increasing demand for plant-based and allergen-free options. The rise in vegan parenting and the growing concern over food allergies in infants have created a niche for specialty products that cater to specific dietary needs. Developing regions such as Asia-Pacific and Latin America represent untapped opportunities, driven by rising disposable incomes, urbanization, and a shift toward modern parenting practices. E-commerce presents another lucrative avenue for growth, allowing brands to reach a wider audience without significant overhead costs. As sustainability becomes a priority for consumers, companies focusing on eco-friendly packaging, carbon-neutral production methods, and fair-trade sourcing will find themselves well-positioned in the competitive landscape. Furthermore, collaboration with healthcare professionals and pediatricians to endorse products can enhance brand credibility and trust, driving sustained growth in the sector.

BABY GOURMET MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Gerber, Plum Organics, Earth’s Best, Sprout Organic Foods, Happy Family Organics, Beech-Nut Nutrition, Ella’s Kitchen, Amara Organic Foods, Little Spoon, Once Upon a Farm |

Baby Gourmet Market Segmentation: By Type

-

Organic Baby Foods

-

Plant-Based Baby Foods

-

Allergen-Free Baby Foods

-

Ready-to-Eat Baby Meals

-

Others

Organic baby foods dominate this segment, accounting for nearly 60% of the market in 2024. Consumers’ increasing preference for organic ingredients and the perception of better nutritional quality make organic options the go-to choice for many parents.

Baby Gourmet Market Segmentation: By End-User

-

Infants (0-6 months)

-

Toddlers (6-24 months)

-

Pre-schoolers (2-4 years)

The toddler segment leads this category, representing 45% of the market share. The broader range of dietary needs and flavors offered for toddlers makes this demographic the largest consumer base.

Baby Gourmet Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the dominant region in the global baby gourmet market, contributing over 40% of the market share in 2024. High disposable incomes, strong consumer awareness about nutrition, and the presence of leading market players have fueled the growth of baby gourmet products in this region. Additionally, a well-established distribution network, combined with widespread adoption of organic and clean-label trends, has strengthened North America’s position in the market. Within the region, the U.S. leads due to its robust consumer base and higher purchasing power, while Canada is emerging as a promising market for innovation in allergen-free and sustainable products.

COVID-19 Impact Analysis on the Baby Gourmet Market:

The COVID-19 pandemic had a profound impact on the baby gourmet market, presenting both challenges and opportunities. One of the most significant hurdles was the disruption of global supply chains, which affected the procurement of raw materials. This led to increased production costs and, in some cases, temporary shortages of specific product lines, creating challenges for manufacturers. However, the pandemic also led to a shift in consumer priorities, particularly among parents who became more focused on their children's health and immunity. This increased demand for premium-quality, nutrient-dense baby food as parents sought the best possible nutrition for their little ones. At the same time, the pandemic accelerated the trend toward online shopping, with e-commerce platforms experiencing a surge in baby gourmet product purchases. In fact, sales through digital channels grew by 30% during this period. As a result, many brands were compelled to shift their focus to digital strategies, emphasizing direct-to-consumer models and bolstering online marketing campaigns to reach a wider audience. Additionally, heightened concerns around food safety and hygiene drove many parents to choose established, certified brands over locally sourced or lesser-known alternatives. This trend underscored the growing importance of brand trust and certification in the eyes of consumers. The pandemic also highlighted the critical need for businesses in the baby gourmet sector to prioritize supply chain resilience. Companies began to recognize the value of diversified sourcing strategies to mitigate potential disruptions and ensure the steady availability of products in the future. Overall, COVID-19 reshaped the baby food industry, emphasizing health-conscious choices, e-commerce growth, and the importance of robust supply chain strategies.

Latest Trends/Developments:

The baby gourmet market is undergoing a significant transformation, driven by several key trends that are reshaping the industry. One of the most prominent shifts is the growing demand for plant-based baby foods. Brands are increasingly introducing innovative products that incorporate nutritious ingredients such as lentils, chickpeas, and quinoa, catering to parents looking for healthier, plant-based options for their babies. Alongside this, sustainability is becoming a major focus for companies, with many adopting recyclable or biodegradable packaging to align with consumer preferences for eco-friendly solutions. Personalization is another emerging trend, as brands respond to the need for tailored baby food options. Subscription services are gaining popularity, allowing parents to receive customized baby food deliveries based on their child's specific dietary needs. This trend emphasizes convenience while also offering more control over nutritional choices. Technological advancements are also playing a key role in shaping the market. AI-driven ingredient sourcing and the use of blockchain for traceability are enhancing product transparency, ensuring that consumers can trust the origins and quality of their baby’s food. Furthermore, collaborations with pediatricians and nutritionists to co-develop scientifically-backed formulations are gaining traction, fostering greater trust and credibility among consumers. These partnerships ensure that products meet the highest standards of nutritional value and safety, which are top priorities for parents. The rise of e-commerce is also changing the competitive landscape of the market. Brands are increasingly investing in digital marketing strategies, leveraging influencer partnerships and social media campaigns to connect with tech-savvy parents. As these trends continue to evolve, the baby gourmet market is expected to see further innovation and growth, driven by consumer demand for healthier, sustainable, and personalized baby food options.

Key Players:

-

Gerber

-

Plum Organics

-

Earth’s Best

-

Sprout Organic Foods

-

Happy Family Organics

-

Beech-Nut Nutrition

-

Ella’s Kitchen

-

Amara Organic Foods

-

Little Spoon

-

Once Upon a Farm

Chapter 1. Baby Gourmet Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Baby Gourmet Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Baby Gourmet Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Baby Gourmet Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Baby Gourmet Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Baby Gourmet Market – By Type

6.1 Introduction/Key Findings

6.2 Organic Baby Foods

6.3 Plant-Based Baby Foods

6.4 Allergen-Free Baby Foods

6.5 Ready-to-Eat Baby Meals

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Baby Gourmet Market – By End-User

7.1 Introduction/Key Findings

7.2 Infants (0-6 months)

7.3 Toddlers (6-24 months)

7.4 Pre-schoolers (2-4 years)

7.5 Y-O-Y Growth trend Analysis By End-User

7.6 Absolute $ Opportunity Analysis By End-User, 2025-2030

Chapter 8. Baby Gourmet Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By End-User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Baby Gourmet Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Gerber

9.2 Plum Organics

9.3 Earth’s Best

9.4 Sprout Organic Foods

9.5 Happy Family Organics

9.6 Beech-Nut Nutrition

9.7 Ella’s Kitchen

9.8 Amara Organic Foods

9.9 Little Spoon

9.10 Once Upon a Farm

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Baby Gourmet Market was valued at USD 4.5 billion in 2024 and is expected to grow at a CAGR of 7.2%, reaching USD 7.3 billion by 2030.

Key drivers include increasing parental awareness of baby nutrition, the rise of organic and clean-label trends, and innovations in convenience-oriented packaging.

The market is segmented by product (organic, plant-based, allergen-free, ready-to-eat, and others) and by application (infants, toddlers, and preschoolers).

North America is the most dominant region, contributing over 40% of the market share due to high consumer awareness and strong demand for premium products.

Leading players include Gerber, Plum Organics, Earth’s Best, Sprout Organic Foods, Happy Family Organics, and Ella’s Kitchen.