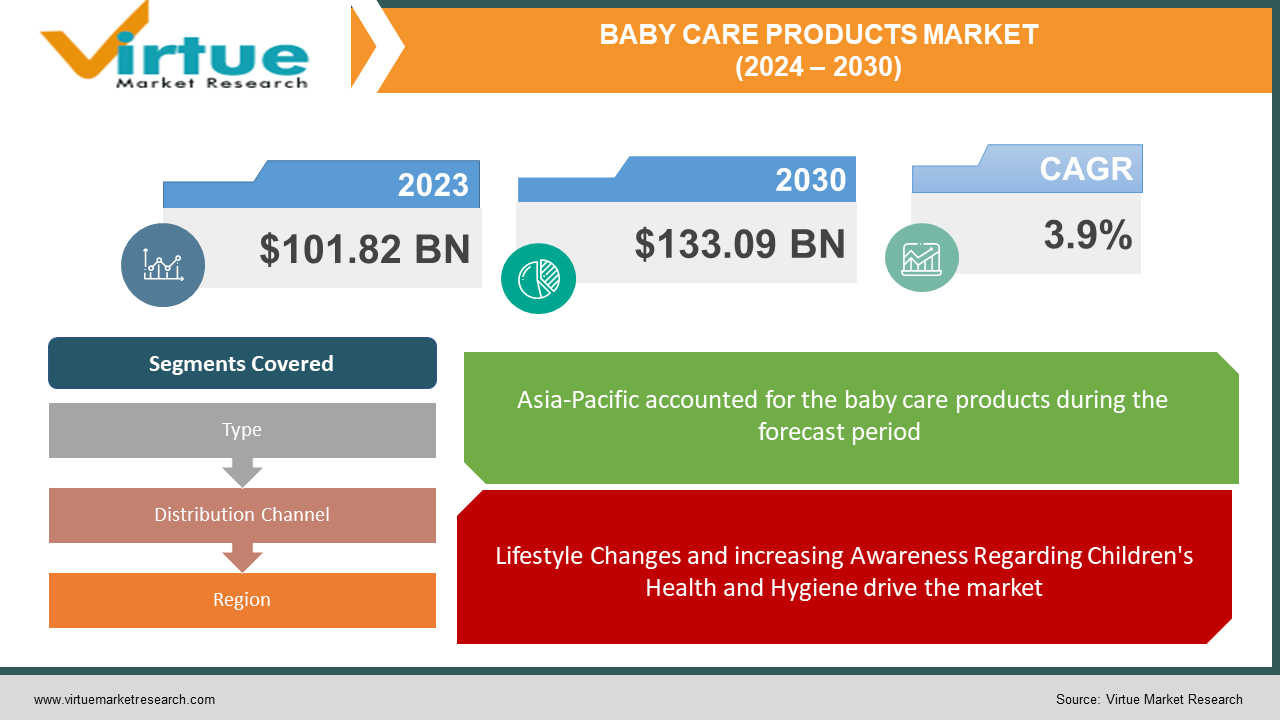

Baby Care Products Market Size (2024 – 2030)

The Baby Care Products Market was valued at USD 101.82 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 133.09 billion by 2030, growing at a CAGR of 3.9%.

Baby care products are meticulously crafted to ensure they are gentle, non-irritating, or utilize ingredients with such qualities. This diverse range encompasses baby oils, creams, lotions, powders, shampoos, soaps, and various others, all geared toward maintaining the cleanliness and comfort of infants. The market for baby care products is predominantly influenced by shifts in parental lifestyles. In recent decades, particularly with mothers increasingly prioritizing careers and leading busy lives, a lucrative growth opportunity has emerged for manufacturers in the baby care product market.

Key Market Insights:

The market for baby care products is tailored to address the unique needs of infants and toddlers, whose sensitive skin demands specialized care. These products are carefully formulated to ensure they are gentle and mild, emphasizing hydration and nourishment to maintain cleanliness and comfort.

In recent years, the baby skincare products market has experienced notable expansion. Heightened parental awareness regarding the significance of opting for safe and natural skincare solutions for their infants has fueled increased demand for such products. Furthermore, the proliferation of the e-commerce sector has simplified access to a broader array of products, facilitating online purchases for parents.

Baby Care Products Market Drivers:

Lifestyle Changes and increasing Awareness Regarding Children's Health and Hygiene drive the market.

In recent years, the baby product industry has experienced substantial growth, fueled by several factors including the rising participation of women in the workforce, increased disposable income, and growing concerns about health and hygiene. As parents find themselves increasingly occupied with work commitments, they aspire to provide the best care for their children, leading to a heightened demand for baby care products to ensure optimal health and safety.

Infant skin differs significantly from adult skin—it is thinner, less hairy, softer, and less cornified, necessitating extra care. One prevalent issue among children, particularly infants, stems from tightly fitting garments, which, when not changed frequently, create a warm, stagnant environment conducive to bacterial growth. This can result in various dermatological and health issues such as skin rashes, diaper rash, and cradle caps. To combat the proliferation of bacteria, baby care products often contain formulations with germicides like cetyl pyridinium chloride and benzethonium chloride, aiding in maintaining the infant's well-being.

Ensuring children receive essential nutrients is paramount for parents. However, challenges in delivering these nutrients through conventional meals have prompted a shift in focus towards supplements.

Baby Care Products Market Restraints and Challenges:

The primary challenge facing the market is the escalating apprehension regarding safety and security among consumers. Counterfeit products pose significant risks, including allergies, infections, and exposure to harmful chemicals, thereby impeding the growth rate of the market.

Furthermore, the market is hindered by the substantial costs associated with research and development, as well as the limited availability of infrastructural facilities. Additionally, in economically disadvantaged regions, there is a lack of awareness which acts as a barrier to market growth.

Moreover, the proliferation of counterfeit products, coupled with insufficient insurance coverage and regulatory compliance, poses challenges to the market, particularly in low- and middle-income countries where suitable infrastructure is lacking. These factors are anticipated to continue challenging the market in the forecast period.

Baby Care Products Market Opportunities:

Companies Focusing on Safety features create opportunities.

Key players in the baby care products market are increasingly prioritizing the development of multipurpose products that combine functional design with style and enhanced safety features. This strategic approach aims to offer parents greater convenience in caring for their children amidst their busy lifestyles. However, new entrants encounter challenges in penetrating the market due to significant barriers to entry, including the high investment requirements associated with product manufacturing, development, and innovation.

An increase in technological advancements creates opportunities.

The market value is experiencing a boost due to rising technological advancements in manufacturing technology. These advancements aim to reduce production costs and waste, alongside the increasing adoption of internet-accessible laundry services. Moreover, a surge in demand across various end-use industries contributes positively to the market's growth rate.

Manufacturers are increasingly incorporating organic ingredients known for promoting the physical and mental growth of babies into their baby care products. Additionally, heightened investment in advertising and promotional campaigns by manufacturers to enhance brand awareness is bolstering market growth. Furthermore, the escalating number of product innovation activities, coupled with an increase in personal disposable income, is expected to further drive the market's growth rate.

BABY CARE PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.9% |

|

Segments Covered |

By Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Johnson & Johnson Private Limited (U.S.), The Proctor and Gamble (U.S.), Dabur India Ltd., (India), Nestle S.A. (Switzerland), Artsana India Private Limited (India), Daxal Cosmetics Private Limited, The Himalaya Drug Company (India), Pigeon India Private Limited (India), Hindustan Unilever Limited (India) |

Baby Care Products Market Segmentation: By Type

-

Skin Care

-

Hair Care

-

Toiletries

-

Food & Beverages

The baby toiletries and hair care segment has dominated the market in terms of revenue share and is anticipated to maintain its leading position throughout the forecast period, 2024-2030. Products such as baby shampoos, conditioners, washes, and wipes are extensively used, particularly for infants, offering instant hydration and skin refreshment. These items are valued for their user-friendly nature, providing a hassle-free and rapid solution for addressing issues like dryness, infections, and diaper rashes.

Conversely, the skincare segment is forecasted to exhibit the highest compound annual growth rate (CAGR). This category encompasses a variety of moisturizers, face creams, powders, and massage oils. Informed parents are increasingly opting for products containing antioxidants, and antibacterial, and antifungal properties, which are deemed beneficial for sensitive infant skin.

Within the baby toiletries and hair care segment, the body wash category commands the largest market share and is poised for significant expansion. Body washes have garnered popularity globally, particularly in the Asia Pacific and North America regions, driven by their adoption among an increasing number of consumers due to the rising population in these areas, prompting greater demand for baby care products.

Baby Care Products Market Segmentation: By Distribution Channel

-

Hypermarkets & Supermarket

-

Convenience Store

-

Online Platform

-

Pharmacy & Drugstores

-

Specialty Store

-

Online

Hypermarkets and supermarkets have secured the largest revenue share, exceeding 45.0% in 2023. Meanwhile, the specialty store segment is poised to achieve the fastest compound annual growth rate (CAGR) of 4.9% during 2024-2030. Customers often opt for these stores due to the convenience of purchase, extensive network coverage, and the opportunity to procure consistent supplies of preferred products. Additionally, these stores capitalize on the increasing popularity of niche items such as organic, natural, and herbal products.

The online segment is anticipated to experience substantial growth, with online sales of baby care products projected to surge during the forecast period. Major e-commerce giants like Amazon and Walmart dominate the online retail space for baby care products, contributing significantly to this segment's growth.

Baby Care Products Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region is poised to emerge as the fastest-growing market for baby care products in the forecast period, 2024-2030, driven by factors such as increasing birth rates, urbanization, and rapid economic expansion leading to higher parental incomes. This rise in purchasing power has significantly boosted consumer spending on baby care products. Furthermore, the growing literacy rate and access to transparent research information have influenced parents to favor organic baby care products, prompting manufacturers to prioritize parameters like ingredient quality, product efficacy, value for money, and absence of additives.

In Central and South America, market expansion is anticipated as manufacturers focus on developing baby care products incorporating a blend of natural and organic ingredients to attract new customer segments.

North America is expected to witness notable growth, supported by the presence of established manufacturers such as Unilever, Kimberly-Clark (KCWW), and Johnson & Johnson Consumer Inc. Additionally, the region benefits from robust infrastructure facilities for retailers, further driving demand for baby care products.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic exerted a substantial influence on the baby care products market, presenting both challenges and opportunities. The magnitude of its impact varied depending on factors such as product category, distribution channels, and shifts in consumer behavior. Global supply chains experienced disruptions, resulting in shortages of specific baby care items, notably during the initial phases of the pandemic. This shortage particularly affected the availability of essentials like diapers and formula. Furthermore, numerous physical retail outlets, including specialty baby stores, grappled with temporary closures or reduced operational hours due to lockdowns and social distancing mandates, thereby adversely affecting in-store sales.

Latest Trends/ Developments:

-

In December 2022, the children's food brand Timios unveiled an organic porridge range tailored for infants and toddlers. According to the company, these porridges are freshly prepared upon customer orders, thereby eliminating the necessity for preservatives, and are crafted solely from organic ingredients.

-

Also in December 2022, Himalaya Wellness Company initiated a digital campaign titled 'Naye Zamane Ka Traditional Oil' to promote its latest baby massage oil range. The brand has devised a customized and comprehensive marketing strategy for this campaign, collaborating with various e-commerce and social media platforms to enhance product visibility.

Key Players:

These are the top 10 players in the Baby Care Products Market: -

-

Johnson & Johnson Private Limited (U.S.)

-

The Proctor and Gamble (U.S.)

-

Dabur India Ltd., (India)

-

Nestle S.A. (Switzerland)

-

Artsana India Private Limited (India)

-

Daxal Cosmetics Private Limited

-

The Himalaya Drug Company (India)

-

Pigeon India Private Limited (India)

-

Hindustan Unilever Limited (India)

Chapter 1. Baby Care Products Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Baby Care Products Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Baby Care Products Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Baby Care Products Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Baby Care Products Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Baby Care Products Market – By Type

6.1 Introduction/Key Findings

6.2 Skin Care

6.3 Hair Care

6.4 Toiletries

6.5 Food & Beverages

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Baby Care Products Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Hypermarkets & Supermarket

7.3 Convenience Store

7.4 Online Platform

7.5 Pharmacy & Drugstores

7.6 Specialty Store

7.7 Online

7.8 Y-O-Y Growth trend Analysis By Distribution Channel

7.9 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Baby Care Products Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Baby Care Products Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Johnson & Johnson Private Limited (U.S.)

9.2 The Proctor and Gamble (U.S.)

9.3 Dabur India Ltd., (India)

9.4 Nestle S.A. (Switzerland)

9.5 Artsana India Private Limited (India)

9.6 Daxal Cosmetics Private Limited

9.7 The Himalaya Drug Company (India)

9.8 Pigeon India Private Limited (India)

9.9 Hindustan Unilever Limited (India)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for baby care products is tailored to address the unique needs of infants and toddlers, whose sensitive skin demands specialized care. These products are carefully formulated to ensure they are gentle and mild, emphasizing hydration and nourishment to maintain cleanliness and comfort.

The top players operating in the Baby Care Products Market are - Johnson & Johnson Private Limited (U.S.), Proctor and Gamble (U.S.), Dabur India Ltd., (India), Nestle S.A. (Switzerland), and Artsana India Private Limited (India).

The COVID-19 pandemic exerted a substantial influence on the baby care products market, presenting both challenges and opportunities. The magnitude of its impact varied depending on factors such as product category, distribution channels, and shifts in consumer behavior.

Key players in the baby care products market are increasingly prioritizing the development of multipurpose products that combine functional design with style and enhanced safety features. This strategic approach aims to offer parents greater convenience in caring for their children amidst their busy lifestyles.

North America is expected to witness notable growth, supported by the presence of established manufacturers such as Unilever, Kimberly-Clark (KCWW), and Johnson & Johnson Consumer Inc.