GLOBAL AYURVEDIC TOOTHPASTE MARKET (2024 - 2030)

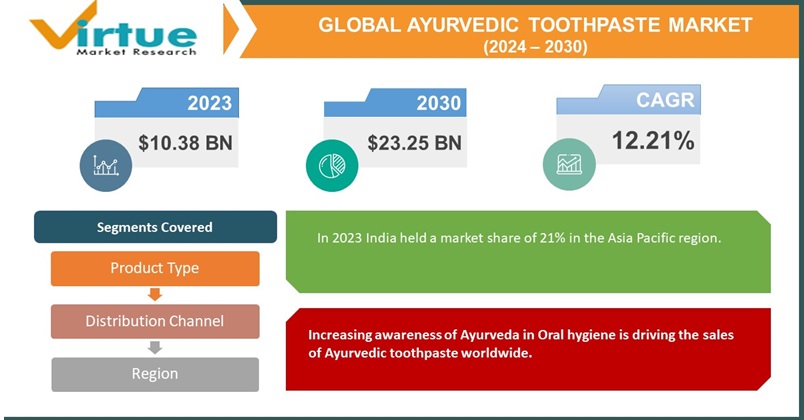

The Global Ayurvedic Toothpaste Market was valued at USD 10.38 billion and is projected to reach a market size of USD 23.25 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.21%.

The Ayurvedic toothpaste industry is witnessing growth due, to the increasing consumer demand for holistic oral care solutions based on traditional Ayurvedic principles. Ayurvedic toothpaste is made using ingredients such as herbs and plant extracts avoiding the use of chemicals and artificial additives. This surge in popularity can be attributed to factors, including the growing awareness of the hazards associated with chemical-laden toothpaste, a preference for herbal and wellness-oriented products, and a rising interest in Ayurveda and natural healthcare. Apart from providing health benefits Ayurvedic toothpaste also meets consumers’ preferences for environmentally friendly options. As more people embrace Ayurvedic wellness products the market, for Ayurvedic toothpaste is expected to witness growth offering alternative choices in the oral care industry.

Key Market Insights:

Before herbal toothpaste can be sold to the public, the Food and Drug Administration (FDA) mandates that they must meet criteria concerning their ingredients, labeling, and safety requirements.

The World Health Organization (WHO) also offers guidance on the utilization of toothpastes that integrate recognized standards and research discoveries concerning oral health products. According to WHO, it is advised that all herbal toothpastes should consist of components that have been proven effective, in combating caries and periodontal diseases.

The Cosmetic Products Regulation, implemented by the European Union (EU) outlines the safety standards, for products including toothpaste. This regulation also addresses aspects such, as packaging, labeling, and relevant information regarding the product’s usage.

In 2021 the Health Resources and Services Administration (HRSA) reported that Louisiana had the highest rate of health problems, among children and teenagers aged 1 to 17. At that time 19% of kids and teens in Louisiana had issues with their health. In contrast, across the United States, 14% of children and adolescents experienced cases.

Based on data, from the American Dental Hygienists Association, it’s estimated that 80% of Americans are prone, to developing at one cavity by the time they turn 71. Furthermore, gum disease seems to impact around 80% of Americans in some capacity.

Ayurvedic Toothpaste Market Drivers:

Increasing awareness of Ayurveda in Oral hygiene is driving the sales of Ayurvedic toothpaste worldwide.

The increasing occurrence of diseases is a driver, for the global ayurvedic market expansion. As stated by the World Health Organization diseases are a concern in numerous countries and have long-term impacts, on individuals causing pain, discomfort, disfigurement, and even mortality. According to the Global Burden of Disease Study 2017, it was estimated that 3.5 billion people worldwide are affected by diseases with permanent tooth decay being the most prevalent condition.

Technical Advancements is boosting market growth.

The continuous advancements, in technology have resulted in the introduction of products in the market. As an example back in 2018 Dabur introduced "Dabur Red Gel," a product that combines ingredients such as mint, clove oil, Tomar, and refreshing gel properties. This unique blend aims to offer protection against issues while ensuring lasting freshness. The intention behind this product was to bring the proven benefits of Ayurveda into a format, for modern-day use.

Growing Consumer Demand for Sustainable, Eco-Friendly, and Chemical-Free Products.

The increasing global demand, for toothpaste, can be attributed to the rising preference for products that are free from chemicals, environmentally friendly, and sustainable. Another factor driving this demand is customers’ inclination towards toothpaste that aids in the remineralization of teeth and gums. The industry has experienced growth due to marketing efforts and promotional campaigns, by key players who actively promote the benefits of using ayurvedic products through advertising and publicity initiatives.

Ayurvedic Toothpaste Market Restraints and Challenges:

The widespread use of toothpaste is anticipated to hinder market growth. The market, for toothpaste is fiercely competitive with numerous local and international companies making claims to meet the increasing global demand. Additionally, the lack of awareness about the health advantages of toothpaste in developing regions, like MEA is expected to limit market expansion.

Ayurvedic Toothpaste Market Opportunities:

The market is expected to see prospects, with the introduction of options for flavored herbal toothpaste. One such example is the Tea Tree Oil & Neem Wintergreen toothpaste developed by Desert Essence, a company. This toothpaste includes extracts from the Neem tree, a type of evergreen tree found in India. These extracts not only breathe and fight mouth bacteria but also help whiten teeth. Additionally the antiseptic properties of tea tree oil aid, in preventing gingivitis.

The market, for toothpaste designed specifically for children, is experiencing a demand, which is expected to provide substantial growth prospects for companies operating in this sector. The increasing prevalence of cavities among kids, coupled with the growing awareness among parents, about the advantages of products is anticipated to drive market growth in the future.

AYURVEDIC TOOTHPASTE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.21% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Himalaya Herbal Healthcare, Procter & Gamble Co., Unilever Group, Colgate-Palmolive Company, GlaxoSmithKline plc Lion Corporation, Marico Limited, Dabur India Ltd., Patanjali Ayurved Limited, Amway Corporation |

Ayurvedic Toothpaste Market Segmentation:

Market Segmentation: By Product Type:

- Whitening Toothpaste

- Sensitivity Toothpaste

- Anti-cavity Toothpaste

- Others

In terms of sales the herbal toothpaste market, in 2023 was largely dominated by the category focused on whitening. The whitening segment accounted for a portion of sales driven by the increasing demand for teeth whitening products as people place importance on dental aesthetics and personal grooming. The popularity of toothpaste with whitening properties is growing because it provides a safe alternative to chemical-based teeth whitening procedures. Consumers are willing to invest more in products that claim to enhance their appearance. Additionally, herbal toothpaste with whitening features includes ingredients like baking soda, charcoal, and silica to remove stains and plaque from teeth without causing any harm to the enamel. The market for toothpaste is continuously expanding within the whitening category due, to the growing trend of using natural products. It is projected that the sensitivity toothpaste sector will experience the fastest growth rate throughout the forecast period.

Market Segmentation: By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Pharmacies/Drug Stores

- Others.

Convenience stores have the most dominant market position and are expected to experience the highest growth rate of 12.69% during the projected period, 2024-2030. These stores are widely spread across India and other emerging countries making them an ideal platform, for brand producers to introduce their products and expand their customer base. With a number of customers, these establishments ensure that they stock brands on their shelves aiming to maximize their visibility. Additionally, convenience stores offer the convenience of finding items under one roof. Take, for example, the Taj Grocer store in the UK which offers products like toothpaste and oral care items along with other everyday necessities making it easy for customers to purchase them together.

Supermarkets and hypermarkets are witnessing the fastest growth as a distribution channel for Ayurvedic toothpaste. This is primarily due to their presence in cities and metropolitan areas which gives them an advantage in influencing consumer choices among the wide range of available products in the market. The demand for toothpaste, in supermarkets and hypermarkets is increasing as consumers become more aware of the long-term risks associated with using chemical-laden products.

Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023 India held a market share of 21% in the Asia Pacific region. The Indian market has been influenced positively by government initiatives, like the promotion of culture and practices through 'AYUSH' and increased focus, on Yoga. Additionally, the availability of a range of priced products has also contributed to the growth of the market.

On the contrary, North America is expected to experience the fastest growth, during the forecasted period. This can be attributed to the increasing popularity of formulations, in the region. One key factor contributing to this market growth is the shift, in consumer preferences from ingredients to ones. Additionally, the rising popularity of products through retail platforms and increased consumer spending on oral care products are driving the demand for these items in the region. It's worth noting that these products do not contain any sweeteners making them suitable, for children well.

COVID-19 Impact Analysis on the Global Ayurvedic Toothpaste Market:

The COVID-19 pandemic has had an effect, on the toothpaste industry. This is because people worldwide have been cautious about going out to prevent getting infected by the coronavirus. As a result, individuals have shifted their preferences from products to herbal methods leading to significant market growth. Consequently, online retailers have experienced increased sales due, to gatherings and the practice of distancing.

Latest Trends/ Developments:

The increasing inclination, towards chemical products and the surging demand for sustainable options are fueling the global market for Ayurvedic toothpaste. This market is driven by the use of ingredients such, as clove, mint extract, ginger, neem holy basil, black pepper, nutmeg, cardamom, and more. These herbal ingredients provide benefits that contribute to teeth effective protection and long-term health of both teeth and gums. Due, to the increasing demand major players in the market are focusing their investments on research and development to create improved toothpaste options. These innovations include varying ingredients, flavors, packaging, and benefits. For example, Auromere recently introduced mint-flavored toothpaste that comes in eco-friendly glass jars with a metal cap and wooden serving spoon. This eco-conscious packaging sets it apart from its competitors in the industry. Gives it a competitive advantage. With no plastic involved and full recyclability consumers looking for alternatives to traditional toothpaste tubes are drawn to this product. As a result, the global toothpaste market is expected to experience growth due to increased health consciousness among consumers and their preference for ayurvedic ingredients along, with the growing importance of oral hygiene.

Key Players:

- Himalaya Herbal Healthcare

- Procter & Gamble Co.

- Unilever Group

- Colgate-Palmolive Company

- GlaxoSmithKline plc

- Lion Corporation

- Marico Limited

- Dabur India Ltd.

- Patanjali Ayurved Limited

- Amway Corporation

In the year 2021, Himalaya Herbal Healthcare introduced a toothpaste named "Herbodent Professional." This toothpaste contains natural plant extracts that aid, in combating germs minimizing gum bleeding, and promoting cleanliness. It has undergone trials. Is completely devoid of any harmful substances, like parabens, triclosan, or fluoride.

Unilever Group made a move in 2021 by acquiring the oral care division of Carver Korea, a company known for its focus, on natural oral care products. This acquisition was driven by Unilever’s desire to broaden its reach in the oral care market.

Chapter 1. GLOBAL AYURVEDIC TOOTHPASTE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL AYURVEDIC TOOTHPASTE MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL AYURVEDIC TOOTHPASTE MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL AYURVEDIC TOOTHPASTE MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL AYURVEDIC TOOTHPASTE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL AYURVEDIC TOOTHPASTE MARKET – By Product Type

6.1. Introduction/Key Findings

6.2. Supermarkets/Hypermarkets

6.3. Specialty Stores

6.4. Convenience stores

6.5. Online Retail

6.6. Y-O-Y Growth trend Analysis By Distribution Channel

6.7. Absolute $ Opportunity Analysis By Distribution Channel , 2023-2030

Chapter 7. GLOBAL AYURVEDIC TOOTHPASTE MARKET – By Distribution Channel

7.1. Introduction/Key Findings

7.2. Food and Beverage

7.3. Industrial

7.4. Consumer

7.5. Others

7.6. Y-O-Y Growth trend Analysis By End User

7.7 . Absolute $ Opportunity Analysis By End User , 2023-2030

Chapter 8. GLOBAL AYURVEDIC TOOTHPASTE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Product Type

8.1.3. By Distribution Channel

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Distribution Channel

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By Distribution Channel

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product Type

8.4.3. By Distribution Channel

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By Distribution Channel

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL AYURVEDIC TOOTHPASTE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Himalaya Herbal Healthcare

9.2. Procter & Gamble Co.

9.3. Unilever Group

9.4. Colgate-Palmolive Company

9.5. GlaxoSmithKline plc

9.6. Lion Corporation

9.7. Marico Limited

9.8. Dabur India Ltd.

9.9. Patanjali Ayurved Limited

9.10. Amway Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Ayurvedic Toothpaste Market was valued at USD 10.38 billion and is projected to reach a market size of USD 23.25 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.21%

Increasing awareness of Oral hygiene, Technical Advancements, and Growing Consumer Demand for Sustainable, Eco-Friendly, and Chemical-Free Products.

Based on the Distribution Channel, the Global Ayurvedic Toothpaste Market is segmented by Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Pharmacies/Drug Stores, and Others.

Asia Pacific is the most dominant region for the Global Ayurvedic Toothpaste Market.

Himalaya Herbal Healthcare, Procter & Gamble Co, Unilever Group, Colgate-Palmolive Company, GlaxoSmithKline plc, and Lion Corporation are the key players operating in the Global Ayurvedic Toothpaste Market.