Aviation Services Market Size (2025-2030)

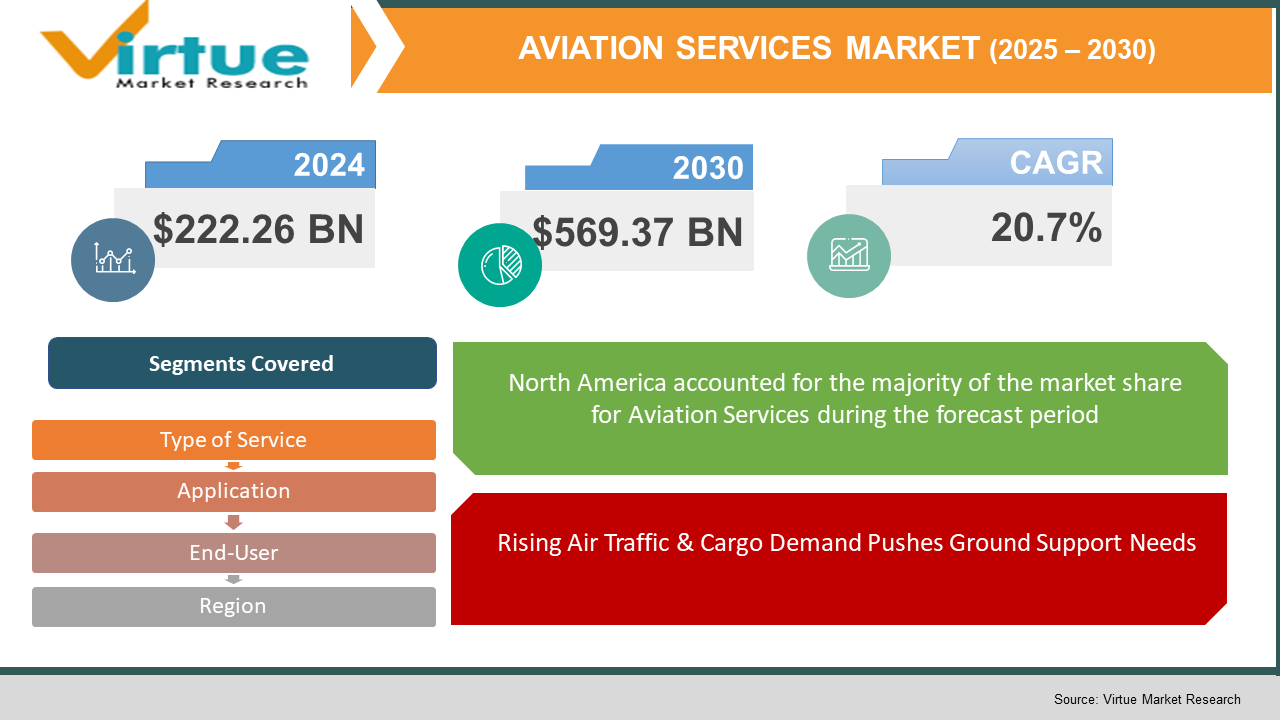

The Aviation Services Market was valued at $222.26 billion in 2024 and is projected to reach a market size of $569.37 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 20.7%.

The Aviation Services Market is changing a lot thanks to more airports being built, upgrades to airport facilities, and an increase in passenger numbers, especially in developing countries. This market includes important services like managing cargo, flight control, and overall operations, as well as helping passengers with customer service. Airport services connect airlines with travelers, making money through both aeronautical services (like landing fees) and non-aeronautical ones (like shops and restaurants). These services help ensure passengers move smoothly through the airport and maintain high standards for airlines with aircraft design and operational support. As renovations of existing airports and new terminal builds happen, service providers are stepping up their game to stay competitive. Digital technology is also making a big impact, as many aviation companies are starting to use software for better efficiency, safety, and cost control. Tools like AI, machine learning, and IoT help with things like maintenance and flight planning, while cloud services and mobile apps make communication smoother across airport operations. Support from regulations and government research initiatives is speeding up the use of secure aviation software, leading to new features and better user experiences. With aviation software now key to saving fuel and boosting sustainability, service providers are adjusting their strategies to meet the fast-changing needs of the industry, especially in growing markets where airport facilities are expanding quickly.

Key Market Insights:

More than 65% of aviation service providers are using digital tools like AI, IoT, and real-time data to improve their operations. This helps with things like flight planning, maintenance, and managing ground activities. Cloud systems and mobile apps allow better communication among pilots, ground crews, and control centers, making things run more smoothly in both commercial and private aviation.

When it comes to handling passengers, over 70% of international airports have started using automated check-in kiosks, biometric security checks, and mobile services. These upgrades help keep customers happy and make things like boarding, baggage handling, and cargo delivery easier.

About 58% of airports in developing areas are being upgraded or expanded, creating a need for better services like aircraft maintenance and ground support. This growth is pushing service providers to boost their capacity and maintain quality to stay in the game.

Non-aeronautical services are now responsible for almost 40% of airport revenue, thanks to things like retail shops, parking, and digital ads. Aviation service providers are taking advantage of this by offering a mix of flight and ground services.

Finally, around 52% of global aviation infrastructure projects are happening through public-private partnerships, attracting investment in better services. Safety and service quality regulations are getting stricter, which is pushing providers to use certified software and security measures to keep up with the rising demands of passengers and operations.

Aviation Services Market Key Drivers:

Digital and AI Integration Boosts Real-Time Efficiency.

Using AI-driven predictive analytics, there's been over a 30% drop in unscheduled maintenance, making planes more reliable and saving money. Airlines and airports are using sensors and cloud tech to streamline routing, baggage handling, and safety checks.

Rising Air Traffic & Cargo Demand Pushes Ground Support Needs.

As air travel picks up again, with passenger numbers nearly back to 2019 levels, ground services like cargo handling are ramping up too. The growth of online shopping is increasing the need for air freight logistics, and expanding maintenance and cargo services.

Airport Upgrades & New Aircraft Stimulate Infrastructure Growth.

Around 60% of airports in developing areas are either expanding or being upgraded, leading to more investment in ground operations and technology. At the same time, new aircraft orders are increasing long-term maintenance needs, while demands for sustainable fuels are boosting green service options.

Aviation Services Market Restraints and Challenges:

Dealing with High Costs, Talent Shortages, ESG Challenges, and Geopolitics.

The Aviation Services Market is facing some tough challenges right now. Smaller companies are struggling with high costs related to infrastructure, modern tech, and the ups and downs of fuel prices, which make operations a bit unpredictable. We're also seeing a big shortage of skilled workers like pilots, technicians, and air traffic controllers. This is causing delays, pushing salaries, and putting pressure on maintenance and repair sectors around the world. On top of that, regulations related to the environment and safety are making things even trickier and more expensive. Rules around sustainable aviation fuel and emissions limits require a lot of money and changes in processes. Geopolitical tensions, airspace limitations, and supply chain issues are making it hard to keep routes flexible and maintain aircraft on time, which affects reliability and profits. Plus, there's a growing threat from cyber-attacks—up 74% since 2020—which is exposing weaknesses in important aviation systems. This means companies need to invest more in security and skilled cyber defense.

Aviation Services Market Opportunities:

Exciting Changes in the Aviation Services Market Thanks to eVTOL Tech, Smart Infrastructure, and Sustainability Efforts.

The Aviation Services Market is changing fast, driven by the rise of electric vertical takeoff and landing (eVTOL) aircraft and urban air travel. This is leading to new designs for vertiports, better ground services, and fresh maintenance and management options. Cities like Dubai, Singapore, Los Angeles, and San Antonio are already investing in vertiports, creating a need for infrastructure experts, charging stations, and air traffic systems focused on low-altitude flights. At the same time, AI in air traffic management and smarter ground services are promising better flight schedules, less congestion, and improved safety as urban mobility expands. Plus, the push for sustainability is opening new opportunities: real-time route optimization, green fuels, and smart airport operations fit right in with global emission goals, giving service providers a shot at leading the way in eco-friendly solutions. With support from governments—like the UAE planning air routes and the UK funding flying taxis—collaboration among regulators, service providers, and tech companies is on the rise. All these trends are mixing traditional aviation services with new urban air mobility and smart infrastructure, giving everyone involved a chance to innovate and succeed in the future of air travel.

AVIATION SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

20.7% |

|

Segments Covered |

By type of service, application, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Swissport International Ltd., Data, Menzies Aviation, SITA, AAR Corporation, Lufthansa Technik AG, Singapore Technologies Engineering Ltd, Delta TechOps, Hallmark Aviation Services, GE Aerospace |

Aviation Services Market Segmentation:

Aviation Services Market Segmentation: By Type of Service

- Aircraft Management

- Aircraft Maintenance / MRO (Maintenance, Repair & Overhaul)

- Ramp & Ground Handling (e.g., baggage loading, pushback)

- Aircraft Rental & Charter (aircraft rental, air taxi)

- Passenger Services (check-in, lounges, cabin provisioning)

- Cargo Management (air freight handling, logistics)

- Aviation Training (pilot, crew, technical training)

- Others (e.g., fuel & oil handling, air traffic management software)

Ramp and ground handling services, like baggage loading and fuel management, are the fastest-growing part of the aviation services market. They made up about 32% of ground handling revenue in 2024, mainly because there's a push to reduce turnaround times and handle more air traffic, particularly in Asia-Pacific and North America. Investments in automated baggage systems and advanced equipment are helping improve efficiency and safety, making these services a top choice for airports looking to enhance operations.

On the other hand, Aircraft Maintenance, Repair & Overhaul (MRO) remains the biggest segment in this market, holding the largest share of spending. The global MRO market was worth over $88 billion in 2023 and is expected to top $115 billion by 2028. Maintenance, particularly engine overhaul, accounts for 41% of MRO revenue and is vital for safety and operations. Leading companies like Lufthansa Technik and Delta TechOps are investing in new facilities and tools, strengthening MRO's key role in the industry.

Aviation Services Market Segmentation: By Application

- Commercial Aviation

- General Aviation

- Military Aviation

The military aviation sector is seeing rapid growth, especially in the rotorcraft area, which is expected to grow about 7% per year from 2025 to 2030, driven by global conflicts and security needs. Fixed-wing military aircraft, like fighters and transport planes, will make up about 87% of the market in 2024, thanks to countries like the U.S., India, and China ramping up their purchases. This military modernization and higher defense budgets are boosting demand for maintenance and support services.

On the other hand, commercial aviation is still the biggest player in the market, accounting for around 53% of the U.S. aviation market in 2024. This growth is supported by increasing passenger traffic after COVID-19, more narrow-body planes, and a rise in air cargo. Narrow-body aircraft generate around 60% of civil aviation revenue, while passenger transport makes up over 80% of civil aviation spending. These trends show that commercial aviation remains essential for driving consistent demand for passenger, cargo, and maintenance services.

Aviation Services Market Segmentation: By End-User

- Airlines (Commercial Carriers)

- Airports

- Government Agencies / Military

- Others (Private Individuals, Charter Operators, Aerial Survey, Agri-Services)

The airlines segment is growing the fastest among users. With passenger traffic almost back to pre-2020 levels and airlines expanding their networks, this area is driving demand for services like ground handling and MRO support. Airlines are embracing tech upgrades, such as automated baggage systems and self-check kiosks, to boost efficiency and reduce delays, which helps service growth.

Major carriers also dominate the market. The airlines segment makes up the largest portion of aviation services revenue because everything revolves around them. They heavily depend on MRO, ground handling, and passenger services to keep operations running smoothly and customers happy. The growth of low-cost carriers and expanding fleets strengthens their hold on market share.

Aviation Services Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

The global Aviation Services Market is concentrated in a few places. North America leads with about 38% of the total assets, due to solid existing institutions and high investor participation. Europe comes next at around 26%, benefiting from cross-border funds and a growing interest in ESG investments. The Asia-Pacific region holds about 24% and is the fastest-growing area, with a rising middle class, more digital tech usage, and efforts from governments to include more people in finance. Latin America makes up roughly 6%, getting a boost from pension changes and fintech, though it still deals with economic ups and downs. Lastly, the Middle East and Africa account for about 6%, with growth supported by things like sovereign wealth funds and Islamic finance, plus more retail investors joining in. This all shows that while North America is still on top, the shift is toward Asia-Pacific and other emerging markets.

COVID-19 Impact Analysis on the Aviation Services Market:

The Aviation Services Market is mainly led by North America, which holds a 29% share in 2024, due to its strong aviation infrastructure and a lot of commercial and business aircraft services. Europe is not far behind with a 25% share, supported by its large networks of low-cost carriers and upgrades in the industry. The Asia-Pacific region, driven by the growth of aviation in countries like China, India, Australia, and Southeast Asia, has about 19% of the market. Latin America makes up around 10% of the market, benefiting from growth in domestic flights in Brazil and better regional connections. The Middle East and Africa together take up close to 8%, with places like the UAE and South Africa contributing to steady growth.

Trends/Developments:

In March 2025, Delhi Airport launched the UTAM Airside Management System, which uses real-time data and advanced tech to improve safety, minimize ground delays, and enhance teamwork between airlines, ground teams, and air traffic control.

In December 2024, GMR Airports rolled out an Airport Predictive Operations Centre at Rajiv Gandhi International Airport. This center makes use of a smart digital twin to streamline everything from airside operations to passenger flow and gate management.

In October 2024, Microsoft revealed a new AI system for airlines and airports. This tech aims to improve traveler experiences with features like booking assistance and biometric check-ins, expecting to cut delays by about 35%, lower service costs by around 30%, and increase revenue per passenger by 10-15%.

In January 2024, Bangalore International Airport introduced the BLR Pulse app. This app, developed with GrayMatter Software Services, gives travelers real-time info on check-ins, baggage updates, terminal navigation, and flight alerts, making the travel experience more straightforward.

Key Players:

- Swissport International Ltd.

- Data

- Menzies Aviation

- SITA

- AAR Corporation

- Lufthansa Technik AG

- Singapore Technologies Engineering Ltd

- Delta TechOps

- Hallmark Aviation Services

- GE Aerospace

Chapter 1. Aviation Services Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Aviation Services Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Aviation Services Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging TYPE Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Aviation Services Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Aviation Services Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Aviation Services Market – By Type of Service

6.1 Introduction/Key Findings

6.2 Aircraft Management

6.3 Aircraft Maintenance / MRO (Maintenance, Repair & Overhaul)

6.4 Ramp & Ground Handling (e.g., baggage loading, pushback)

6.5 Aircraft Rental & Charter (aircraft rental, air taxi)

6.6 Passenger Services (check-in, lounges, cabin provisioning)

6.7 Cargo Management (air freight handling, logistics)

6.8 Aviation Training (pilot, crew, technical training)

6.9 Others (e.g., fuel & oil handling, air traffic management software)

6.10 Y-O-Y Growth trend Analysis By Type of Service

6.11 Absolute $ Opportunity Analysis By Type of Service , 2025-2030

Chapter 7. Aviation Services Market – By Application

7.1 Introduction/Key Findings

7.2 Commercial Aviation

7.3 General Aviation

7.4 Military Aviation

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Aviation Services Market – By End-User

8.1 Introduction/Key Findings

8.2 Airlines (Commercial Carriers)

8.3 Airports

8.4 Government Agencies / Military

8.5 Others (Private Individuals, Charter Operators, Aerial Survey, Agri-Services)

8.6 Y-O-Y Growth trend Analysis End-User

8.7 Absolute $ Opportunity Analysis End-User , 2025-2030

Chapter 9. Aviation Services Market Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Type of Service

9.1.3. By End-User

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Type of Service

9.2.3. By End-User

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Type of Service

9.3.3. By End-User

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By End-User

9.4.3. By Application

9.4.4. By Type of Service

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By End-User

9.5.3. By Type of Service

9.5.4. By Application

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Aviation Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Swissport International Ltd.

10.2 Data

10.3 Menzies Aviation

10.4 SITA

10.5 AAR Corporation

10.6 Lufthansa Technik AG

10.7 Singapore Technologies Engineering Ltd

10.8 Delta TechOps

10.9 Hallmark Aviation Services

10.10 GE Aerospace

.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Increased air traffic, investment in infrastructure, and upgrades to fleets.

Commercial airlines, airports, and defense agencies are the top users.

AI helps with maintenance, cuts down on delays, and boosts safety.

North America and Europe are growing their aviation services fast

Sustainability, digital changes, and self-driving ground operations are on the rise.