Aviation Gas Turbine Market Size (2024-2030)

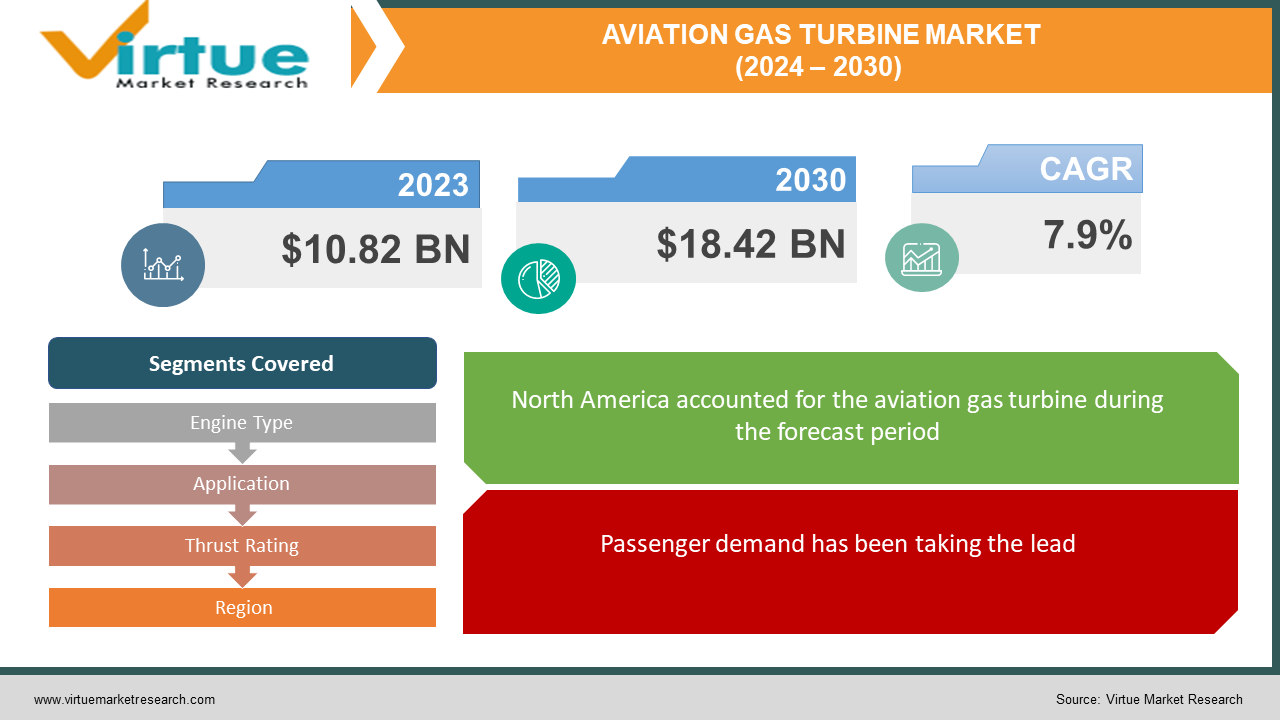

The aviation gas turbine market was valued at USD 10.82 billion in 2023 and is projected to reach a market size of USD 18.42 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.9%.

A gas turbine is a type of rotary engine that transforms chemical energy from fuel into mechanical energy by using air as the working fluid. The engine and propeller of the aircraft are powered by this energy. Aerial vehicles are propelled by gas turbines. They are installed above the wings of contemporary commercial airplanes. Turbojet engines are used in fighter aircraft and military planes. Sustainable fuels and hybrid technologies are being prioritized in this market. Data analytics and predictive maintenance keep engines purring like well-oiled machines, optimizing performance, and minimizing downtime. The future holds immense potential for hypersonic engines.

Key Market Insights:

The aviation gas turbine market has undergone significant transformation over the years. Sustainability is being emphasized, with research into alternative fuels like biofuels and hydrogen promising greener skies. Hybrid electric gas turbines are in demand, highlighting silent taxiing and electric takeoffs. Predictive maintenance and data analytics also contribute to the smooth operation of engines and the reduction of downtime.

But along with this, the industry is subjected to many difficulties as well. Rising fuel costs, geopolitical tensions, and environmental concerns require careful navigation. But within these challenges lie opportunities. Innovation in materials, design, and alternative fuels is offering numerous possibilities for the market.

The aviation gas turbine market is a complex ecosystem, with established players like Rolls-Royce, GE Aviation, and Pratt & Whitney leading the charge. But startups and research institutions are also fueling the journey. By understanding the trends, technologies, and forecasts, businesses can chart their course toward success in this ever-expanding market.

Aviation Gas Turbine Market Drivers:

Passenger demand has been taking the lead.

The growing appetite for air travel, particularly in emerging markets like Asia-Pacific, drives the need for more efficient and reliable engines. Busy airports are full of excited travelers; each trip fueled by these powerful turbines is possible because of this.

Regional jets have been ruling the runway.

Short-haul flights are experiencing a boom, creating a demand for smaller, fuel-efficient gas turbines designed for shorter routes. Nimble regional jets zipping between cities are powered by engines optimized for swift regional hops.

An increasing emphasis on sustainability has been fueling the growth.

Sustainability has been pushing for engines that minimize emissions and explore alternative fuels like biofuels and hydrogen. R&D activities are being carried out to construct planes that can utilize renewable energy sources, thereby creating a greener future.

Efficiency is helping with market development.

Airlines prioritize fuel efficiency to reduce costs and emissions, impacting engine design and material development. Lighter, stronger components and innovative technologies like geared turbofans have been contributing to every drop of fuel going further.

Technological advancements have been contributing to the success.

Advancements in areas like additive manufacturing and data analytics are transforming the industry. Intricate engine parts are being crafted layer by layer with unmatched precision, while sensors with operational insights, ensuring smooth performance and preventing costly downtime, are being delivered.

Urban air mobility has been accelerating the growth rate.

The future of transportation might involve buzzing through cityscapes in eVTOL aircraft powered by small gas turbines. A world where these nimble vehicles offer a quieter, cleaner, and more convenient way to navigate urban landscapes is possible.

Aviation Gas Turbine Market Restraints and Challenges:

Associated fuel costs are one of the major barriers in this market.

Rising fuel prices can put a damper on airline profits and dampen demand for new engines. Airlines are facing a fuel squeeze, forcing them to tighten their belts and potentially delay fleet modernization plans.

Bringing new technologies like alternative fuels and hybrid engines to the market can be challenging due to high costs, complex regulations, and infrastructure limitations. Research breakthroughs are subjected to facing real-world obstacles, requiring collaboration and investment to overcome.

Geopolitical tensions have been creating obstacles.

Global conflicts and political instability have been disrupting supply chains, impacting travel demand, and dampening investment in the market.

Environmental concerns are hindering the market's expansion.

Concerns about noise pollution and emissions, both from engine operation and fuel production, continue to be a major challenge. With rising awareness about our environment, suitable measures need to be taken to tackle the same.

Economic downturns have been creating issues.

Global economic downturns can lead to decreased air travel and reduced airline budgets, impacting the demand for new engines and maintenance services. This can lead to significant losses and demotivate the companies.

Aviation Gas Turbine Market Opportunities:

To save on running expenses and their impact on the environment, there is an increasing need for more fuel-efficient engines. To increase fuel economy, there are opportunities to build sophisticated turbine engines with greater bypass ratios, better combustion systems, and lightweight materials. There are chances to create petrol turbine engines with reduced emissions of pollutants and greenhouse gases as environmental sustainability and carbon emissions become more and more of a concern. Research and development on alternative fuels, such as hydrogen, biofuels, and synthetic fuels, is included in this. Technological developments in materials science and manufacturing present prospects for the development of turbines with enhanced durability, lower production costs, and greater strength-to-weight ratios. Innovation is concentrated in the fields of improved coatings, composite materials, and additive manufacturing.

AVIATION GAS TURBINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.9% |

|

Segments Covered |

By Engine Type, Application, Thrust Rating, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

General Electric Aviation (GE), Rolls-Royce, Pratt & Whitney, Safran Aircraft Engines, MTU Aero Engines, Honeywell Aerospace, Mitsubishi Heavy Industries, IHI Corporation, Avio Aero, Aero Engine Corporation of China (AECC) |

Aviation Gas Turbine Market Segmentation: By Engine Type

-

Turbofan Engines

-

Turboprop Engines

-

Turboshaft Engines

In the aviation gas turbine market, turbofan engines are the largest segment, powering most commercial and regional aircraft with their blend of fuel efficiency and thrust. The fastest-growing segment belongs to smaller turboprop engines, fueling the regional air travel boom and conquering short-haul routes with efficiency and robustness.

Aviation Gas Turbine Market Segmentation: By Application

-

Commercial Aviation

-

Military Aviation

-

Business Aviation

Commercial aviation is the largest segment, carrying the bulk of passengers and cargo across continents. It uses hired aircraft to carry people or goods. Military aviation is the fastest-growing segment, fueled by rising geopolitical tensions and the need for advanced engines in fighter jets and transport aircraft.

Aviation Gas Turbine Market Segmentation: By Thrust Rating

-

Low-Thrust Engines

-

Medium-Thrust Engines

-

High-Thrust Engines

Medium-thrust engines are the largest segment in this market. Because they balance power output and fuel efficiency, medium-thrust engines may be used in a variety of flight profiles and operating environments. Compared to bigger engines used in wide-body aircraft, they offer fuel efficiency and adequate thrust for both short- and medium-haul trips. Low-thrust engines claim the fastest-growing title, fueled by the regional air travel boom and their perfect fit for smaller jets zipping between local hubs.

Aviation Gas Turbine Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest growing market in terms of area, holding a rough share of 32% in 2023. Countries like the United States and Canada are at the forefront. The main reason for this is the economy. This makes it easier for them to fund and invest in various projects. Besides, this area has some of the best-established players in the market. They have a global presence, creating more profits. Companies like General Electric Aviation (GE), Rolls-Royce, and Pratt & Whitney are the prominent ones. Even the military plays a vital role, shaping engines for power and reliability in demanding missions.

Asia-Pacific is the fastest-growing region, with a share of around 22%. Economic stability is being achieved in many countries on these continents. Research and developmental activities are being prioritized to create innovations. Local startups and manufacturers have been contributing to the expansion as well. Countries like China, India, and South Korea are at the top.

Europe, with its stringent regulations on emissions, drives the development of cleaner skies, with alternative fuels and hybrid engines taking flight. Countries like Germany and the United Kingdom are the notable ones.

South America has untapped potential, particularly in business aviation and regional travel. Private jets and smaller commercial aircraft are in growing demand for their connectivity. However, infrastructure challenges need to be tackled through collaboration and investment to unlock the full potential of this exciting market.

The Middle East and Africa have a growing economy, and travel demands fuel the market, especially in the business aviation and cargo sectors.

COVID-19 Impact Analysis on the Aviation Gas Turbine Market:

The outbreak of the virus hurt the market. Travel restrictions, lockdowns, and social isolation were the new norm. Financial restraints were prevalent because of uncertainty in the economy. People were losing jobs. But amidst the turbulence, there were few development opportunities. Sustainable fuels and hybrid engines have gained a lot of prominence. The market, adapting to the new landscape, embraces smaller jets for shorter routes, all while technological advancements like data-driven insights and alternative fuels propel it forward. Post-pandemic, the aviation gas turbine market, with its unwavering resilience and focus on innovation, has begun to pick up.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

The aviation gas turbine market has been buzzing with advancements like geared turbofans promising quieter, lighter journeys and 3D-printed parts pushing the boundaries of efficiency. Data-driven whispers keep engines healthy, while hypersonic dreams ignite imaginations of crossing continents in a blink. Collaboration uniting airlines, manufacturers, and researchers to conquer sustainability challenges is emphasized. An urban revolution has been brewing, with eVTOL taxis powered by miniature turbines.

Key Players:

-

General Electric Aviation (GE)

-

Rolls-Royce

-

Pratt & Whitney

-

Safran Aircraft Engines

-

MTU Aero Engines

-

Honeywell Aerospace

-

Mitsubishi Heavy Industries

-

IHI Corporation

-

Avio Aero

-

Aero Engine Corporation of China (AECC)

In December 2023, General Electric Aerospace (GEA) announced that their hypersonic ramjet test had been successful. The test was performed in the Niskayuna, New York, and research facility of the corporation. The test showed a dual-mode ramjet operating in supersonic air flow with a continuous rotating combustion process. According to GEA, this could be the first hypersonic dual-mode ramjet (DMRJ) rig test in history to use rotating detonation combustion (RDC) in a supersonic flow stream. Per GEA, the new ramjet designs have the potential to power flights faster than Mach 5, or more than 4,000 miles per hour.

In July 2022, Rolls-Royce Defense Company designed, constructed, and operated a novel compact engine concept. This project is revolutionary and will alter the way technology and products are created for the UK's Future Combat Air Strategy (FCAS). The first demonstrator engine concept, called Orpheus, is on display at the Farnborough International Air Show (FIAS). It was developed entirely through an agile approach, and it was built almost twice as quickly as a conventional engine program. The second demonstrator in the family is currently being tested in Bristol, UK.

Chapter 1. Aviation Gas Turbine Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aviation Gas Turbine Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aviation Gas Turbine Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aviation Gas Turbine Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aviation Gas Turbine Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aviation Gas Turbine Market – By Engine Type

6.1 Introduction/Key Findings

6.2 Turbofan Engines

6.3 Turboprop Engines

6.4 Turboshaft Engines

6.5 Y-O-Y Growth trend Analysis By Engine Type

6.6 Absolute $ Opportunity Analysis By Engine Type, 2024-2030

Chapter 7. Aviation Gas Turbine Market – By Application

7.1 Introduction/Key Findings

7.2 Commercial Aviation

7.3 Military Aviation

7.4 Business Aviation

7.5 Y-O-Y Growth trend Analysis By Application:

7.6 Absolute $ Opportunity Analysis By Application:, 2024-2030

Chapter 8. Aviation Gas Turbine Market – By Thrust Rating

8.1 Introduction/Key Findings

8.2 Low-Thrust Engines

8.3 Medium-Thrust Engines

8.4 High-Thrust Engines

8.5 Y-O-Y Growth trend Analysis By Thrust Rating

8.6 Absolute $ Opportunity Analysis By Thrust Rating, 2024-2030

Chapter 9. Aviation Gas Turbine Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Engine Type

9.1.3 By Application:

9.1.4 By Thrust Rating

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Engine Type

9.2.3 By Application:

9.2.4 By Thrust Rating

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Engine Type

9.3.3 By Application:

9.3.4 By Thrust Rating

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Engine Type

9.4.3 By Application:

9.4.4 By Thrust Rating

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Engine Type

9.5.3 By Application:

9.5.4 By Thrust Rating

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Aviation Gas Turbine Market – Company Profiles – (Overview, By Engine Type Portfolio, Financials, Strategies & Developments)

10.1 General Electric Aviation (GE)

10.2 Rolls-Royce

10.3 Pratt & Whitney

10.4 Safran Aircraft Engines

10.5 MTU Aero Engines

10.6 Honeywell Aerospace

10.7 Mitsubishi Heavy Industries

10.8 IHI Corporation

10.9 Avio Aero

10.10 Aero Engine Corporation of China (AECC)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The aviation gas turbine market was valued at USD 10.82 billion in 2023 and is projected to reach a market size of USD 18.42 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.9%.

Passenger demand, regional jets, sustainability, efficiency, technological thrust, and urban air mobility are the main drivers in this market.

Commercial aviation, military aviation, and business aviation are the segments based on application.

North America is the most dominant region in the aviation gas turbine market.

General Electric Aviation (GE), Rolls-Royce, Pratt & Whitney, Safran Aircraft Engines, MTU Aero Engines, Honeywell Aerospace, and Mitsubishi Heavy Industries are the key players in this market.