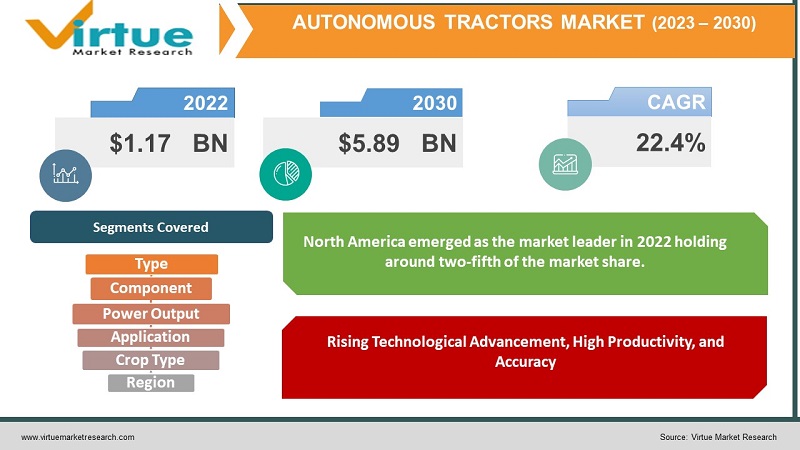

Autonomous Tractors Market Size (2023 - 2030)

In 2022, the Global Autonomous Tractors Market was valued at $1.17 billion, and is projected to reach a market size of $5.89 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 22.4%.

Autonomous tractors are farming machines that do not require the presence of a human inside the tractor to function. Autonomous tractors are outfitted with advanced technologies like sensors, laser diodes, GPS systems, vision systems, and other devices for agricultural tasks, allowing them to operate without the need for constant human interaction.

There is a need to improve the efficiency of agricultural operations to cater to the world's food requirements as the world population has grown exponentially over the past few decades. Also, there has been a large decrease in the agricultural workforce due to rapid urbanization. All these factors led farmers to look for processes and alternatives that can boost the yields and productivity to meet the demand. Investments in the agricultural sector have increased as a result of government measures to strengthen the sector which has driven the autonomous tractor market growth towards a positive trend. The government's backing for sustainable production practices like smart & precision farming, which incorporates modern technologies like the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML), is creating a market for automated technologies. Farmers globally are willfully adopting autonomous tractors as a substitute for manual labor.

Farmers can employ these self-driving tractors whenever they choose, according to their routines and plans. These vehicles also have automatic steering, which allows farmers to do their farming more consistently, boosting the market's growth. Autonomous tractors make use of cutting-edge technology, such as overlapping and redundant sensor arrays, they assist in agricultural production as they can spot any anomalies in the field during operation. Additionally, safety concerns and climate change are all big barriers to production, thus farmers are increasingly adopting autonomous tractors to ensure that constant productivity is maintained. However, lack of knowledge and the high cost of the machine can act as a major decelerating factor that may hinder the growth of the market.

MARKET DRIVERS

Rising Technological Advancement, High Productivity, and Accuracy

There is a dire need to bring efficiency in the farming sector to meet the increased demand for food. Also, there has been a shortage of agricultural labor so the farmers are looking for an alternative that can assist them in farming and could act as a substitute for manual labor. The autonomous tractor has conveniently provided a solution thus farmers are readily incorporating the tractors in farming activities, which has thereby resulted in fueling the market growth. Autonomous tractors make use of cutting-edge technology, such as overlapping and redundant sensor arrays, they assist in agricultural production as they can spot any anomalies in the field during operation. Additionally, safety concerns and climate change are all big barriers to production, thus farmers are increasingly adopting autonomous tractors to ensure that constant productivity is maintained which has subsequently acted as a proponent for market growth.

MARKET RESTRAINTS

High Cost of tractors and Lack of Awareness in underdeveloped countries

The market for autonomous and semi-autonomous tractors is anticipated to have a sluggish growth rate in developing countries. The growth is hampered by a lack of expertise and technological integration in underdeveloped nations. Because the end-users of these automated tractors are mostly farmers, it might be difficult for them to stay up with the current trends and technologies that have a direct impact on the adoption of such sophisticated tractors. Furthermore, the high cost of advanced autonomous tractors is limiting the market size for autonomous and semi-autonomous tractors.

AUTONOMOUS TRACTORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

22.4% |

|

Segments Covered |

By Type, Component, Power Output, Application, Crop type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Yanmar, AGCO Corporation, Komatsu, Raven Industries, Trimble, Mahindra & Mahindra, Kubota Corporation, KINZE Manufacturing, and Massey Ferguson. Deere & Company, CNH Industrial, Sonalika International Autonomous Tractor Corporation, Dutch Power Company, and Escorts |

Market Segmentation

Autonomous Tractors Market – By Type:

- Autonomous tractors

- Semi-Autonomous tractors

Based on type the autonomous tractor market is divided into Autonomous and Semi-autonomous tractors type. These two autonomous tractor types are expected to witness significant growth with a CAGR of 27.10 over the forecast period. There is a constant decrease in the number of agricultural laborers because of rapid urbanization. Due to this farmers are increasingly adopting tractors and agricultural modernization equipment as a replacement for manual labor. The use of a tractor has proved to be more cost-effective and has also reduced time-consuming activities like plowing and sowing of seed, hence resulting in increased overall productivity. The autonomous tractor is equipped with technologies such as LiDAR, and GPS among others have eased out operation and thus are widely being adopted by farmers for cultivation. Thus, such factors are driving the growth of the segment.

Autonomous Tractors Market – By Component:

- Sensors

- LiDAR

- Radar

- GPS

- Vision Systems

- Others

On the basis, the Autonomous Tractor Market has been segmented into Sensors, LiDAR, Radar, GPS, and vision systems among others. The radar component segment is set to contribute significantly to the market growth. Radar systems are capable of monitoring the velocity, range, and angle of moving objects and can function in all weather conditions. Attributing to the feature such as the capability to navigate and auto-steer autonomous tractors for lengthy periods, the GPS component sector is predicted to capture nearly one–third of the market share and drive market growth. The vision system is also expected to grow substantially in the coming years with a CAGR of 21.7%.

Autonomous Tractors Market – By Power Output:

- Less than 30 HP

- 30-50 HP

- 51-100 HP

- More than 100HP

Based on power output, the segment is classified into tractors with less than 30HP, 30-50 HP, 51-100 HP, and above 100 HP. Among these, 101 HP and above dominated the market followed by the 31 -100 HP segment in terms of share. The demand for medium-powered tractors is set to pick up in coming years as the landholding per farmer is decreasing and also the maintenance and the fuel economy are better as compared to the higher power tractor thus propelling the market growth.

Autonomous Tractors Market – By Application:

- Tillage

- Harvesting

- Seed Sowing

- Others

Based on application, the Autonomous tractors are being used for activities such as tillage, harvesting, and seed sowing among others. The harvesting segment is poised to grow significantly with a CAGR of 27.1% over the forecast period. The time required for the harvesting process has been substantially reduced with the deployment of autonomous tractors and thus has enhanced productivity. The tillage segment will also garner substantial market share in the coming years. With the latest technological advancements and various research and innovation by scientists, tillage activities have been automated for broadacre and row crop farming activities.

Autonomous Tractors Market – By Crop Type:

- Cereals & Grains

- Fruits & Vegetables

- Oilseed & Pulses

- Others

Autonomous Tractors Market – By Region:

- North America

- Europe

- Asia-Pacific

- Others

By Geography, North America emerged as the market leader in 2022 holding around two-fifth of the market share. Factors such as the high rate of adoption of automation-related equipment prevalence of major tractor manufacturing companies that are making huge investments in research and development of autonomous tractors are leading the market towards positive market trends. Also, the availability of large fields, high disposable income, and shortage of agricultural labor force in the North American region are major factors driving the growth in the region.

The Asia Pacific market is also set to grow significantly and is projected to witness the fastest CAGR of 22.7% during the forecast period of 2022 -2030. Owing to rising agricultural activities in developing nations like India, the Asia Pacific is projected to see significant expansion in the autonomous tractor market, which might boost demand for these products in this area. The presence of major firms in the autonomous tractor industry in the Asia Pacific might also help the region's autonomous tractor market flourish. The European market is projected to witness moderate growth in the autonomous tractor market.

Key Market Players

- Yanmar

- AGCO Corporation

- Komatsu

- Raven Industries

- Trimble

- Mahindra & Mahindra

- Kubota Corporation

- KINZE Manufacturing

- Massey Ferguson

- Deere & Company

- CNH Industrial

- Sonalika International Autonomous Tractor Corporation

- Dutch Power Company

- Escorts

The prevalence of larger manufacturers makes the market consolidated. The major players are focusing on innovation and product launches to capture market share and increase their product portfolio.

NOTABLE HAPPENINGS IN THE AUTONOMOUS TRACTORS MARKET

- PRODUCT LAUNCH- In January 2022, Deere and Co. announced that it has created a completely autonomous tractor for large-scale farming and plans to launch the unit later this year.

- COLLABORATION – In April 2022, Mahindra & Mahindra, Mitsubishi Mahindra Agricultural Machinery, and Kubota collaborated to offer products, services, and solutions to meet customer needs through mutual utilization of resources in Japan. Under the partnership, the two firms will expand the existing scope of original joint equipment manufacturing supply, focusing on tractors, rice transplanters, and combine harvesters, including implements and associated equipment.

- MERGER AND ACQUISITION- In August 2022 - Deere & Company has agreed to buy Bear Flag Robotics for USD 250 million. The agreement will expedite the development and deployment of agricultural automation equipment on the farm. It will also help John Deere achieve its long-term goal of developing more innovative tractors with sophisticated technology to meet the demands of individual customers.

- COLLABORATION – in 2022, AGCO and Carl Geringhoff Vertriebsgesellschaft mbH& Co. KG agreed into collaborating on the distribution and development of combined harvesters’ headers. Gering Hoff is a successful organization that has an instrumental role in the development and adoption of harvester header technologies that assist farmers to increase yield.

- COLLABORATION – In 2022, Kubota announced its collaboration with Nvidia, a US chipmaker. Both these companies will work together to produce extremely complex self-driving farm tractors capable of producing fully autonomous tractors. The partnership intends to grow the market for self-driving tractors.

- PRODUCT LAUNCH- In 2022, The MF NEXT, a magnificent new concept tractor was unveiled by Massey Ferguson, It is a product that encapsulates Massey Ferguson's DNA and aim of making tractor technology more accessible, user-friendly, and cost-efficient.

COVID-19 IMPACT ON AUTONOMOUS TRACTORS MARKET

The global crisis caused by the COVID-19 pandemic caused significant disruptions in most industries and the manufacturing industry was severely hit. The agriculture sector was among the few sectors that showed positive market growth during the pandemic because of the surge in demand for agricultural items in the market. However, the lockdown imposed due to the pandemic caused the major manufacturing sectors to suspend their operations. The restriction created a supply chain crisis during the pandemic as there was a shortage of labor, and raw materials and the localized shutdown of a few production plants decelerated the overall market growth. Moreover, numerous industries ceased operations during the first and second waves of the pandemic, and the production of several components for autonomous tractors was suspended. However, in the upcoming years, the market is expected to bounce back and gain momentum due to the relaxation of restrictions and restarting of the R&D and manufacturing activities. All these factors are working as proponents for the growth of the market rise during the forecast period.

Chapter 1. Global Autonomous Tractors Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Autonomous Tractors Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global Autonomous Tractors Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Autonomous Tractors Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Autonomous Tractors Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Autonomous Tractors Market – By Type

6.1. Autonomous tractors

6.2. Semi-Autonomous tractors

Chapter 7. Global Autonomous Tractors Market – By Component

7.1. Sensors

7.2. LiDAR

7.3. Radar

7.4. GPS

7.5. Vision Systems

7.6. Others

Chapter 8. Global Autonomous Tractors Market- By Power Output

8.1. Less than 30 HP

8.2. 30-50 HP

8.3. 51-100 HP

8.4. More than 100HP

Chapter 9. Global Autonomous Tractors Market- By Application

9.1. Tillage

9.2. Harvesting

9.3. Seed Sowing

9.4. Others

Chapter 10. Global Autonomous Tractors Market- By Application

10.1. Cereals & Grains

10.2. Fruits & Vegetables

10.3. Oilseed & Pulses

10.4. Others

Chapter 11. Global Autonomous Tractors Market- By Region

11.1. North America

11.2. Europe

11.3. Asia-Pacific

11.4. Rest of the World

Chapter 12. Global Autonomous Tractors Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

12.1. Company 1

12.2. Company 2

12.3. Company 3

12.4. Company 4

12.5 Company 5

12.6. Company 6

12.7. Company 7

12.8. Company 8

12.9. Company 9

12.10. Company 10

Download Sample

Choose License Type

2500

4250

5250

6900