Autonomous Therapy System Market Size Size (2023 – 2030)

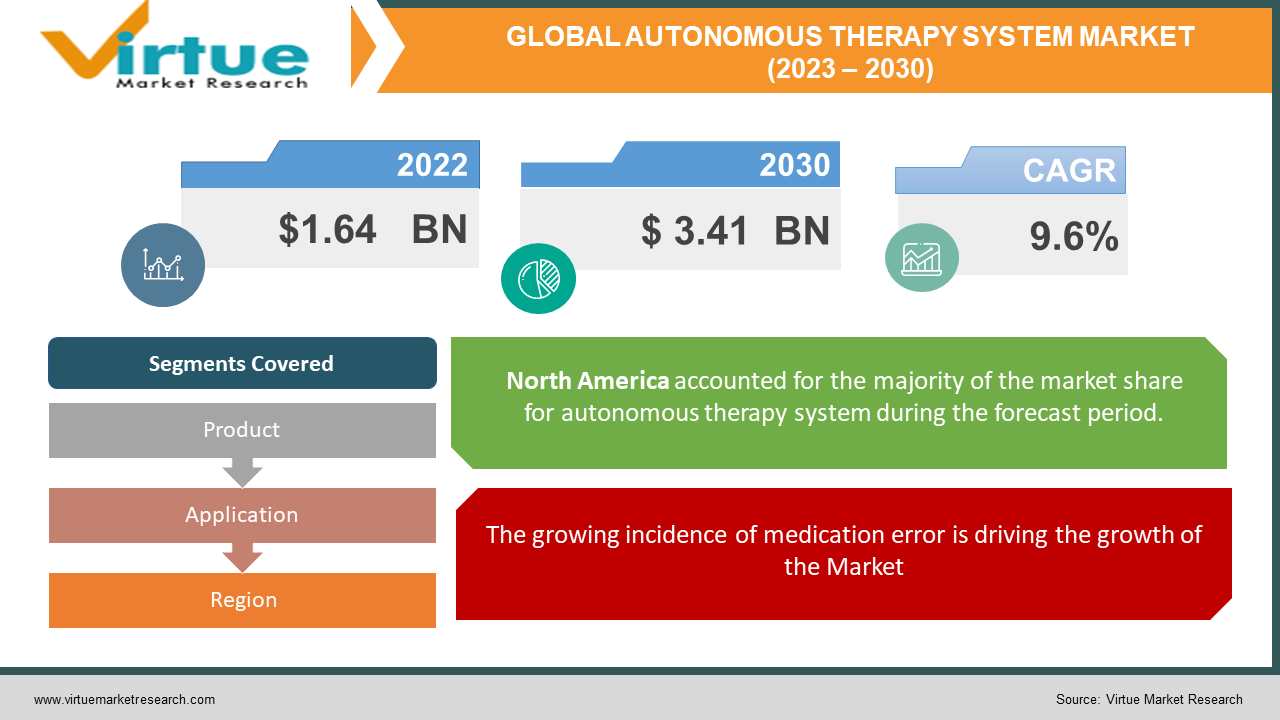

As per our research report, the global Autonomous Therapy System Market size was USD 1.64 billion in 2022 and is estimated to grow to USD 3.41 billion by 2030. The market is Following a CAGR OF 9.6%. Increasing demand for accurate laparoscopic surgeries, growing need for surgical procedures in the geriatric population, and rising cases of trauma injuries are the factors driving the growth of this market. Higher per capita healthcare spending and technological advancements in surgical medical equipment are majorly driving the growth of the industry.

Industry Overview:

Medical robot systems are trending to change in a few years due to technological upgrades in several areas such as HD surgical microscope cameras, 3D imaging, motion sensors, data loggers and motion analyzers data dynamics, and robotic catheter control systems (CCS) and remote navigation. The da Vinci surgical system most frequently used by Intuitive Surgery Inc. was developed using a computer system capable of laparoscopic surgery.

The continuous development of medical technologies shows the rapid development of medical robotic systems. ProvenCare, an insurance initiative of Geisinger Health System, provides patients with guaranteed coverage after 90 days of follow-up admission. This initiative will help reduce surgical errors and complications as well as reduce surgical costs.

The future scope of robotics technology is to explore new functions for existing processes, which is expected to drive demand for medical robots. The market continuously sees an increasing number of technology transfer partnerships with third-party vendors to develop new applications for robotic systems.

According to the FDA, the use of robots in the United States increased from 25,000 to 450,000 per year between 2005 and 2012. According to the National Cancer Institute (NCI), it is estimated that in 2014, about 80% of surgical removals. prostate was performed. made. use of medical robots, compared with just 1% of all surgeries in 2001. The growing penetration of technologically advanced robotic systems is expected to drive demand over the years.

COVID-19 impact on Autonomous Therapy System Market

COVID19 has become a global stress test. As the number of people infected with the virus increases around the world, concerns about global economic growth grow. In 2020, this number is still growing. Robots, drones, and artificial intelligence have all grown in popularity due to the new coronavirus.

The global outbreak of COVID19 is impacting the robotics industry. He encourages the development of professional service robots, which help replenish essential infrastructure staff and reduce stress in the supply chain. In addition, these technologies have helped manage significant staffing shortages in healthcare, industry, and supply chains, as well as "social distancing" and detection and response to the pandemic.

MARKET DRIVERS:

The growing incidence of medication error is driving the growth of the Market

Medication error is an unintended failure in the course of drug treatment that poses a risk to the patient's health. Errors in prescribing, preparing, storing, dispensing, and administering medicines are the most common preventable causes of adverse events and pose a great burden to public health. Appropriate care is ensured when patients and healthcare providers have access to complete and accurate EHRs that provides a patient's complete medical history. Such recording can improve diagnosis, prevent errors, save time, and even reduce waiting times for patients. To achieve quality care, successful implementation and use of CDSS and its complementary systems is imperative for hospitals and physicians, driving their adoption globally.

MARKET RESTRAINTS:

Data security concerns related to cloud-based CDSS is restraining the growth of the Market

A major concern with cloud-based CDSS is that the data stored by the provider is not as secure as its on-premise counterpart. Patient information is considered sensitive and a high level of confidentiality must be maintained so that it is accessible only to authorized users. Patient information in all countries has been scrutinized by regulatory frameworks, such as data privacy requirements legislated by the Accountability and Availability Act. health insurance (HIPAA). Similarly, the European Union introduced the European Data Protection Regulation, which has an impact on the protection of sensitive health data. In many countries, a patient's protected health information (PHI) cannot be transferred outside of the country of origin. Public cloud faces the same security issues as traditional IT systems and is therefore not preferred. Although private clouds offer more access protocols and systems, the healthcare industry is not assured of its effectiveness.

ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9.6% |

|

Segments Covered |

By Product, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

MAKO Surgical Corp, Renishaw Plc., Varian, Accuray, Intuitive Surgical Inc, Health robotics S.R.L. |

This research report on the Autonomous Therapy System Market has been segmented and sub-segmented based on Product, Application, and region.

Autonomous Therapy System Market – By Product

- Surgical Robots

- rehabilitation Robots

- Non Invasive Radiosurgery Robots

- Hospitals and Pharmacy Robots

- Emergency Response Robotic Systems

Based on the Product, Medical robot systems are classified into the following products: Surgical Robots, Non-Invasive Surgical Robotic Systems, Robotic Emergency Response Systems, Prosthetics, Support and Rehabilitation Systems, and Non-medical Hospital Robotics systems. Surgical robots dominated the market in 2014 with a 65% market share due to the increasing adoption rate of robotic systems in hospitals and increasing demand for minimally invasive surgeries.

In addition, technological developments that alleviate the limitations of laparoscopic surgery including Da Vinci surgery with greater accuracy and consistent results are expected to accelerate the growth of the market. school during this period. The growing prevalence of surgical procedures is expected to drive the demand for medical robots between 2014 and 2022.

The growing acceptance of assistive and rehabilitation systems for physical therapy in the treatment of stroke and motor disability-related neurological disorders is expected to drive growth. With the increasing importance of disease treatment methods, the number of patients treated by medical robots is also increasing. The non-medical hospital products segment is expected to become the fastest-growing segment with a CAGR of 16.8% compared to the forecast. Institutional centralization and the growing healthcare IT market are the factors driving the increase in demand for medical robotic systems.

Autonomous Therapy System Market - By Application

- Neurology

- Orthopedics robotic systems

- Laparoscopy

- Special Education

- Others

Based on application, Robotic systems are divided into four applications including neurology, orthopedics, laparoscopy, and others. The neurological segment is expected to grow the fastest at a CAGR of 16.7% during this time due to the global increase in neurological disorders such as Alzheimer's disease and depression. Technological developments in the hardware and software of the NeuroMate system and in the field of robotic neurotechnology with an improved range of ergonomics and neuroscience will lead to high penetration of robotic systems. medical boots. In addition, the advent of advanced technologies such as the invention of RoboDoc by ULCA Neurosurgery (a mobile robot for periodic monitoring of the patient by the surgeon himself without the need for him to move) will facilitate an event for developers.

Laparoscopy accounted for the highest proportion in the application segment with a CAGR of 12.3% in 2014. The development of new systems with improved maneuverability and magnification, easier device manipulation, and improved micro-motions of the device in the patient's body will lead to higher accuracy. of the surgical procedure. In addition, these robotic systems have proven to be technically viable and are specifically designed to meet the needs of surgeons. The growth of the market can be attributed to the growing geriatric population, the growing demand for endoscopic diagnostic and therapeutic procedures, and the increasing number of unhealthy lifestyle habits such as fast food and alcohol. These factors are expected to drive the growth of targeted surgeries which in turn is expected to drive the growth of the market from 2015 to 2022.

Orthopedic robotic systems is expected to be the second-fastest application segment compared to forecasts. This segment is expected to grow at a CAGR of 14.2% from 2015 to 2022. Significant growth in software used for total hip arthroplasty (THA), Total knee arthroplasty (TKA), and anterior cruciate ligament (ACL) knee reconstruction stimulates the need for minimally invasive robotic surgery. The increase in the number of musculoskeletal conditions such as rheumatoid arthritis, low back pain, osteoarthritis, and osteoporosis is expected to drive the demand for robot-assisted surgeries in time.

Autonomous Therapy System Market - By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East

- Africa

Geographically, North America leads the way in medical robotics systems with 49.7% of the total market share in 2014, while emerging economies such as Asia-Pacific are expected to grow the fastest at a CAGR. is 15.6% compared to the forecast. The growing geriatric population with low bone density and accidental injuries is expected to contribute positively to the growth of the market in the coming years.

Asia-Pacific is expected to grow at a rapid pace during this period thanks to the presence of emerging opportunities, improved healthcare infrastructure, and increased disease awareness. core. The growing penetration of minimally invasive surgeries is one of the key growth drivers for this market. The advent of new technologies such as capsule robotic systems, engineered software, and imaging systems to minimize the complications of surgical procedures are expected to drive the market growth during this period. Key product segments contributing to Asia Pacific's growth include products such as surgical robots and non-invasive radiosurgery systems.

The European market for medical robotic systems is expected to follow the Asia-Pacific market at a CAGR of 11.7% from 2015 to 2022. Surgical procedures change rapidly. With the aid of technology, it is increasingly being replaced by robotic surgeries and efficient procedures that pose fewer health risks, speed up patient recovery, and minimize scarring. The presence of these factors is expected to boost the growth of the market.

Autonomous Therapy System Market Share by company

- MAKO Surgical Corp

- Renishaw Plc.

- Varian

- Accuray

- Intuitive Surgical Inc

- Health robotics S.R.L.

Recently Market players are adopting strategies to increase their market share by increasing penetration into untapped economies and thus broadening their profit prospects. Furthermore, large companies are adding new products to maintain their competitive edge, thereby contributing to this market.

Developed economies such as North America and Europe have high barriers to entry compared to developing economies such as Asia-Pacific. Due to low barriers to entry and lucrative market opportunities in Asia-Pacific, the region is expected to grow faster from 2022-to 2030.

Suppliers invest in research and development to develop technologically advanced systems that give them a competitive advantage over other providers and provide an economic benefit to the industry. The industry is expected to see several mergers and acquisitions over the next few years. Companies are taking proactive steps to gain market share and provide a diversified product portfolio.

NOTABLE HAPPENINGS IN THE AUTONOMOUS THERAPY SYSTEM MARKET IN THE RECENT PAST:

Product Launch - In April 2021, Epic and OCHIN launched the COVID-19 Preparedness Screening app, which helped improve interoperability, care coordination, and overall clinical readiness in the state of Washington, US.

Collaboration - In April 2020, Cerner extended its collaboration with Tenet Healthcare corporation to make effective use of Cerner’s IT solutions across Tenet’s hospitals to engage patients and providers.

Chapter 1. Autonomous Therapy System Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Autonomous Therapy System Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Autonomous Therapy System Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Autonomous Therapy System Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Autonomous Therapy System Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Autonomous Therapy System Market – By Product

6.1. Surgical Robots

6.2. rehabilitation Robots

6.3. Non Invasive Radiosurgery Robots

6.4. Hospitals and Pharmacy Robots

6.5. Emergency Response Robotic Systems

Chapter 7. Autonomous Therapy System Market – By Application

7.1. Neurology

7.2. Orthopedics robotic systems

7.3. Laparoscopy

7.4. Special Education

7.5. Others

Chapter 8. Autonomous Therapy System Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Autonomous Therapy System Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. MAKO Surgical Corp

9.2. Renishaw Plc.

9.3. Varian

9.4. Accuray

9.5. Intuitive Surgical Inc

9.6. Health robotics S.R.L.

Download Sample

Choose License Type

2500

4250

5250

6900