GLOBAL AUTONOMOUS TAXI SERVICES MARKET (2024 - 2030)

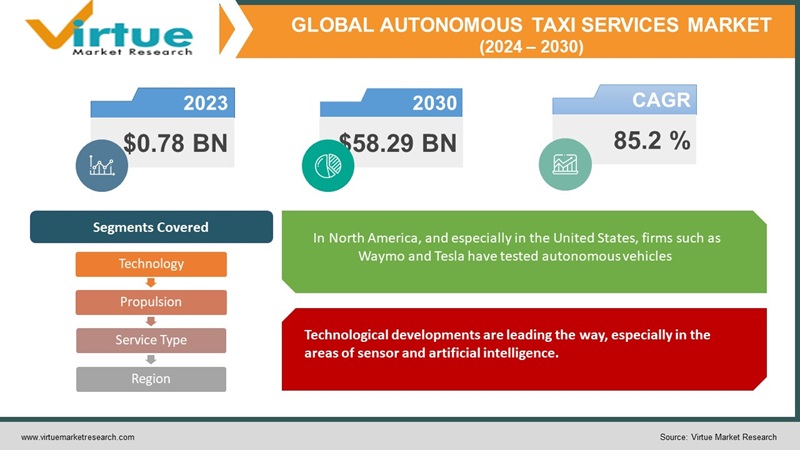

The Autonomous Taxi Services Market was valued at USD 0.78 Billion in 2023 and is projected to reach a market size of USD 58.29 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 85.2%.

Autonomous taxi services are those that provide transportation services without the need for a human driver by moving customers between locations using self-driving or autonomous cars. By utilising cutting-edge technologies, such as artificial intelligence, sensors, cameras, radar, and other parts, these services allow cars to drive themselves and negotiate roadways. Autonomous taxi services utilise cars that are outfitted with advanced sensors and computer systems, enabling them to sense their surroundings and decide without human assistance. The elimination or reduction of the necessity for human drivers is one of the main objectives of autonomous taxi services. This might improve efficiency, save labour costs, and improve safety.

Key Market Insights:

Technological developments and rising investments from large players are propelling the market for autonomous taxi services' rapid expansion. A focus on improving the technology infrastructure, such as cutting-edge sensor systems and artificial intelligence algorithms, to raise the safety and dependability of autonomous vehicles is one of the major takeaways. In order to capitalise on their own advantages, tech companies and traditional automakers have formed strategic alliances and collaborations in this fiercely competitive sector. Regulations have a significant influence on the industry, and businesses actively navigate changing requirements to get licences for testing and implementation. One major issue facing the industry as it develops is gaining the public's trust via thorough public awareness campaigns and stringent safety testing. Firms are also investigating a range of pricing schemes, taking into account elements such as pay-per-ride and subscription services, all the while hoping to expand internationally and adjusting to different local difficulties. Currently, the market shared by MaaS providers like Uber, Didi, Grab, Ola, and Lyft is estimated to be worth $109 billion. ARK estimates that the market should be valued between $600 billion and $3 trillion, depending on the time horizon of an investor, while taking into consideration the potential cash flow from autonomous taxi services.

Autonomous taxis are expected to be significantly more economical in the future because of their lower costs; they will probably only cost $0.50 to $1.00 per mile, which is less than that of human-powered taxis. When compared to having a personal vehicle, autonomous taxi services will also be more affordable for individuals who drive fewer than 5,000 miles annually.

Autonomous Taxi Services Market Drivers:

Technological developments are leading the way, especially in the areas of sensor and artificial intelligence.

Autonomous vehicles are becoming safer, more dependable, and more capable of navigating intricate urban situations as a result of ongoing advancements in these fields. The market is growing as a result of companies' significant R&D investments and advancements in perception systems, decision-making algorithms, and vehicle-to-everything (V2X) connectivity.

The growing focus on solving urban mobility issues is another important factor.

In highly populated locations, autonomous taxi services are positioned as game-changing solutions for easing traffic congestion, cutting emissions, and delivering efficient transportation. Autonomous taxis present a viable substitute for traditional transport systems as cities around the world struggle with their effects on the environment and logistics. Policymakers and technology companies are interested in autonomous taxi services because they can reduce parking space requirements, improve traffic flow, and improve the overall efficiency of urban mobility.

The increasing inclination of consumers towards mobility-as-a-service (MaaS) and the emergence of the sharing economy are major factors propelling the expansion of autonomous taxi services.

Autonomous taxis complement this trend by offering simple, on-demand mobility solutions, as more and more people choose access to transportation services over owning a car. As a key element of the changing transportation ecosystem, autonomous taxi services are in high demand due to the promise of convenient, affordable transportation that doesn't require parking or maintenance costs. Consumers are looking for travel options that are both flexible and efficient.

Autonomous Taxi Services Market Restraints:

A significant impediment to the market for autonomous taxi services is the intricate and dynamic regulatory framework.

The implementation of autonomous vehicles is subject to strict guidelines and norms that differ between areas, which is a big obstacle for businesses hoping to go global with their products. It takes a lot of time and money to navigate through many legal frameworks, and the rate of market expansion might be slowed down by concerns about liability, safety regulations, and public approval. The sector is still significantly hampered by the lack of a single regulatory framework. Standardised and clear laws are essential for fostering customer confidence and permitting the smooth integration of autonomous taxis into current transportation infrastructures.

The high expense of creating and deploying cutting-edge autonomous driving technology is another important barrier to the market for autonomous taxi services.

Advanced technologies like lidar, radar, artificial intelligence (AI) algorithms, and complex sensor systems are expensive to create, test, and investigate. Moreover, a great deal of testing and validation is needed to guarantee the dependability and safety of autonomous cars, which raises the entire cost. These financial obstacles may limit the rate at which autonomous taxi services are widely adopted and can be a challenge, especially for startups or smaller businesses trying to break into the market. Achieving economies of scale and technological maturity will be essential for making autonomous taxi services more accessible and financially viable as the industry strives to address cost-related issues.

GLOBAL AUTONOMOUS TAXI SERVICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

85.2% |

|

Segments Covered |

By Technology, Propulsion Type, Service Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Waymo (Alphabet Inc.), Uber ATG (Advanced Technologies Group), Lyft, Tesla, Aurora Innovation, Baidu Apollo, Aptiv, Cruise (General Motors), DiDi Autonomous Driving Zoox (Amazon) |

Market Segmentation: By Technology

- Lidar, Radar and Camera

- Sensor fusion and perception

Advanced technologies like lidar, radar, artificial intelligence (AI) algorithms, and complex sensor systems are expensive to create, test, and investigate. Moreover, a great deal of testing and validation is needed to guarantee the dependability and safety of autonomous cars, which raises the entire cost. These financial obstacles may limit the rate at which autonomous taxi services are widely adopted and can be a challenge, especially for startups or smaller businesses trying to break into the market. Achieving economies of scale and technological maturity will be essential for making autonomous taxi services more accessible and financially viable as the industry strives to address cost-related issues. The growth of autonomous systems is aided by the increasing accessibility of lidar technology. All sensor technologies are essential, but the segment with the most market share is still one of dynamic interaction, with lidar, radar, and camera systems all having an impact on the industry's expansion for autonomous taxi services.

Market Segmentation: By Propulsion

- Electric Vehicles

- Hybrid Vehicles

- Fuel Cell

A rising number of autonomous taxi services are utilising a variety of propulsion technologies, such as fuel cell, hybrid, and electric vehicles (EVs). Battery-powered electric cars are becoming the fastest-growing market segment for autonomous taxis and are well-known for being environmentally sustainable. The swift uptake of electric autonomous taxis can be attributed to the development of battery technology and the growing EV infrastructure. While fuel cell vehicles, which use hydrogen fuel cells to create electricity, represent a potential but emerging industry, hybrid vehicles, which combine internal combustion engines with electric power, offer an intermediate answer for businesses transitioning to completely electric fleets. Electric vehicles presently hold a dominant market share due to their alignment with environmental aims and growing popularity as urban transportation alternatives, as the global automobile industry shifts its focus towards sustainable mobility.

Market Segmentation: By Service Type

- Car Rental

- Station Based

There are various operational models that autonomous taxi services use; automobile rental and station-based services are two examples of alternative ways. Similar to traditional vehicle rental services, consumers can temporarily access autonomous taxis under the car rental model, giving them flexibility for a range of trip lengths. On the other side, autonomous taxis are parked at specified stations under the station-based model, which enables users to pick up and drop off cars at predetermined locations. Although the automobile rental model serves a more adaptable and demand-driven clientele, the station-based strategy provides organised and central locations for vehicle access. The car rental model is perhaps the one that is expanding the fastest since it fits in with the trend of on-demand, temporary transportation options that are ideal for the changing demands of contemporary urban mobility.

Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- South-America

- Middle East and Africa

- Europe

The landscape of autonomous taxi services is complex and impacted by a variety of elements, including public acceptability, infrastructural development, regulatory settings, and economic situations, according to regional analyses. In North America, and especially in the United States, firms such as Waymo and Tesla have tested autonomous vehicles extensively, and the region is seeing the progressive introduction of autonomous taxis into some urban settings. European nations like Germany and the UK serve as centres for research on autonomous vehicles, and automakers like Daimler and BMW are investigating the idea of driverless taxis. The dynamic Asia-Pacific area, driven by China, has made large investments in autonomous technology, which has encouraged the emergence of autonomous taxi services from businesses like Baidu and DiDi.

Regulations vary across countries; for example, some have accepted pilot programmes more freely than others. This leads to regional inequities. Infrastructure readiness is also important, since autonomous taxi deployments are more likely to occur in mature cities with strong digital infrastructure. Regional differences are also determined by cultural views and public acceptability; certain regions are more enthusiastic and receptive to autonomous technology than others. The intricate interaction between local preferences, legislative developments, and technical breakthroughs will be reflected in the evolving regional analysis of autonomous taxi services as the market evolves.

Autonomous Taxi Services Market COVID-19 Impact Analysis:

The market for autonomous cab services was profoundly affected by the COVID-19 epidemic, which radically changed the industry's long- and short-term dynamics. Testing and development of autonomous vehicles was short-term hampered by disruptions in manufacturing, supply networks, and labour availability. Travel restrictions and lockdowns made consumers reluctant to use shared transportation, which resulted in a significant fall in consumer demand for ride-hailing services, especially autonomous taxis. In addition, the recession put a strain on the finances of businesses operating in the autonomous taxi industry; several experienced delays in anticipated investments and restrictions on funding.

In the long run, nonetheless, the pandemic sparked the evolution of the sector. The use of driverless taxis as a safer substitute for conventional ride-sharing has increased due to the focus on cleanliness and contactless services. In response to shifting customer expectations, businesses refocused on improving digital infrastructure and user interfaces. As cities looked for reliable and effective transportation options, the pandemic highlighted the potential of autonomous taxis in maximising urban mobility and sparked a renewed interest in these services. Furthermore, the greater focus on health and safety issues prompted investments in features like enhanced air filtering and hygienic practises, establishing autonomous taxis as a major force in transportation after the pandemic.

Latest Trends/ Developments:

- The perception skills of autonomous vehicles were being improved by ongoing advancements in lidar, radar, and camera technology, which improved their dependability and safety.

- Aurora announced alliances and joint ventures with a number of businesses to quicken the advancement and implementation of driverless technology across a range of industries, including taxis.

Key Players:

- Waymo (Alphabet Inc.)

- Uber ATG (Advanced Technologies Group)

- Lyft

- Tesla

- Aurora Innovation

- Baidu Apollo

- Aptiv

- Cruise (General Motors)

- DiDi Autonomous Driving

- Zoox (Amazon)

Chapter 1. GLOBAL AUTONOMOUS TAXI SERVICES MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL AUTONOMOUS TAXI SERVICES MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL AUTONOMOUS TAXI SERVICES MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL AUTONOMOUS TAXI SERVICES MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL AUTONOMOUS TAXI SERVICES MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL AUTONOMOUS TAXI SERVICES MARKET – By Technology

6.1. Lidar, Radar and Camera

6.2. Sensor fusion and perception

Chapter 7. GLOBAL AUTONOMOUS TAXI SERVICES MARKET – By Propulsion

7.1. Electric Vehicles

7.2. Hybrid Vehicles

7.3. Fuel Cell

Chapter 8. GLOBAL AUTONOMOUS TAXI SERVICES MARKET – By service Type

8.1. Car Rental

8.2. Station Based

Chapter 9. GLOBAL AUTONOMOUS TAXI SERVICES MARKET, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Technology

9.1.3. By Propulsion

9.1.4. By Service Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Technology

9.2.3. By Propulsion

9.2.4. By Service Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Technology

9.3.3. By Propulsion

9.3.4. By Service Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest South America

9.4.2. By Technology

9.4.3. By Propulsion

9.4.4. By Service Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Technology

9.5.3. By Propulsion

9.5.4. By Service Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL AUTONOMOUS TAXI SERVICES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Waymo (Alphabet Inc.)

10.2. Uber ATG (Advanced Technologies Group)

10.3. Lyft

10.4. Tesla

10.5. Aurora Innovation

10.6. Baidu Apollo

10.7. Aptiv

10.8. Cruise (General Motors)

10.9. DiDi Autonomous Driving

10.10. Zoox (Amazon)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Autonomous Taxi Services Market was valued at USD 0.78 Billion in 2023.

Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 85.2%.

There are a number of important factors driving the market for autonomous taxi services. Technological developments are leading the way, especially in the areas of sensor and artificial intelligence.

A significant impediment to the market for autonomous taxi services is the intricate and dynamic regulatory framework.

Lidar, Radar and Camera and Sensor fusion and perception are the segmentation type.