Autonomous Shuttle Market Size (2025-2030)

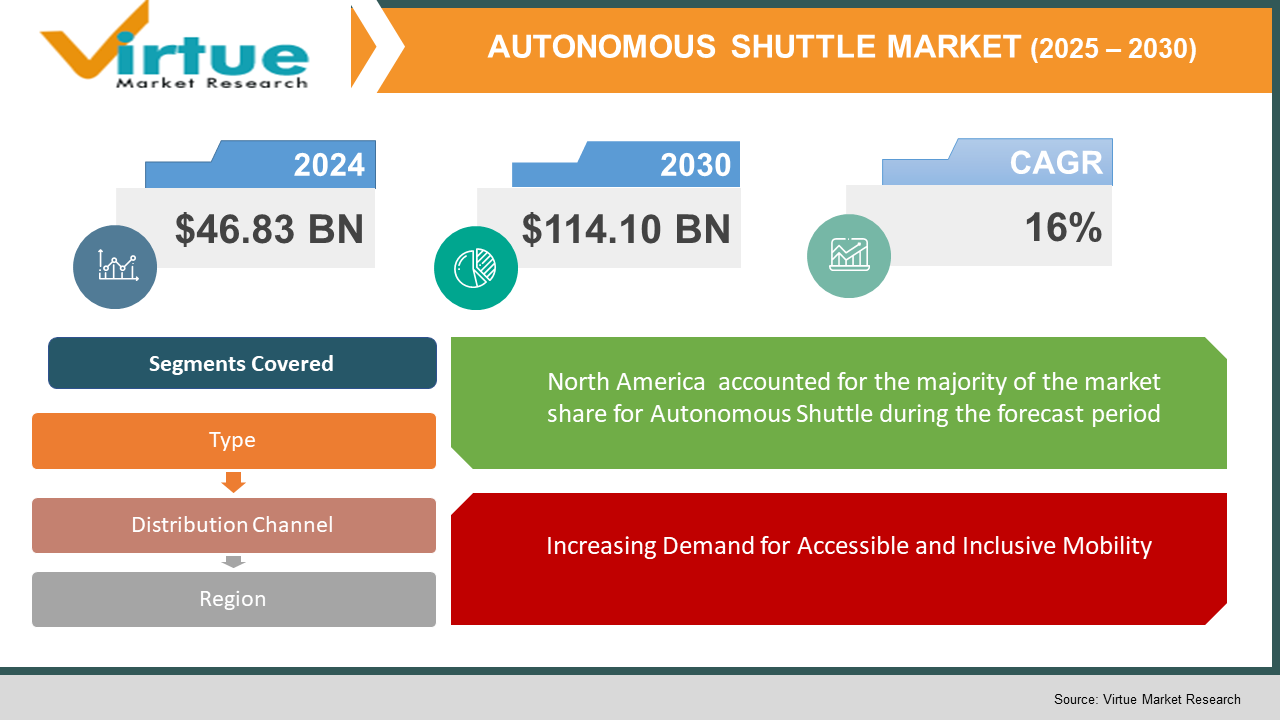

The Autonomous Shuttle Market was valued at USD 46.83 Billion in 2024 and is projected to reach a market size of USD 114.10 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 16%.

The autonomous shuttle market is a burgeoning segment within the broader autonomous vehicle landscape, focusing on the development and deployment of self-driving vehicles designed for transporting passengers over short to medium distances. Unlike self-driving cars intended for individual ownership, autonomous shuttles are typically deployed in defined environments, such as university campuses, business parks, airports, and residential communities, offering on-demand or scheduled transportation services. These shuttles leverage a suite of advanced technologies, including lidar, radar, cameras, and sophisticated software algorithms, to perceive their surroundings, navigate safely, and interact with passengers. The market is driven by the potential to improve transportation efficiency, reduce traffic congestion, enhance accessibility, and offer cost-effective mobility solutions. The market is characterized by a mix of established automotive manufacturers, technology companies specializing in autonomous driving software, and startups developing purpose-built autonomous shuttles. The regulatory landscape surrounding autonomous vehicle deployment is evolving rapidly, influencing the pace of market development. The market is also influenced by public acceptance of autonomous technology and the development of robust safety standards. The autonomous shuttle market represents a significant step towards the broader adoption of self-driving vehicles and the transformation of urban mobility. The increasing focus on smart city initiatives and the integration of autonomous shuttles with public transportation systems are also shaping the market.

Key Market Insights:

- The total market value of autonomous shuttles is projected to exceed $12.5 billion in 2024.

- More than 60% of autonomous shuttles deployed in 2024 will be electric-powered.

- Over 150 cities worldwide are running autonomous shuttle pilot programs in 2024.

- An estimated 37% of global autonomous shuttle deployments will occur in corporate campuses.

- Passenger capacity per autonomous shuttle averages between 8 and 15 seats.

- Over 75% of autonomous shuttles utilize LiDAR-based navigation systems.

- Autonomous shuttle deployments in airports will increase by 42% in 2024.

- Public transit authorities account for 55% of autonomous shuttle purchases in 2024.

- More than 80% of autonomous shuttle deployments are within urban or semi-urban settings.

- Private sector demand for autonomous shuttles is set to grow by 50% in 2024.

- The average speed of autonomous shuttles ranges between 15 and 25 km/h.

- Over 40% of autonomous shuttles are integrated with 5G-based V2X technology.

- By 2024, an estimated 12 million passengers will use autonomous shuttles globally.

- 68% of fleet operators prefer electric autonomous shuttles over hybrid alternatives.

Market Drivers:

Growing Need for Efficient and Sustainable Transportation Solutions is Driving the Market Growth:

Urban areas worldwide are facing increasing challenges related to traffic congestion, air pollution, and limited parking availability. Autonomous shuttles offer a promising solution by providing efficient, on-demand transportation services that can reduce the number of vehicles on the road, alleviate traffic congestion, and lower emissions. The increasing focus on sustainable transportation and the need to reduce carbon footprint are driving the adoption of electric autonomous shuttles. The potential for autonomous shuttles to optimize traffic flow and improve the utilization of existing infrastructure is also contributing to market growth. The integration of autonomous shuttles with smart city initiatives and public transportation systems further enhances their appeal as a sustainable transportation solution. The growing awareness of the environmental impact of traditional transportation methods is also fueling the demand for cleaner alternatives like autonomous shuttles.

Increasing Demand for Accessible and Inclusive Mobility: Autonomous shuttles have the potential to significantly improve mobility for individuals with disabilities, elderly populations, and others who may have difficulty driving or accessing traditional transportation options. These vehicles can be designed with features that enhance accessibility, such as wheelchair ramps, audio-visual aids, and user-friendly interfaces. The potential for autonomous shuttles to provide door-to-door service and improve transportation independence for individuals with mobility limitations is a key driver of the market. The increasing focus on inclusive design and the need to provide accessible transportation for all members of society are also contributing to the growth of the autonomous shuttle market. The potential for autonomous shuttles to bridge transportation gaps in underserved communities is another factor driving market growth.

Market Restraints and Challenges:

Despite significant advancements in autonomous driving technology, several technological challenges remain. Ensuring the safety and reliability of autonomous shuttles in complex and unpredictable real-world traffic conditions is a major concern. Developing robust software algorithms that can handle unexpected events, such as pedestrian behaviour, inclement weather, and construction zones, is crucial. The need for extensive testing and validation of autonomous shuttle systems is essential to build public trust and ensure regulatory approval. The development of standardized safety protocols and testing procedures for autonomous vehicles is also a challenge. The potential for cybersecurity threats and the need to protect autonomous shuttles from hacking and malicious attacks is another critical concern. The regulatory landscape surrounding autonomous vehicle deployment is still evolving. Governments worldwide are grappling with how to regulate these vehicles, including issues such as safety standards, liability frameworks, and data privacy. The lack of clear and consistent regulations can create uncertainty for manufacturers and hinder market development. The need for international harmonization of regulations is also a challenge. The development of legal frameworks that address liability in the event of an accident involving an autonomous shuttle is a key consideration. The patchwork of regulations across different jurisdictions can create complexities for companies operating in multiple markets.

Market Opportunities:

Autonomous shuttles offer a significant opportunity to integrate with smart city initiatives and contribute to the development of intelligent transportation systems. Connecting autonomous shuttles to city infrastructure, such as traffic lights, sensors, and data networks, can enable optimized traffic flow, improved route planning, and enhanced overall transportation efficiency. The integration of autonomous shuttles with smart parking systems, electric vehicle charging infrastructure, and other smart city components can create a seamless and interconnected urban mobility ecosystem. The application of autonomous shuttle technology can be expanded beyond traditional passenger transportation. There are opportunities for deploying autonomous shuttles in logistics and delivery services, airport operations, and other specialized use cases. The potential for autonomous shuttles to transport goods, packages, and even medical supplies opens up new markets and revenue streams. The development of purpose-built autonomous shuttles for specific applications, such as delivery robots or airport shuttles, is a growing trend.

AUTONOMOUS SHUTTLE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Waymo, Cruise, Zoox, Mobileye, Navya, Easy Mile, May Mobility |

Autonomous Shuttle Market Segmentation:

Autonomous Shuttle Market Segmentation by Type:

- Passenger Shuttles

- Cargo Shuttles

Most Dominant Type: Passenger shuttles currently dominate the market due to the primary focus on passenger transportation applications.

Fastest-Growing Type: Cargo shuttles are expected to experience faster growth as the demand for autonomous delivery and logistics solutions increases.

Autonomous Shuttle Market Segmentation by Distribution Channel:

- Direct Sales to Fleet Operators

- Partnerships with Transportation Service Providers

- Government Contracts

Most Dominant Distribution Channel: Direct sales to fleet operators, such as public transportation agencies and private companies, are currently the most dominant distribution channel.

Fastest-Growing Distribution Channel: Partnerships with transportation service providers, such as ride-sharing companies and logistics providers, are expected to grow rapidly as these companies integrate autonomous shuttles into their existing services.

Autonomous Shuttle Market Segmentation by Regional Analysis:

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Most Dominant Region: North America and Europe are currently the most dominant markets due to their technological advancements and supportive regulatory environments. North America is a significant market due to its advanced technological infrastructure, supportive regulatory environment, and high demand for innovative transportation solutions.

Fastest-Growing Region: The Asia Pacific region is projected to be the fastest-growing market due to the factors mentioned earlier. The Asia Pacific region is expected to witness significant growth due to rapid urbanization, increasing infrastructure development, and growing adoption of autonomous vehicle technology

COVID-19 Impact Analysis on the Market:

The COVID-19 pandemic had a mixed impact on the autonomous shuttle market. Initially, lockdowns and travel restrictions led to a temporary slowdown in pilot programs and deployments. Reduced ridership and concerns about hygiene also impacted the demand for shared transportation services, including autonomous shuttles. However, the pandemic also highlighted the potential of autonomous technology to provide contactless transportation and reduce the spread of infectious diseases. The increasing focus on public health and safety may accelerate the adoption of autonomous shuttles in certain applications, such as healthcare facilities and essential services. The pandemic also underscored the importance of resilient and flexible transportation systems, which could further drive the interest in autonomous shuttle technology. As the world recovers from the pandemic, the autonomous shuttle market is expected to continue its growth trajectory, driven by long-term trends and the increasing recognition of the benefits of autonomous transportation. The pandemic also accelerated the adoption of automation and contactless technologies across various industries, which could indirectly benefit the autonomous shuttle market.

Latest Trends and Developments:

Advancements in sensor technologies, such as lidar, radar, and cameras, are improving the perception capabilities of autonomous shuttles. The development of high-resolution sensors with longer ranges and improved performance in adverse weather conditions is crucial for enhancing safety and reliability.

Continuous improvement in software algorithms and artificial intelligence is enhancing the decision-making and navigation capabilities of autonomous shuttles. The development of more robust and adaptable AI systems that can handle complex traffic scenarios and unexpected events is essential for achieving Level 4 and Level 5 autonomy.

Manufacturers are increasingly focusing on enhancing the passenger experience in autonomous shuttles. This includes features such as comfortable seating, user-friendly interfaces, entertainment systems, and accessibility features. Creating a positive and enjoyable passenger experience is crucial for attracting riders and promoting the adoption of autonomous shuttles.

The integration of autonomous shuttles with smart city infrastructure is a key trend. Connecting autonomous shuttles to traffic management systems, data networks, and other smart city components can optimize traffic flow, improve route planning, and enhance overall transportation efficiency.

Key Players in the Market:

- Waymo

- Cruise

- Zoox

- Mobileye

- Navya

- Easy Mile

- May Mobility

- Local Motors

- Bestmile

- Transdev

- Keolis

- Continental AG

- ZF Friedrichshafen AG

- NVIDIA

- Intel

Chapter 1. AUTONOMOUS SHUTTLE MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. AUTONOMOUS SHUTTLE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. AUTONOMOUS SHUTTLE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. AUTONOMOUS SHUTTLE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. AUTONOMOUS SHUTTLE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. AUTONOMOUS SHUTTLE MARKET – By Type

6.1 Introduction/Key Findings

6.2 Passenger Shuttles

6.3 Cargo Shuttles

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. AUTONOMOUS SHUTTLE MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales to Fleet Operators

7.3 Partnerships with Transportation Service Providers

7.4 Government Contracts

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. AUTONOMOUS SHUTTLE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Distribution Channel

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Distribution Channel

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Distribution Channel

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Distribution Channel

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. AUTONOMOUS SHUTTLE MARKET – Company Profiles – (Overview, Packaging Type Portfolio, Financials, Strategies & Developments)

9.1 Waymo

9.2 Cruise

9.3 Zoox

9.4 Mobileye

9.5 Navya

9.6 Easy Mile

9.7 May Mobility

9.8 Local Motors

9.9 Bestmile

9.10 Transdev

9.11 Keolis

9.12 Continental AG

9.13 ZF Friedrichshafen AG

9.14 NVIDIA

9.15 Intel

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The growth of the Autonomous Shuttle Market is driven by rising smart city initiatives, advancements in AI, 5G, and LiDAR technology, increasing demand for sustainable urban mobility, government incentives for zero-emission transport, expansion of ride-sharing services, and the need for efficient first-mile and last-mile connectivity solutions in congested urban areas.

The main concerns about the Autonomous Shuttle Market include regulatory uncertainty, safety risks, high initial costs, cybersecurity threats, public trust issues, and infrastructure limitations. Additionally, challenges like weather adaptability, liability in accidents, data privacy, and integration with existing transport systems hinder widespread adoption and large-scale commercialization of autonomous shuttles.

Waymo, Cruise, Zoox, Mobileye, Navya, Easy Mile, May Mobility

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.