Automotive V2X Market Size (2024 – 2030)

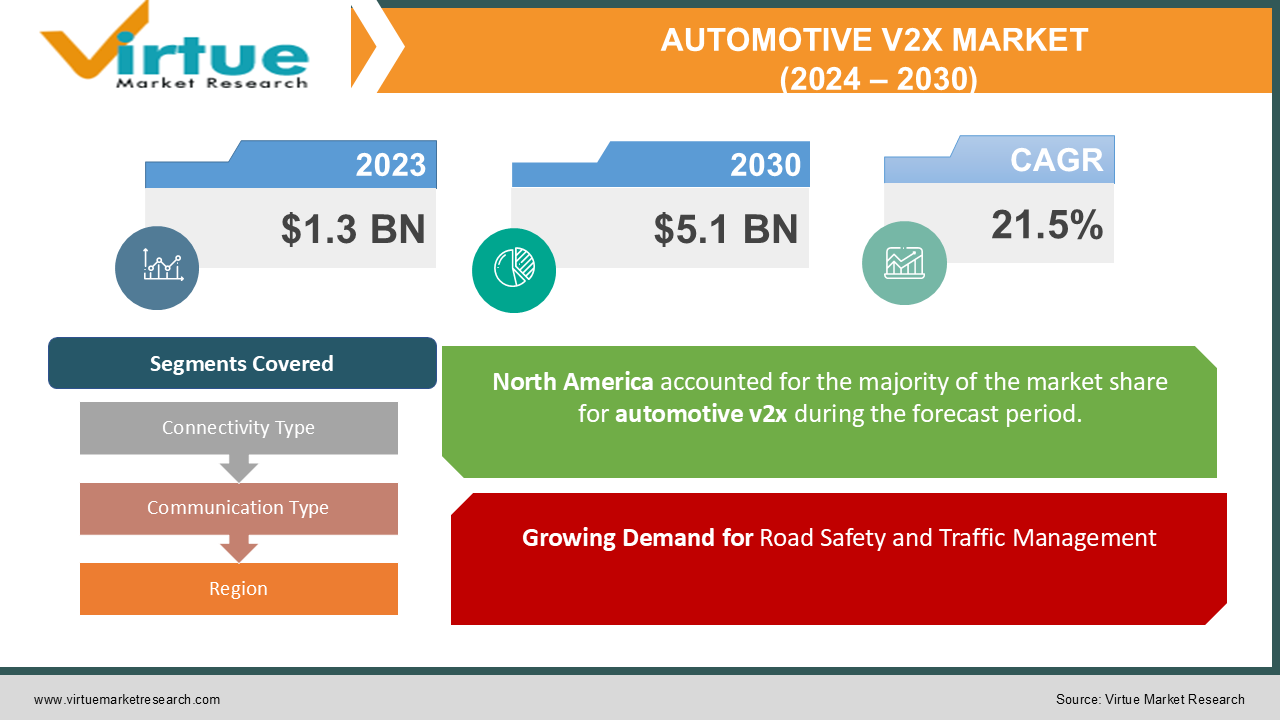

The Global Automotive V2X Market was valued at USD 1.3 billion in 2023 and is projected to grow at a CAGR of 21.5% from 2024 to 2030, reaching an estimated market size of USD 5.1 billion by 2030.

The Automotive V2X (Vehicle-to-Everything) market focuses on the integration of communication systems within vehicles to interact with each other and surrounding infrastructure, enhancing safety and optimizing traffic flow. This market is expected to expand rapidly due to the increased demand for connected vehicle technologies and government initiatives encouraging smart transport systems.

The global V2X (Vehicle-to-Everything) market is experiencing significant growth, driven by the increasing demand for safer and more efficient transportation systems. V2X technology enables vehicles to communicate with each other, infrastructure, and pedestrians, allowing for real-time information exchange and collaborative decision-making. This technology has the potential to revolutionize road safety by preventing accidents, reducing traffic congestion, and improving overall traffic flow. Key applications of V2X include collision avoidance, intersection safety, traffic signal priority, and cooperative adaptive cruise control. As the automotive industry embraces autonomous and connected vehicles, the V2X market is poised for further expansion, with major players investing heavily in research and development to advance this transformative technology.

Key Market Insights:

The global shift toward autonomous and semi-autonomous vehicles is driving the V2X market, with an estimated 70% of new vehicles expected to have V2X capabilities by 2030.

North America and Europe are leading regions for V2X technology adoption, accounting for over 60% of the global market share.

The development of 5G networks is expected to play a pivotal role in the market, enhancing connectivity speeds and enabling faster data exchange in V2X applications.

Government policies and initiatives across countries like the U.S., Japan, and China are promoting V2X adoption to improve traffic safety and reduce congestion.

Major automotive manufacturers such as Ford, BMW, and Audi are actively implementing V2X technology in their vehicles to comply with upcoming regulatory standards.

The Asia-Pacific region, led by China and Japan, is projected to witness the highest growth due to the integration of V2X technology in electric vehicles (EVs).

V2X communication types, such as Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I), are witnessing robust adoption, with V2V making up around 45% of the V2X applications.

The Direct Short Range Communication (DSRC) and cellular communication segments are major communication types, with cellular technology expected to hold the majority share by 2030.

Global Automotive V2X Market Drivers:

Growing Demand for Road Safety and Traffic Management

The increasing incidence of road accidents and the resulting fatalities underscore the need for advanced safety features in vehicles. V2X technology addresses these concerns by enabling vehicles to communicate with each other and infrastructure, effectively reducing collision risks. V2X technology helps drivers anticipate hazards, assess road conditions, and navigate congested areas. In particular, the V2V aspect of V2X allows vehicles to share information about speed, location, and heading, thus providing essential data to avoid potential collisions. Governments worldwide are supporting this trend with regulations encouraging the inclusion of V2X capabilities in new vehicles, further accelerating market growth.

Advancements in Communication Technologies

Rapid advancements in communication technology, such as the rollout of 5G, are instrumental in the growth of the V2X market. 5G provides faster data transmission speeds, enhanced connectivity, and low latency, which are crucial for real-time communication between vehicles. With 5G, V2X applications are expected to handle larger amounts of data, facilitating complex processes such as real-time hazard warnings, traffic signal interactions, and pedestrian detection. The adoption of 5G by automotive companies is anticipated to enhance V2X efficiency, especially in autonomous and semi-autonomous vehicles, where instantaneous communication is crucial for operational safety and performance.

Government Initiatives and Policies Supporting Smart Transportation

Many governments are promoting the adoption of V2X as part of their smart city initiatives. The U.S. Department of Transportation, for example, has set guidelines to incorporate V2X technology in vehicles to improve road safety. Similarly, China’s Ministry of Industry and Information Technology is heavily investing in V2X infrastructure to integrate this technology across urban areas, making cities safer and more efficient. Such government initiatives have been instrumental in driving the demand for V2X technology. Additionally, subsidies for adopting connected vehicle technologies in some countries are encouraging automotive manufacturers to integrate V2X capabilities in vehicles, thereby boosting market growth.

Global Automotive V2X Market Challenges and Restraints:

High Costs and Infrastructure Requirements

The integration of V2X technology in vehicles and infrastructure comes with substantial costs. Installing sensors, communication modules, and the necessary supporting infrastructure requires high capital investment, which can be a deterrent for many automotive manufacturers, particularly smaller players. Additionally, V2X infrastructure demands regular maintenance to ensure reliable data exchange, adding to the operational costs. This challenge is particularly pronounced in emerging markets, where infrastructure development and maintenance costs can be prohibitively high, thus limiting the reach and effectiveness of V2X technology in these regions.

Cybersecurity Concerns in V2X Communication

V2X technology relies on continuous data exchange between vehicles, infrastructure, and pedestrians, which opens up potential security vulnerabilities. Cyber threats such as hacking and data interception pose serious risks, as unauthorized access to a vehicle's communication system could endanger passengers’ safety and privacy. Addressing these cybersecurity risks requires significant investment in secure communication protocols and encryption technologies. This aspect not only adds to the cost of implementing V2X but also complicates the integration process, as manufacturers must work to ensure secure data transmission to maintain public trust in connected vehicle systems.

Market Opportunities:

The increasing push toward sustainable and smart urban infrastructure presents a significant growth opportunity for the Automotive V2X Market. As more cities move toward becoming "smart cities," there is a rising demand for technology solutions that can improve transportation efficiency, reduce traffic congestion, and enhance road safety. V2X technology aligns with these goals, enabling vehicles to communicate with each other and with urban infrastructure, such as traffic lights and road signs, to improve traffic flow. Moreover, the integration of V2X technology in electric vehicles (EVs) is gaining traction, as these vehicles benefit from improved route optimization, which enhances battery life and energy efficiency. With EV adoption expected to rise sharply, the demand for V2X systems in EVs will likely drive market growth. Furthermore, partnerships between automotive manufacturers, technology providers, and government bodies to develop V2X-enabled smart infrastructure will unlock new avenues for innovation and market expansion.

AUTOMOTIVE V2X MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

21.5% |

|

Segments Covered |

By Connectivity Type, Communication Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Qualcomm Technologies, Inc., NXP Semiconductors N.V., Continental AG, Robert Bosch GmbH, Delphi Technologies, Denso Corporation, Autotalks Ltd., Savari Inc., Cohda Wireless, Kapsch TrafficCom AG |

Automotive V2X Market Segmentation: By Connectivity Type

-

Vehicle-to-Vehicle (V2V)

-

Vehicle-to-Infrastructure (V2I)

-

Vehicle-to-Pedestrian (V2P)

-

Vehicle-to-Network (V2N)

-

Vehicle-to-Grid (V2G)

Vehicle-to-Vehicle communication is anticipated to hold the largest market share within the connectivity type segment. V2V communication enables vehicles to share information on speed, location, and direction, significantly enhancing on-road safety by preventing collisions and optimizing traffic flow. This segment is expected to grow rapidly, as V2V technology offers critical safety improvements, especially in urban environments.

Automotive V2X Market Segmentation: By Communication Type

-

Dedicated Short-Range Communications (DSRC)

-

Cellular (5G, LTE)

Cellular technology, especially with the advent of 5G, is projected to dominate the communication type segment. The advantages of 5G, including high-speed data transmission and low latency, make it ideal for real-time applications in V2X systems. The Cellular V2X (C-V2X) segment is expected to expand as 5G networks become more widespread, enhancing the performance of V2X applications.

Automotive V2X Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America is currently the largest market for Automotive V2X, accounting for approximately 35% of the global market share. The region's well-developed road infrastructure, high vehicle ownership rates, and favorable government policies promoting connected vehicle technology contribute to its dominance. The United States, in particular, has invested heavily in V2X pilot projects and infrastructure, positioning it as a leader in the market.

COVID-19 Impact Analysis on the Automotive V2X Market:

The COVID-19 pandemic initially slowed down the adoption of V2X technology as automotive production faced disruptions due to lockdowns and supply chain constraints. Many V2X-related projects and infrastructure developments were put on hold as countries prioritized healthcare resources and infrastructure over smart city and transportation projects. However, as economies began to recover, the V2X market experienced a rebound. The pandemic has highlighted the need for resilient and efficient transportation systems, and many governments have since increased investments in smart infrastructure and connectivity solutions. Post-pandemic, the demand for V2X technology has grown as automotive manufacturers and governments seek to build safer and more efficient urban mobility systems.

Latest Trends/Developments:

One of the most significant trends in the Automotive V2X Market is the integration of 5G technology into V2X systems. 5G offers the high bandwidth and low latency required for real-time communication, making it essential for advanced V2X applications, particularly those involving autonomous vehicles. Another trend is the increased adoption of V2X technology in electric vehicles, as V2X offers benefits such as optimized energy consumption and real-time navigation. Partnerships between automotive companies and technology firms are also on the rise, aiming to accelerate the development of V2X systems. Additionally, V2X pilot projects in smart cities are paving the way for large-scale deployment, demonstrating the potential of V2X in reducing traffic congestion and improving safety. Key trends include the widespread adoption of Cellular-V2X (C-V2X) communication technology, which offers broader coverage and higher data rates compared to traditional DSRC. Additionally, the integration of artificial intelligence and machine learning is enhancing V2X systems' capabilities, enabling more sophisticated applications like predictive analytics and autonomous driving. Governments worldwide are investing in V2X infrastructure and incentivizing its deployment, further accelerating market growth. Major automotive manufacturers and technology companies are collaborating to develop innovative V2X solutions, such as cooperative adaptive cruise control, intersection collision avoidance, and platooning. As the automotive industry shifts towards electrification and autonomous driving, V2X technology is emerging as a critical component for realizing a future of safer, more efficient, and sustainable transportation.

Key Players:

-

Qualcomm Technologies, Inc.

-

NXP Semiconductors N.V.

-

Continental AG

-

Robert Bosch GmbH

-

Delphi Technologies

-

Denso Corporation

-

Autotalks Ltd.

-

Savari Inc.

-

Cohda Wireless

-

Kapsch TrafficCom AG

Chapter 1. Automotive V2X Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive V2X Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive V2X Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive V2X Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive V2X Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive V2X Market – By Connectivity Type

6.1 Introduction/Key Findings

6.2 Vehicle-to-Vehicle (V2V)

6.3 Vehicle-to-Infrastructure (V2I)

6.4 Vehicle-to-Pedestrian (V2P)

6.5 Vehicle-to-Network (V2N)

6.6 Vehicle-to-Grid (V2G)

6.7 Y-O-Y Growth trend Analysis By Connectivity Type

6.8 Absolute $ Opportunity Analysis By Connectivity Type, 2024-2030

Chapter 7. Automotive V2X Market – By Communication Type

7.1 Introduction/Key Findings

7.2 Dedicated Short-Range Communications (DSRC)

7.3 Cellular (5G, LTE)

7.4 Y-O-Y Growth trend Analysis By Communication Type

7.5 Absolute $ Opportunity Analysis By Communication Type, 2024-2030

Chapter 8. Automotive V2X Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Connectivity Type

8.1.3 By Communication Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Connectivity Type

8.2.3 By Communication Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Connectivity Type

8.3.3 By Communication Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Connectivity Type

8.4.3 By Connectivity Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Connectivity Type

8.5.3 By Communication Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Automotive V2X Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Qualcomm Technologies, Inc.

9.2 NXP Semiconductors N.V.

9.3 Continental AG

9.4 Robert Bosch GmbH

9.5 Delphi Technologies

9.6 Denso Corporation

9.7 Autotalks Ltd.

9.8 Savari Inc.

9.9 Cohda Wireless

9.10 Kapsch TrafficCom AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 1.3 billion in 2023 and is projected to reach USD 5.1 billion by 2030, growing at a CAGR of 21.5%.

Key drivers include the demand for road safety, advancements in 5G and communication technologies, and supportive government initiatives for smart transportation.

The market segments include Connectivity Type (V2V, V2I, V2P, V2N, V2G) and Communication Type (DSRC, Cellular).

North America leads with a 35% market share due to its advanced infrastructure and favorable policies.

Leading players include Qualcomm, NXP Semiconductors, Continental AG, Bosch, and Delphi Technologies.