Automotive Textiles Market Size (2024 – 2030)

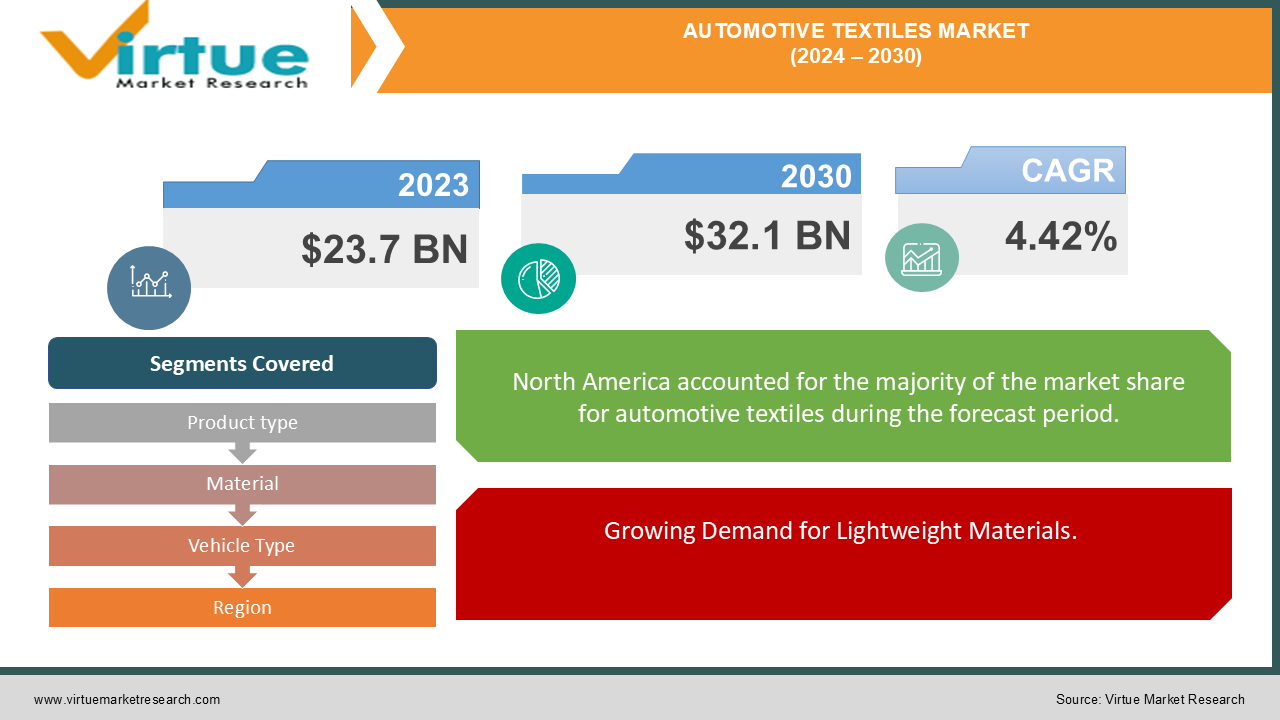

The Global Automotive Textiles Market was valued at USD 23.7 billion in 2023 and is projected to reach a market size of USD 32.1 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 4.42% between 2024 and 2030.

The Global Automotive Textiles Market is experiencing significant growth driven by the increasing demand for lightweight, durable, and high-performance materials in the automotive industry. As automakers strive to meet stringent environmental regulations and enhance vehicle efficiency, the use of advanced textiles in vehicle manufacturing has become crucial. Automotive textiles, which include a wide range of materials such as woven, knitted, and non-woven fabrics, play a vital role in various applications, including interior upholstery, airbags, seat belts, and tire reinforcements. These textiles offer essential properties like comfort, safety, aesthetics, and functionality, making them indispensable in modern vehicles. The market is also witnessing innovations in sustainable and recyclable materials as manufacturers aim to reduce the environmental impact of their products. Additionally, the rising consumer demand for premium interiors and the growing trend of electric vehicles (EVs) are further fueling the market's expansion. With continuous advancements in textile technologies and the automotive sector's push towards more sustainable practices, the Global Automotive Textiles Market is poised for robust growth, offering new opportunities for manufacturers and suppliers worldwide.

Key Market Insights:

About 40% of automotive textiles are used in interiors like seats and carpets.

Around 25% of automotive textiles are used in safety components like airbags and seat belts.

The demand for lightweight automotive textiles is growing by 15% annually.

Non-woven fabrics make up approximately 20% of the automotive textiles market.

Around 10% of automotive textiles are now made from sustainable or recycled materials.

Global Automotive Textiles Market Drivers:

Growing Demand for Lightweight Materials.

The increasing emphasis on fuel efficiency and reduced emissions in the automotive industry is driving the demand for lightweight materials, including automotive textiles. As governments worldwide implement stricter environmental regulations, automakers are under pressure to produce vehicles that are both lighter and more fuel-efficient. Automotive textiles, such as lightweight fabrics and composites, play a critical role in achieving these goals by reducing the overall weight of vehicles without compromising on safety or comfort. These textiles are increasingly being used in various components, including seat covers, headliners, and interior panels, replacing heavier materials like leather and traditional plastics. The trend towards electric vehicles (EVs) has further amplified the need for lightweight materials to extend battery life and improve energy efficiency, making this a significant driver in the global automotive textiles market.

Increasing Focus on Vehicle Safety.

Safety has always been a paramount concern in the automotive industry, and the rising focus on enhancing vehicle safety features is a major driver of the automotive textiles market. Advanced textiles are integral to the functionality of critical safety components such as airbags, seat belts, and protective linings. The growing consumer demand for safer vehicles, coupled with stringent safety regulations, has led to increased adoption of high-performance textiles that offer superior strength, durability, and reliability. Innovations in textile technology have enabled the development of materials that can withstand extreme conditions, ensuring the safety of occupants during accidents. As automakers continue to prioritize safety in their designs, the demand for automotive textiles that contribute to vehicle safety is expected to grow, driving further market expansion.

Global Automotive Textiles Market Restraints and Challenges:

The Global Automotive Textiles Market faces several restraints and challenges that could hinder its growth. One of the primary challenges is the high cost associated with advanced automotive textiles, especially those made from sustainable or high-performance materials. These costs can be prohibitive for manufacturers, particularly in price-sensitive markets, leading to limited adoption despite their benefits. Additionally, the market is constrained by the complexity of integrating these textiles into vehicles without compromising safety, durability, or comfort. Stringent regulations and standards for automotive materials further add to the cost and complexity of compliance, making it challenging for manufacturers to innovate while staying within regulatory bounds. Another significant challenge is the fluctuating availability and prices of raw materials, which can disrupt production and affect profitability. Furthermore, the transition to electric vehicles (EVs) presents its own set of challenges, as the industry must adapt to new requirements for lightweight and thermally efficient materials while balancing cost and performance. These factors collectively create barriers that could slow down the market's growth and pose significant challenges for industry players aiming to innovate and expand in this competitive landscape.

Global Automotive Textiles Market Opportunities:

The Global Automotive Textiles Market presents numerous opportunities driven by advancements in technology, sustainability initiatives, and the evolving automotive landscape. One of the most significant opportunities lies in the growing demand for electric vehicles (EVs). As the EV market expands, there is an increasing need for lightweight, durable, and thermally efficient textiles that can enhance vehicle performance and energy efficiency. This shift towards EVs also opens up avenues for innovative materials that offer better insulation and soundproofing, catering to the unique requirements of electric drivetrains. Additionally, the push for sustainability in the automotive industry is creating opportunities for textiles made from recycled and bio-based materials. Manufacturers are increasingly looking for eco-friendly alternatives that align with environmental regulations and consumer preferences for greener products. The premium vehicle segment also offers opportunities for high-end textiles that provide superior comfort, aesthetics, and customization options, catering to the growing demand for luxury vehicles. Moreover, the integration of smart textiles with embedded sensors and connectivity features could revolutionize vehicle interiors, offering enhanced safety and user experiences. These trends suggest a promising future for the automotive textiles market, with opportunities for growth through innovation, sustainability, and technological advancements.

AUTOMOTIVE TEXTILES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.42% |

|

Segments Covered |

By Product type, Material, Vehicle Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Adient plc, Autoneum Holding AG, Toyoda Gosei Co., Ltd., Faurecia S.A., Seiren Co., Ltd., Suminoe Textile Co., Ltd., Lear Corporation, Freudenberg Group, Sage Automotive Interiors, Grupo Antolin, Toyota Boshoku Corporation, Hyosung Corporation |

Global Automotive Textiles Market Segmentation: By Product Type

-

Interior textiles.

-

Exterior textiles

-

Technical textiles

In 2023, based on market segmentation by Product Type, Interior textiles had the highest share of the Global Automotive Textiles Market. The interior segment of the automotive textiles market holds a dominant position due to its critical role in enhancing the comfort, aesthetics, and overall passenger experience. As the most visible and occupant-facing part of a vehicle, interior textiles are integral to creating a pleasant and functional environment. This includes a wide range of applications such as seat covers, carpets, headliners, door panels, and more, each requiring specific materials that cater to different needs. The demand for material diversity is high, with natural fibers often chosen for their comfort and breathability, synthetic fibers for their durability and resistance to wear, and blends that combine the best of both worlds for enhanced performance. Moreover, interior textiles are subject to stringent regulatory requirements, particularly concerning safety standards like fire resistance and flammability. These regulations drive the need for specialized materials and rigorous testing, further expanding the market's scope. While exterior and technical textiles also play vital roles in vehicle construction, the extensive use of textiles within the interior, combined with the need for diverse materials and compliance with safety standards, positions this segment as the largest and most complex within the automotive textiles market.

Global Automotive Textiles Market Segmentation: By Material

-

Natural fibers

-

Synthetic fibers

-

Blended fabrics

In 2023, based on market segmentation by Material, Synthetic Fibers had the highest share of the Global Automotive Textiles Market. Synthetic fibers, such as polyester, nylon, and polypropylene, have emerged as dominant materials in the automotive textiles market due to their superior performance and cost-effectiveness. These fibers offer a range of benefits including enhanced durability, stain resistance, and ease of maintenance compared to natural fibers, which makes them highly attractive to automotive manufacturers. Their versatility is a key advantage, as synthetic fibers can be engineered to possess specific properties such as flame resistance, water repellency, and UV protection, addressing the diverse needs of automotive applications. Additionally, synthetic fibers are generally more affordable to produce than natural fibers, contributing to their widespread use in vehicle interiors. Although natural fibers have gained popularity due to their sustainability benefits, the automotive industry is increasingly focusing on making synthetic fibers more eco-friendly. Innovations in recycled synthetic fibers and bio-based materials aim to reduce their environmental impact, aligning with the industry's sustainability trends. As a result, synthetic fibers not only meet performance and cost requirements but are also adapting to environmental considerations, reinforcing their dominance in the automotive textiles market and catering to the evolving demands of both manufacturers and consumers.

Global Automotive Textiles Market Segmentation: By Vehicle Type

-

Passenger cars

-

Commercial vehicles

-

Electric vehicles

In 2023, based on market segmentation by Vehicle Type, Passenger Cars had the highest share of the Global Automotive Textiles Market. Passenger cars dominate the automotive textiles market due to their high production volumes and emphasis on interior comfort and aesthetics. As the most widely produced type of vehicle globally, passenger cars drive a significant demand for various automotive textiles, including seat covers, carpets, headliners, and door panels. The focus on enhancing interior comfort and perceived quality in passenger vehicles fuels the need for diverse textile materials that cater to different preferences and requirements. Additionally, the growing trend of vehicle customization, where consumers seek personalized options and unique designs, further amplifies the demand for a wide range of textile materials and patterns. This customization trend encourages manufacturers to offer a broader selection of textiles to meet individual tastes and preferences. Although commercial vehicles also use automotive textiles, the volume and diversity of passenger cars far surpass those of commercial vehicles, making passenger cars the dominant segment in terms of textile consumption. The combination of high production rates, a focus on interior quality, and consumer demand for personalization collectively drives the extensive use of automotive textiles in passenger vehicles.

Global Automotive Textiles Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, North America had the highest share of the Global Automotive Textiles Market. North America, particularly the United States, holds a dominant position in the Global Automotive Textiles Market due to several key factors. The region boasts a long-standing and well-established automotive industry, which drives a strong demand for automotive textiles essential for vehicle production and customization. High vehicle ownership rates contribute to a consistent need for textiles used in various vehicle components, including interiors. Additionally, North American consumers place a high value on luxury and personalization, leading to increased demand for premium and high-quality automotive textiles that enhance comfort and aesthetic appeal. The focus on luxury and customization encourages manufacturers to provide a diverse range of textile options to meet consumer preferences. Furthermore, stringent regulatory compliance related to vehicle safety and environmental standards in North America drives the need for specialized automotive textiles that adhere to these regulations. While regions like Asia-Pacific and Europe are experiencing significant growth in the automotive sector, North America's established market infrastructure and emphasis on luxury and customization maintain its leading role in the automotive textiles market as of 2023.

COVID-19 Impact Analysis on the Global Automotive Textiles Market.

The COVID-19 pandemic had a significant impact on the Global Automotive Textiles Market, disrupting the industry in multiple ways. During the initial stages of the pandemic, the automotive industry faced widespread production halts, supply chain disruptions, and a sharp decline in vehicle sales as lockdowns and economic uncertainties prevailed. This led to reduced demand for automotive textiles, as manufacturers scaled back production and delayed new projects. Additionally, the closure of factories and restrictions on labor movement caused delays in the manufacturing and distribution of automotive textiles, further straining the market. However, as the industry began to recover, there was a renewed focus on health and safety, leading to increased demand for antimicrobial and easy-to-clean textiles in vehicle interiors. The pandemic also accelerated the shift towards electric vehicles (EVs), which in turn spurred demand for lightweight and innovative textile materials to improve vehicle efficiency. While the market experienced short-term setbacks due to COVID-19, the recovery phase has highlighted new opportunities, particularly in sustainable and health-conscious textile solutions, positioning the automotive textiles market for future growth as the global economy stabilizes and the automotive sector rebounds.

Latest trends / Developments:

The Global Automotive Textiles Market is witnessing several key trends and developments that are shaping its future. One of the most prominent trends is the increasing demand for sustainable and eco-friendly textiles, driven by both consumer preferences and stricter environmental regulations. Manufacturers are exploring innovative materials like recycled fibers, bio-based fabrics, and low-emission textiles that reduce the environmental footprint of vehicles. Another significant development is the integration of smart textiles into vehicle interiors. These advanced materials, embedded with sensors and electronic components, can monitor passenger health, adjust temperature, and even interact with vehicle systems, offering enhanced comfort and safety. The rise of electric vehicles (EVs) is also influencing the market, as the need for lightweight and thermally efficient textiles becomes crucial for improving battery life and overall vehicle efficiency. Additionally, there is a growing focus on premium automotive textiles that offer superior aesthetics, durability, and customization options, catering to the luxury vehicle segment. Innovations in manufacturing processes, such as 3D knitting and digital printing, are further enabling the production of complex designs and personalized interiors. These trends indicate a dynamic market, with opportunities for growth driven by sustainability, technology, and changing consumer demands.

Key Players:

-

Adient plc

-

Autoneum Holding AG

-

Toyoda Gosei Co., Ltd.

-

Faurecia S.A.

-

Seiren Co., Ltd.

-

Suminoe Textile Co., Ltd.

-

Lear Corporation

-

Freudenberg Group

-

Sage Automotive Interiors

-

Grupo Antolin

-

Toyota Boshoku Corporation

-

Hyosung Corporation

Chapter 1. Automotive Textiles Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Textiles Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Textiles Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Textiles Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Textiles Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Textiles Market – By Product Type

6.1 Introduction/Key Findings

6.2 Interior textiles.

6.3 Exterior textiles

6.4 Technical textiles

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Automotive Textiles Market – By Material

7.1 Introduction/Key Findings

7.2 Natural fibers

7.3 Synthetic fibers

7.4 Blended fabrics

7.5 Y-O-Y Growth trend Analysis By Material

7.6 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Automotive Textiles Market – By Vehicle Type

8.1 Introduction/Key Findings

8.2 Passenger cars

8.3 Commercial vehicles

8.4 Electric vehicles

8.5 Y-O-Y Growth trend Analysis By Vehicle Type

8.6 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 9. Automotive Textiles Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Material

9.1.4 By Vehicle Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Material

9.2.4 By Vehicle Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Material

9.3.4 By Vehicle Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Material

9.4.4 By Vehicle Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Material

9.5.4 By Vehicle Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Automotive Textiles Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Adient plc

10.2 Autoneum Holding AG

10.3 Toyoda Gosei Co., Ltd.

10.4 Faurecia S.A.

10.5 Seiren Co., Ltd.

10.6 Suminoe Textile Co., Ltd.

10.7 Lear Corporation

10.8 Freudenberg Group

10.9 Sage Automotive Interiors

10.10 Grupo Antolin

10.11 Toyota Boshoku Corporation

10.12 Hyosung Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Automotive Textiles market is expected to be valued at US$ 23.7 billion.

Through 2030, the Automotive Textiles market is expected to grow at a CAGR of 4.42%.

By 2030, the Global Automotive Textiles Market is expected to grow to a value of US$ 32.1 billion.

Asia-Pacific is predicted to lead the Global Automotive Textiles market.

The Global Automotive Textiles Market has segments By product type, material type, vehicle type, and Region.