Automotive Telematics Market Size (2024-2030)

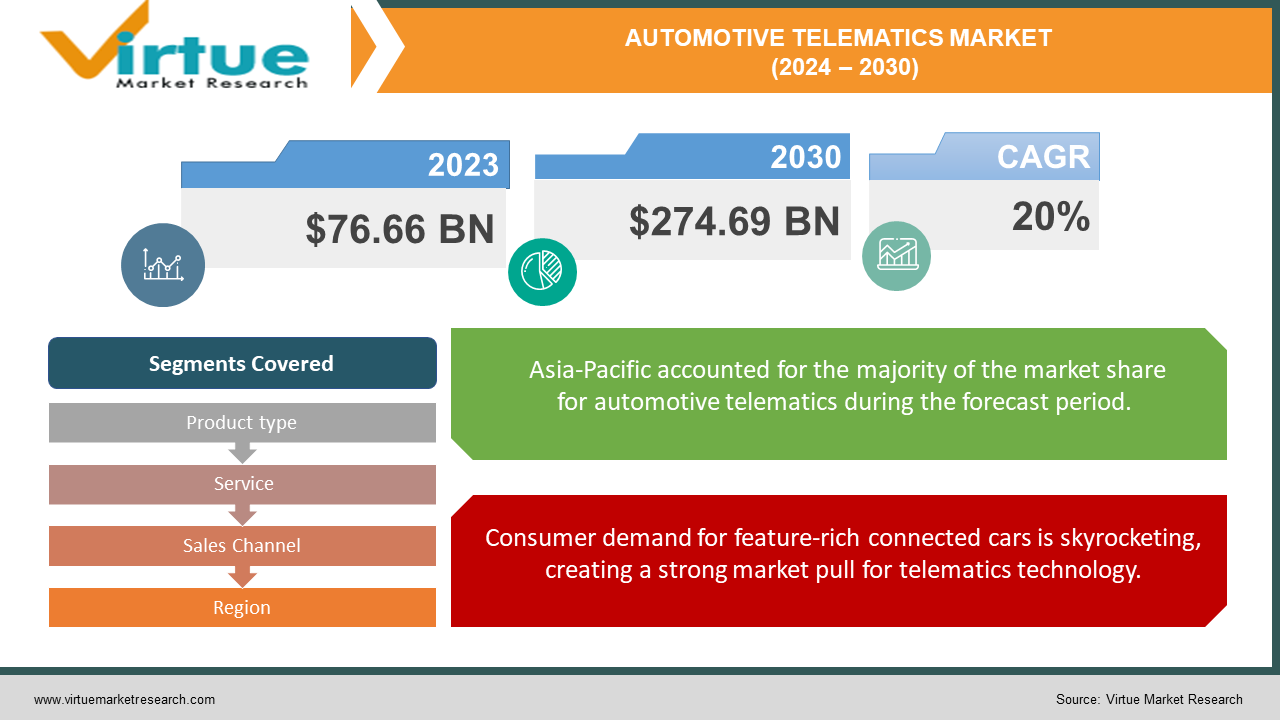

The Global Automotive Telematics Market was valued at USD 76.66 billion in 2023 and is projected to reach a market size of USD 274.69 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 20%.

The automotive telematics market is on a fast track, driven by a surge in demand for connected cars. Consumers are increasingly interested in features like navigation, remote diagnostics, and emergency assistance, all reliant on telematics technology. Governments in some regions are even mandating telematics systems in new cars for safety reasons. Additionally, the rise of usage-based insurance, which rewards safe driving with lower premiums, is fueling the market growth. Telematics data plays a key role in UBI programs by tracking factors like mileage, speed, and braking habits.

Key Market Insights:

North America and Europe currently dominate the automotive telematics market, accounting for a significant share due to the early adoption of telematics solutions and stringent regulations promoting vehicle safety and connectivity.

The automotive telematics market is witnessing rapid technological advancements, including the integration of 5G technology, AI-based analytics, and cloud computing in telematics systems.

The innovations enhance real-time data transmission, improve vehicle connectivity, and enable advanced driver assistance systems (ADAS).

Stringent regulatory mandates about vehicle safety, emissions, and insurance requirements are driving the integration of automotive telematics systems.

Automotive Telematics Market Drivers:

Consumer demand for feature-rich connected cars is skyrocketing, creating a strong market pull for telematics technology.

Consumer preferences have shifted dramatically towards vehicles equipped with a suite of advanced features that enhance convenience, safety, and overall driving experience. Remote diagnostics, used by a staggering 40% of fleet managers to improve operational efficiency, allow drivers to proactively address potential maintenance issues before they become major problems. Emergency assistance features, widely adopted for their life-saving potential, provide immediate help in case of accidents.

Government regulations prioritize safety by mandating telematics systems in new vehicles, acting as a powerful growth catalyst.

Safety remains a top concern for governments around the world. To address this critical issue, some governments are enacting regulations that mandate the installation of telematics systems in new vehicles. Europe's eCall system serves as a prime example. This regulation requires all new cars to have a built-in emergency call function, ensuring that first responders can be dispatched swiftly in the event of an accident. These regulations not only enhance overall road safety but also act as a powerful growth catalyst for the telematics market, as manufacturers are required to integrate telematics technology into their vehicles to comply.

Usage-based insurance (UBI) incentivizes safe driving with telematics data, creating a win-win situation for drivers and insurers.

The rise of UBI programs is another key driver transforming the automotive insurance landscape. UBI programs leverage telematics data to reward safe driving habits with lower premiums. This data can include factors that are demonstrably linked to accident risk, such as total mileage (studies have shown a correlation between mileage and accident risk), speeding behavior, and how harshly a driver brakes. By tracking these metrics, UBI programs create a win-win situation for both insurance companies, who can more accurately assess risk profiles and safety-conscious drivers who are rewarded for their responsible behavior.

The expanding universe of telematics applications unlocks new functionalities and fosters sustained market growth.

Telematics data is a valuable resource with far-reaching potential that extends beyond core automotive functions. We are witnessing the continuous emergence of innovative applications that leverage telematics data in entirely new ways. These applications span a diverse range of areas, including real-time traffic management systems that can help alleviate congestion, weather update services that provide drivers with hyper-local and up-to-the-minute weather information, and even advanced car theft prevention systems that can deter criminals.

Automotive Telematics Market Restraints and Challenges:

Despite the promising growth trajectory of the automotive telematics market, there are roadblocks that need to be addressed. A significant challenge is the high cost of implementation. Telematics systems require not only hardware and software installation but also ongoing connectivity fees. These upfront costs can be a hurdle for both individual consumers and fleet managers, particularly in developing economies. This can hinder the wider adoption of telematics technology. Another major concern is data security. Telematics systems collect a vast amount of sensitive data, including vehicle location, diagnostics, and even driver behavior. This raises privacy issues for consumers who are understandably cautious about how their data is used. To build trust and encourage wider adoption, the industry needs robust security measures and clear data usage policies to ensure user privacy is respected.

A lack of standardization also poses a challenge. Currently, there's no single standard for communication interfaces, protocols, or technologies used in telematics systems. This inconsistency can lead to inaccurate data collection and make it difficult to integrate systems from different vendors. Establishing industry-wide standards is crucial to ensure seamless operation and continued market growth.

Finally, cybersecurity threats loom large. Telematics systems are vulnerable to cyberattacks that could compromise sensitive data or even take remote control of a vehicle. To mitigate these risks and ensure the safety and security of telematics systems, robust cybersecurity measures, and ongoing security updates are essential.

Automotive Telematics Market Opportunities:

The future of the automotive telematics market is paved with exciting opportunities. Telematics data holds immense potential to revolutionize various aspects of the driving experience. One key area lies in Advanced Driver-Assistance Systems (ADAS). By analyzing real-time data on driving behavior and road conditions, telematics can contribute to the development of even more sophisticated ADAS features, ultimately leading to safer roads. Telematics also plays a vital role in the development and operation of Autonomous Vehicles (AVs). Real-time data on traffic flow, weather, and vehicle performance is essential for safe and efficient autonomous navigation. As AV technology advances, the demand for robust telematics solutions will surge.

Beyond safety advancements, telematics data can be used to create personalized driver services. Imagine customized route planning based on traffic patterns and your preferences, or infotainment systems suggesting restaurants and gas stations along your journey in real-time. For fleet managers, telematics offers a goldmine of data for optimizing operations. They can gain valuable insights into driver behavior, vehicle performance, and route optimization, leading to significant cost savings and improved efficiency.

AUTOMOTIVE TELEMATICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20% |

|

Segments Covered |

By Product type, Service, Sales Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Robert Bosch GmbH, Continental AG, AT&T, LG Electronics, Verizon, Agero, Clarion, Denso. Embitel Technologies, HARMAN International, Inseego, Intel |

Automotive Telematics Market Segmentation: By Product Type

-

Embedded Telematics

-

Integrated Telematics

-

Tethered Telematics

The dominant segment in the Automotive Telematics Market (By Product Type) is embedded telematics, accounting for around 60% of the market share. These factory-installed systems offer essential features like diagnostics and emergency assistance. The fastest-growing segment is tethered telematics, which caters to older vehicles through add-on devices. As consumers seek to upgrade existing cars with telematics functionality, this aftermarket segment is poised for significant growth.

Automotive Telematics Market Segmentation: By Service

-

Safety and Security

-

Information and Technology

-

Diagnostics and Maintenance

-

Fleet Management

The dominant segment by service in the Automotive Telematics Market is likely Safety and Security. This is driven by factors like mandatory emergency call systems in some regions and rising consumer demand for features like stolen vehicle tracking. However, the fastest-growing segment is expected to be Fleet Management. As businesses strive for operational efficiency, telematics data offers valuable insights for route optimization, driver behavior monitoring, and fuel cost reduction.

Automotive Telematics Market Segmentation: By Sales Channel

-

Original Equipment Manufacturer (OEM)

-

Aftermarket

The dominant sales channel in the automotive telematics market is currently the Original Equipment Manufacturer (OEM) segment, with factory-installed telematics systems becoming increasingly standard. However, the Aftermarket segment is expected to be the fastest-growing segment as consumers look for ways to add telematics functionality to their existing vehicles.

Automotive Telematics Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America boasts a mature automotive industry with a high demand for connected cars. Government regulations promoting safety features and the widespread adoption of UBI programs are driving the telematics market in North America. Additionally, the presence of major automotive manufacturers and technology companies further fuels innovation in this region.

Europe is another major player, characterized by a strong focus on safety and stringent regulations like eCall, mandating telematics systems in new vehicles. This focus on safety, coupled with a growing demand for connected car features, is propelling the European telematics market forward. Additionally, a well-developed technological infrastructure makes Europe a fertile ground for telematics innovation.

Asia-Pacific is expected to witness the fastest growth in the automotive telematics market. The rapid rise of the automotive industry in countries like China and India, coupled with a growing middle class with disposable income, is creating a significant demand for feature-rich vehicles. Additionally, government initiatives promoting connected car technologies are further accelerating growth in this region.

COVID-19 Impact Analysis on the Automotive Telematics Market:

The COVID-19 pandemic threw a curveball at the automotive telematics market. Short-term challenges arose due to supply chain disruptions that limited vehicle production and, in turn, the installation of factory-installed telematics systems. Additionally, lockdowns and business shutdowns led to a decrease in fleet activity, reducing demand for fleet management telematics solutions.

However, the pandemic might have also nudged the market in a positive direction for the long term. A potential shift towards personal car ownership, driven by a desire for safe and convenient mobility solutions, could boost demand for connected car features and telematics technology. Furthermore, the pandemic's emphasis on remote capabilities could lead to a rise in telematics solutions for both personal and fleet vehicles, enabling proactive maintenance and minimizing physical service visits. Finally, evolving consumer preferences might favor feature-rich, connected vehicles, benefiting the telematics market in the long run as car buyers prioritize features like remote diagnostics and emergency assistance. While the immediate impact of COVID-19 was disruptive, the long-term outlook for the automotive telematics market appears promising, with opportunities arising from evolving industry trends and consumer preferences.

Latest Trends/ Developments:

The automotive telematics market is a hotbed of innovation, constantly pushing the boundaries of what's possible. One of the most exciting trends is the rise of Vehicle-to-Everything (V2X) communication. Telematics data is the backbone of V2X, allowing vehicles to exchange information with their surroundings, creating a smarter transportation ecosystem. This technology has the potential to revolutionize road safety, improve traffic flow, and pave the way for the future of autonomous driving.

Another key trend is the integration of telematics with wearable technology and health devices. In the future telematics systems can monitor driver fatigue or even detect potential health problems. This integration has the potential to completely transform driver safety and well-being on the road. Finally, telematics data is fundamentally changing the landscape of auto insurance. Usage-based insurance (UBI) is becoming increasingly popular, and telematics is providing insurers with the data they need to create personalized risk profiles and offer more competitive rates. As telematics data continues to evolve, we can expect even further innovation in the world of telematics insurance. These trends represent just a glimpse into the exciting future of the automotive telematics market, where technology and connectivity will continue to reshape the driving experience.

Key Players:

-

Robert Bosch GmbH

-

Continental AG

-

AT&T

-

LG Electronics

-

Verizon

-

Agero

-

Clarion

-

Denso

-

Embitel Technologies

-

HARMAN International

-

Inseego

-

Intel

Chapter 1. Automotive Telematics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Telematics Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Telematics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Telematics Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Telematics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Telematics Market – By Product Type

6.1 Introduction/Key Findings

6.2 Embedded Telematics

6.3 Integrated Telematics

6.4 Tethered Telematics

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Automotive Telematics Market – By Service

7.1 Introduction/Key Findings

7.2 Safety and Security

7.3 Information and Technology

7.4 Diagnostics and Maintenance

7.5 Fleet Management

7.6 Y-O-Y Growth trend Analysis By Service

7.7 Absolute $ Opportunity Analysis By Service, 2024-2030

Chapter 8. Automotive Telematics Market – By Sales Channel

8.1 Introduction/Key Findings

8.2 Original Equipment Manufacturer (OEM)

8.3 Aftermarket

8.4 Y-O-Y Growth trend Analysis By Sales Channel

8.5 Absolute $ Opportunity Analysis By Sales Channel, 2024-2030

Chapter 9. Automotive Telematics Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Service

9.1.4 By By Sales Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Service

9.2.4 By Sales Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Service

9.3.4 By Sales Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Service

9.4.4 By Sales Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Service

9.5.4 By Sales Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Automotive Telematics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Robert Bosch GmbH

10.2 Continental AG

10.3 AT&T

10.4 LG Electronics

10.5 Verizon

10.6 Agero

10.7 Clarion

10.8 Denso

10.9 Embitel Technologies

10.10 HARMAN International

10.11 Inseego

10.12 Intel

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Automotive Telematics Market was valued at USD 76.66 billion in 2023 and is projected to reach a market size of USD 274.69 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 20%.

Soaring Demand for Feature-Rich, Connected Cars, Government Regulations Prioritizing Safety with Telematics, Usage-Based Insurance (UBI) Incentivizes Safe Driving with Telematics Data, The Expanding Universe of Telematics Applications.

Embedded Telematics, Integrated Telematics, Tethered Telematics.

The fastest growing region for the Automotive Telematics Market is currently Asia-Pacific, driven by rapid automotive industry growth and a growing middle class with disposable income.

Robert Bosch GmbH, Continental AG, AT&T, LG Electronics, Verizon, Agero, Clarion, Denso, Embitel Technologies, HARMAN International, Inseego, Intel.