Automotive Start-Stop Battery Market Size (2025-2030)

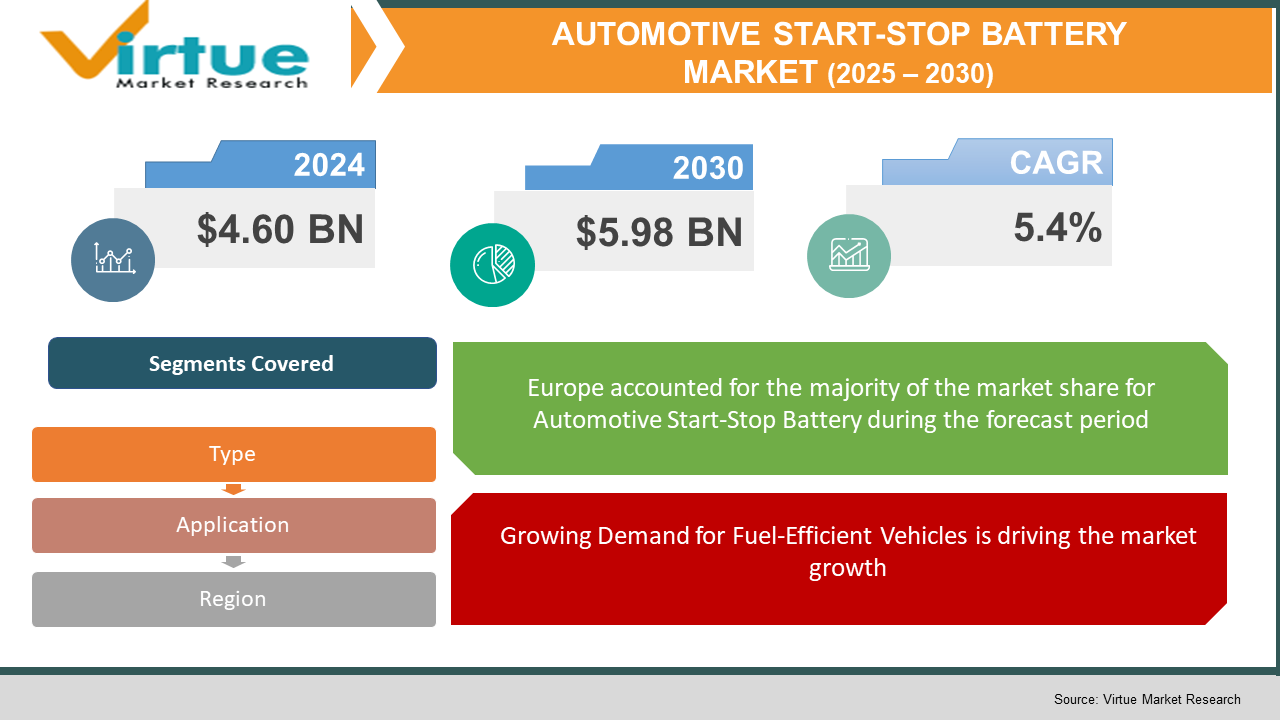

The Global Automotive Start-Stop Battery Market was valued at USD 4.60 billion in 2024 and will grow at a CAGR of 5.4% from 2025 to 2030. The market is expected to reach USD 5.98 billion by 2030.

The Automotive Start-Stop Battery Market revolves around the batteries used in start-stop systems that enable vehicles to reduce fuel consumption and emissions by automatically shutting down and restarting the internal combustion engine. These systems require batteries with high cycling durability, charge acceptance, and quick restart capability. The market has grown significantly due to stringent environmental regulations, growing demand for fuel-efficient vehicles, and increasing adoption of advanced vehicle technologies. Enhanced flooded batteries (EFB) and absorbent glass mat (AGM) batteries are commonly used, with AGM being preferred for premium and high-performance vehicles. With rising vehicle electrification and OEM integration of fuel-saving technologies, the start-stop battery segment is expected to remain vital in both developed and emerging markets.

Key Market Insights:

Absorbent Glass Mat (AGM) batteries accounted for over 45% of global revenue in 2024 due to their high performance and deep cycling capabilities.

Passenger cars remained the largest application segment in 2024, contributing more than 70% of total market demand.

Europe led the market with a 38% share in 2024, supported by stringent emission standards and wide vehicle fleet adoption of start-stop systems.

Enhanced Flooded Batteries (EFB) segment is projected to grow at a CAGR of 6.1% between 2025 and 2030.

Asia-Pacific is expected to witness the fastest growth, with a projected CAGR of 6.8% from 2025 to 2030, driven by rising vehicle production.

Integration of start-stop systems has increased from 55% in new vehicles in 2019 to over 70% in 2024 globally.

Aftermarket segment is gaining traction due to increasing replacement cycles of start-stop batteries every 3–5 years.

Global Automotive Start-Stop Battery Market Drivers

Stringent Emissions Norms Driving Adoption is driving the market growth

Governments worldwide are implementing increasingly strict vehicle emissions and fuel economy regulations, pushing automakers to adopt technologies that reduce fuel consumption and carbon emissions. Start-stop systems help meet these requirements by automatically turning off the engine when the vehicle is idle and restarting it when the driver releases the brake or engages the clutch. This feature results in measurable reductions in fuel usage and CO₂ emissions, particularly in urban stop-and-go traffic scenarios. As emission standards such as Euro 6 in Europe and CAFE in the United States become more stringent, original equipment manufacturers (OEMs) are integrating start-stop technologies across a wide range of vehicle segments, including entry-level models. These systems rely heavily on start-stop batteries with high durability and fast recharge capabilities. The enforcement of Real Driving Emissions (RDE) testing and future targets aligned with climate goals are anticipated to further accelerate demand. As regulatory agencies continue to raise performance thresholds for automotive systems, the need for advanced, reliable start-stop batteries becomes indispensable.

Growing Demand for Fuel-Efficient Vehicles is driving the market growth

Rising fuel prices and environmental consciousness among consumers have led to increasing demand for vehicles that offer improved fuel efficiency without compromising performance. Start-stop systems provide a simple, cost-effective solution for fuel savings, which can range from 5% to 10% depending on driving conditions. The ability of these systems to automatically shut off the engine during idling periods is particularly attractive to urban drivers who face heavy traffic and frequent stops. Automakers are integrating start-stop systems as standard features in mid-range and even economy vehicles to address consumer demand and stay competitive. Batteries in such systems must handle frequent cycling and offer reliable engine restarts, which has driven the demand for advanced technologies like AGM and EFB batteries. Additionally, the global rise in hybrid and micro-hybrid vehicles, which also depend on start-stop functionality, has contributed to market expansion. The trend toward lightweight, fuel-saving vehicles will ensure consistent demand for start-stop batteries over the coming years.

Expansion of Micro-Hybrid and Mild-Hybrid Technologies is driving the market growth

The increasing adoption of micro-hybrid and mild-hybrid vehicles is a major growth driver for the start-stop battery market. These vehicle types do not rely on a full hybrid drivetrain but instead use auxiliary electric systems, regenerative braking, and start-stop functions to enhance fuel economy and reduce emissions. Micro-hybrids use enhanced batteries capable of rapid charge and discharge cycles, making AGM and EFB batteries critical components. With automakers facing pressure to transition away from internal combustion engines, but still requiring cost-effective intermediary solutions, micro-hybrids are becoming more prevalent. They offer a practical bridge between traditional ICE vehicles and fully electric vehicles. The start-stop batteries in these vehicles need to support high load endurance, fast restarts, and compatibility with energy recovery systems. OEMs are actively investing in upgrading their 12V battery systems to handle these loads. As more models across various brands include micro-hybrid features, demand for robust start-stop batteries is expected to grow significantly in both original equipment and replacement markets.

Global Automotive Start-Stop Battery Market Challenges and Restraints

Shorter Lifespan Compared to Conventional Batteries is restricting the market growth

Start-stop batteries endure a much higher number of charge and discharge cycles than traditional car batteries, which significantly impacts their lifespan. While they are designed for durability, the frequent cycling—especially in vehicles used primarily in urban environments—can lead to early degradation. Most start-stop batteries require replacement every three to five years, depending on usage patterns, which increases ownership costs for consumers. In contrast, standard lead-acid batteries in non-start-stop vehicles can last longer under moderate usage. Additionally, improper handling, irregular maintenance, or use in vehicles without compatible alternator systems can lead to underperformance. These factors contribute to customer dissatisfaction and may dissuade some consumers from embracing start-stop systems, particularly in regions where product awareness and battery maintenance services are lacking. As electric vehicle penetration grows, consumers may also question investing in start-stop batteries for conventional vehicles, potentially limiting aftermarket growth. Manufacturers must continue innovating battery chemistry and designs to improve longevity and value proposition.

High Cost of Advanced Start-Stop Battery Technologies is restricting the market growth

One of the major restraints in the market is the higher cost of advanced start-stop battery types such as AGM and EFB compared to conventional lead-acid batteries. AGM batteries, in particular, can cost two to three times more than standard batteries. While these costs are often justified by performance, durability, and energy efficiency, price-sensitive consumers—especially in emerging markets—may hesitate to invest in these technologies. Furthermore, replacement costs can be significant, as vehicles equipped with start-stop systems require compatible batteries, and using a standard battery may void warranties or damage vehicle electronics. The cost factor is also a concern for fleet owners and commercial vehicle operators who need to manage total cost of ownership. Although economies of scale and technological advancements are expected to bring prices down over time, the current price disparity limits adoption in lower-income regions and restricts OEM penetration in budget vehicle segments. Manufacturers must work toward cost-optimization without compromising battery quality or safety.

Market Opportunities

The Automotive Start-Stop Battery Market offers several opportunities for growth and innovation, particularly in the context of technological evolution, emerging market expansion, and increasing focus on vehicle electrification. One of the most promising opportunities lies in the ongoing development of battery chemistries with improved charge acceptance, durability, and thermal performance. New advancements in AGM and EFB batteries, as well as hybrid chemistries, can extend lifespan and reduce replacement frequency, thereby enhancing user value. Additionally, integrating start-stop batteries with vehicle energy management systems (EMS) offers further efficiency improvements, allowing real-time diagnostics and predictive maintenance. Emerging economies in Asia, Africa, and Latin America represent untapped growth potential. As vehicle ownership rises in these regions, and governments begin adopting emissions regulations, the demand for start-stop systems and compatible batteries is expected to grow. OEMs and aftermarket suppliers can gain a competitive edge by tailoring products to local needs, offering cost-effective variants, and establishing widespread distribution and service networks. Another key opportunity lies in the fleet and commercial vehicle segment, where start-stop technologies can contribute significantly to fuel cost savings and emission reductions. Educating fleet managers on the ROI benefits of start-stop batteries can unlock new revenue streams. Moreover, the integration of solar and regenerative braking technologies in vehicles enhances the need for high-performance auxiliary batteries, reinforcing market expansion. Strategic partnerships between battery manufacturers, OEMs, and automotive electronics firms can drive innovations that meet evolving market expectations. As sustainable mobility becomes a global imperative, the automotive start-stop battery segment is well-positioned to play a critical role in supporting transitional vehicle technologies.

AUTOMOTIVE START-STOP BATTERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Johnson Controls, Exide Technologies, Clarios, GS Yuasa, East Penn, Banner, VARTA AG, Amara Raja, Leoch, EnerSys |

Automotive Start-Stop Battery Market Segmentation

Automotive Start-Stop Battery Market Segmentation By Product Type:

• Enhanced Flooded Batteries (EFB)

• Absorbent Glass Mat (AGM)

• Lead-acid

• Others

Absorbent Glass Mat (AGM) batteries dominate the market due to their deep cycle capabilities, resistance to vibration, and ability to support energy-intensive start-stop systems. Their high performance in cold conditions and low self-discharge rate make them ideal for premium vehicles and high-traffic urban use. AGM batteries are now the preferred choice for OEMs seeking reliability, durability, and compliance with strict emissions norms.

Automotive Start-Stop Battery Market Segmentation By Application:

• Passenger Cars

• Commercial Vehicles

Passenger cars represent the dominant application segment in the automotive start-stop battery market, driven by widespread implementation of start-stop systems in compact and mid-range vehicles. OEMs are integrating start-stop features as standard in new car models to meet fuel economy targets and emission regulations. The affordability and availability of EFB and AGM batteries have made this integration feasible for a wide range of consumer vehicles globally.

Automotive Start-Stop Battery Market Regional Segmentation

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

Europe leads the global automotive start-stop battery market, accounting for nearly 38% of total market revenue in 2024. The region's dominance is attributed to strict vehicle emission laws, particularly the Euro 6 standards and future Euro 7 regulations, which necessitate efficient fuel-saving technologies like start-stop systems. European automakers have been early adopters of these systems, offering them as standard across a broad range of vehicles, including entry-level models. High levels of environmental awareness among consumers and government incentives for low-emission technologies further support the adoption of start-stop compatible batteries. Germany, the UK, France, and Nordic countries are key contributors, benefiting from mature automotive industries, strong aftermarket distribution networks, and supportive public policy. The widespread prevalence of urban driving conditions in European cities also aligns well with the operational strengths of start-stop systems. As the EU continues to push for greener mobility solutions and enforces fleet-wide CO₂ reduction targets, demand for AGM and EFB batteries is expected to remain robust in both OEM and replacement segments.

COVID-19 Impact Analysis on the Automotive Start-Stop Battery Market

The COVID-19 pandemic disrupted the Automotive Start-Stop Battery Market initially, with global vehicle production and sales experiencing a sharp decline in the first half of 2020. Lockdowns, factory shutdowns, and supply chain disruptions affected both OEM and aftermarket battery supplies. Demand for new vehicles declined as consumers delayed purchases and auto manufacturers paused assembly lines. However, the market began recovering in late 2020 and into 2021, driven by government stimulus, renewed automotive demand, and a shift in consumer preferences toward private mobility. As economic recovery progressed, replacement battery demand increased due to prolonged vehicle downtimes during lockdowns, which weakened batteries and led to higher failure rates. This trend was particularly noticeable in regions with mature automotive fleets. In the long term, the pandemic accelerated the adoption of digital retail and aftermarket services, leading to more online battery sales and home installation models. Consumers also prioritized cost-effective and fuel-efficient vehicle features, increasing the appeal of start-stop systems. On the production side, manufacturers began investing in supply chain resilience and localizing operations to mitigate risks of future disruptions. While COVID-19 initially slowed growth, it reinforced the importance of maintenance-free, efficient vehicle technologies, indirectly benefiting the start-stop battery segment. The market has since regained momentum and is expected to remain resilient amid evolving mobility trends.

Latest Trends/Developments

The Automotive Start-Stop Battery Market is evolving rapidly with several key trends shaping its future trajectory. A major development is the increasing integration of intelligent battery management systems (BMS) that enhance battery life, optimize performance, and provide real-time diagnostics. These systems are becoming essential in modern vehicles with complex electrical architectures. Another trend is the rise of eco-friendly battery designs, with manufacturers focusing on recyclable materials, reduced lead content, and sustainable production processes. Technological innovation is driving enhancements in AGM and EFB batteries to offer higher cycling capacity and better temperature resistance. OEMs are exploring dual-battery configurations to support next-generation start-stop systems in hybrid vehicles. Additionally, partnerships between automakers and battery producers are leading to joint ventures aimed at localized production and customized battery solutions for specific vehicle models. The aftermarket segment is also transforming, with digital platforms enabling direct-to-consumer battery sales and installation services. New product lines are emerging for commercial and fleet vehicles, reflecting their growing share in urban transportation. Moreover, as EVs gain momentum, start-stop batteries are finding relevance in plug-in hybrid applications where auxiliary systems require continuous power. Innovations in solid-state technologies and nanomaterials, though in early stages, hold long-term potential to redefine the capabilities of start-stop batteries. Collectively, these trends underscore the market’s transition toward smarter, greener, and more resilient energy storage solutions in the automotive sector.

Key Players:

- Johnson Controls

- Exide Technologies

- Clarios

- GS Yuasa

- East Penn Manufacturing

- Banner Batteries

- VARTA AG

- Amara Raja Batteries

- Leoch International

- EnerSys

Chapter 1. Automotive Start-Stop Battery Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. AUTOMOTIVE START-STOP BATTERY MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. AUTOMOTIVE START-STOP BATTERY MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. AUTOMOTIVE START-STOP BATTERY MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. AUTOMOTIVE START-STOP BATTERY MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. AUTOMOTIVE START-STOP BATTERY MARKET – By Type

6.1 Introduction/Key Findings

6.2 Enhanced Flooded Batteries (EFB)

6.3 Absorbent Glass Mat (AGM)

6.4 Lead-acid

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. AUTOMOTIVE START-STOP BATTERY MARKET – By Application

7.1 Introduction/Key Findings

7.2 Passenger Cars

7.3 Commercial Vehicles

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. AUTOMOTIVE START-STOP BATTERY MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. AUTOMOTIVE START-STOP BATTERY MARKET – Company Profiles – (Overview, Type , Portfolio, Financials, Strategies & Developments)

9.1 Johnson Controls

9.2 Exide Technologies

9.3 Clarios

9.4 GS Yuasa

9.5 East Penn Manufacturing

9.6 Banner Batteries

9.7 VARTA AG

9.8 Amara Raja Batteries

9.9 Leoch International

9.10 EnerSys

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automotive Start-Stop Battery Market was valued at USD 4.60 billion in 2024 and will grow at a CAGR of 5.4% from 2025 to 2030. The market is expected to reach USD 5.98 billion by 2030.

Regulations, fuel-efficiency needs, and micro-hybrid vehicle growth are key drivers.

Segments include product type (AGM, EFB, lead-acid) and application (passenger cars, commercial vehicles).

Europe dominates the market with a 38% share due to strict emissions laws and early system adoption