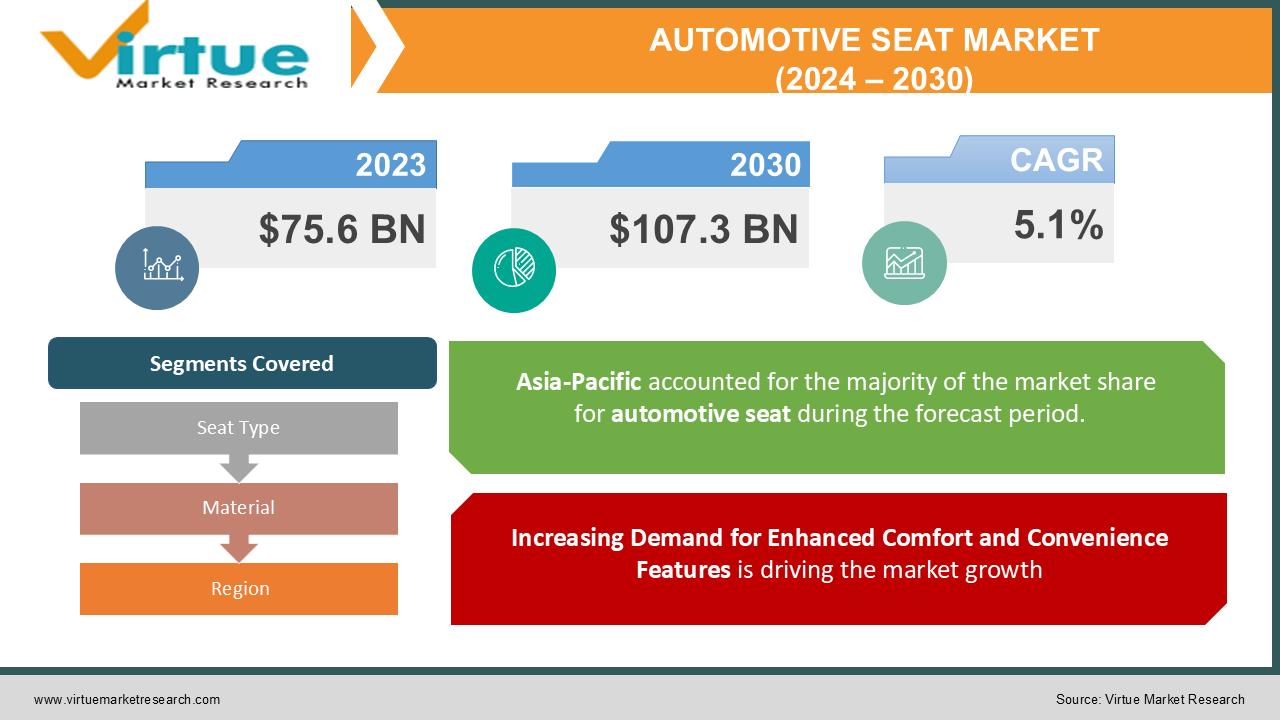

Automotive Seat Market Size (2024–2030)

The Global Automotive Seat Market was valued at USD 75.6 billion in 2023 and is expected to grow at a CAGR of 5.1% from 2024 to 2030, reaching approximately USD 107.3 billion by 2030.

Automotive seats are critical to vehicle comfort, safety, and user experience, influencing both consumer purchasing decisions and vehicle performance. The automotive seating market has expanded as manufacturers prioritize ergonomic designs, safety features, and lightweight materials to enhance fuel efficiency and comfort. Demand is especially strong in passenger and electric vehicles, with manufacturers integrating more innovative features such as ventilated seats, massaging capabilities, and customizable adjustments.

Automotive seats are no longer merely functional components but integral to overall vehicle design, impacting consumer satisfaction and driving the adoption of new materials and technologies. This shift reflects the rising consumer interest in comfort and premium features, even in entry-level models.

Key Market Insights:

Passenger cars dominated the market with a 65% share in 2023, driven by rising sales of passenger vehicles globally and increased demand for advanced seating features.

The electric vehicle (EV) segment is witnessing rapid growth, with a 9% CAGR projected, as lightweight, sustainable, and ergonomic seating solutions become essential in EV design.

Leather seats accounted for 30% of market revenue in 2023, particularly in luxury and high-end vehicles, where premium materials enhance brand perception and user experience.

The Asia-Pacific region held the largest market share, representing approximately 40% of total revenue due to strong automotive production hubs in China, Japan, and South Korea.

Smart and ergonomic seating solutions are in demand as more consumers prioritize health benefits, with seat designs increasingly tailored to support posture and reduce fatigue.

Lightweight materials such as advanced composites and synthetic fabrics are increasingly adopted to improve fuel efficiency, reduce emissions, and align with global sustainability goals.

OEMs and seating suppliers are forming strategic partnerships for in-house design and production capabilities, enhancing customization and reducing lead times.

Global Automotive Seat Market Drivers:

Increasing Demand for Enhanced Comfort and Convenience Features is driving the market growth:

Consumer expectations regarding comfort and convenience in vehicle interiors have transformed automotive seating from a basic necessity into a crucial value-added feature. As a result, manufacturers are increasingly focusing on offering ergonomic designs, advanced cushioning, and supportive structures that align with consumer health preferences. Automotive seats with added functionality, such as adjustable lumbar support, heated and ventilated options, and even massage features, are becoming standard in various car models, especially in luxury and premium vehicles. The rise in long-distance commuting and increased awareness of the physical strain associated with prolonged driving are also influencing this trend. Comfort features like adaptive seats, memory foam, and contour adjustments are gaining traction across segments, extending from high-end models to mass-market vehicles. This focus on health and wellness in automotive seating has become a significant differentiator for manufacturers and continues to drive market growth.

Technological Advancements in Smart and Connected Seating is driving the market growth:

The automotive seat market is experiencing a transformation with the advent of smart technology. Innovations such as seat sensors that monitor occupant weight, position, and even biometric data are becoming common, especially in high-end vehicles. These advanced features enable real-time adjustments to enhance comfort and safety, optimizing seat position based on driver and passenger preferences. Additionally, some systems integrate with in-car connectivity to allow remote customization of seat settings and provide health monitoring capabilities, aligning with consumer expectations for a personalized experience. Autonomous and electric vehicle developments are accelerating these technological advancements, as seats in these vehicles are often designed to accommodate both traditional driving positions and relaxed, reclined postures for self-driving modes. Automotive seats now incorporate connectivity features, making them compatible with broader vehicle infotainment systems. The integration of these technologies enhances user experience and serves as a competitive advantage for automotive manufacturers, driving the adoption of smart seating solutions in mainstream markets.

Sustainability and Demand for Lightweight, Eco-Friendly Materials is driving the market growth:

The push towards sustainability in automotive manufacturing is encouraging the use of lightweight and eco-friendly materials in seat production. As governments and regulatory bodies impose stricter emission standards, manufacturers are increasingly opting for recyclable, bio-based, and synthetic materials to reduce the carbon footprint of automotive seats. Lightweight materials such as advanced composites, recycled polyester, and synthetic leathers help reduce overall vehicle weight, improving fuel efficiency and supporting eco-conscious consumer preferences. The shift towards electric vehicles has amplified the need for lightweight materials, as every kilogram saved extends vehicle range and enhances efficiency. Additionally, manufacturers are embracing environmentally responsible production methods, such as using water-based adhesives and incorporating plant-based foams. These innovations align with the sustainability goals of automotive brands, attracting consumers who prioritize eco-friendly choices and supporting long-term market growth.

Global Automotive Seat Market Challenges and Restraints:

High Costs Associated with Advanced Seat Features is restricting the market growth:

Although advanced features such as heating, cooling, massaging, and connectivity are becoming increasingly popular, they come with added costs that can raise the overall vehicle price. Incorporating these features requires specialized materials, complex mechanical components, and electronic systems, making seats one of the costliest interior components in a vehicle. This can be a deterrent, particularly in price-sensitive segments and emerging markets where consumers prioritize affordability over luxury features. For manufacturers, balancing the demand for these features with cost-effective production can be challenging. Additionally, while luxury vehicles can incorporate high-end seat features as part of their premium offerings, mid-range and economy models may struggle to justify the added expense. As a result, while consumer demand for comfort and technological integration continues to grow, the high costs associated with advanced seating systems remain a restraint for broader market penetration.

Challenges with Material Sourcing and Supply Chain Disruptions is restricting the market growth:

The automotive seat market relies heavily on various raw materials, including leather, foam, and specialized textiles. Disruptions in the supply chain, such as material shortages, fluctuating prices, and transportation delays, can impact production timelines and manufacturing costs. For instance, leather and premium synthetic materials are often sourced from specific regions, and supply chain bottlenecks can hinder timely delivery and increase costs, affecting the availability of high-quality seating materials. Recent global supply chain disruptions, exacerbated by the pandemic and geopolitical tensions, have underscored the vulnerability of the automotive supply chain. Shortages of raw materials, increased freight costs, and supply delays make it challenging for seat manufacturers to meet demand while maintaining consistent quality and cost-effectiveness. This supply chain volatility not only impacts pricing but also poses a risk to production stability, especially as demand for high-quality materials continues to rise.

Market Opportunities:

The Global Automotive Seat Market is poised for growth due to the rising adoption of innovative seating solutions, the growth of electric and autonomous vehicles, and sustainability trends. As consumers increasingly prioritize comfort and customization, there is a growing market for technologically advanced seating solutions that offer features such as temperature control, massaging functions, and enhanced adjustability. These features have gained particular importance in the luxury and premium segments, where high-end comfort solutions are a competitive differentiator.

Electric vehicles present unique opportunities for seating manufacturers, as seat designs need to accommodate the specific interior layouts of EVs, which often require lighter materials to maximize vehicle range. Additionally, as autonomous driving technology advances, automotive seats will likely be redesigned to cater to a variety of seating arrangements, allowing for greater flexibility within vehicle interiors. This shift in seating design aligns with the increasing consumer interest in adaptable and multi-functional seating options, presenting significant growth prospects for the market. The drive toward sustainable automotive manufacturing also opens new avenues in eco-friendly seating materials. With a focus on reducing environmental impact, manufacturers are exploring options such as bio-based foams, recycled textiles, and synthetic leathers that provide a sustainable alternative to traditional materials. Such innovations align with regulatory goals to reduce emissions, offering market players an opportunity to attract eco-conscious consumers and align their offerings with sustainability trends.

AUTOMOTIVE SEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Seat Type, Material, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Adient plc, Lear Corporation, Faurecia, Toyota Boshoku Corporation, Magna International Inc., TACHI-S Co., Ltd., NHK Spring Co., Ltd, RECARO Automotive, TS Tech Co., Ltd., Grammer AG |

Automotive Seat Market Segmentation: By Seat Type

-

Bucket

-

Bench

-

Folding

Bucket seats dominate the market with 55% market share, primarily due to their popularity in passenger and luxury vehicles. Known for their ergonomic design, bucket seats provide individualized support and are typically integrated with advanced comfort features, making them the preferred choice for modern vehicles.

Automotive Seat Market Segmentation: By Material

-

Leather

-

Fabric

-

Synthetic

Leather seats hold the dominant share in the material segment, accounting for 30% of the market. Leather is a preferred choice in luxury vehicles due to its durability and premium appeal. Despite higher costs, leather’s aesthetic and comfort value make it popular among premium car buyers.

Automotive Seat Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

The Asia-Pacific region is the market leader with approximately 40% of the global share, driven by robust automotive production in countries like China, Japan, and South Korea. The region’s automotive industry benefits from strong consumer demand and a vast manufacturing base, with local players and international brands alike investing in innovative seating solutions to meet evolving consumer preferences.

COVID-19 Impact Analysis:

The COVID-19 pandemic disrupted the automotive seat market, particularly affecting the supply chain for essential raw materials and components. As vehicle production slowed due to lockdowns and restrictions, the demand for automotive seats dropped sharply in the early stages of the pandemic. However, as economies reopened, the market showed resilience, with a rapid recovery fueled by increased vehicle sales, especially in the passenger and electric vehicle segments. The pandemic also accelerated shifts toward remote work, prompting automotive companies to innovate around comfort and ergonomic seating. Additionally, consumer awareness of hygiene led to innovations in antimicrobial and easy-to-clean materials, influencing post-pandemic market dynamics.

Latest Trends/Developments:

The market is witnessing a shift toward smart seating solutions with integrated sensors, sustainable materials, and personalized comfort features. Automakers are increasingly using eco-friendly and recycled materials to meet sustainability goals, and technological advancements enable seats to monitor health metrics, adjust for comfort automatically, and offer heated or ventilated options. Autonomous and electric vehicles are driving further seat design innovations, as interior flexibility becomes essential for multi-purpose use. These trends underscore the market's focus on both sustainability and technological enhancement, catering to the evolving preferences of modern consumers.

Key Players:

-

Adient plc

-

Lear Corporation

-

Faurecia

-

Toyota Boshoku Corporation

-

Magna International Inc.

-

TACHI-S Co., Ltd.

-

NHK Spring Co., Ltd.

-

RECARO Automotive

-

TS Tech Co., Ltd.

-

Grammer AG

Chapter 1. Automotive Seat Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Seat Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Seat Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Seat Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Seat Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Seat Market – By Seat Type

6.1 Introduction/Key Findings

6.2 Bucket

6.3 Bench

6.4 Folding

6.5 Y-O-Y Growth trend Analysis By Seat Type

6.6 Absolute $ Opportunity Analysis By Seat Type, 2024-2030

Chapter 7. Automotive Seat Market – By Material

7.1 Introduction/Key Findings

7.2 Leather

7.3 Fabric

7.4 Synthetic

7.5 Y-O-Y Growth trend Analysis By Material

7.6 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Automotive Seat Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Seat Type

8.1.3 By Material

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Seat Type

8.2.3 By Material

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Seat Type

8.3.3 By Material

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Seat Type

8.4.3 By Material

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Seat Type

8.5.3 By Material

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Automotive Seat Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Adient plc

9.2 Lear Corporation

9.3 Faurecia

9.4 Toyota Boshoku Corporation

9.5 Magna International Inc.

9.6 TACHI-S Co., Ltd.

9.7 NHK Spring Co., Ltd.

9.8 RECARO Automotive

9.9 TS Tech Co., Ltd.

9.10 Grammer AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 75.6 billion in 2023 and is expected to reach USD 107.3 billion by 2030.

The market is driven by consumer demand for comfort, smart seating technology, and eco-friendly materials.

The market is segmented by seat type (bucket, bench, folding) and material (leather, fabric, synthetic).

Asia-Pacific is the dominant region, accounting for around 40% of the market share.

Key players include Adient plc, Lear Corporation, Faurecia, Toyota Boshoku Corporation, and Magna International Inc.