Automotive Refinish Coatings Market Size (2024 – 2030)

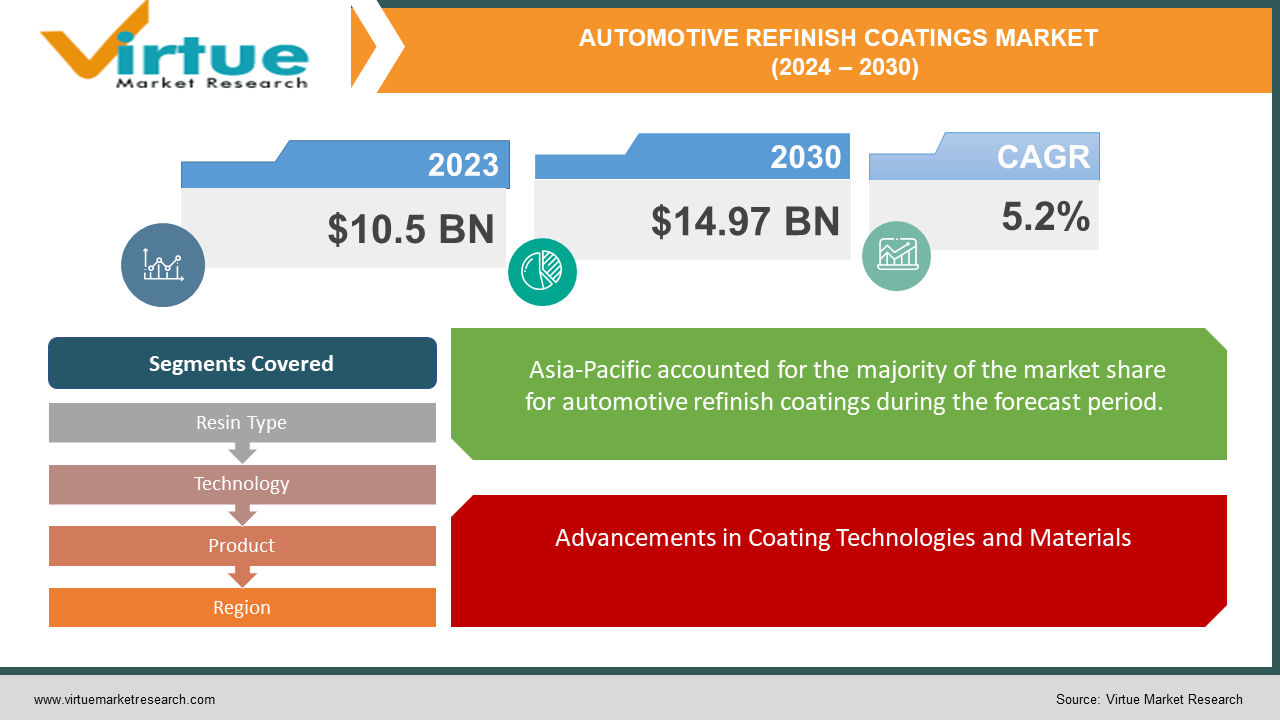

The Global Automotive Refinish Coatings Market was valued at USD 10.5 billion in 2023 and is projected to reach a market size of USD 14.97 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.2% between 2024 and 2030.

The global automotive refinish coatings market is a critical segment of the automotive aftermarket industry, dedicated to the repair, maintenance, and aesthetic enhancement of vehicles. These coatings, applied to vehicles' exteriors and interiors, serve multiple purposes, including restoring the original appearance, providing protection against environmental damage, and enabling customization for personal or commercial use. As vehicle ownership increases globally, particularly in emerging markets, the demand for refinish coatings has surged. This market is characterized by a wide range of products, including primers, basecoats, clearcoats, and specialized coatings designed for various vehicle surfaces and conditions. Technological advancements have played a significant role in shaping the market, with innovations such as waterborne coatings, UV-cured coatings, and digital color-matching systems enhancing both performance and environmental compliance. Additionally, the rise of electric vehicles and the growing importance of sustainability have prompted the development of eco-friendly coating solutions. Despite challenges such as stringent environmental regulations and fluctuating raw material costs, the market continues to grow, driven by factors such as increased vehicle longevity, higher frequency of road accidents, and consumer preferences for vehicle customization and aesthetic improvements. This dynamic market is poised for continued expansion, offering numerous opportunities for innovation and growth.

Key Market Insights:

Waterborne coatings account for about 40% of the total market share due to their low VOC content and environmental compliance.

The Asia-Pacific region contributes approximately 35% of the total market value, making it the largest market share holder.

Commercial vehicles make up about 45% of the market demand for refinish coatings, with passenger cars accounting for 55%.

Over 30% of automotive refinish coating applications now incorporate digital color-matching technologies, enhancing precision and reducing application time.

The cost of raw materials, including resins, pigments, and additives, constitutes about 60-70% of the total production cost for refinishing coatings.

More than 50% of new product developments are focused on eco-friendly and sustainable coatings, reflecting the industry's shift towards greener solutions.

Global Automotive Refinish Coatings Market Drivers:

Growing Demand for Vehicle Aesthetics and Customization.

The global automotive refinish coatings market is significantly driven by the increasing consumer demand for vehicle aesthetics and customization. As car ownership continues to rise, particularly in emerging economies, consumers are increasingly focused on enhancing the appearance and personalizing their vehicles. This trend is fueled by a growing automotive culture where the exterior appearance of a vehicle is seen as a reflection of the owner’s personality and status. Custom paint jobs, specialized finishes, and high-quality repair coatings are becoming more popular, leading to a surge in demand for refinish coatings. Furthermore, the rising disposable incomes and a growing middle-class population in developing countries are amplifying this demand. As a result, automotive refinish coatings are no longer just about repair and maintenance but are becoming a key component of vehicle customization and enhancement.

Advancements in Coating Technologies and Materials.

Technological advancements in coating materials and application techniques are another major driver of the global automotive refinish coatings market. Innovations such as high-performance, environmentally-friendly coatings, and advanced application methods have revolutionized the industry. Waterborne coatings, for instance, are gaining traction due to their lower environmental impact compared to traditional solvent-based coatings. Additionally, advancements in UV-cured coatings and the development of nanotechnology-based coatings are providing superior durability, faster curing times, and enhanced aesthetic qualities. These technological innovations are not only meeting the stringent environmental regulations but also offering cost-effective and high-performance solutions to end-users. As a result, automotive repair shops and coating manufacturers are increasingly adopting these advanced technologies, driving the growth of the automotive refinish coatings market.

Global Automotive Refinish Coatings Market Restraints and Challenges:

The global automotive refinish coatings market faces several significant restraints and challenges that could impede its growth. One of the primary challenges is the stringent environmental regulations imposed by governments worldwide. These regulations, aimed at reducing volatile organic compound (VOC) emissions, often require manufacturers to invest in expensive research and development to create compliant products, thereby increasing production costs. Additionally, the high cost of raw materials used in manufacturing advanced refinish coatings, such as pigments, resins, and additives, further elevates the overall cost of the coatings. This cost factor can be a substantial barrier for small and medium-sized enterprises (SMEs) in the industry. Moreover, the market is highly fragmented, with numerous local and regional players, leading to intense competition and price wars, which can erode profit margins. Another challenge is the skill gap in the workforce; applying modern refinish coatings often requires specialized training and expertise, which are not always readily available. This lack of skilled labor can result in subpar application quality, affecting the final finish and durability of the coatings. Together, these factors pose significant hurdles to the growth and profitability of the automotive refinish coatings market.

Global Automotive Refinish Coatings Market Opportunities:

The global automotive refinish coatings market presents numerous opportunities driven by emerging trends and technological advancements. One significant opportunity lies in the increasing adoption of electric and hybrid vehicles. As these eco-friendly vehicles gain popularity, they create a new demand for specialized coatings that can enhance their aesthetic appeal and protect their advanced materials. Additionally, the rise in vehicle ownership in emerging economies, coupled with the expanding automotive aftermarket, offers substantial growth potential for refinish coatings. The proliferation of smart technologies and digital color-matching systems also opens new avenues for market players. These technologies not only improve the precision and efficiency of coating applications but also enhance the overall customer experience by providing more accurate and customizable color options. Furthermore, the growing focus on sustainability and green technologies presents an opportunity for manufacturers to develop and market eco-friendly, low-VOC, and waterborne coatings, which are increasingly favored by environmentally conscious consumers and regulators. Strategic collaborations and partnerships with automotive manufacturers and repair shops can also help companies expand their market reach and improve their service offerings. By capitalizing on these opportunities, market participants can drive innovation, meet evolving consumer demands, and achieve sustainable growth in the automotive refinish coatings market.

AUTOMOTIVE REFINISH COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Resin Type, Technology, Product, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sherwin-Williams Company, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., 3M Company, The Valspar Corporation, KCC Corporation, Sikkens, DuPont, RPM International Inc., Matrix System Automotive Finishes, BESA (Bergers Group) |

Global Automotive Refinish Coatings Market Segmentation: By Resin Type

-

Acrylic

-

Alkyd

-

Epoxy

The Global Automotive Refinish Coatings Market by Resin Type, Acrylic market share last year and is poised to maintain its dominance throughout the forecast period. Acrylic resins are increasingly gaining traction in the global automotive refinish coatings market, driven by several key factors. Firstly, rising disposable incomes worldwide have heightened consumer demand for vehicle customization and a broader range of color options, benefits that acrylic coatings can effectively provide. Moreover, stringent environmental regulations in various regions favor acrylics due to their lower VOC emissions compared to traditional alternatives, aligning with global efforts toward sustainability. Despite these advantages, acrylics have yet to dominate the market completely. Polyurethane resins remain prevalent, primarily due to their superior durability and performance under harsh environmental conditions. Polyurethanes offer exceptional resistance to chemicals, weathering, and abrasion, making them preferred for applications demanding long-lasting protection. However, the increasing preference for acrylics underscores a shift towards greener and more versatile coating solutions in the automotive refinish sector. As technology advances and environmental regulations tighten further, acrylic resins are expected to continue expanding their market presence, appealing to both consumers and industry professionals seeking reliable performance with reduced environmental impact.

Global Automotive Refinish Coatings Market Segmentation: By Technology

-

Waterborne

-

Solvent-borne

-

UV-cured

The Global Automotive Refinish Coatings Market by Technology, Waterborne market share last year and is poised to maintain its dominance throughout the forecast period. Waterborne coatings are increasingly favored in the automotive refinish market due to their environmental benefits and technological advancements. Regulatory pressures to reduce VOC emissions have spurred the adoption of waterborne paints, which emit significantly lower levels of volatile organic compounds compared to solvent-based alternatives. This shift aligns with global efforts towards sustainability and environmental stewardship, making waterborne coatings a preferred choice among consumers and regulatory bodies alike. Technological improvements have also addressed previous challenges, such as longer drying times, and enhancing the overall performance and application flexibility of waterborne paints. Despite these advancements, solvent-borne coatings still maintain a dominant position in the market, primarily due to their faster drying times and established application techniques that ensure efficiency in repair settings. Many automotive repair professionals continue to rely on solvent-borne paints for their familiarity and perceived reliability, particularly in scenarios where rapid turnaround is crucial. However, with ongoing innovations and increasing awareness of environmental concerns, Waterborne Coatings is poised to continue its growth trajectory, expanding its market share and establishing itself as a leading choice in the automotive refinishing industry.

Global Automotive Refinish Coatings Market Segmentation: By Product

-

Primer

-

Basecoat

-

Clearcoat

-

Activators & Fillers

The Global Automotive Refinish Coatings Market by Product, Primer market share last year and is poised to maintain its dominance throughout the forecast period. Primers stand as a cornerstone in the automotive refinishing process, playing a pivotal role across various repair and customization tasks. Their multifaceted benefits include enhancing adhesion between surfaces and subsequent paint layers, shielding metal against corrosion, and establishing a smooth foundation for topcoats. Unlike basecoats that provide color or clearcoats that offer gloss, primers are universally indispensable in almost every refinishing job, irrespective of vehicle age or repair type. This universality ensures that primers maintain a steadfast position in the automotive refinish coatings market. While their market share may experience minor fluctuations, primers are unlikely to be supplanted by any other product segment. Their critical role in ensuring durability, improving paint adhesion, and preventing corrosion solidifies their dominance. As the automotive industry evolves with technological advancements and environmental considerations, primers continue to evolve with formulations that address modern challenges while reinforcing their essential role in achieving high-quality, long-lasting automotive finishes. Thus, primers are not just integral but foundational to the entire automotive refinishing process, ensuring both aesthetic appeal and long-term protection for vehicles worldwide.

Global Automotive Refinish Coatings Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Global Automotive Refinish Coatings Market by Region, Asia-Pacific market share last year and is poised to maintain its dominance throughout the forecast period. The Asia-Pacific region stands as a powerhouse in the global automotive refinish coatings market, driven by several compelling growth factors. Primarily, the region benefits from a rapidly expanding automotive industry, particularly in countries like China and India, where robust growth in car production and sales creates a substantial demand for refinish coatings essential for repair, maintenance, and customization. This surge is further bolstered by increasing vehicle ownership levels due to rising disposable incomes, which amplify the need for refinish products to maintain and enhance the appearance of vehicles. Moreover, a significant portion of the vehicle fleet in Asia-Pacific comprises older cars, prompting a steady demand for refinish coatings for repairs and rejuvenation efforts. Reports consistently highlight Asia-Pacific's current dominance in the global market, a position expected to persist throughout the forecast period. Market research from reputable sources underscores this trend, showcasing Asia-Pacific as the largest regional market for automotive refinish coatings. Industry insights and news articles reinforce this perspective, detailing the region's strategic importance and the dynamic growth opportunities it offers to manufacturers and stakeholders. While Asia-Pacific's dominance appears secure, ongoing developments in North America and Europe, with their established markets and strong industry players, remain influential factors that could shape the global market landscape in the years ahead.

COVID-19 Impact Analysis on the Global Automotive Refinish Coatings Market.

The COVID-19 pandemic had a profound impact on the global automotive refinish coatings market, primarily due to the disruptions in the automotive industry and supply chains. With lockdowns and restrictions imposed worldwide, there was a significant decline in vehicle sales and usage, leading to reduced demand for automotive repairs and refinishing services. Automotive manufacturing plants and repair shops faced temporary closures, workforce shortages, and supply chain interruptions, further exacerbating the market downturn. Additionally, the economic uncertainty and reduced consumer spending power during the pandemic resulted in postponed or canceled vehicle maintenance and customization projects. However, the market began to recover as restrictions eased and economic activities resumed. The increased emphasis on personal mobility to avoid public transport during the pandemic spurred a gradual rebound in vehicle sales and aftermarket services, including refinish coatings. Moreover, the pandemic accelerated the adoption of digital and contactless services in the automotive repair sector, prompting companies to innovate and enhance their service delivery. Despite the initial setbacks, the automotive refinish coatings market showed resilience, adapting to the new normal with enhanced safety protocols and a renewed focus on sustainability and technological advancements to meet evolving customer needs in the post-pandemic era.

Latest trends / Developments:

The global automotive refinish coatings market is witnessing several latest trends and developments that are shaping its future. One significant trend is the increasing adoption of eco-friendly and sustainable coatings, driven by stringent environmental regulations and growing consumer awareness. Waterborne coatings, low-VOC formulations, and UV-cured coatings are gaining popularity due to their reduced environmental impact and superior performance. Another notable development is the integration of advanced digital technologies in the automotive refinish sector. Digital color matching systems, augmented reality (AR) for virtual color visualization, and AI-driven predictive maintenance are enhancing precision, efficiency, and customer satisfaction. The rise of electric vehicles (EVs) and advanced automotive technologies is also influencing the market, with a demand for specialized coatings that can provide protection and aesthetic appeal to new vehicle materials and designs. Additionally, there is a growing focus on lightweight materials and coatings that contribute to fuel efficiency and reduced emissions. The expansion of the automotive aftermarket in emerging economies, coupled with increasing vehicle ownership, is further driving market growth. Companies are also exploring strategic partnerships and acquisitions to expand their product portfolios and global reach, ensuring they stay competitive in this evolving market landscape.

Key Players:

-

Sherwin-Williams Company

-

Kansai Paint Co., Ltd.

-

Nippon Paint Holdings Co., Ltd.

-

3M Company

-

The Valspar Corporation

-

KCC Corporation

-

Sikkens

-

DuPont

-

RPM International Inc.

-

Matrix System Automotive Finishes

-

BESA (Bergers Group)

Chapter 1. Automotive Refinish Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Refinish Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Refinish Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Refinish Coatings Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Refinish Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Refinish Coatings Market – By Resin Type

6.1 Introduction/Key Findings

6.2 Acrylic

6.3 Alkyd

6.4 Epoxy

6.5 Y-O-Y Growth trend Analysis By Resin Type

6.6 Absolute $ Opportunity Analysis By Resin Type, 2024-2030

Chapter 7. Automotive Refinish Coatings Market – By Technology

7.1 Introduction/Key Findings

7.2 Waterborne

7.3 Solvent-borne

7.4 UV-cured

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Automotive Refinish Coatings Market – By Product

8.1 Introduction/Key Findings

8.2 Primer

8.3 Basecoat

8.4 Clearcoat

8.5 Activators & Fillers

8.6 Y-O-Y Growth trend Analysis By Product

8.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 9. Automotive Refinish Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Resin Type

9.1.3 By Technology

9.1.4 By Product

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Resin Type

9.2.3 By Technology

9.2.4 By Product

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Resin Type

9.3.3 By Technology

9.3.4 By Product

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Resin Type

9.4.3 By Technology

9.4.4 By Product

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Resin Type

9.5.3 By Technology

9.5.4 By Product

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Automotive Refinish Coatings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Sherwin-Williams Company

10.2 Kansai Paint Co., Ltd.

10.3 Nippon Paint Holdings Co., Ltd.

10.4 3M Company

10.5 The Valspar Corporation

10.6 KCC Corporation

10.7 Sikkens

10.8 DuPont

10.9 RPM International Inc.

10.10 Matrix System Automotive Finishes

10.11 BESA (Bergers Group)

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

By 2023, the Global Automotive Refinish Coatings market is expected to be valued at US$ 10.5 billion.

Through 2030, the Global Automotive Refinish Coatings market is expected to grow at a CAGR of 5.2%.

By 2030, the Global Automotive Refinish Coatings Market is expected to grow to a value of US$ 14.97 billion.

North America is predicted to lead the Global Automotive Refinish Coatings market.

The Global Automotive Refinish Coatings Market has segments By Resin Type, Product Type, and Region.