Automotive Powder Coatings Market Size (2023 – 2030)

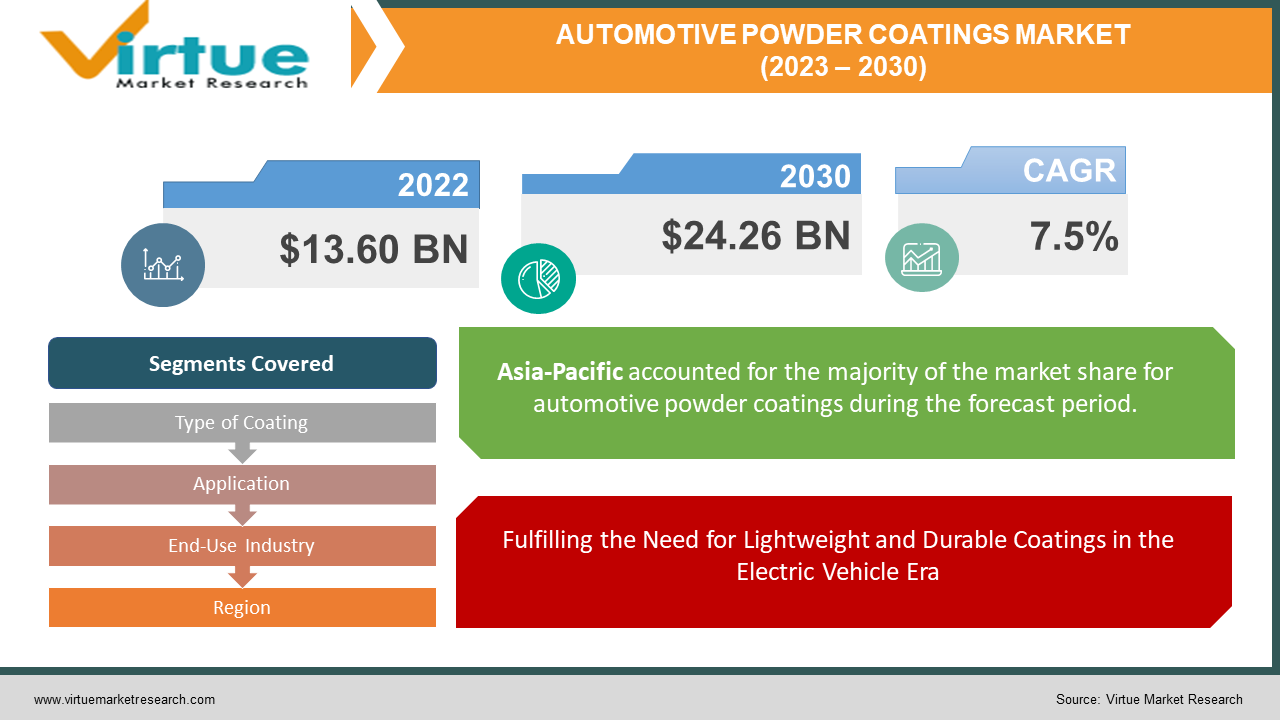

The Global Automotive Powder Coatings Market was valued at USD 13.60 Billion and is projected to reach a market size of USD 24.26 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 7.5%.

The Global Automotive Powder Coating Market is a key player in the broader coatings industry, with a significant impact on various sectors, including automotive, aerospace, and healthcare. Its historical trajectory reflects steady growth, underpinned by rising demand due to its unique properties and environmental benefits. Looking ahead, the future of the automotive powder coating market appears promising, marked by continued growth driven by technological advancements, expanding applications, and a growing emphasis on environmentally friendly materials across industries.

Key Market Insights:

Asia Pacific leads the charge as the largest market, commanding over 50% of the global market share in 2022. Within the automotive sector, the original equipment manufacturer (OEM) segment takes the lion's share, representing over 60% of the global market share in 2022. Impressively, epoxy polyester resin dominates as the preferred resin type, contributing to over 70% of the worldwide market share in 2022.

As the electric vehicle market surges forward, there is a growing demand for lightweight, durable coatings to protect these advanced automobiles from environmental challenges. Powder coatings, renowned for their lightweight properties and exceptional durability, are gaining prominence as the preferred choice within the automotive sector. The automotive industry is also witnessing a rising wave of environmental consciousness. This heightened awareness, shared by both manufacturers and consumers, is driving the adoption of powder coatings. These coatings produce fewer volatile organic compounds (VOCs) and generate minimal waste, aligning seamlessly with sustainability objectives and enhancing their attractiveness within the industry.

Additionally, governments worldwide are implementing increasingly stringent environmental regulations to combat industrial pollution. In response, the automotive sector is increasingly turning to eco-friendly alternatives like powder coatings, which offer a reduced environmental footprint. This trend positions powder coating as the preferred choice for automakers committed to meeting rigorous compliance standards and advancing sustainability efforts.

Automotive Powder Coatings Market Drivers:

Fulfilling the Need for Lightweight and Durable Coatings in the Electric Vehicle Era:

In the era of electric vehicles (EVs), the automotive industry faces a critical demand for coatings that combine lightweight properties with exceptional durability. EVs, known for their environmental benefits and cutting-edge technology, require coatings that protect against corrosion and environmental damage without adding unnecessary weight. Powder coatings are the ideal solution, as they strike a balance between being lightweight and offering outstanding durability. This unique combination positions powder coatings as a preferred choice for safeguarding EVs and various automotive components, aligning seamlessly with the industry's push for sustainability and innovation.

Embracing the Green Revolution: Rising Environmental Awareness Fuels Demand for Powder Coatings:

The automotive landscape is undergoing a profound transformation, driven by growing awareness of environmental issues. As consumers and regulators alike champion sustainability, automotive manufacturers are under increasing pressure to reduce their environmental footprint. Powder coatings emerge as a beacon of eco-friendliness in this context. These coatings produce fewer volatile organic compounds (VOCs) and generate less waste compared to their counterparts, making them an environmentally responsible choice. This alignment with the green revolution is propelling the demand for powder coatings in the automotive sector, as manufacturers seek to embrace cleaner and more sustainable practices.

Riding the Automotive Expansion Wave: Increased Vehicle Demand Drives Powder Coating Adoption:

The automotive industry is witnessing a surge in global vehicle demand, increasing the need for protective and visually appealing coatings. Powder coatings, known for their versatility and performance, are capitalizing on this trend, finding widespread adoption as the preferred coating technology for both consumer and commercial vehicles.

Advancements Paving the Path: Technological Progress Enhances Powder Coating Appeal:

The automotive powder coatings industry is not static but rather marked by continuous technological advancements. These developments are driving the creation of new and improved powder coatings with enhanced performance and durability characteristics. As technology evolves, powder coatings become more attractive to automotive manufacturers seeking coatings that withstand the rigors of the road while offering aesthetic versatility. These innovations position powder coatings at the forefront of coating technology, cementing their appeal as a choice that aligns with the automotive industry's quest for excellence in performance and sustainability.

Automotive Powder Coatings Market Restraints and Challenges:

Challenges Arising from Stringent Environmental Regulations and Compliance Complexity:

The automotive powder coatings industry faces an increasingly intricate landscape of stringent environmental regulations. Governments worldwide are intensifying their efforts to curtail industrial pollution. A prime example is the European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation, mandating manufacturers to register and assess the safety of every chemical they produce or import. Complying with these regulations is not only demanding but also financially burdensome.

The Pervasive Struggle: Competing Against Diverse Coating Technologies:

Automotive powder coatings, despite their numerous advantages, face formidable competition from alternative coating technologies. Liquid coatings and electroplating, for instance, offer certain advantages over powder coatings, including cost-effectiveness and a broader spectrum of colors and finishes. Liquid coatings exhibit greater versatility, applicable to a wide array of substrates beyond what powder coatings can achieve.

Navigating the Thinning Talent Pool: Skilled Labor Shortages Amidst Equipment Advancements:

The automotive powder coatings sector heavily relies on skilled labor to operate intricate equipment and ensure product quality. However, a challenging predicament has emerged as there's a noticeable shortage of skilled workers in the industry. Several factors contribute to this shortage, including an aging workforce and the increasing complexity of powder coating equipment. As the industry continues to evolve and demands grow, securing an adequately skilled workforce becomes a pivotal challenge.

Automotive Powder Coatings Market Opportunities:

Sustainable Mobility Revolution and the Role of Powder Coatings in Electric Vehicle Proliferation:

As the world embraces sustainable mobility solutions, electric vehicles (EVs) are at the forefront of this revolution. EVs require lightweight and durable coatings to protect sensitive components from environmental factors and ensure longevity. Powder coatings, renowned for their lightweight properties and excellent durability, have become the preferred choice for safeguarding EVs against corrosion and wear. This growing demand for eco-friendly and efficient coatings is driving the prominence of powder coatings in the automotive industry, aligning with the global shift toward sustainable transportation.

Eco-Conscious Consumer Preferences: A Catalyst for Powder Coating Adoption in Automotive Manufacturing:

Today's consumers are increasingly eco-conscious, making sustainable choices a significant influence on their purchasing decisions. This trend extends to the automotive sector, where car buyers are seeking environmentally friendly vehicles and products. Powder coatings, with their reduced volatile organic compound (VOC) emissions and minimal waste production, resonate with both automotive manufacturers and consumers. This heightened environmental awareness propels the adoption of powder coatings in the automotive industry as a more sustainable coating option.

Navigating Regulatory Terrain: Stringent Environmental Standards Propel Powder Coating Utilization:

Governments worldwide are enacting rigorous environmental regulations to combat industrial pollution and mitigate the impact of manufacturing activities on the planet. These regulations are shaping the automotive industry's coating preferences, favoring eco-friendly options like powder coatings. With their minimal environmental footprint, powder coatings align seamlessly with evolving compliance standards, positioning themselves as a preferred choice for automotive manufacturers committed to sustainability.

Technological Evolution and the Quest for High-Performance Coatings in Automotive Applications:

The automotive powder coatings sector is characterized by continuous technological advancements aimed at enhancing coating performance and durability. These innovations are pivotal in developing new and improved powder coatings tailored to meet the rigorous demands of the automotive industry. This confluence of technology and coating excellence cements the appeal of powder coatings in the automotive manufacturing landscape.

AUTOMOTIVE POWDER COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Type of Coating, Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Akzo Nobel N.V, The Sherwin-Williams Company, PPG Industries, Inc., BASF SE, DSM, Valspar, Arkema S.A., Jotun A/S, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., RPM International Inc., Tiger Coatings, TCI Powder Coatings, Teknos Group |

Automotive Powder Coatings Market Segmentation: By Type of Coating

- Epoxy Polyester

- Polyester

- Acrylic

- Polyurethane

- Others

Epoxy Polyester coatings lead the automotive powder coatings market with a commanding 70% market share in 2023, owing to their well-established reputation for durability, corrosion resistance, and cost-effectiveness. Polyester coatings follow closely, capturing 15% of the market share, with their growth driven by efficiency and affordability. Polyurethane coatings account for 10% of the market, prized for their exceptional flexibility and impact resistance. Acrylic coatings, constituting 5% of the market, find their niche in applications where aesthetic appeal is paramount. Other coatings, including hybrids and fluoropolymers, collectively make up 1% of the market, addressing specialized automotive requirements. This segmentation reflects the automotive industry's quest for high-quality coatings that balance performance and cost-effectiveness.

Automotive Powder Coatings Market Segmentation: By Application

- Body Panels

- Wheels

- Bumpers

- Under-the-Hood Components

- Others

In the automotive powder coatings market, various applications dictate the demand landscape. Body Panels dominate with a substantial 40% market share in 2023, as powder coatings provide robust protection against corrosion and environmental damage, ensuring the longevity of these crucial components. Wheels command a notable 20% market share, driven by the need for durable and visually appealing finishes that can withstand the rigors of driving. Bumpers and Under-the-Hood Components each account for 15% of the market share, emphasizing the significance of powder coatings in safeguarding these automotive elements. Lastly, others make up 10% of the market share, representing a range of additional applications within the automotive sector where powder coatings play a vital role.

Automotive Powder Coatings Market Segmentation: By End-Use Industry

- OEM (Original Equipment Manufacturers)

- Aftermarket

In the automotive powder coatings market, end-use industries define the distribution of demand. OEMs (Original Equipment Manufacturers) hold the lion's share, commanding 60% of the market in 2023. These manufacturers rely on powder coatings for various automotive components, emphasizing their trust in the technology. In contrast, the Aftermarket sector contributes 40% of the market share, highlighting the significance of powder coatings beyond initial manufacturing, as companies that sell and install automotive parts recognize the value of these coatings for maintenance and repairs.

Automotive Powder Coatings Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023, the Asia-Pacific region will emerge as the dominant force in the automotive powder coatings market, claiming a substantial 50% market share. This dominance is propelled by the region's thriving automotive industry, notably in countries like China and India, where robust vehicle production drives the demand for powder coatings. Furthermore, the Asia-Pacific's growing commitment to sustainability aligns perfectly with the eco-friendly attributes of these coatings.

North America secures a noteworthy 30% market share, largely due to its concentration of major automotive manufacturers that heavily rely on powder coatings for their exceptional durability and corrosion resistance. Meanwhile, Europe, with a 15% market share, reflects the continued significance of the automotive sector in the region. Latin America, with a 5% market share, signifies the automotive industry's expansion in the region, while the Middle East and Africa, capturing 1%, also experience growth in this market, albeit at a slower pace.

COVID-19 Impact Analysis on the Global Automotive Powder Coatings Market:

The COVID-19 pandemic initially hurt the Automotive Powder Coatings Market, causing a decline in demand due to setbacks in the global automotive industry, including reduced production and sales, and disruptions in supply chains. However, the pandemic also brought about positive effects, fostering increased awareness of sustainability, which boosted the demand for sustainable powder coatings made from renewable resources. Additionally, the accelerated shift towards electric vehicles (EVs) drove demand for powder coatings to protect EV components from corrosion and environmental damage. Statistically, the market experienced a decline in demand due to the pandemic's adverse effects, but it also saw a surge in demand for sustainable and EV-related coatings, signaling a changing landscape in response to the crisis. Despite the initial challenges, the market is expected to rebound in 2023, aligned with the recovery of the global automotive sector.

Latest Trends/Developments:

The automotive powder coatings market is experiencing significant trends and developments, driven by several key factors. Firstly, there's a growing demand for sustainable powder coatings, fueled by automotive manufacturers' increasing emphasis on environmental responsibility. New powder coatings made from renewable resources are gaining traction, with lower VOC emissions. These sustainable coatings are becoming more popular due to their ability to align automotive production with eco-conscious practices.

Moreover, the rise of electric vehicles (EVs) is contributing to the increased utilization of powder coatings. As EVs become more prevalent, powder coatings are playing a crucial role in protecting vital components like batteries from corrosion and environmental damage. Their durability and protective characteristics make them a preferred choice in EV manufacturing, contributing to the longevity and reliability of electric vehicles.

In addition to these trends, the automotive powder coatings industry is witnessing continuous innovation in coating technologies. Some coatings are engineered to be self-healing, automatically mending minor damages. Leading companies such as AkzoNobel, PPG Industries, and BASF are at the forefront of these advancements. AkzoNobel's Interpon RE range, made from renewable resources, is aligned with automotive manufacturers' efforts to reduce their environmental footprint, with the global market share for automotive powder coatings dominated by the Asia Pacific region, accounting for over 50% in 2022.

Key Players:

- Akzo Nobel N.V

- The Sherwin-Williams Company

- PPG Industries, Inc.

- BASF SE

- DSM

- Valspar

- Arkema S.A.

- Jotun A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- RPM International Inc.

- Tiger Coatings

- TCI Powder Coatings

- Teknos Group

In August 2023, AkzoNobel announced the launch of its new Interpon 700 powder coating range. This range is designed for automotive applications and offers several advantages, including improved durability, corrosion resistance, and UV protection. The Interpon 700 powder coating range is available in a wide range of colors and finishes to meet the specific needs of automotive manufacturers. In May 2023, DSM announced that it is developing a new range of sustainable powder coatings. These coatings are made from renewable resources and have a lower environmental impact than traditional powder coatings.

Chapter 1. Automotive Powder Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Powder Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Powder Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Powder Coatings Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Powder Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Powder Coatings Market – By Type of Coating

6.1 Introduction/Key Findings

6.2 Epoxy Polyester

6.3 Polyester

6.4 Acrylic

6.5 Polyurethane

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type of Coating

6.8 Absolute $ Opportunity Analysis By Type of Coating, 2023-2030

Chapter 7. Automotive Powder Coatings Market – By Application

7.1 Introduction/Key Findings

7.2 Body Panels

7.3 Wheels

7.4 Bumpers

7.5 Under-the-Hood Components

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. Automotive Powder Coatings Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 OEM (Original Equipment Manufacturers)

8.3 Aftermarket

8.4 Y-O-Y Growth trend Analysis By End-Use Industry

8.5 Absolute $ Opportunity Analysis By End-Use Industry, 2023-2030

Chapter 9. Automotive Powder Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type of Coating

9.1.3 By Application

9.1.4 By End-Use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type of Coating

9.2.3 By Application

9.2.4 By End-Use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type of Coating

9.3.3 By Application

9.3.4 By End-Use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 ByMicroorganisms Type

9.4.3 By Application

9.4.4 By End-Use Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 ByMicroorganisms Type

9.5.3 By Application

9.5.4 By End-Use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Automotive Powder Coatings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Akzo Nobel N.V

10.2 The Sherwin-Williams Company

10.3 PPG Industries, Inc.

10.4 BASF SE

10.5 DSM

10.6 Valspar

10.7 Arkema S.A.

10.8 Jotun A/S

10.9 Kansai Paint Co., Ltd.

10.10 Nippon Paint Holdings Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automotive Powder Coatings Market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 24.27 billion by 2030.

Axalta Coating Systems, LLC, the Sherwin-Williams Company, Jotun, Akzo Nobel NV, and PPG Industries Inc. are the major companies operating in the Powder coating market.

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2023-2030).

In 2023, the Asia Pacific accounts for the largest market share in the Powder Coatings Market.

Key factors that are driving the powder coating market growth include supportive environmental regulations, and rising product applications in automotive, consumer goods, and general industrial sectors.