AUTOMOTIVE PHOTONICS MARKET (2023 -2030)

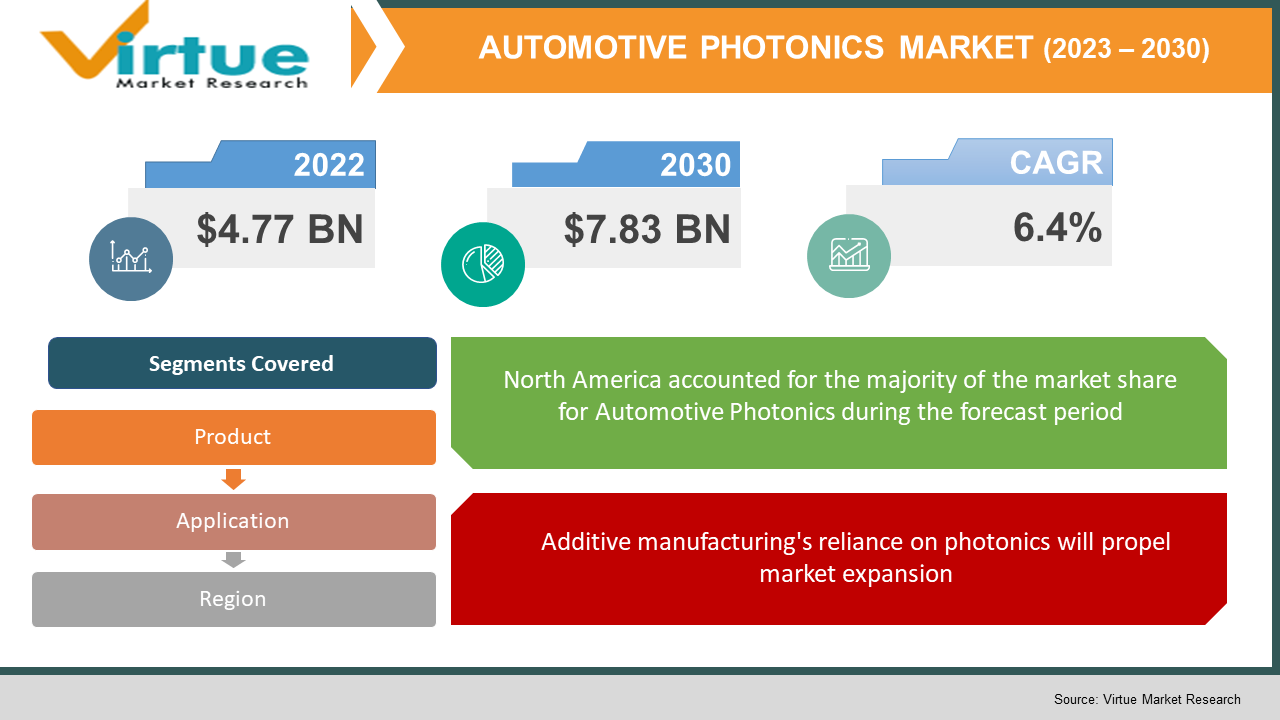

In 2022, the Global Automotive Photonics Market was valued at $4.77 Billion and is projected to reach a market size of $7.83 Billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6.4%.

INDUSTRY OVERVIEW

Photonics is a branch of science and technology that relates to the production, detection, transmission, switching, amplifying, passing of signals, and modulation of light. The word photonics is derived from the Greek word "phos," which means light, and the root word "photo," and it first appeared in the 1960s. who wanted to use light to do a variety of tasks based on light. Electronics have always been used in the sectors of communication and information technology. The 1970s were a pivotal decade for the invention of diodes. Optical fibers are utilized for information transfer in telecommunications operations and are afterwards supported for the construction of Internet processors. The term "photonics" was frequently used in the networking industry in the 1980s to describe the transport of information through optical data fiber lines. The information, communication, and technology (ICT) sectors were the exclusive focus of the photonics industry in 2001, with several inventions and technical applications.

In recent years, photonics has experienced a revolution in the automobile sector, moving beyond its original focus on lighting to offer cutting-edge technology for imaging, sensing, smart displays, and media communication networks. As a result, photonics has expanded significantly beyond vehicle illumination to include quality assurance and industrial processes. That the automobile sector is becoming more interested in cutting-edge, photonics-based technology is not estimated. The lighting market is growing at a rate of roughly 5% per year due to a variety of growth prospects. The market for automotive photonics is anticipated to experience even larger growth. The worldwide photonics market is expanding because of the growing and increased utilization of the disposable market. Solid State Lightning is based on technology such as Light Emitting Diodes (LEDs), Organic Light Emitting Diodes (OLEDs), and many more. Solid State Lightning is often utilized for the utilization of light in various applications and the use of photonics. Solid state lighting decreases energy consumption while enhancing symbolic development and quality.

The major application of photonics is the creation of light, including its emission, transmission, amplification, detection, and modification. The market has grown thanks to the invention of technologies based on light sources, which are guided by photonics. The main components of photonics are optical fibers, lasers, and lights used in homes, hotels, computer displays, automobiles, televisions, and theatres. It is a branch of science and technology that produces, controls, modifies, and creates. The hunt for light by scientists’ dates back many years. In the medical field, for instance, photonics may be used to investigate and evaluate diseases, detect issues, and even find a solution to a crime. This has boosted the usage of photonics and improved the market economy.

COVID-19 IMPACT ON THE AUTOMOTIVE PHOTONICS MARKET

The forecast for the 3D printing business is still positive, despite the pandemic's negative effects on the majority of sectors. The use of this technology in laser, optical scanning system, and image solution applications is becoming more and more intriguing. Due to supply chain issues, the rollout of 5G in many countries may be delayed, and the cost of fiber optic cable may go up as a result of adverse effects on countries like China that produce fiber optic cable.

MARKET DRIVERS:

Additive manufacturing's reliance on photonics will propel market expansion

Beam creation and beam steering are not the only applications of photonics. Laser beam diagnostics and accurate performance metrics based on photonics are aids to the growing industrial maturity of the technology. According to some background, even little adjustments to the beam and scanning parameters might cause serious quality losses to occur during the constructing process. The market is continuously seeing new additive processes emerge, which has sped up production and expanded the range of available materials. Additionally, more industries employ technology.

On the other hand, AM methods are utilized by the mechanical engineering, automotive, aerospace, energy, and chemical plant industries. They employ extra procedures to indirectly produce axle housing and wheel hub molds in addition to prototypes and tools. Additionally, it employs process design flexibility and manufactures increasingly complicated car components in tiny numbers. A well-thought-out design can enable the sandwiching together of several separate components into a single section. As a result, there is less effort involved in certification, quality control, and storage. Additionally, the sandwich structure technique uses a laser to expose the metal powder exactly where the component's intended structure calls for it, greatly decreasing the component's weight and enabling the integration of additional features. This can include everything from lubricant supply optimization tools to cooling ducts. It is more intriguing to not retain spare parts and instead print as required based on recorded design data the more specialized the equipment or vehicle. With the advent of Industry 4.0, sensor-monitored mechanical components may be pre-printed toward the end of their useful lives and proactively put together before expensive flaws or equipment failures occur during maintenance.

MARKET RESTRAINTS:

Few raw materials face strict environmental regulations, limiting market expansion

The efficiency of photonics products is being hampered by strict environmental regulations. Even though the majority of goods are environmentally friendly, some performance-enhancing substances are thought to be hazardous to the environment. By REACH and the RoHS, toxic compounds like boron oxide and arsenic oxide are restricted. Arsenic oxide is a component of UV detectors, sensors, and other goods. Chemical registration, evaluation, authorization, and limitation are governed by the REACH regulation of the European Union. It controls the production and use of chemical substances, such as boron oxide and arsenic oxide, because of the possible consequences on human health and the environment. In the creation of electrical and electronic products, RoHS restricts or outright prohibits the use of cadmium, lead, mercury, flame retardants, polybrominated biphenyls (PBB), and polybrominated diphenyl ethers (PBDE), and chromium VI. Products and services that use photonics are expensive. Devices with photonics capabilities perform better and use less energy than comparable products.

AUTOMOTIVE PHOTONICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.4% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

TRUMPF , HAMAMATSU PHOTONICS K.K. , IPG PHOTONICS CORPORATION , MOLEX , INNOLUME , II-VI INCORPORATED , NEOPHOTONICS CORPORATION , ONE SILICON CHIP PHOTONICS INC. , NKT PHOTONICS A/S , AIO CORE , SICOYA GMBH , RANOVUS |

This research report on the Automotive Photonics Market has been segmented and sub-segmented based on Product, Application and By Region.

AUTOMOTIVE PHOTONICS MARKET – BY PRODUCT

- Waveguides

- Optical Modulators

- Optical Interconnects

- LEDs

- Wavelength Division Multiplexer (WDM) Filters

- Photo Detectors

- Lasers

- Amplifiers

Based on application, the automotive photonics market is segmented into Waveguides, Optical Modulators, Optical Interconnects, LEDs, Wavelength Division Multiplexer (WDM) Filters, Photo Detectors, Lasers and Amplifiers. Due to its benefits including mass productivity, high port counts, and low loss, WDM filters are estimated to become a dominating product category throughout the projection period. The development of modern photonic networks, such as optical cross-connect and optical add/drop multiplexing systems, is thought to be considerably aided by WDM filters. Throughout the forecast period, it is anticipated that demand for photodetectors would increase significantly. As they provide increased involvement with the machine environment interface, photodetectors are being employed more often in a variety of devices. These items serve as a low-volume, low-mass replacement for bulky conventional detectors and sensors used in the production facility. Over the forecast period, high brightness LEDs, which are transforming the lighting sector, are anticipated to dominate the market for LEDs. Since they have a wide range of applications, high-brightness LEDs have become more and more in demand. The incorporation of LEDs into automobiles to improve their lighting, displays, and energy economy is a new trend in the market. For the continued growth of a low carbon economy, these items are essential which is eventually driving the market growth.

AUTOMOTIVE PHOTONICS MARKET - BY APPLICATION

- Displays

- Information

- Measure and Machine Vision

- Lighting

- Communication

- Defense and Security

- Optical component

Based on application, the automotive photonics market is segmented into displays, information, measure and machine vision, lighting, communication, defense and security, and optical component. The market's largest segment is displayed, and it is anticipated that they will continue to rule the market during the projected period. The main industrial photonic applications are laser-based semiconductor manufacture, metrology, and microelectronic production. Common applications include photolithography, laser-based machinery for flexible and high-density interconnects (HDIs), printed circuit boards (PCBs), through drilling, IC packaging, and the manufacturing and processing of displays used in the automobile industry.

In aerospace and military applications, such as ring laser gyroscopes for aerial and maritime navigation and guiding systems for missile and UAV (drone) guidance, lasers are utilized in mission-critical inertial navigation systems. When it comes to sensing and imaging in challenging environments, photonics is especially crucial for military equipment that is airborne, spaceborne, or on the ground. However, when using bulk optical components, high energy and expense are significant disadvantages.

AUTOMOTIVE PHOTONICS MARKET - BY REGION

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East

- Africa

By region, the Automotive Photonics Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. Given the area's growing adoption of cutting-edge next-generation technology, North America is projected to become a prominent market throughout the projected period. The development in the United States can be ascribed to rising government investment in research and development (R&D) and applications of laser optics and photonic-enabled technologies. Over the projected period, it is anticipated that the U.S. government would make large expenditures to work on the development of cutting-edge lasers for military vehicle purposes. The primary force behind the growth of the photonics market is anticipated to be the demand for high-speed transmission in data communication applications in an autonomous vehicle. The application of data communication is thought to be driven by the decrease in power loss, demand for high bandwidth, and availability at its low prices in various regions, including in nations like the United States and Canada.

Over the projection period, Europe is anticipated to increase significantly. To foster a vibrant and competitive photonics sector in the area, member states from throughout the region have made a long-term commitment to public-private partnerships (PPP). To work on the creation of novel photonics-based component manufacturing processes, the area is progressively setting up pilot production facilities for research institutions and businesses.

As a result of the region's first mover advantage and growing investment in R&D and innovations, the market in the Asia Pacific is predicted to rise quickly. When it comes to significant developments and breakthroughs in the field of photonics, China in particular has been at the forefront. The majority of the top businesses are Chinese, with locally based manufacturing facilities and a solid supply chain that sells photonics parts all over the world. Since its market is well established, China is anticipated to hold a sizeable portion of the photonics market over the projection period. It is anticipated that increasing the use of this product in the creation of new integrated electronics that are quicker and more effective would drive market expansion.

AUTOMOTIVE PHOTONICS MARKET - BY COMPANIES

Some of the major players operating in the Automotive Photonics Market include:

- TRUMPF

- HAMAMATSU PHOTONICS K.K.

- IPG PHOTONICS CORPORATION

- MOLEX

- INNOLUME

- II-VI INCORPORATED

- NEOPHOTONICS CORPORATION

- ONE SILICON CHIP PHOTONICS INC.

- NKT PHOTONICS A/S

- AIO CORE

- SICOYA GMBH

- RANOVUS

NOTABLE HAPPENING IN THE AUTOMOTIVE PHOTONICS MARKET

- PRODUCT LAUNCH- January 2021 - The development of light-carrying chips helps machine learning. In conjunction with a global team, researchers from the University of Münster are creating cutting-edge approaches and process designs to address these difficulties effectively. They have now shown that so-called photonic computers, which process data by utilizing light, are capable of processing information even quicker and in parallel than electrical chips.

- ACQUISITION- In April 2019, TRUMPF finished acquiring the photonics branch of Philips, which it had disclosed in December 2018. Smartphones, digital data transfer applications, and sensors for driverless vehicles all use laser diodes from Philips Photonics. Since the acquisition, TRUMPF Photonics Components has been created. As a consequence of the purchase, TRUMPF will have access to a new market sector that will enhance its present high-power diode laser business.

- PRODUCT LAUNCH- In May 2022, OSRAM AG announced the introduction of the OSLON Optimal family of LEDs for horticulture lighting. The OSLON Optimal family is based on the most recent ams OSRAM 1mm2 chip and delivers an exceptional balance of high efficiency, dependable performance, and excellent value.

Chapter 1. AUTOMOTIVE PHOTONICS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. AUTOMOTIVE PHOTONICS MARKET – Executive Summary

2.1. Market Size & Forecast – (2022 – 2026) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2022 - 2026

2.3.2. Impact on Supply – Demand

Chapter 3. AIOPS FOR TELECOM OPERATIONS MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. AUTOMOTIVE PHOTONICS MARKET Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. AUTOMOTIVE PHOTONICS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. AUTOMOTIVE PHOTONICS MARKET – By Product

6.1. Waveguides

6.2. Optical Modulators

6.3. Optical Interconnects

6.4. LEDS

6.5. WAVELENGTH DIVISON MULTIPLEXER FILTERS

6.6. PHOTO DETECTORS

6.7. LASERS

6.8. Amplifiers

Chapter 7. AUTOMOTIVE PHOTONICS MARKET – By Application

7.1. Displays

7.2. Information

7.3. Measure and Machine Vision

7.4. Lighting

7.5. Communication

7.6. Defense and Security

7.7. Optical Component

Chapter 8. AUTOMOTIVE PHOTONICS MARKET – By Region

8.1. North America

8.2. Europe

8.3. Asia-P2acific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. AUTOMOTIVE PHOTONICS MARKET – By Companies

9.1. TRUMPF

9.2. HAMAMATSU PHOTONICS K.K.

9.3. IPG PHOTONICS CORPORATION

9.4. MOLEX

9.5. INNOLUME

9.6.II-VI INCORPORATED

9.7. NEOPHOTONICS CORPORATION

9.8. ONE SILICON CHIO PHOTONICS INC.

9.9. NKT PHOTONICS A/S

9.10. AIO CORE

9.11. SICOYA GMBH

9.12. RANOVUS

Download Sample

Choose License Type

2500

4250

5250

6900