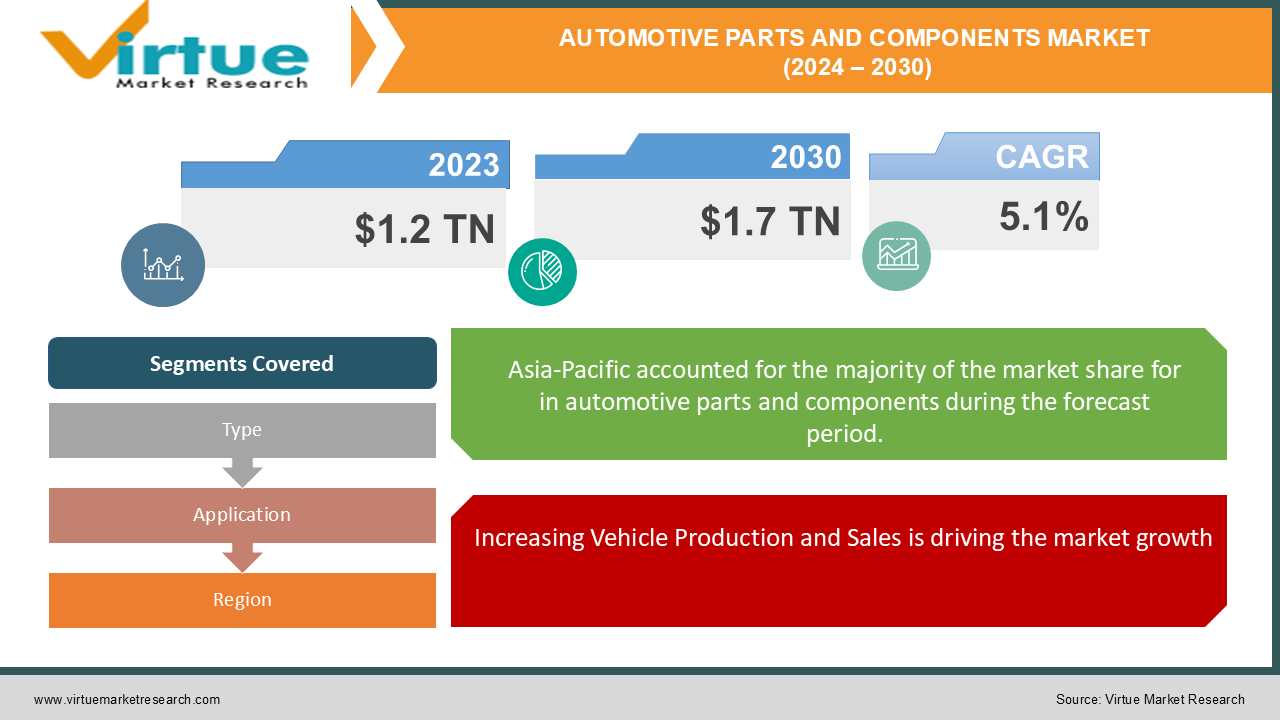

Automotive Parts and Components Market Size (2024–2030)

The Global Automotive Parts and Components Market was valued at USD 1.2 trillion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. The market is expected to reach USD 1.7 trillion by 2030.

Automotive parts and components encompass a wide range of products, including engine, transmission, electrical systems, and body components, which are integral to the performance and functionality of vehicles. The increasing demand for passenger and commercial vehicles, the rise of electric vehicles (EVs), and advancements in technology are key drivers of this market’s growth. The shift toward lightweight materials and more efficient components, aimed at improving fuel economy and reducing emissions, is also playing a significant role.

Key Market Insights:

Passenger vehicles held the largest market share in 2023, accounting for over 60% of total revenue, due to increased urbanization, rising disposable incomes, and a growing preference for personal mobility, especially in developing regions like Asia-Pacific.

The electric vehicle (EV) segment within the automotive components market is expected to grow at a rapid pace, with a CAGR of 18% from 2024 to 2030, driven by stringent environmental regulations and rising consumer demand for eco-friendly vehicles.

Engine components remain the largest product segment, accounting for 35% of the market in 2023, though demand is gradually shifting towards electric powertrain components as electric vehicles gain traction.

Asia-Pacific is the largest regional market, holding over 40% of the global market share in 2023. China, India, Japan, and South Korea are major hubs for both vehicle manufacturing and parts production, driving regional dominance.

Aftermarket automotive parts are gaining prominence, representing a significant portion of the overall market. Increased vehicle longevity and consumer preference for cost-effective replacement parts contribute to this growth.

Technological innovations such as autonomous driving systems, advanced driver assistance systems (ADAS), and connected car technologies are creating new opportunities in the automotive parts sector. Components related to sensors, software, and electronics are witnessing robust demand.

Global Automotive Parts and Components Market Drivers:

Increasing Vehicle Production and Sales is driving the market growth The global automotive industry has witnessed steady growth in vehicle production and sales, particularly in emerging markets such as China, India, and Southeast Asia. The rise in urbanization, increasing disposable incomes, and the growing preference for personal mobility are key factors driving this growth. In 2023, global vehicle sales reached approximately 85 million units, with passenger vehicles accounting for the majority of sales. The expanding middle-class population in developing regions has fueled the demand for affordable passenger vehicles, leading to a surge in automotive production. This, in turn, drives the demand for a wide range of automotive parts and components, from engines and transmissions to electrical systems and infotainment modules. Manufacturers in these regions are investing in advanced production facilities to cater to the growing demand for both original equipment manufacturer (OEM) and aftermarket parts.

Technological Advancements and Innovation is driving the market growth The automotive industry is undergoing a significant transformation driven by advancements in technology, particularly in areas such as electrification, connectivity, and autonomous driving. These innovations are reshaping the landscape of automotive parts and components, with a growing emphasis on electronics, software, and sensor technologies. The integration of advanced driver assistance systems (ADAS), such as adaptive cruise control, lane-keeping assistance, and automatic emergency braking, is becoming standard in many vehicles. These systems require a range of sensors, cameras, radar, and software components, driving demand for electronic and electrical parts. Moreover, the development of autonomous driving technologies is creating opportunities for new types of components, including high-performance computing platforms, artificial intelligence (AI) systems, and LIDAR sensors.

Growth of the Aftermarket Segment is driving the market growth The aftermarket for automotive parts and components represents a significant and growing segment of the global market. As vehicles become more durable and remain in service longer, the demand for replacement parts, maintenance, and repair services has increased. Consumers are opting to repair and upgrade their vehicles rather than purchasing new ones, especially in regions where vehicle ownership costs are high. In 2023, the global automotive aftermarket was valued at approximately USD 450 billion, with strong growth expected over the forecast period. Key drivers of this growth include increasing vehicle longevity, rising vehicle ownership rates, and the expanding availability of online platforms for purchasing aftermarket parts. The proliferation of e-commerce platforms has made it easier for consumers and mechanics to access a wide range of parts at competitive prices, boosting the aftermarket’s share of the overall market.

Global Automotive Parts and Components Market Challenges and Restraints:

Supply Chain Disruptions and Raw Material Costs are restricting the market growth The global automotive parts and components market is highly dependent on complex supply chains that span multiple regions and involve various suppliers of raw materials, components, and subassemblies. Disruptions in these supply chains, whether due to geopolitical tensions, natural disasters, or pandemics, can have a significant impact on the availability of parts and components, leading to production delays and increased costs for manufacturers. For instance, the COVID-19 pandemic caused widespread disruptions in global supply chains, affecting the availability of critical components such as semiconductors, wiring harnesses, and raw materials like steel and aluminum. These shortages led to production slowdowns and even temporary plant closures for many automakers, highlighting the vulnerability of the automotive supply chain to external shocks. In addition, geopolitical tensions, such as trade disputes and tariffs between major economies like the U.S. and China, have further exacerbated supply chain challenges for automotive manufacturers.

Increasing Regulatory and Environmental Compliance is restricting the market growth The automotive industry is subject to stringent regulatory requirements related to vehicle safety, emissions, and environmental sustainability. These regulations vary by region but often require manufacturers to invest heavily in research and development (R&D) to ensure compliance. For automotive parts and components manufacturers, keeping up with evolving regulations presents both a challenge and a cost burden. One of the most significant regulatory challenges facing the automotive industry is the push for lower emissions and improved fuel efficiency. Governments worldwide are implementing stricter emissions standards to combat climate change and reduce air pollution. In the European Union, for example, the Euro 7 emissions standards are expected to impose even more stringent limits on vehicle emissions by the end of the decade. Similarly, the U.S. has implemented Corporate Average Fuel Economy (CAFE) standards that require automakers to improve the fuel efficiency of their vehicles.

Market Opportunities:

The global automotive parts and components market presents numerous opportunities for growth, particularly in the areas of electric vehicles (EVs), autonomous driving technologies, and emerging markets. As the automotive industry shifts toward electrification, there is an increasing demand for specialized components that support electric powertrains, batteries, and charging infrastructure. The global push for greener and more sustainable transportation solutions is expected to accelerate the adoption of EVs, driving demand for components such as electric motors, power electronics, and battery management systems. Additionally, the development of autonomous driving technologies presents new opportunities for parts manufacturers. Autonomous vehicles (AVs) require a wide range of sensors, software, and computing systems to operate safely and efficiently. The integration of advanced driver assistance systems (ADAS), such as radar, cameras, LIDAR, and AI-based decision-making systems, is creating demand for high-tech components that enhance vehicle safety and automation. As the adoption of autonomous vehicles increases, manufacturers of these advanced components are poised to benefit from significant growth. Furthermore, emerging markets in Asia-Pacific, Latin America, and Africa offer substantial growth potential for automotive parts manufacturers. As these regions experience economic development and rising disposable incomes, the demand for both passenger and commercial vehicles is expected to grow. The automotive industries in countries like India, Brazil, and South Africa are expanding rapidly, creating opportunities for local and international parts manufacturers to establish a presence in these high-growth markets. Governments in these regions are also investing in infrastructure development and incentivizing the production of electric and fuel-efficient vehicles, further supporting the growth of the automotive parts sector.

AUTOMOTIVE PARTS AND COMPONENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Robert Bosch GmbH, Denso Corporation, Continental AG, Magna International Inc., ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., Valeo SA, BorgWarner Inc., Aptiv PLC, Faurecia SE |

Automotive Parts and Components Market Segmentation: By Type

-

Engine Components

-

Transmission Components

-

Electrical Components

-

Suspension and Steering Components

-

Brake Components

-

Body Components

-

Others

The Engine Components segment dominates the global automotive parts and components market, accounting for 35% of total revenue in 2023. Engine components include parts such as pistons, crankshafts, camshafts, and valves, which are essential to the operation of internal combustion engines (ICEs). Despite the increasing shift toward electric vehicles, ICE-powered vehicles remain the majority of the global vehicle fleet, ensuring sustained demand for engine components. However, as the market gradually transitions to electric powertrains, the demand for traditional engine components is expected to decline over time.

Automotive Parts and Components Market Segmentation: By Application

-

Passenger Vehicles

-

Commercial Vehicles

The Passenger Vehicles segment holds the largest share of the automotive parts and components market, representing over 60% of the total market in 2023. This dominance is driven by the rising demand for personal mobility, particularly in urbanized regions of Asia-Pacific, Europe, and North America. The increased production of electric passenger vehicles and the integration of advanced driver assistance systems (ADAS) in new models are further contributing to the segment's growth.

Automotive Parts and Components Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region dominates the global automotive parts and components market, holding over 40% of the total market share in 2023. This dominance is attributed to the presence of major automotive manufacturing hubs in China, Japan, India, and South Korea, which are key producers of both vehicles and automotive components. The region's strong industrial base, coupled with increasing vehicle demand in emerging economies, positions Asia-Pacific as the leading market for automotive parts. Additionally, government initiatives to promote electric vehicles and reduce emissions in the region are driving the adoption of advanced components and technologies, further boosting market growth.

COVID-19 Impact Analysis:

The COVID-19 pandemic significantly impacted the global automotive parts and components market, causing widespread disruptions in production, supply chains, and consumer demand. During the initial stages of the pandemic, automotive manufacturing plants were temporarily closed due to lockdowns and restrictions on movement, leading to production halts and delays in the supply of critical components. In particular, the shortage of semiconductors had a severe impact on the automotive industry, as these chips are essential for various vehicle systems, including infotainment, safety, and engine control units. However, the pandemic also accelerated the adoption of digital transformation in the automotive industry. As vehicle manufacturers sought to recover from supply chain disruptions, they increasingly adopted digital tools for production management, inventory control, and supplier collaboration. Additionally, the shift toward e-commerce and online retail platforms created new opportunities for the sale of aftermarket parts, as consumers turned to online channels for purchasing replacement components and accessories. As the global economy gradually recovers from the pandemic, the automotive parts and components market is expected to rebound, with a renewed focus on resilient supply chains and local production capabilities. Governments and manufacturers are investing in efforts to diversify their supply chains, increase domestic production of key components, and reduce dependence on foreign suppliers, particularly for critical items like semiconductors and battery materials.

Latest Trends/Developments:

Several key trends are shaping the future of the global automotive parts and components market. One of the most significant trends is the increasing focus on electrification, driven by growing consumer demand for electric vehicles (EVs) and stricter emissions regulations. The transition from internal combustion engines (ICEs) to electric powertrains is transforming the landscape of automotive components, with rising demand for electric motors, battery systems, and power electronics. Another important trend is the growing adoption of lightweight materials such as aluminum, carbon fiber, and high-strength steel. Automakers are increasingly using these materials to reduce vehicle weight, improve fuel efficiency, and comply with emissions regulations. This shift toward lightweighting is driving demand for new types of components and materials in the automotive parts market.Autonomous driving technologies are also gaining traction, with major automakers and tech companies investing in the development of self-driving cars. The integration of advanced sensors, AI-powered decision-making systems, and LIDAR technologies is creating new opportunities for automotive parts manufacturers to supply components that enable safer and more efficient autonomous vehicles.

Key Players:

-

Robert Bosch GmbH

-

Denso Corporation

-

Continental AG

-

Magna International Inc.

-

ZF Friedrichshafen AG

-

Aisin Seiki Co., Ltd.

-

Valeo SA

-

BorgWarner Inc.

-

Aptiv PLC

-

Faurecia SE

Chapter 1. Automotive Parts and Components Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Parts and Components Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Parts and Components Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Parts and Components Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Parts and Components Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Parts and Components Market – By Type

6.1 Introduction/Key Findings

6.2 Engine Components

6.3 Transmission Components

6.4 Electrical Components

6.5 Suspension and Steering Components

6.6 Brake Components

6.7 Body Components

6.8 Others

6.9 Y-O-Y Growth trend Analysis By Type

6.10 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Automotive Parts and Components Market – By Application

7.1 Introduction/Key Findings

7.2 Passenger Vehicles

7.3 Commercial Vehicles

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Automotive Parts and Components Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Automotive Parts and Components Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Robert Bosch GmbH

9.2 Denso Corporation

9.3 Continental AG

9.4 Magna International Inc.

9.5 ZF Friedrichshafen AG

9.6 Aisin Seiki Co., Ltd.

9.7 Valeo SA

9.8 BorgWarner Inc.

9.9 Aptiv PLC

9.10 Faurecia SE

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automotive Parts and Components Market was valued at USD 1.2 trillion in 2023 and is expected to reach USD 1.7 trillion by 2030, growing at a CAGR of 5.1%.

Major drivers include the increasing production of vehicles, technological advancements in electrification and automation, and the growth of the aftermarket segment.

The market is segmented by Type (Engine Components, Transmission Components, Electrical Components, Others) and Application (Passenger Vehicles, Commercial Vehicles).

Asia-Pacific is the dominant region, accounting for over 40% of the market share, driven by strong automotive production in China, Japan, and India.

Leading players include Robert Bosch GmbH, Denso Corporation, Continental AG, Magna International Inc., and ZF Friedrichshafen AG.