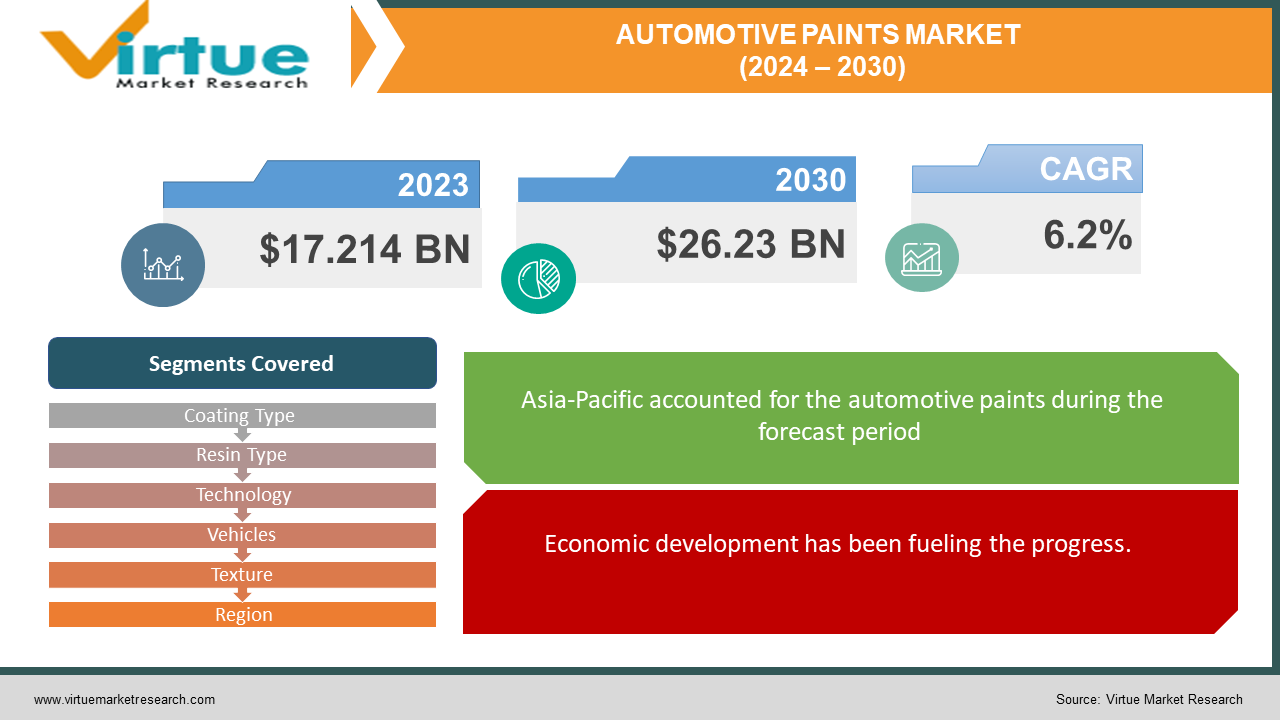

Automotive Paints Market Size (2024 – 2030)

The global automotive paints market was valued at USD 17.214 billion and is projected to reach a market size of USD 26.23 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6.2%.

Using a spray gun, automotive paint, which is a water-based mixture, is sprayed on a surface. Its polyurethane-based enamel adds a glossy sheen to the automobile while shielding the surface from environmental degradation. Automotive paint is applied to cars for both aesthetic and protective reasons. This market has had a significant presence in the past. They were primarily used for providing finishing and painting for cars. Presently, with growing environmental concerns, a shift towards water-based automotive paints has been observed. Advanced technologies have been gaining traction, leading to greater profits. Shortly, with a focus on bio-based formulations and other sustainable methods, this market is anticipated to have a tremendous expansion.

Key Market Insights:

Global car sales increased to around 67.2 million vehicles in 2022, as per Statista, thereby increasing the need for automotive paints.

Global motor vehicle manufacturing reached 85 million cars in 2022.

China's vehicle manufacturing business has grown at a 1.5% compound annual growth rate (CAGR) to reach $763 billion. Revenue increased by 0.7% in 2023, resulting in a 3.3% profit.

The Indian automobile industry manufactured 2,59,31,867 automobiles between April 2022 and March 2023. These vehicles included passenger cars, commercial vehicles, two-wheelers, three-wheelers, and quadricycles.

The painting process is responsible for over 80% of the emissions produced during the manufacture of cars. To tackle this, organizations have been focusing on water-based solvents to reduce emissions.

Automotive Paint Market Drivers:

Economic development has been fueling the progress.

Over the years, there have been many changes in the standard of living because of economic growth. Urbanization has led to a rising middle class and an increasing disposable income. There have been many lifestyle changes. People can live a luxurious life and afford the necessities. As such, the sales of vehicles have increased drastically. This has created an upsurge in automotive production. More cars, trucks, bikes, and other vehicles are being produced, which has elevated the demand for automotive paints. Besides, many brands are coming up with new models with better features and designs. Emerging economies like China, Japan, and Germany are among the biggest hubs in the automotive industry. Furthermore, electric vehicles (EVs) have gained immense popularity. A greater percentage of the population has an option for these vehicles due to their being economy-friendly. As cities are expanding and the population is growing, there is a higher demand for developing more public and private transportation.

Rising demand for vehicle refurbishment has been accelerating the growth rate.

As vehicles age, they are subjected to a lot of wear and tear and become more sensitive to environmental pollution, dust, contaminants, sunlight, and other such factors. This makes them lose their shine and paint with time. As such, owners of these vehicles have started to invest in repainting the old vehicles. Additionally, this method is cost-effective compared to buying a new vehicle. To keep up with this, there have been many companies that specialize in refurbishing and repainting old vehicles to give them a new look. Besides, DIY (do it yourself) trends have gained popularity. There are a lot of individuals who paint and make the necessary changes. This demand for such services has been helping with the generation of more income for the industry.

Automotive Paints Market Restraints and Challenges:

Price volatility, environmental issues, health concerns, technological complexities, and intense competition are the main barriers that the market is currently facing.

Automotive paints have many raw materials, like solvents, additives, and resins. These materials are associated with a hefty price. Besides, certain vehicles might require special materials and paint. Manufacturers often find difficulties managing these expenses. Additionally, they have to purchase good-quality paint to prevent early damage. Secondly, solvent-based automotive paints create a lot of environmental problems. VOCs (volatile organic compounds) are emitted, contributing to air and ozone pollution as well as smog. Hazardous waste is generated, leading to disposal concerns. Besides, heavy metals can also be released into the environment. Water bodies are affected. Furthermore, VOC can cause health issues like irritation in the eyes and skin and damage to the kidneys. Besides, they are carcinogenic, meaning they can cause cancer. Apart from this, developing advanced coatings can face complexities. Quality, performance, durability, and formulations must be right. Manufacturers should overcome these obstacles to create innovative products. The market is also subject to a lot of competition. Companies need to differentiate their products to stand out.

Automotive Paint Market Opportunities:

Water-based and eco-friendly formulations have been providing an ample number of possibilities for the market. Manufacturers have been investing in sustainable paintings to attract a broader consumer base. Research and developmental activities are being prioritized to develop such formulations. Secondly, advancements in nanotechnology fields have been beneficial. Coatings with characteristics like increased corrosion resistance, self-cleaning surfaces, and anti-fingerprint coatings can be created due to this field. In addition to enhancing cars' looks, these materials also increase their lifetime, sustainability, and compatibility with both customer preferences and legal requirements. Apart from this, digital tools like artificial intelligence, machine learning, and data analytics help reduce waste and streamline production.

AUTOMOTIVE PAINTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Coating Type, Resin Type, Technology, Vehicles, Texture, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PPG Industries, Axalta Coating Systems, BASF SE, Sherwin-Williams Company, Akzo Nobel N.V., Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Jotun Group, RPM International, Inc., KCC Corporation |

Automotive Paints Market Segmentation: By Coating Type

-

Primer

-

Base coat

-

Clearcoat

-

Electrocoat

Based on type, the base coat is the largest segment. Following primer, base coat paint is the initial layer of paint to be applied to the surface. It aids in keeping the car's surface free of rust and corrosion, which over time can do significant harm. Additionally, the paint aids in UV protection, which prevents paint from fading and discoloration. Base coat paint provides a long-lasting, high-gloss finish that is simple to maintain. Clear coat is the fastest-growing category. Transparent finish paint, commonly used as a topcoat over previously painted surfaces or parts, is called an automobile clear coat. A clear coat is a type of coating that gives a car's surface exceptional toughness and resilience to various chemical and mechanical agents.

Automotive Paints Market Segmentation: By Resin Type

-

Polyurethane

-

Epoxy

-

Acrylic

-

Others

Polyurethane (PU) paint is the largest growing resin type, with a rough share of around 45% in 2023. It is an acrylic-based coating that is transparent and offers exceptional weather resistance, lightfastness, and UV protection. Paints made of polyurethane are renowned for their resilience to weather-related stresses, including precipitation, ultraviolet radiation, and high temperatures. Compared to other paint kinds, they are also more visually beautiful and long-lasting. The acrylic segment is the fastest-growing. This is a very affordable paint. Because it dries the fastest, there are fewer application errors. Acrylic paint is renowned for its long-lasting, glossy, and less harmful properties.

Automotive Paints Market Segmentation: By Technology

-

Solvent-borne

-

Waterborne

-

Powder Coating

Due to their ability to shield vehicles from extreme weather conditions and considerable cost savings, waterborne coatings are the largest growers, with a share exceeding 65% in 2023 . This is because it offers great chemical resistance, reduced processing temperatures, and solvent-free coating preparation. Powder coatings are the fastest-growing segment. Large end-use applications favor powder coating because it provides a precise film thickness that allows for the correction of improperly coated areas. Additionally, some of the major trends that the market participants follow are the appealing qualities of paints and coatings, such as their affordability, environmental friendliness, high quality, ease of use, and quick paint application.

Automotive Paints Market Segmentation: By Vehicles

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

Passenger Cars

The passenger vehicle segment is both the largest and the fastest-growing due to the rise in the production of cars and three-wheelers as a result of urbanization. Refinish coatings are primarily used in exterior components of passenger cars for long-term protection. The rising demand for automotive refinish coatings in this segment is influenced by the rise in repair and maintenance for new and old passenger cars to protect them from accidents and a harsh environment.

Automotive Paints Market Segmentation: By Texture

-

Matte

-

Solid

-

Metallic

Based on texture, the metallic category is the largest growing. These coatings give automobiles a shinier look. Unlike other materials, the metallic finish conceals tiny flaws better and provides depth and refinement. Metallic textures are also becoming increasingly popular among manufacturers and consumers alike because of the trend towards sleek, contemporary features in automobile design. Matte is the fastest-growing texture. The surface of matte automobile paint is flat and lacks light reflection. It gives off a somewhat grainy or rough appearance. A matte finish is a non-reflective, low-profile finish with excellent coverage.

Automotive Paints Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on region, Asia-Pacific is the largest and fastest-growing market. Countries like China, India, South Korea, and Japan are at the top. The main reason for this is that these countries are involved in bulk manufacturing of various automotive vehicles like cars, buses, trains, scooters, etc. A lot of major companies are present in Asian countries, which increases profit. These organizations have a global presence. Prominent ones include Nippon Paint Holdings Co., Ltd. (Japan), Kansai Paint Co., Ltd. (Japan), KCC Corporation (South Korea), and Berger Paints India Limited (India). Numerous governments in the Asia-Pacific region have been actively supporting the automobile sector by creating infrastructure, offering incentives, and enacting favorable laws. The market for automotive paints is further supported by these policies, which increase vehicle manufacturing and sales. The Asia-Pacific region's fast adoption of electric cars (EVs) is fueling the need for specialty car paints that can handle the particular difficulties presented by lightweight materials and EV batteries.

COVID-19 Impact Analysis on the Global Automotive Paints Market:

The outbreak of the virus hurt the market. The new normal included mobility limitations, lockdowns, and social isolation. The logistics of transportation, the supply chain, and other areas were severely disrupted by this. This resulted in employment losses for many. To stop the virus from spreading, the majority of businesses and industries were closed. A significant demand reduction led to a notable downturn in sales. Besides, due to financial losses, people did not invest in vehicles. Instead, they focused on the necessities that were required. This caused losses for the automotive paint industry. The data gathered by OICA indicates a 16% decrease in output, amounting to fewer than 78 million automobiles during the pandemic. The majority of the partnerships and launches were canceled or postponed. Most of the money went towards funding medical essentials such as ventilators, oxygen tanks, hospital beds, and vaccine development. Following the epidemic, the market has started to recover as a result of the uplift of rules and loosened restrictions.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Smart coatings have been gaining emphasis. In the automobile sector, smart coatings with features like temperature regulation, anti-glare, anti-fouling, and self-healing are becoming more popular. These coatings improve protection, durability, and aesthetics, all of which add to a better driving experience. UV-cured coatings are becoming popular because of their quick curing periods, energy economy, and environmental advantages.

Key Players:

-

PPG Industries

-

Axalta Coating Systems

-

BASF SE

-

Sherwin-Williams Company

-

Akzo Nobel N.V.

-

Nippon Paint Holdings Co., Ltd.

-

Kansai Paint Co., Ltd.

-

Jotun Group

-

RPM International, Inc.

-

KCC Corporation

In July 2023, Nippon Paint Automotive Coatings Co., Ltd. (NPAC) revealed a new dry film coating technique that achieves a 50% reduction in CO2 emissions. For fleet operators, manufacturers, and customers, the technology also provides a plethora of customization choices.

In May 2023, PPG stated that PPG Advanced Surface Technologies, a new joint venture founded with Entrotech, Inc., a producer of technology-driven film solutions, will supply paint and clear film solutions for automotive and industrial clients. In the joint venture, PPG still owns the lion's share.

In December 2022, BASF introduced automobile coatings with a certified biomass balancing methodology and renewable raw ingredients. ColorBrite® ReSource, a component of BASF's biomass balancing range of aqueous basecoats, reduces carbon emissions by 20% without requiring changes to the product's performance or formulation.

Chapter 1. Automotive Paints Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Paints Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Paints Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Paints Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Paints Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Paints Market – By Coating Type

6.1 Introduction/Key Findings

6.2 Primer

6.3 Base coat

6.4 Clearcoat

6.5 Electrocoat

6.6 Y-O-Y Growth trend Analysis By Coating Type

6.7 Absolute $ Opportunity Analysis By Coating Type, 2024-2030

Chapter 7. Automotive Paints Market – By Resin Type

7.1 Introduction/Key Findings

7.2 Polyurethane

7.3 Epoxy

7.4 Acrylic

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Resin Type

7.7 Absolute $ Opportunity Analysis By Resin Type, 2024-2030

Chapter 8. Automotive Paints Market – By Technology

8.1 Introduction/Key Findings

8.2 Solvent-borne

8.3 Waterborne

8.4 Powder Coating

8.5 Y-O-Y Growth trend Analysis Organization Size

8.6 Absolute $ Opportunity Analysis Organization Size, 2024-2030

Chapter 9. Automotive Paints Market – By Vehicles

9.1 Introduction/Key Findings

9.2 Light Commercial Vehicles

9.3 Heavy Commercial Vehicles

9.4 Passenger Cars

9.5 Y-O-Y Growth trend Analysis End-User

9.6 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Automotive Paints Market – By Texture

10.1 Introduction/Key Findings

10.2 Matte

10.3 Solid

10.4 Metallic

10.5 Y-O-Y Growth trend Analysis Application

10.6 Absolute $ Opportunity Analysis Application, 2024-2030

Chapter 11. Automotive Paints Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Coating Type

11.1.2.1 By Resin Type

11.1.3 By Technology

11.1.4 By Texture

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Coating Type

11.2.3 By Resin Type

11.2.4 By Technology

11.2.5 By Vehicles

11.2.6 By Texture

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Coating Type

11.3.3 By Resin Type

11.3.4 By Technology

11.3.5 By Vehicles

11.3.6 By Texture

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Coating Type

11.4.3 By Resin Type

11.4.4 By Technology

11.4.5 By Vehicles

11.4.6 By Texture

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Coating Type

11.5.3 By Resin Type

11.5.4 By Technology

11.5.5 By Vehicles

11.5.6 By Texture

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Automotive Paints Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 PPG Industries

12.2 Axalta Coating Systems

12.3 BASF SE

12.4 Sherwin-Williams Company

12.5 Akzo Nobel N.V.

12.6 Nippon Paint Holdings Co., Ltd.

12.7 Kansai Paint Co., Ltd.

12.8 Jotun Group

12.9 RPM International, Inc.

12.10 KCC Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global automotive paints market was valued at USD 17.214 billion and is projected to reach a market size of USD 26.23 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6.2%.

Economic development and rising demand for vehicle refurbishment are the main drivers in the global automotive paint market.

Based on coating type, the global automotive paints market is segmented into primer, base coat, clear coat, and electrocoat.

Asia-Pacific is the most dominant region for the global automotive paints market.

PPG Industries, Axalta Coating Systems, and BASF SE are some of the key players operating in the global automotive paints market.