Automotive Motor Oil Market Size (2024 –2030)

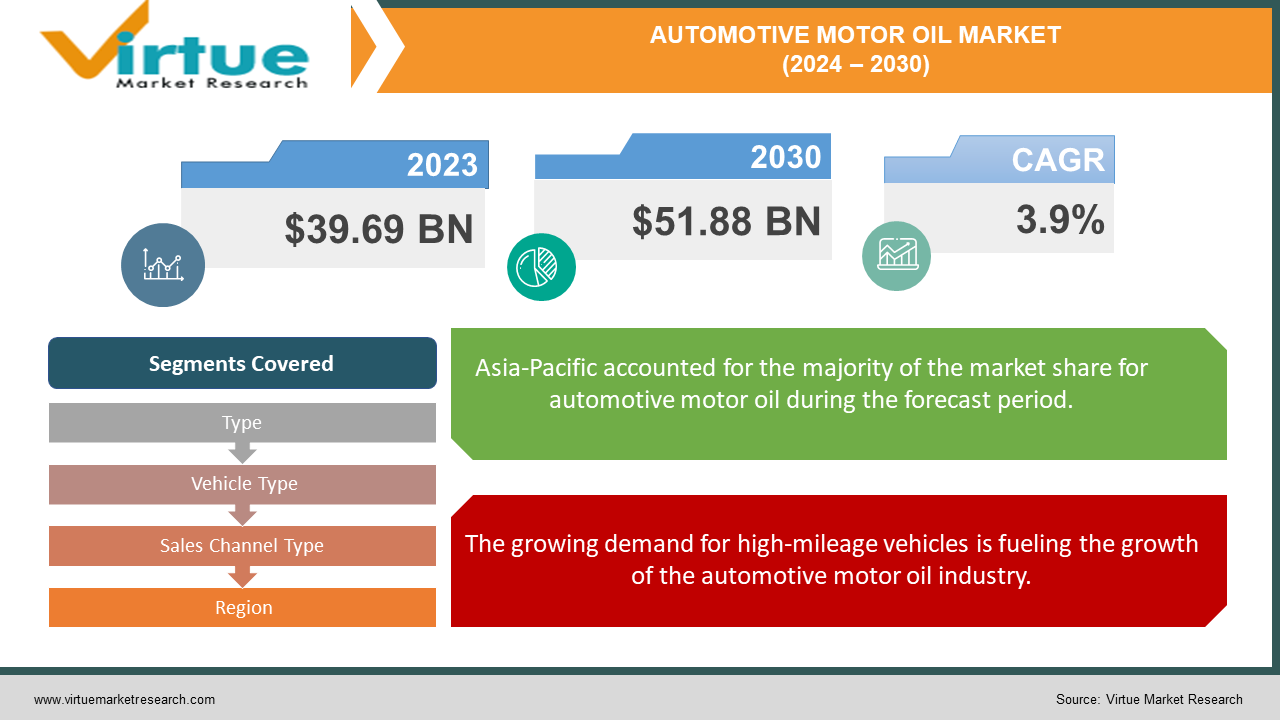

The Global Automotive Motor Oil Market was valued at USD 39.69 billion and is projected to reach a market size of USD 51.88 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.9%.

Engine oil keeps the engines of cars, motorcycles, and other vehicles operating smoothly. Engine oil's primary function is to lessen wear and friction on moving parts. Additionally, it aids in engine cleaning by getting rid of buildups like sludge and varnish. Engine oil neutralizes acids produced during fuel combustion and enhances piston sealing. By removing heat from the moving parts, it also aids in cooling the engine.

Key Market Insights:

Synthetic motor oils capture around 35% of the global automotive motor oil market share, driven by their superior performance and longer drain intervals.

Passenger cars account for approximately 60% of the global automotive motor oil demand, while commercial vehicles constitute the remaining 40%.

The Asia-Pacific region dominates the global automotive motor oil market, consuming over 30% of the total volume, driven by the growing automotive industry in countries like China and India.

In the United States, around 25% of the automotive motor oil market is occupied by premium-tier products, reflecting the increasing demand for high-performance lubricants.

Global Automotive Motor Oil Market Drivers:

The main factors propelling the market's expansion are the growing demand for both traditional and synthetic goods, as well as increased car manufacturing.

Car engine oil has seen tremendous growth in the world market in recent years. A growing population and an increase in car sales are major contributors to this. Furthermore, it is anticipated that the automotive industry's adoption of cutting-edge technology will continue to raise the need for engine oil. High-performance oils are a focus for automakers in order to improve vehicle performance, which is expected to sustain market growth in the upcoming years.

The growing demand for high-mileage vehicles is fueling the growth of the automotive motor oil industry.

An engine runs more smoothly when it is well-oiled because the moving parts—such as the piston—don't have to work as hard. Engine oil keeps the car cooler and runs more smoothly. Motor oil with a lower viscosity, which is thinner and flows more readily, is gaining traction due to its increased fuel efficiency and manufacturer recommendations. The need for motor oil is further increased by developments in engine technology, such as turbochargers, which also contribute to emissions reduction and increased fuel efficiency.

Automotive Motor Oil Market Challenges and Restraints:

Environmental regulations, shortages, and changes in currency exchange rates are some of the factors that affect motor oil prices. The motor oil market faces challenges as a result of these price changes. The high cost of producing motor oil as a result of the intricate production process is one major problem. An additional issue is the growing number of businesses vying for customers, which raises questions about sustainability. Businesses confront increasing risks and rewards as competition increases. Customers want fair prices, and manufacturing costs are high due to the numerous steps involved in making motor oil, making it difficult for buyers to afford the products.

Automotive Motor Oil Market Opportunities:

Motivated by a number of trends and opportunities, the automotive motor oil market is expanding significantly. One of the main forces is the rising demand from developing countries, particularly those in the Asia-Pacific region. The expanding middle class and rising affordability of vehicles are major factors driving vehicle sales, especially in China, India, and Southeast Asia. Synthetic and semi-synthetic blends of engine oil, which provide superior performance and environmental advantages, are examples of advanced engine oils that have been developed in response to the global focus on lowering vehicle emissions and increasing fuel efficiency. The partnership between motor oil producers and automakers to create oils that satisfy particular vehicle requirements and adhere to strict emission regulations represents another noteworthy opportunity. Through this partnership, it is possible to guarantee that the oils not only safeguard engines but also improve fuel efficiency and reduce emissions. Additionally, as engine technology continues to advance, specialized oils become more and more necessary, creating a constant need for novel products, due to high vehicle ownership rates and stringent environmental regulations, which fuel demand for premium, eco-friendly motor oils, the North American market—particularly the US market—remains strong. In a similar vein, Europe's robust automotive sector and emphasis on environmentally friendly goods have contributed to its continuous growth. Because synthetic motor oils have longer replacement cycles and appeal to consumers seeking affordable maintenance solutions, their demand is growing in Latin America.

AUTOMOTIVE MOTOR OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.9% |

|

Segments Covered |

By Type, Vehicle Type, Sales Channel Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Exxon Mobil Corporation, ROYAL DUTCH SHELL PLC, Infineum International Limited, Valvoline Inc., Gulf Oil Lubricants India Limited, The Lubrizol Corporation, Chevron Corporation, BP PLC, China Petroleum & Chemical Corporation, Petro, Canada Lubricants Inc. |

Global Automotive Motor Oil Market Segmentation: By Type

-

Conventional

-

Synthetic Blend

-

Full Synthetic

-

High-Mileage

There are various types of motor oil available in the automotive market, including fully synthetic, synthetic blend, conventional, and high-mileage oils. Synthetic blends are anticipated to rule the market for the duration of the forecast. Semi-synthetic oil, also referred to as synthetic blend oil, is an oil that blends conventional and synthetic oils to provide some advantages each with fewer disadvantages. Engine protection and performance are enhanced by this mixture. With its refined crude oil composition, conventional oil is the fastest-growing category. This type of motor oil is the most accessible and reasonably priced, and it fulfills the majority of engines' basic requirements. However because conventional oil is less stable and viscous than synthetic oil, it degrades more quickly and generates more pollutants. For it to continue working, it also needs to be altered more frequently.

Global Automotive Motor Oil Market Segmentation: By Vehicle Type

-

Passenger Car

-

Heavy-Duty Vehicle

The markets for passenger cars and heavy-duty commercial vehicles make up the two segments of the automotive motor oil market. Because motor oil sales are rising, passenger cars are predicted to continue to be the most popular and fastest-growing segment. The growing middle-class and upper-class populations are the primary drivers of the rising demand for passenger cars. Global purchasing power rises with the economic growth of emerging nations, and there is a greater emphasis on cutting back on fuel use, vehicle emissions, and general maintenance expenses. It is anticipated that this trend will increase demand for motor oil for automobiles.

Global Automotive Motor Oil Market Segmentation: By Sales Channel Type

-

Quick Lube

-

Independent Workshop

-

Maintenance/Repair Shop

-

FWS/OEM Dealership

-

Service Station

-

Truck Stop

There are several segments in the automotive motor oil market, such as truck stops, independent workshops, quick lube centers, dealerships, maintenance/repair shops, and service stations. It is anticipated that during the forecast period, quick lube centers will be the fastest-growing and most dominant segment. These shops are highly well-liked because they provide prompt, convenient auto repair from reputable mechanics. For customers to receive the best care for their vehicles, they put a lot of emphasis on enhancing service quality, educating personnel, and establishing connections between manufacturers, dealers, and repair facilities.

Global Automotive Motor Oil Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The market for automotive motor oil is expanding fastest in the Asia-Pacific area as a result of rising demand from developing nations. The Society of Automotive Engineers (SAE) and the American Petroleum Institute (API) have strict standards that have improved product quality and fueled market expansion. The market is being helped by the widespread use of synthetic oils in Latin America, which have a longer interval between changes. It is anticipated that the presence of significant corporations in the area will accelerate this growth. Because of growing car demand and a large number of luxury vehicles, North America continues to be the largest market for automotive motor oil, especially in the United States. The need for fuel-efficient vehicles, rising consumer awareness of routine oil changes, and an increase in auto repair facilities are all factors driving market expansion throughout the Americas.

COVID-19 Impact on the Global Automotive Motor Oil Market:

In many industries, the COVID-19 pandemic has had a significant effect. Many nations implemented partial or complete lockdowns to stop the virus's spread, which resulted in business closures and halted operations. The abrupt decline in vehicle demand and the travel restrictions presented the motor oil industry with unanticipated challenges. On the other hand, the motor oil market is anticipated to grow significantly in the future as more people get vaccinated and as industries resume normal operations.

Latest Trend/Development:

The market for motor oil for automobiles is changing along several important lines. More environmentally friendly oils, such as the lower-viscosity SAE 0W-20, are being pushed for by sustainability and environmental regulations in an effort to improve fuel economy and cut emissions. More advanced engine oils provide improved fuel efficiency and piston cleanliness. One example is the new ILSAC GF-7. Because fully synthetic oils offer better protection and performance, there is an increasing demand for them. The market is being impacted by the growing popularity of electric vehicles, which necessitates the use of specific lubricants for EV parts. Due to rising car ownership, the Asia-Pacific market is expanding regionally, while Europe and North America continue to be sizable markets controlled by large corporations like Shell and ExxonMobil.

Key Players:

-

Exxon Mobil Corporation

-

ROYAL DUTCH SHELL PLC

-

Infineum International Limited

-

Valvoline Inc.

-

Gulf Oil Lubricants India Limited

-

The Lubrizol Corporation

-

Chevron Corporation

-

BP PLC

-

China Petroleum & Chemical Corporation

-

Petro

-

Canada Lubricants Inc.

Chapter 1. Automotive Motor Oil Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Deployment Models

1.5 Secondary Deployment Models

Chapter 2. Automotive Motor Oil Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Motor Oil Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Motor Oil Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Motor Oil Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Motor Oil Market – By Type

6.1 Introduction/Key Findings

6.2 Conventional

6.3 Synthetic Blend

6.4 Full Synthetic

6.5 High-Mileage

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Automotive Motor Oil Market – By Vehicle Type

7.1 Introduction/Key Findings

7.2 Passenger Car

7.3 Heavy-Duty Vehicle

7.4 Y-O-Y Growth trend Analysis By Vehicle Type

7.5 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 8. Automotive Motor Oil Market – By Sales Channel Type

8.1 Introduction/Key Findings

8.2 Quick Lube

8.3 Independent Workshop

8.4 Maintenance/Repair Shop

8.5 FWS/OEM Dealership

8.6 Service Station

8.7 Truck Stop

8.8 Y-O-Y Growth trend Analysis By Sales Channel Type

8.9 Absolute $ Opportunity Analysis By Sales Channel Type, 2024-2030

Chapter 9. Automotive Motor Oil Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Vehicle Type

9.1.4 By Sales Channel Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Vehicle Type

9.2.4 By Sales Channel Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Vehicle Type

9.3.4 By Sales Channel Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Vehicle Type

9.4.4 By Sales Channel Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Vehicle Type

9.5.4 By Sales Channel Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Automotive Motor Oil Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Exxon Mobil Corporation

10.2 ROYAL DUTCH SHELL PLC

10.3 Infineum International Limited

10.4 Valvoline Inc.

10.5 Gulf Oil Lubricants India Limited

10.6 The Lubrizol Corporation

10.7 Chevron Corporation

10.8 BP PLC

10.9 China Petroleum & Chemical Corporation

10.10 Petro

10.11 Canada Lubricants Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Internal combustion engines that power motorcycles, vehicles, and a variety of other automotive engines utilize automotive motor oil as a lubricant.

The Global Automotive Motor Oil Market was estimated to be worth USD 39.69 billion in 2023 and is projected to reach a value of USD 51.88 billion by 2030, growing at a CAGR of 3.9% during the forecast period 2024-2030.

The need for synthetic and traditional goods as well as rising car manufacturing and an increase in demand for high-mileage vehicles are the factors driving the Global Automotive Motor Oil Market.

Due to the erratic price changes, the market for automobile motor oil is now experiencing several difficulties.

The conventional type is the fastest growing in the Global Automotive Motor Oil Market.