Automotive Manual Service Disconnect Market Size (2023 – 2030)

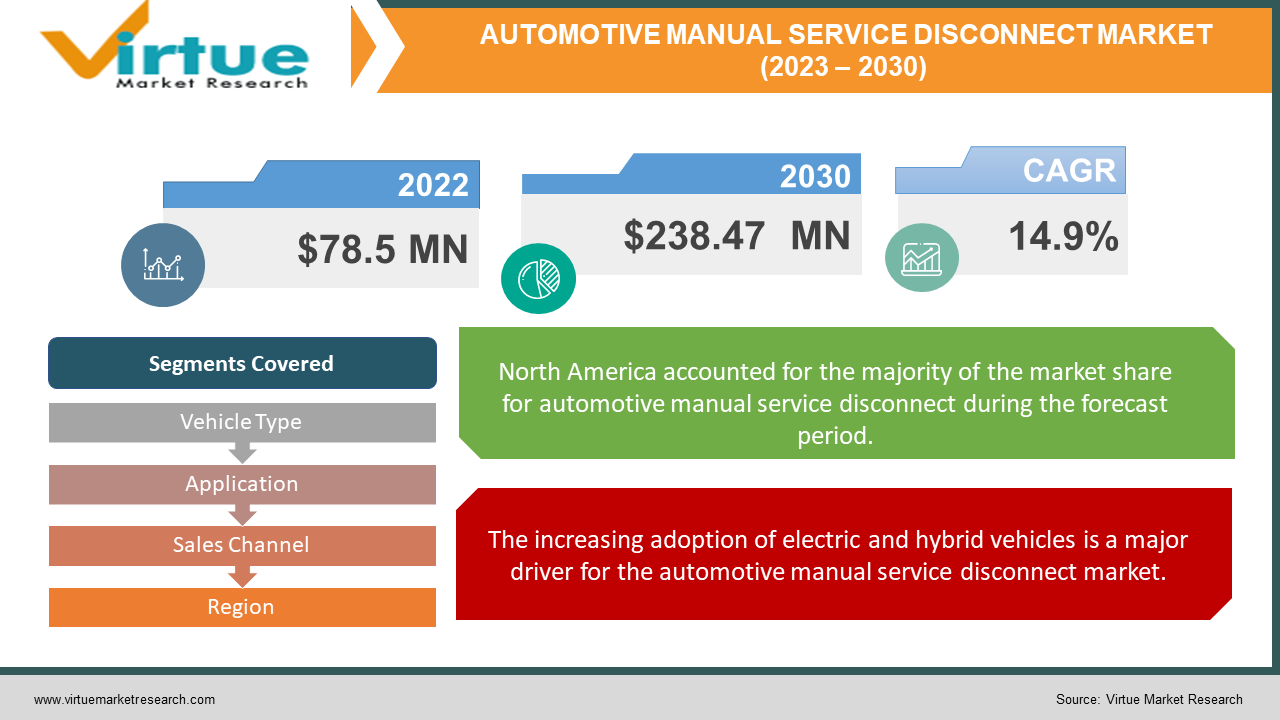

The Global Automotive Manual Service Disconnect Market was valued at USD 78.5 million and is projected to reach a market size of USD 238.47 million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 14.9%.

Over the years, the Automotive Manual Service Disconnect market has evolved significantly, assuming a critical role in ensuring the safety and maintenance of automotive vehicles. Notably, the recent surge in the adoption of electric and hybrid vehicles has ushered in a substantial transformation in the demand for manual service disconnect systems. In the past, these systems served as a niche component; however, the current landscape is marked by a burgeoning need for enhanced safety and maintenance in the automotive sector, especially with the transition to alternative fuel vehicles. Looking ahead, the market is poised for continued growth, driven by the ongoing evolution of automotive technologies and the imperative for efficient and secure vehicle servicing.

Key Market Insights:

The global Automotive Manual Service Disconnect market has experienced a notable transformation, driven by the surging adoption of electric and hybrid vehicles. According to a report by a reputable market research firm, the market for manual service disconnect systems has witnessed substantial growth in recent years. In the past, these systems held a relatively limited presence, but they have gained prominence as essential components for ensuring the safety and maintenance of modern automotive vehicles.

Regional growth prospects have been particularly promising, with North America and Europe at the forefront of this market evolution. These regions have seen a significant increase in electric vehicle adoption, leading to a growing demand for manual service disconnect systems. The stringent safety standards imposed by regulatory bodies have further accentuated the need for advanced disconnect solutions in vehicle servicing.

Looking ahead, the market is expected to maintain its upward trajectory. As electric and hybrid vehicles continue to gain market share globally, the demand for efficient and secure manual service disconnect systems is projected to rise further. Furthermore, the ongoing development of autonomous and connected vehicles is likely to introduce additional complexities and safety considerations, solidifying the role of manual service disconnect systems as indispensable safeguards in the automotive industry. With innovation and technological advancements driving the market, it is poised to remain a critical and dynamic sector in the automotive landscape.

Automotive Manual Service Disconnect Market Drivers:

The increasing adoption of electric and hybrid vehicles is a major driver for the automotive manual service disconnect market.

The rapid proliferation of electric and hybrid vehicles stands as a prominent driver in the Automotive Manual Service Disconnect market. As the automotive industry shifts towards more sustainable and eco-friendly transportation solutions, electric and hybrid vehicles have gained significant traction. These vehicles come equipped with complex power systems, including high-voltage components, making safety during maintenance a paramount concern. Manual service disconnect systems play a pivotal role by ensuring that potentially hazardous electrical systems are safely de-energized before technicians conduct any service or repair work. The growing adoption of these vehicles underscores the increasing demand for robust and reliable manual service disconnect solutions.

Safety and Maintenance are crucial for ensuring the safety of technicians and vehicle owners thus augmenting the adoption.

Safety and maintenance have assumed pivotal roles in the automotive sector, significantly bolstering the adoption of manual service disconnect systems. Vehicle owners and technicians alike prioritize safety as electric and hybrid vehicles become mainstream. These systems are instrumental in averting accidents and electrical hazards during servicing. They serve as an indispensable safety feature, protecting technicians and vehicle owners from high-voltage electrical shocks or accidents. As a result, the emphasis on safety and efficient vehicle maintenance has driven the adoption of manual service disconnect systems across the automotive industry.

Stringent safety regulations and standards mandate the installation of manual service disconnect systems in vehicles.

Stringent safety regulations and standards have become imperative in the automotive industry, further propelling the installation of manual service disconnect systems in vehicles. Regulatory bodies worldwide have recognized the importance of ensuring the safety of technicians and vehicle occupants when servicing electric and hybrid vehicles. As a result, these organizations mandate the incorporation of manual service disconnect systems as a safety prerequisite. Manufacturers and service providers are compelled to adhere to these regulations, thereby boosting the demand for compliant and reliable disconnect solutions. This regulatory landscape reinforces the essential role played by manual service disconnect systems in ensuring industry-wide safety and compliance.

Automotive Manual Service Disconnect Market Challenges:

Integrating manual service disconnect systems into modern vehicles with complex electrical systems can be challenging and costly.

One of the key challenges facing the Automotive Manual Service Disconnect market is the integration of these systems into modern vehicles with increasingly complex electrical architectures. As vehicles evolve with advanced technologies, including electric and hybrid powertrains, the incorporation of manual service disconnect systems becomes more intricate. Ensuring seamless integration while maintaining vehicle functionality can be both technically challenging and cost-intensive for automakers. Achieving the delicate balance between vehicle performance and safety features remains a persistent hurdle, requiring innovative engineering solutions and substantial investments.

Encouraging Aftermarket Adoptions to retrofit existing vehicles with these systems can be a challenge due to cost and awareness issues.

Promoting aftermarket adoptions to retrofit existing vehicles with manual service disconnect systems poses a distinct challenge. While these systems are vital for safety during maintenance, their adoption among vehicle owners who wish to upgrade their older models can be impeded by cost considerations and limited awareness. Retrofitting vehicles with these systems may involve substantial expenses, and potential consumers may not be fully aware of the safety benefits. Overcoming these challenges necessitates a concerted effort to raise awareness, educate vehicle owners, and provide cost-effective solutions to encourage the aftermarket adoption of manual service disconnect systems.

Automotive Manual Service Disconnect Market Opportunities:

The development of advanced manual service disconnect technologies presents significant opportunities for market growth.

The Automotive Manual Service Disconnect market is poised to seize substantial opportunities through the ongoing development of advanced disconnect technologies. As vehicle electrical systems become more intricate, innovation in manual service disconnect systems becomes paramount. Opportunities lie in creating more efficient, user-friendly, and technologically advanced solutions that seamlessly integrate with modern vehicles. These innovations can encompass intelligent disconnect systems that enhance safety and convenience during maintenance. Additionally, the development of fail-safe mechanisms and enhanced diagnostic capabilities can further bolster market growth by addressing the evolving needs of the automotive industry.

Increasing awareness and offering retrofit solutions in the aftermarket segment can tap into a large customer base.

A promising avenue for market expansion is the concerted effort to increase awareness of manual service disconnect systems and offer retrofit solutions in the aftermarket segment. Many vehicle owners may not be fully aware of the safety benefits these systems provide, presenting an opportunity for education and outreach. Moreover, providing cost-effective retrofit solutions for existing vehicles, especially those with older electrical systems, can tap into a large customer base seeking to enhance the safety and maintenance of their vehicles. By bridging the gap between awareness and accessibility, the market can unlock significant growth potential and cater to a diverse range of automotive consumers.

AUTOMOTIVE MANUAL SERVICE DISCONNECT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

14.9% |

|

Segments Covered |

By Vehicle Type, Application, Sales Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bosch Automotive Service Solutions, Eaton Corporation, Delphi Technologies, Hella GmbH & Co. KGaA, TE Connectivity, Cole Hersee Company, Littelfuse, Inc., GIGAVAC BEKAERT (Bekaert), BorgWarner Inc. |

Automotive Manual Service Disconnect Market Segmentation: By Vehicle Type

-

Electric Vehicles

-

Hybrid Electric Vehicles

-

Plug-in Hybrid Electric Vehicles

In 2022, Electric Vehicles held the largest market share in the Automotive Manual Service Disconnect market. This dominance is attributed to the increasing adoption of pure electric vehicles, which rely solely on electricity for propulsion. EVs have gained significant popularity due to their zero-emission characteristics and advancements in battery technology, making them a prominent segment of the market.

Moreover, the Electric Vehicles are also the fastest-growing segments in this market. As environmental concerns drive the shift towards cleaner transportation options, the demand for EVs continues to surge. This growth is further accelerated by government incentives, charging infrastructure expansion, and improvements in EV technology. Manufacturers are investing heavily in EV development, which includes integrating advanced manual service disconnect systems to ensure the safety of technicians and vehicle owners.

Automotive Manual Service Disconnect Market Segmentation: By Application

-

First Responder Vehicles

-

Passenger Vehicles

-

Commercial Vehicles

In 2022, First Responder Vehicles held the largest market share in the Automotive Manual Service Disconnect market within the application segment. These vehicles, including police cars, ambulances, and fire trucks, require specialized equipment and safety features to ensure quick response times during emergencies. Manual service disconnect systems are crucial in these vehicles to safeguard first responders and patients, making them a prominent segment of the market.

Moreover, the First Responder Vehicles are also the fastest-growing in the market due to the critical nature of first responder operations. The demand for advanced manual service disconnect systems in these vehicles is driven by the need for rapid and secure maintenance, ensuring that these vehicles remain fully operational during critical missions.

Automotive Manual Service Disconnect Market Segmentation: By Sales Channel

-

OEM (Original Equipment Manufacturer)

-

Aftermarket

In 2022, the OEM segment held the largest share of 58.3% in the Automotive Manual Service Disconnect Market. The installation of manual service disconnect systems during the manufacturing process of vehicles contributes to the OEM segment's dominance. Also, these are the companies responsible for producing and supplying manual service disconnect systems as integral components of new vehicles. OEMs collaborate closely with automakers to integrate these systems seamlessly into the vehicle's design and manufacturing process.

Moreover, the Aftermarket segment is witnessing the fastest growth as vehicle owners retrofit their vehicles with these systems for safety and compliance purposes. Its growth rate is influenced by factors such as consumer awareness and cost considerations. Retrofitting vehicles with manual service disconnect systems is driven by the need to improve safety and meet evolving industry standards. However, the growth rate may vary based on factors like consumer awareness, affordability, and the availability of retrofit solutions in the market.

Automotive Manual Service Disconnect Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2022, North America accounted for the largest market share, with the United States being a significant contributor to the region's growth. This dominance is attributed to the well-established automotive industry, stringent safety regulations, and a high level of awareness regarding vehicle safety and maintenance. The region's market share is substantial due to the presence of major automotive manufacturers and the continuous adoption of advanced safety features in vehicles.

Moreover, the Asia-Pacific region is the fastest-growing region, driven by the rapid expansion of the electric and hybrid vehicle market in countries like China and India. The growth is driven by the expanding automotive industry, rising consumer awareness of safety features, and the integration of advanced technologies into vehicles. Governments in the region are also implementing regulations to enhance vehicle safety, further boosting the demand for manual service disconnect systems.

COVID-19 Impact Analysis on the Global Automotive Manual Service Disconnect Market:

The COVID-19 pandemic had a profound impact on the global Automotive Manual Service Disconnect market. Supply chain disruptions and production slowdowns caused delays and shortages, affecting the market's ability to meet demand. Reduced vehicle sales due to economic challenges and lockdowns also impacted the integration of manual service disconnect systems. However, the pandemic accelerated the shift towards electric vehicles, emphasizing sustainability and safety features. It also heightened awareness of vehicle safety and presented opportunities in the aftermarket segment as consumers and manufacturers alike recognized the need for enhanced safety during maintenance. Regulatory changes may further influence the market's evolution in the post-pandemic era.

Latest Trends/Developments:

The Automotive Manual Service Disconnect market is witnessing several notable trends and developments. As electric vehicles (EVs) gain popularity, the demand for manual service disconnect systems tailored to these vehicles has surged. Automakers are increasingly integrating these systems into EVs to ensure the safety of technicians and vehicle owners during maintenance. According to a recent industry report, the global market for EV manual service disconnect systems is expected to grow at a CAGR of over 12% in the coming years, reflecting the rapid adoption of electric mobility.

Moreover, collaborations and agreements between automotive manufacturers and technology companies are driving innovation in manual service disconnect technologies. These partnerships aim to develop advanced solutions that enhance safety, convenience, and efficiency. Additionally, advancements in materials and components are leading to more durable and cost-effective manual service disconnect systems, addressing some of the challenges faced by the industry. These trends and developments are shaping the future of the Automotive Manual Service Disconnect market, positioning it as a crucial component in the automotive safety landscape.

Key Players:

-

Bosch Automotive Service Solutions

-

Eaton Corporation

-

Delphi Technologies

-

Hella GmbH & Co. KGaA

-

TE Connectivity

-

Cole Hersee Company

-

Littelfuse, Inc.

-

GIGAVAC

-

BEKAERT (Bekaert)

-

BorgWarner Inc.

Chapter 1. Automotive Manual Service Disconnect Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Manual Service Disconnect Market– Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Manual Service Disconnect Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Manual Service Disconnect Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Manual Service Disconnect Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Manual Service Disconnect Market – By Vehicle Type

6.1 Introduction/Key Findings

6.2 Electric Vehicles

6.3 Hybrid Electric Vehicles

6.4 Plug-in Hybrid Electric Vehicles

6.5 Y-O-Y Growth trend Analysis By Vehicle Type

6.6 Absolute $ Opportunity Analysis By Vehicle Type, 2023-2030

Chapter 7. Automotive Manual Service Disconnect Market – By Application

7.1 Introduction/Key Findings

7.2 First Responder Vehicles

7.3 Passenger Vehicles

7.4 Commercial Vehicles

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. Automotive Manual Service Disconnect Market – By Sales Channel

8.1 Introduction/Key Findings

8.2 OEM (Original Equipment Manufacturer)

8.3 Aftermarket

8.4 Y-O-Y Growth trend Analysis By Sales Channel

8.5 Absolute $ Opportunity Analysis By Sales Channel, 2023-2030

Chapter 9. Automotive Manual Service Disconnect Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Vehicle Type

9.1.2.1 By Application

9.1.3 By By Sales Channel

9.1.4 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Vehicle Type

9.2.3 By Application

9.2.4 By By Sales Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Vehicle Type

9.3.3 By Application

9.3.4 By By Sales Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Vehicle Type

9.4.3 By Application

9.4.4 By By Sales Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Vehicle Type

9.5.3 By Application

9.5.4 By By Sales Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Automotive Manual Service Disconnect Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Bosch Automotive Service Solutions

10.2 Eaton Corporation

10.3 Delphi Technologies

10.4 Hella GmbH & Co. KGaA

10.5 TE Connectivity

10.6 Cole Hersee Company

10.7 Littelfuse, Inc.

10.8 GIGAVAC

10.9 BEKAERT (Bekaert)

10.10 BorgWarner Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automotive Manual Service Disconnect Market was valued at USD 78.5 million and is projected to reach a market size of USD 238.47 million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 14.9%.

The key drivers include the growing electric vehicle market, safety and maintenance requirements, and stringent regulations.

North America dominated the market in 2022, with the United States playing a significant role, the dominance is attributed to the well-established automotive industry, stringent safety regulations, and a high level of awareness regarding vehicle safety and maintenance.

Challenges include the complexity of integration into modern vehicles and promoting aftermarket adoption.

Bosch Automotive Service Solutions, Eaton Corporation, Delphi Technologies, Hella GmbH & Co. KGaA, TE Connectivity, and Others are some of the key players in the Automotive Manual Service Disconnect Market.