Global Automotive Lubricant Additives Market Size (2024 - 2030)

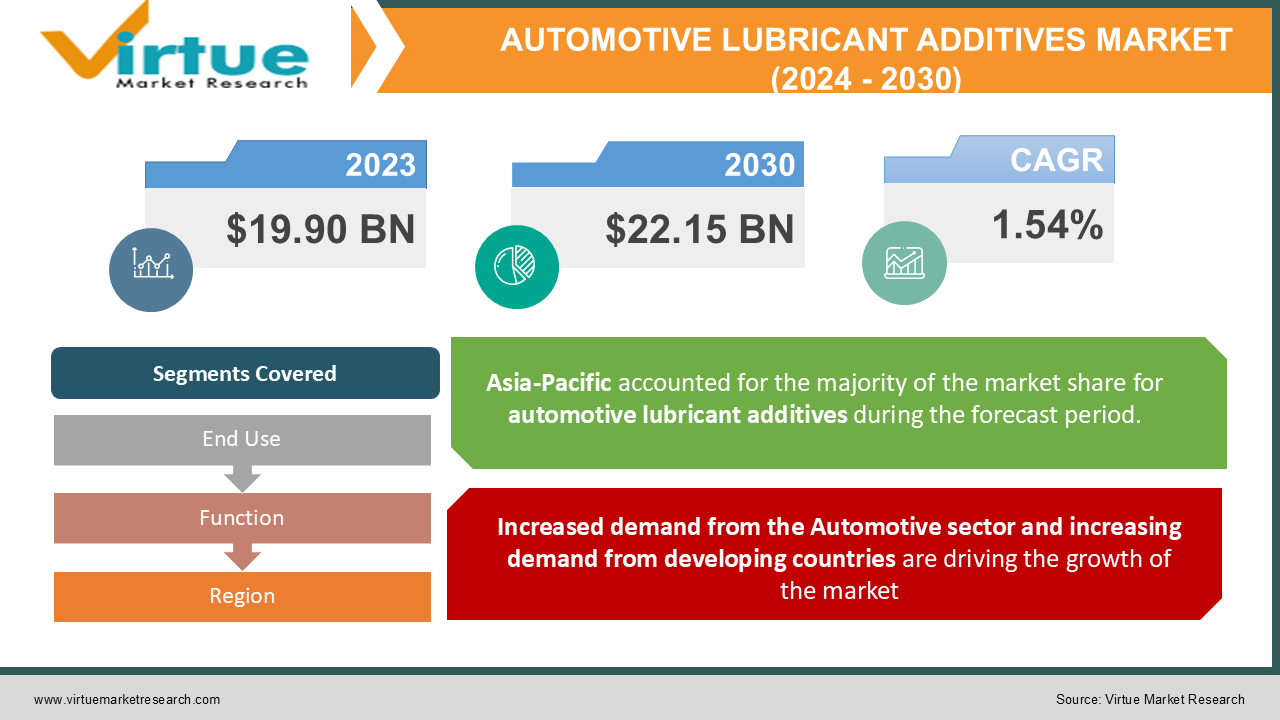

The Global Automotive Lubricant Additives Market was valued at USD 19.90 Billion in 2023 and is projected to reach a market size of USD 22.15 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 1.54%.

Industry Overview:

Lubricant components are chemical factors or supplies that, when utilized at a unique amount, function one or extra functions in the fluid. To make whole lubricants, lubricant components are blended with base oils. Organic or inorganic factors dissolved or excluded as solids in oil are referred to as "solids." Depending on the equipment, they can vary from 0.1% to 30% of the complete oil volume. These components enhance the existence and manufacturing of last lubricants in a range of ways. These additives' high-quality overall performance additionally will increase the lifestyles of machines and lowers renovation expenses.

Depending on the end-use application, these mixes are used one at a time or in combination. Heavy-duty and passenger vehicle lubricants in the automobile industry, devour the most lubricant additives, accompanied by metalworking fluids and mechanical engine oils in the industrial sector. Lubricant components are additionally vital for the administration of electricity and emissions in a range of vehicle and end-use sectors.

Basic substances such as oils and greases can no longer meet the ultra-modern demand for lubrication throughout the globe with a number of climatic conditions. As a result, components are essential components of the lubricant industry. The lifespan, thermal steadiness manufacturing, storage, performance, and lubricating potential of lubricant formula are appreciably expanded with the aid of these wonderful additives. It is, therefore, possible to improve particularly environment-friendly transmission fluids, metallic working fluids, hydraulic oils, engine oils, chain oils, compressor oils, high-temperature lubricants, turbine oils, and greases by means of making use of primary fluids to their most capacity.

COVID-19 impact on the Automotive Lubricant Additives Market

The international pandemic has affected nearly every quarter of the world. The lubricating oil components market has proven to terrible increase as it was once affected due to disruptions in the world provide chain and a fall in the oil prices. This scenario occurs due to a fall in demand in the car sector. The market is pretty structured in the car and industrial sectors. APAC is the biggest area in phrases of cost for the lubricating oil components market.

The tour bans and lockdown imposed in most of the main cities in China had decreased the manufacturing of oil in the country. It has additionally affected the personnel neighborhood except which, many ports, such as Shenzhen and Shanghai, are closed for operations. However, The USA. has proven symptoms of recuperation after the lockdown of three months. Most of the corporations have reopened, which is anticipated to generate the demand for lubricating oil additives. Other growing international locations too have accelerated their automobile manufacturing in 2021 after the rollout of the mass vaccination drive.

MARKET DRIVERS:

Increased demand from the Automotive sector and increasing demand from developing countries are driving the growth of the market

The growing income of passenger motors and business automobiles power the lubricating oil components market in the car industry. Lubricating oil components are majorly used in engine oil, equipment oil, transmission fluid, and hydraulic fluid to stop adhesive put on and guard steel components. According to the European Automobile Manufacturers Association, whole motor automobiles elevated from 390,980,124 in 2018 to 397,312,339 in 2019 in the European Union, reflecting a trade of 1.6%.

According to the International Organization of Motor Vehicle Manufacturers, in India annual manufacturing of motors reached USD 2.3 million in the first 1/2 of 2021 in contrast to USD 1.2 million in the first half of 2020. India is anticipated to emerge as the world’s third-largest passenger car market through the stop of 2021. According to Trading Economics, automobile income in China multiplied by 12.8 % year-on-year attaining 2.57 million in September 2020. Thus, the rising demand for motor cars is anticipated to lead to an expansion in the demand for lubricants which is anticipated to extend the demand for lubricant anti-oxidant agents.

MARKET RESTRAINTS:

Health Concerns Associated with the Use of Humic Acid is restraining the growth of the market

Major lubricant oil components agent producers face hard opposition from unorganized gamers who provide inexpensive and sub-standard products. Unorganized gamers in the market encompass nearby and gray market players; the neighborhood gamers promote items manufactured in-house with their neighborhood manufacturer names, whereas the gray market gamers import and promote items thru unauthorized dealers. These unorganized gamers overpower the massive gamers with their decreased prices, competitiveness, and nearby furnish network, which is hard for international players. Increasing income by way of both, neighborhood and gray market gamers limit possibilities for international gamers in growing their market share. This restricts the entry of international gamers into neighborhood markets, thereby limiting their investments in these markets.

AUTOMOTIVE LUBRICANT ADDITIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

1.54% |

|

Segments Covered |

By End Use, Function and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Elantas GmbH (Germany), Axalta Coating Systems (the U.S.), Von Roll Holdings AG (Switzerland), Hitachi Chemicals Company Ltd. (Japan), 3M Company (the U.S.), and Kyocera Corporation (Japan) |

This research report on the global Automotive Lubricant Additives Market has been segmented and sub-segmented based on the Function, End-Use, and region.

Automotive Lubricant Additives Market - By Function:

- Dispersants

- Viscosity Index Improvers

- Detergents

- Antioxidants

- Anti-wear Additives

- Friction Modifiers

- Other Functions

Based on function, the viscosity index improvers phase will account for 22.3% of the whole market share in 2021. Lubricant components suspended in oil are utilized to impart features such as viscosity index improvers, detergents, dispersants, anti-wear additives, friction modifiers, and antioxidants, amongst others such as corrosion inhibitors and emulsifiers. These are being used throughout industries such as automotive, marine, and metallurgy sectors.

Depending on the characteristic class, the tempo of enlargement varies substantially. An emphasis on engine cleanliness, gas economy, and long-lasting engine lubricants, for example, has boosted the utilization of dispersants, antioxidants, and friction modifiers. As extra multi-grade engine oils are utilized, the utilization of VII (viscosity index improvers) is rising. The use of detergents and anti-wear chemicals, on the different hand, is prohibited due to worries related to compatibility with emission manipulation systems.

Automotive Market - By End-Use:

- Automotive & Transportation

- Food Processing

- Metal Working

- Power Generation

- Others

Based on End-Use, demand in the automotive and transportation phase will expand at a huge tempo over the forecast period. The manufacturing of automobiles, mild and heavy industrial vehicles, and two-wheelers is increasing, which is riding lubricant components demand all over the globe.

In a car, lubricant components are used to clean, cool, and guard steel components in opposition to corrosion and rust. Engine oil is used in cars to enhance gasoline effectivity and performance, and equipment oil is used in car gearboxes to shield tool elements from extreme mechanical pressure. As an end result of the quick growth of the car enterprise and growing automobile production, demand for equipment and engine oil will rise, as it has an extensive variety of purposes in the automobile sector.

Automotive Lubricant Additives Market - By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East

- Africa

Geographically, Asia-Pacific garnered the very best share in the lubricant components market in 2021, in phrases of revenue, and is predicted to hold its dominance in the course of the forecast period. This is attributed to the presence of key gamers and a big customer base in the region. The economic boom in the area coupled with growing industrialization has allowed higher manufacturing and possession of motors riding the demand for lubricant components in the region.

The car zone in the U.S. is integral for financial growth, with giant hyperlinks throughout the country's industrial and cultural fabric. In the U.S., Original Equipment Manufacturers (OEMs) have modified their manufacturing techniques to prioritize high-margin and most-demanded fashions to keep profitability (e.g., trucks), which is riding the utilization of excessive overall performance lubricant additives.

Europe is one of the main markets for lubricating oil additives. The key international locations in the European market consist of Italy, Spain & UK, which collectively preserve a considerable share of the standard European market. The lubricating oil components market in Europe is closely regulated, with REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) carefully monitoring and issuing tips to make certain an excessive stage of safety for the surroundings and human fitness from the dangers that can be posed via chemicals.

Automotive Lubricant Additives Market Share by Company

- BASF SE,

- Chevron Oronite Company LLC

- The Lubrizol Corporation,

- Afton Chemical,

- Evonik Industries AG,

- LANXESS AG,

- Croda International Plc.

- Infineum International Limited

- ADEKA CORPORATION

- BRB International

- International Petroleum

- Additives Company

- Tianhe Chemicals

- Vanderbilt Chemicals, LLC

- MOL-LUB Ltd

- Eni S.p.A.

- Clariant AG (Switzerland)

Recently, Chevron Oronite Company LLC signed an agreement with quantity for the distribution of OLOA lubricant additives, OGA gasoline additives, PARATONE viscosity additives, and raw material intermediates and components including PIBSA, inhibitors,Also, Afton Chemical Corporation completed the expansion of its chemical additive manufacturing facility in Jurong Island, Singapore.

The international market is relatively aggressive with a giant range of well-diversified regional, and unbiased small- and large-scale producers and suppliers. The small-scale organizations majorly compete on the foundation of price, aftersales services, and transport timelines. Whereas large-scale agencies center attention on product improvement and improvements as properly as advertising and marketing strategies. Some corporations are additionally redefining their grant chain to limit fee and consumer delays.

Key gamers as properly as new entrants are focusing on the improvement of bio-lubricants, owing to the future issues of power safety for petroleum products. However, bio-lubricants, being in the immature phase, have positive restrictions, such as temperature resistance and oxidative stability. Thus, agencies are investing in R&D things to do for these products. Prominent producers are worried about increasing their manufacturing websites in the creating areas of Asia, Africa, and South America owing to the rising demand for industrial and vehicle lubes. Apart from lubricant manufacturing capacities, important gamers are additionally focusing on discovering new oil wells to be self-sustainable, in phrases of uncooked materials, for inside manufacturing, and to hold their income revenue.

NOTABLE HAPPENINGS IN THE GLOBAL AUTOMOTIVE LUBRICANT ADDITIVE MARKET IN THE RECENT PAST:

- Product Expansion - In June 2021, For MAN B&W two-stroke engines, Infineum has expanded their single oil category II solutions. The new Infineum M7095 with Infineum performance booster additive package meets the demands of MAN Energy Solutions category II lubricants

- Product Launch - In February 2021, Dover Chemical Corporation has released a lubricity-improving polymeric ester additive for the metalworking sector.

Chapter 1. Automotive Lubricant Additives Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Automotive Lubricant Additives Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Automotive Lubricant Additives Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Automotive Lubricant Additives Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Automotive Lubricant Additives Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Automotive Lubricant Additives Market – By Function

6.1. Dispersants

6.2. Viscosity Index Improvers

6.3. Detergents

6.4. Antioxidants

6.5. Anti-wear Additives

6.6. Polyamides

6.7. Friction Modifiers

6.8. Other Functions

Chapter 7. Automotive Lubricant Additives Market – By End - User

7.1. Automotive and Transportation

7.2. Food Processing

7.3. Metal Working

7.4. Power Generation

7.5. Others

Chapter 8. Automotive Lubricant Additives Market – By Geography and Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Automotive Lubricant Additives Market – By Companies

9.1. BASF SE

9.2. Chevron Oronite Company LLC

9.3. The Lubrizol Corporation

9.4. Afton Chemical

9.5. Evonik Industries AG

9.6. LANXESS AG

9.7. Croda International Plc.

9.8. Infineum International Limited

9.9. ADEKA CORPORATION

9.10. BRB International

9.11. International Petroleum

9.12. Additives Company

9.13. Tianhe Chemicals

9.14. Vanderbilt Chemicals, LLC

9.15. MOL-LUB Ltd.

9.16. Eni S.p.A.

9.17. Clariant AG

Download Sample

Choose License Type

2500

4250

5250

6900