Automotive Lighting Market Size (2024 – 2030)

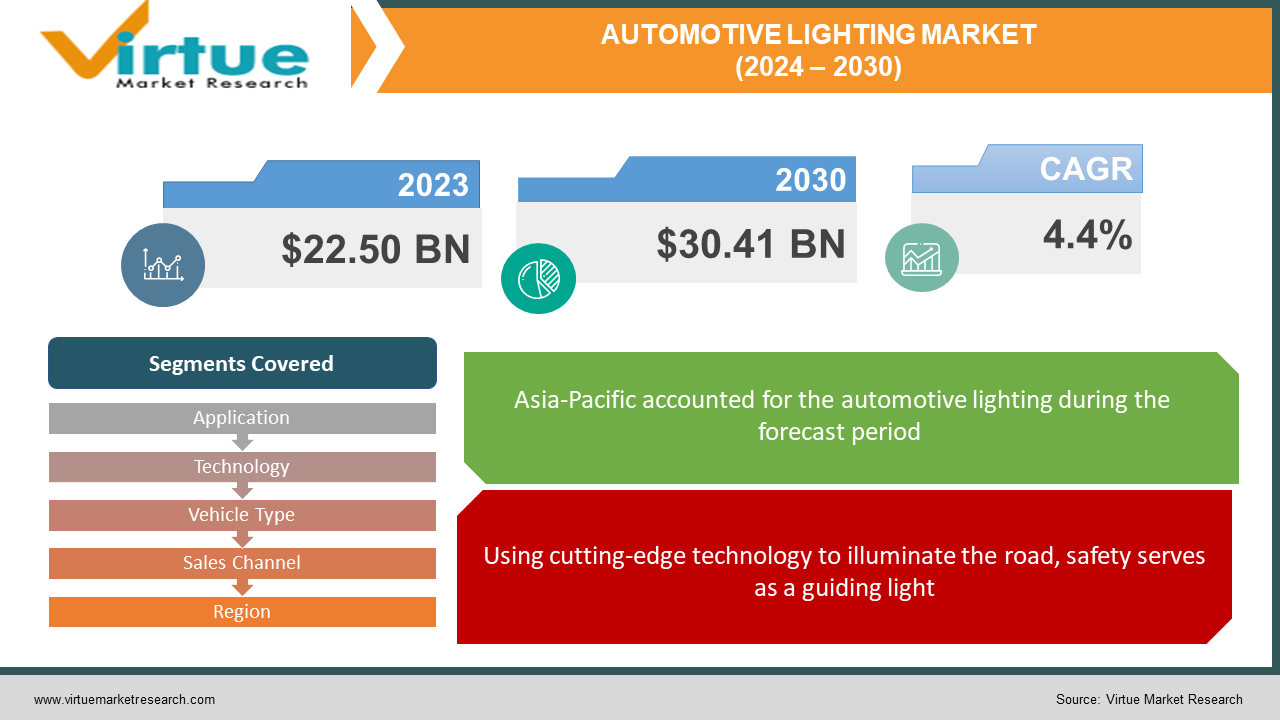

The global automotive lighting Market size was exhibited at USD 22.50 billion in 2023 and is projected to hit around USD 30.41 billion by 2030, growing at a CAGR of 4.4% during the forecast period from 2024 to 2030.

Global automotive lighting refers to all vehicle lighting systems, from headlamps that illuminate the road to taillights that communicate movements. They guarantee motorists and other road users alike safety, visibility, and style. While taillights frequently use LEDs for improved visibility, headlights are available in a variety of technologies, including LED and laser. Interior illumination, DRLs, and signal lights all have a role to play. This market, which was estimated to be worth $33.64 billion in 2022, is anticipated to rise to $67.39 billion by 2030 because of laws, luxury tastes, safety concerns, and technological developments like OLED taillights and adaptive headlights. Anticipate a future dominated by intelligent, connected, personalized, and sustainable lighting systems that enhance the safety, efficiency, and aesthetic appeal of automobiles.

Key Market Insights:

Car lighting works its magic to provide safety, visibility, and style. Headlights cut through the night, taillights express intent, and interiors shine with comfort. The billion-dollar global business is expected to rise due to consumer demand for high-end experiences, safer roads, and cutting-edge technology. Imagine dynamic messages being painted by taillights, headlights that adjust to the road, and interiors that customize their atmosphere. Driven by technological advancements like linked systems and laser beams, this future is calling. Anticipate even more visually attractive, environmentally friendly, and intelligent lighting to illuminate the way ahead, making cars safer, more efficient, and unquestionably cooler.

Global Automotive Lighting Market Drivers:

Using cutting-edge technology to illuminate the road, safety serves as a guiding light.

In the market for automobile lighting, safety is the driving force behind demand from the public and laws. While automated high beams smoothly react to traffic, adaptive headlights modify their beams so as not to blind other people. With visually striking displays, dynamic taillights convey intentions for braking and turning. Beyond these developments, integrated pedestrian identification and lane departure alerts will soon make roads safer and brighter for everyone.

Beyond Performance-Based Luxuries Redefined by Light.

Luxurious automobile lighting creates a distinct visual identity that goes beyond simple illumination. Personalized interior lighting customizes the driving experience by setting the mood with a range of colours and intensities, while intricate designs and distinctive DRLs modify exteriors. As you approach your automobile at night, welcoming lights lead the way, resulting in an interior that is perfectly lit. Not only is this symphony of light aesthetically pleasing, but it also stands as a tribute to luxury. Upcoming developments like gesture-controlled lighting and holographic displays promise to further enhance the experience.

Fuel Efficiency Takes the Lead: Illuminating Sustainability

The worldwide automotive lighting market is undergoing a significant transition towards energy-efficient solutions, as environmental concerns gain prominence. LED technology is leading the way, providing a ray of hope for the environment and drivers alike. LED lights beam brighter and use a lot less energy than conventional halogen lamps. There are some concrete advantages to this. For drivers, this translates to increased fuel economy, which lowers petrol prices and lessens reliance on fossil fuels. Greater air quality and a reduction in the transport sector's contribution to climate change are the results of reduced overall emissions.

Global Automotive Lighting Market Restraints and Challenges:

Although the global automotive lighting business is booming, there are still unknowns. Difficulties impede growth even as innovation propels it with eye catching features like laser beams and adaptable headlights. These technologies are luxury items due to their high cost and difficult integration, which puts producers' abilities to the test. The worldwide patchwork created by unclear legislation limits the potential of innovation. Durability issues persist, particularly when complex systems are subjected to challenging conditions. Ultimately, a lot of drivers still don't fully understand how these improvements can help them. Together, we can overcome these obstacles. The keys to reducing costs are improved production, more seamless integration, and unified regulations. Their full potential can be realized by educating customers about the safety, efficiency, and aesthetic value of these lighting wonders. By working together, we can pave the way for an even brighter and safer future for vehicle lighting.

Global Automotive Lighting Market Opportunities:

It is made possible by advanced LED technology, which gives drivers the ability to customize their illumination for the highest level of comfort and flair. Consumers that care about the environment want greener products, and vehicle lighting complies. While solar- and self-powered lighting technologies offer a future powered by clean energy, energy-efficient LEDs lower pollution. The advent of connected lighting systems heralds a new age. Envision automobiles interacting with infrastructure and one another to minimize accidents and enhance traffic efficiency. Integrated headlights with pedestrian recognition provide unmatched safety, while dramatic taillights with eye-catching displays alert onlookers to your intentions. The possibilities are endless in the future. Gesture-controlled interior illumination, holographic displays projected onto the road, and even light fixtures with self-healing capabilities.

AUTOMOTIVE LIGHTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.4% |

|

Segments Covered |

By Application, Technology, Vehicle Type, Sales Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AMS Osram, Cree, Hella, Hyundai Mobis Koito, Luminus Devices, Magneti Marelli Osram Licht AG, Stanley Electric, Valeo |

Global Automotive Lighting Market Segmentation: By Application

-

Exterior Lighting

-

Interior Lighting

Due to laws requiring safety features like headlights, taillights, and brake lights, exterior lighting presently holds the most market share in the vehicle lighting industry. The dominance of this market is partly attributed to advancements in safety-focused technologies such as adaptive headlights and daytime running lights. The market value of external lighting is increased by the quick adoption of technology like LED bulbs and laser lights, which improve performance and aesthetics. Conversely, the interior lighting market is expected to increase at the fastest rate in the upcoming years. Innovations like ambient lighting and technology breakthroughs like LED and OLED displays, driven by consumer demand for comfort and personalisation, open new possibilities. The spread of sophisticated interior lighting systems is further driven by the growing emphasis on safety and the expansion of the luxury car market.

Global Automotive Lighting Market Segmentation: By Technology

-

Halogen

-

LED (Light-Emitting Diode)

-

Xenon

-

Emerging Technologies

The worldwide vehicle lighting market is currently dominated by halogen because of its more affordable price, advanced technology, and useful illumination. With its dependable supply chain and affordable option for manufacturers and cost-conscious customers, halogen holds the biggest market share. The fastest-growing market right now is LEDs, which are predicted to shortly overtake halogen. The rapid expansion of LEDs is driven by their higher efficiency, longer lifespan, flexibility in design, and technological breakthroughs including enhanced brightness. Because LEDs use less energy and produce fewer emissions and better fuel economy, they are becoming more and more popular in the changing automotive lighting market.

Global Automotive Lighting Market Segmentation: By Vehicle Type

-

Passenger Cars

-

Commercial Vehicles

Passenger automobiles rule the worldwide automotive lighting market. The sheer number of passenger cars produced which surpasses that of business vehicles and fuels the need for lighting systems is the primary cause of this popularity. The growing demand for personal automobiles in developing nations is a result of rising disposable income, which in turn drives the rise of the passenger car market. The importance that consumers place on safety and aesthetics elements helps to drive market expansion. But in the upcoming years, the market for electric and hybrid cars is expected to develop at the quickest rate. The exponential rise of the worldwide electric car market, which is still expanding and shows no signs of slowing down, is what is driving this surge. Specialised lighting solutions are required since electric and hybrid vehicles have different lighting requirements because of their specific functionality and design aesthetics.

Global Automotive Lighting Market Segmentation: By Sales Channel

-

OEM (Original Equipment Manufacturers

-

Aftermarket

Most lighting systems sold nowadays are sold by OEMs (Original Equipment Manufacturers), primarily because manufacturers pre-install lighting systems in new cars. But in the next years, the aftermarket is expected to develop at the quickest rate. This spike in demand for replacement parts, especially lighting systems, can be linked to several variables, one of them being the average age of cars. The industry is expanding because of consumers' growing desire to personalise their cars with aftermarket lighting upgrades such LED upgrades and decorative lighting. The availability and affordability of technologies like adaptive headlights and laser lights in the aftermarket, together with other advancements in lighting technology, are driving demand even more. Moreover, the growing market for electric cars (EVs).

Global Automotive Lighting Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Throughout the forecast period, Asia Pacific is anticipated to be the automotive lighting market with the highest profitability. Over the past few years, Asia Pacific countries like China and India have seen notable increases in automotive manufacturing and sales, primarily in the medium-to premium luxury car segment. Asia Pacific is predicted to see an increase in the manufacturing of passenger cars, with India experiencing the strongest growth rate. Depending on the state of the national economy, the area offers a suitable selection of both high-end and cheap cars. For instance, there is a substantial demand for halogen, Xenon/HID, and LED since China and India produce more economy and mid-range automobiles. On the other hand, luxury car adoption rates are greater in South Korea and Japan, where LED lighting is the norm.

COVID-19 Impact Analysis on the Global Automotive Lighting Market:

A brief shadow was thrown by COVID-19 over the worldwide automotive lighting market. Production was stopped by lockdowns and supply chain disruptions, while luxury lighting upgrades were shelved by consumers on a tight budget. Resources became scarce, and R&D stagnated. Still, the market is recovering thanks to resurgent demand and rearranged priorities. While energy-efficient LEDs are being pushed towards adoption by sustainability, safety concerns are driving interest in features like pedestrian detection and adaptive headlights. The digital push of the epidemic creates opportunities for intelligent, networked lighting systems that may interact with infrastructure and other cars. Ultimately, the industry is positioned to shine brighter, focused on safety, sustainability, and a connected future, even though the pandemic dimmed its brilliance.

Recent Trends and Developments in the Global Automotive Lighting Market:

A development collaboration between OSRAM Continental and REHAU aims to incorporate lighting into external components, providing automobile manufacturers with innovative lighting options that improve functionality and design flexibility. For rear combination lamps, Hella unveiled a revolutionary lighting innovation called Hella FlatLight technology. A Memorandum of Understanding (MoU) was signed by Samvardhana Motherson Automotive Systems Group BV (SMRPBV), a division of Motherson Group, and Marelli Automotive Lighting to investigate a technology collaboration focused on intelligently lighted external body components. Valeo debuted their revolutionary 360° lighting system at the Shanghai Auto Show. This technology surrounds the car with a band of light, projecting instantaneous, clear signs that other drivers can see from a distance. Pedestrians, cyclists, and scooter riders are especially susceptible to these signals

Key Players:

-

AMS Osram

-

Cree

-

Hella

-

Hyundai Mobis

-

Koito

-

Luminus Devices

-

Magneti Marelli

-

Osram Licht AG

-

Stanley Electric

-

Valeo

Chapter 1. Automotive Lighting Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Lighting Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Lighting Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Lighting Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Lighting Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Lighting Market – By Technology

6.1 Introduction/Key Findings

6.2 Halogen

6.3 LED (Light-Emitting Diode)

6.4 Xenon

6.5 Emerging Technologies

6.6 Y-O-Y Growth trend Analysis By Technology

6.7 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Automotive Lighting Market – By Application

7.1 Introduction/Key Findings

7.2 Exterior Lighting

7.3 Interior Lighting

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Automotive Lighting Market – By Vehicle Type

8.1 Introduction/Key Findings

8.2 Passenger Cars

8.3 Commercial Vehicles

8.4 Y-O-Y Growth trend Analysis By Vehicle Type

8.5 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 9. Automotive Lighting Market – By Sales Channel

9.1 Introduction/Key Findings

9.2 OEM (Original Equipment Manufacturer)

9.3 Aftermarket

9.4 Y-O-Y Growth trend Analysis By Sales Channel

9.5 Absolute $ Opportunity Analysis By Sales Channel, 2024-2030

Chapter 10. Automotive Lighting Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Technology

10.1.2.1 By Application

10.1.3 By Vehicle Type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Technology

10.2.3 By Application

10.2.4 By Vehicle Type

10.2.5 By Sales Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Technology

10.3.3 By Application

10.3.4 By Vehicle Type

10.3.5 By Sales Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Technology

10.4.3 By Application

10.4.4 By Vehicle Type

10.4.5 By Sales Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Technology

10.5.3 By Application

10.5.4 By Vehicle Type

10.5.5 By Sales Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Automotive Lighting Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 AMS Osram

11.2 Cree

11.3 Hella

11.4 Hyundai Mobis

11.5 Koito

11.6 Luminus Devices

11.7 Magneti Marelli

11.8 Osram Licht AG

11.9 Stanley Electric

11.10 Valeo

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global automotive lighting Market size was exhibited at USD 22.50 billion in 2023.

The worldwide Global Market growth is estimated to be 4.4% from 2024 to 2030.

The Global Automotive Lighting Market is segmented By Technology (Halogen, LED (Light-Emitting Diode), Xenon, Emerging Technologies).

Future trends and opportunities for the Global Automotive Lighting Market With connectivity, sustainability, and personalisation, car lighting has a bright future. Anticipate driver-customized interiors with control over colour and intensity, environmentally friendly features like solar-powered lights, and smart systems that connect to other cars and infrastructure to improve efficiency and safety. Our relationship with cars is changed by the futuristic touch of gesture control and holographic displays. Get ready for a voyage ahead that will be safer, brighter, and more connected!

The Global Automotive Lighting Market was first negatively impacted by COVID-19 due to production delays, cost-conscious consumers, and slower research and development. With increased demand, an emphasis on safety features like adaptive headlights, and a drive towards energy-efficient LEDs, it is making a comeback. A brighter future is possible with the help of smart, networked lighting solutions, made possible by the pandemic's acceleration of digitization.