Automotive Insurance Market Size (2025 – 2030)

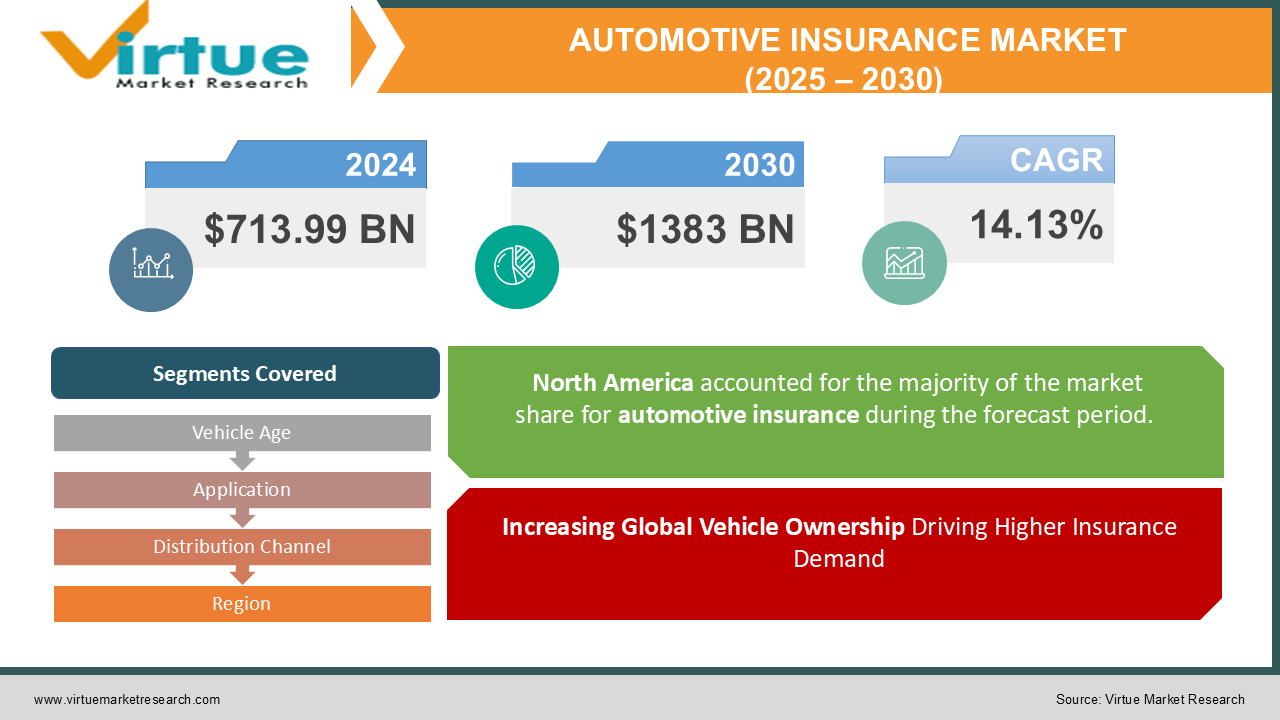

The Global Automotive Insurance Market was valued at USD 713.99 billion in 2024 and is projected to reach a market size of USD 1383 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 14.13%.

The automotive insurance market is a vital sector within the broader insurance industry, providing financial protection against vehicle-related risks such as accidents, theft, and damage. It encompasses various coverage types, including liability, collision, and comprehensive insurance, catering to individuals, businesses, and commercial fleets. Driven by factors such as increasing vehicle ownership, regulatory mandates, and technological advancements like telematics and AI-driven risk assessment, the market is highly competitive with insurers leveraging data analytics to offer personalized policies. The rise of electric vehicles, autonomous cars, and digital insurance platforms is reshaping the industry, influencing pricing models and customer engagement strategies.

Key Market Insights:

-

The automotive insurance market is evolving rapidly, driven by factors such as rising vehicle ownership, technological advancements, and regulatory changes. One key trend is the increasing use of telematics-based insurance, where insurers leverage real-time driving data to offer personalized premiums. Studies indicate that telematics adoption has grown significantly, with over 30% of auto insurers now offering usage-based insurance (UBI) policies. Additionally, the rise in electric vehicle (EV) adoption is influencing underwriting models, as EV repairs tend to be costlier than traditional vehicles, leading insurers to adjust pricing structures accordingly.

-

Another significant factor impacting the market is the surge in claim costs due to inflation and supply chain disruptions. Recent data shows that the average cost of car repairs has increased by over 15% in the past year, contributing to higher insurance premiums. Severe weather events have also led to a rise in comprehensive insurance claims, prompting insurers to reassess risk pricing models.

-

Despite these challenges, the industry is witnessing digital transformation, with insurers integrating AI and machine learning for faster claims processing and risk assessment. Online policy purchases and digital claim settlements have surged, with over 60% of consumers now preferring digital channels for managing their auto insurance. As the market continues to evolve, insurers are focusing on customer-centric innovations, including pay-per-mile policies, AI-driven claims automation, and enhanced risk prediction models to stay competitive in an increasingly dynamic landscape.

-

Car insurance rates have sharply increased, with some drivers paying up to $200 more per month. The average cost of full coverage in Washington has risen to $1,845, reflecting a 12% increase since February 2024. Nationwide, full coverage car insurance averages $2,670 annually, with rates expected to climb by 5% by the end of 2025 due to factors such as inflation, natural disasters, and advanced vehicle technologies.

Automotive Insurance Market Drivers:

Increasing Global Vehicle Ownership Driving Higher Insurance Demand

The surge in vehicle ownership worldwide is one of the primary factors fueling the growth of the automotive insurance market. As urbanization increases and disposable incomes rise, more individuals and businesses are investing in personal and commercial vehicles. With many governments mandating vehicle insurance as a legal requirement, the market is experiencing consistent expansion. Additionally, factors like financing options and leasing services contribute to more people acquiring vehicles, further increasing the demand for comprehensive insurance coverage. Insurers are adapting to this trend by offering customized policies, competitive pricing, and enhanced services to cater to the growing number of policyholders.

Telematics and Artificial Intelligence Revolutionizing Insurance Pricing Models

Technological advancements in telematics and artificial intelligence (AI) are transforming the way insurance companies assess risk and price policies. Telematics devices installed in vehicles collect real-time driving data, allowing insurers to personalize premiums based on driver behavior, distance traveled, and vehicle usage patterns. This shift from traditional fixed-rate policies to dynamic, usage-based insurance (UBI) provides a fairer and more accurate pricing model for customers. AI also enhances claims processing by detecting fraudulent activities, automating assessments, and expediting settlements. These innovations improve efficiency, reduce operational costs, and enhance customer satisfaction by offering more transparent and tailored insurance solutions.

Electric and Autonomous Vehicles Changing Insurance Risk Assessments

The increasing adoption of electric and autonomous vehicles is reshaping risk evaluation in automotive insurance. EVs often come with higher repair costs, impacting premium calculations. Meanwhile, liability concerns around self-driving technology are prompting insurers to develop specialized policies for these new vehicle categories.

Growing Cybersecurity Risks and Fraudulent Claims in Digital Insurance

As the automotive insurance industry shifts towards digitalization, it faces increasing threats related to cybersecurity and fraudulent claims. The storage and transmission of sensitive customer data online make insurers vulnerable to hacking, data breaches, and identity theft. Additionally, fraudulent claims, such as staged accidents and false reports, cost the industry billions of dollars annually. To combat these challenges, insurers are implementing advanced fraud detection technologies like blockchain, AI-driven monitoring systems, and machine learning algorithms. Strengthening cybersecurity measures and fraud prevention strategies will be crucial for insurers to maintain trust, ensure policyholder protection, and uphold market integrity in the evolving digital landscape.

Automotive Insurance Market Restraints and Challenges:

Fraud, Cybersecurity Risks, and Evolving Vehicle Technology Disrupting Automotive Insurance Market Growth

The automotive insurance market faces several restraints and challenges that impact its growth and stability. One of the major challenges is the rising number of fraudulent claims, which cost insurers billions annually and lead to higher premiums for policyholders. Additionally, the increasing complexity of electric and autonomous vehicles presents difficulties in risk assessment and policy pricing, as insurers must adapt to new liability structures and costly repairs. Cybersecurity threats are also a growing concern, as the digitalization of insurance services makes companies more vulnerable to data breaches and hacking attempts. Stringent government regulations and compliance requirements vary across regions, making it difficult for insurers to standardize policies globally. Moreover, the lack of awareness and affordability in developing nations limits market penetration, as many vehicle owners remain uninsured. The rise of usage-based insurance (UBI) and AI-driven pricing models, while innovative, also pose challenges related to data privacy and consumer acceptance. Market competition is intensifying, forcing insurers to balance profitability with competitive pricing. Economic uncertainties, inflation, and fluctuating vehicle costs further impact premium structures, making it crucial for insurers to continuously adapt to industry changes and evolving customer expectations.

Automotive Insurance Market Opportunities:

The automotive insurance market presents substantial growth opportunities driven by the adoption of telematics, AI-driven pricing, and usage-based insurance (UBI) models. As electric and autonomous vehicles become more prevalent, there is an increasing demand for specialized policies tailored to their unique risks, including high repair costs and liability issues. The rise of digital platforms and mobile applications enhances consumer accessibility, making it easier for policyholders to purchase and manage insurance. Additionally, expanding into emerging markets with low insurance penetration offers significant room for growth, especially as vehicle ownership and government mandates increase the need

AUTOMOTIVE INSURANCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

14.13% |

|

Segments Covered |

By Vehicle Age, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

State Farm, Geico, Progressive, Allstate, AXA, Liberty Mutual, Zurich Insurance Group, Nationwide, Berkshire Hathaway, Travelers, The Hartford, Munich Re, Swiss Re |

Automotive Insurance Market Segmentation: By Distribution Channel

-

Insurance Agents/Brokers

-

Direct Response

-

Banks

-

Others

The insurance agents and broker are the dominant distribution channel in the automotive insurance market. These intermediaries provide personalized services, helping customers navigate complex policies and offering expert advice. They have strong relationships with insurers and access to a wide range of products, making them the preferred choice for many consumers seeking tailored coverage.

The direct response segment is experiencing the fastest growth due to the increasing shift towards online platforms and digital interactions. Consumers are increasingly purchasing automotive insurance directly from insurers via websites, mobile apps, and call centers, as it offers convenience, competitive pricing, and faster policy issuance.

Automotive Insurance Market Segmentation: By Vehicle Age

-

New Vehicles

-

Used Vehicles

The new vehicle segment is the dominant sub-segment in the automotive insurance market. Consumers who purchase new vehicles typically opt for comprehensive coverage to protect their investment, including additional options such as warranties and roadside assistance.

The used vehicle segment is the fastest growing in the automotive insurance market. As the market for pre-owned cars expands due to rising affordability and increasing consumer preference for used vehicles, the demand for insurance coverage for these cars is also growing.

Automotive Insurance Market Segmentation: By Application

-

Personal

-

Commercial

Personal automotive insurance is leading in the market, driven by the large number of individual vehicle owners. As personal transportation remains essential for many people, the demand for these policies continues to dominate the automotive insurance market.

The commercial automotive insurance is expanding at the fastest rate, largely due to the growth in business operations, fleet management, and e-commerce logistics. Companies with delivery vehicles, service fleets, and transportation needs require specialized insurance products to protect their assets and minimize operational risks. As demand for goods and services grows globally, the need for tailored commercial vehicle insurance solutions increases.

Automotive Insurance Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America remains the dominant region in the automotive insurance market, contributing the largest share due to its well-established automotive industry and high vehicle ownership rates. The market is driven by a mature consumer base and high insurance penetration, with consumers opting for comprehensive coverage options. The region's strong economy, extensive vehicle fleets, and advanced technological infrastructure ensure its continued dominance in the global market.

Asia-Pacific is the fastest growing region in the automotive insurance market, driven by the rapid growth of vehicle sales and increasing middle-class populations in countries like China and India. The rise in disposable income and urbanization is fueling the demand for automobiles and, consequently, for automotive insurance. Additionally, advancements in technology, such as mobile apps and telematics, are making insurance more accessible and affordable in this region, further contributing to its rapid growth.

COVID-19 Impact Analysis on the Global Automotive Insurance Market:

The COVID-19 pandemic had a significant impact on the global automotive insurance market, leading to both challenges and opportunities. With lockdowns and travel restrictions reducing vehicle usage, insurers experienced a decline in claims, leading to increased profitability. However, economic uncertainty and reduced new vehicle sales resulted in lower policy purchases, affecting market growth. Many insurers introduced flexible premium payment plans and usage-based insurance (UBI) models to adapt to changing consumer behavior. The rise of remote work also shifted driving patterns, prompting insurers to reassess risk models. As the market recovers, digital transformation and telematics-based policies continue to shape the industry's future.

Latest Trends/ Developments:

The automotive insurance sector is witnessing major shifts with the rise of connected vehicles, AI-driven risk assessment, and embedded insurance solutions. Insurers are integrating telematics and IoT devices to offer pay-as-you-drive and pay-how-you-drive policies, making coverage more personalized. The surge in electric vehicle (EV) adoption is also influencing insurance models, as EV repairs and battery replacements tend to be more expensive.

Recent developments in the automotive insurance market include the increasing adoption of telematics and usage-based insurance (UBI) models, allowing insurers to offer more personalized and data-driven policies. The rise of AI and machine learning is improving risk assessment, claims processing, and fraud detection. Insurers are also integrating digital platforms and mobile apps to enhance customer experience, offering convenience and faster service. Additionally, the growth of electric and autonomous vehicles is prompting insurers to develop specialized policies that address the unique risks and repair costs associated with these new technologies.

Key Players:

-

State Farm

-

Geico

-

Progressive

-

Allstate

-

AXA

-

Liberty Mutual

-

Zurich Insurance Group

-

Nationwide

-

Berkshire Hathaway

-

Travelers

-

The Hartford

-

Munich Re

-

Swiss Re

Chapter 1. Automotive Insurance Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Insurance Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Insurance Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Insurance Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Insurance Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Insurance Market – By Distribution Channel

6.1 Introduction/Key Findings

6.2 Insurance Agents/Brokers

6.3 Direct Response

6.4 Banks

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Distribution Channel

6.7 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 7. Automotive Insurance Market – By Application

7.1 Introduction/Key Findings

7.2 Personal

7.3 Commercial

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Automotive Insurance Market – By Vehicle Age

8.1 Introduction/Key Findings

8.2 New Vehicles

8.3 Used Vehicles

8.4 Y-O-Y Growth trend Analysis By Vehicle Age

8.5 Absolute $ Opportunity Analysis By Vehicle Age, 2025-2030

Chapter 9. Automotive Insurance Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Distribution Channel

9.1.3 By Application

9.1.4 By Vehicle Age

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Distribution Channel

9.2.3 By Application

9.2.4 By Vehicle Age

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Distribution Channel

9.3.3 By Application

9.3.4 By Vehicle Age

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Distribution Channel

9.4.3 By Application

9.4.4 By Vehicle Age

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Distribution Channel

9.5.3 By Application

9.5.4 By Vehicle Age

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Automotive Insurance Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 State Farm

10.2 Geico

10.3 Progressive

10.4 Allstate

10.5 AXA

10.6 Liberty Mutual

10.7 Zurich Insurance Group

10.8 Nationwide

10.9 Berkshire Hathaway

10.10 Travelers

10.11 The Hartford

10.12 Munich Re

10.13 Swiss Re

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automotive Insurance Market was valued at USD 713.99 billion in 2024 and is projected to reach a market size of USD 1383 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 14.13%.

Key drivers of the global automotive insurance market include the increasing vehicle ownership and the rise in accident claims, prompting demand for comprehensive coverage. Additionally, advancements in technology like telematics and AI are driving more personalized and efficient insurance solutions.

Based on vehicle age, the Global Automotive Insurance Market is segmented into new vehicle and old vehicles.

North America is the most dominant region for the Global Automotive Insurance Market.

State Farm, Geico, Progressive, and Allstate are the key players operating in Global Automotive Insurance Market.