Automotive Filter Paper Market Size (2024 – 2030)

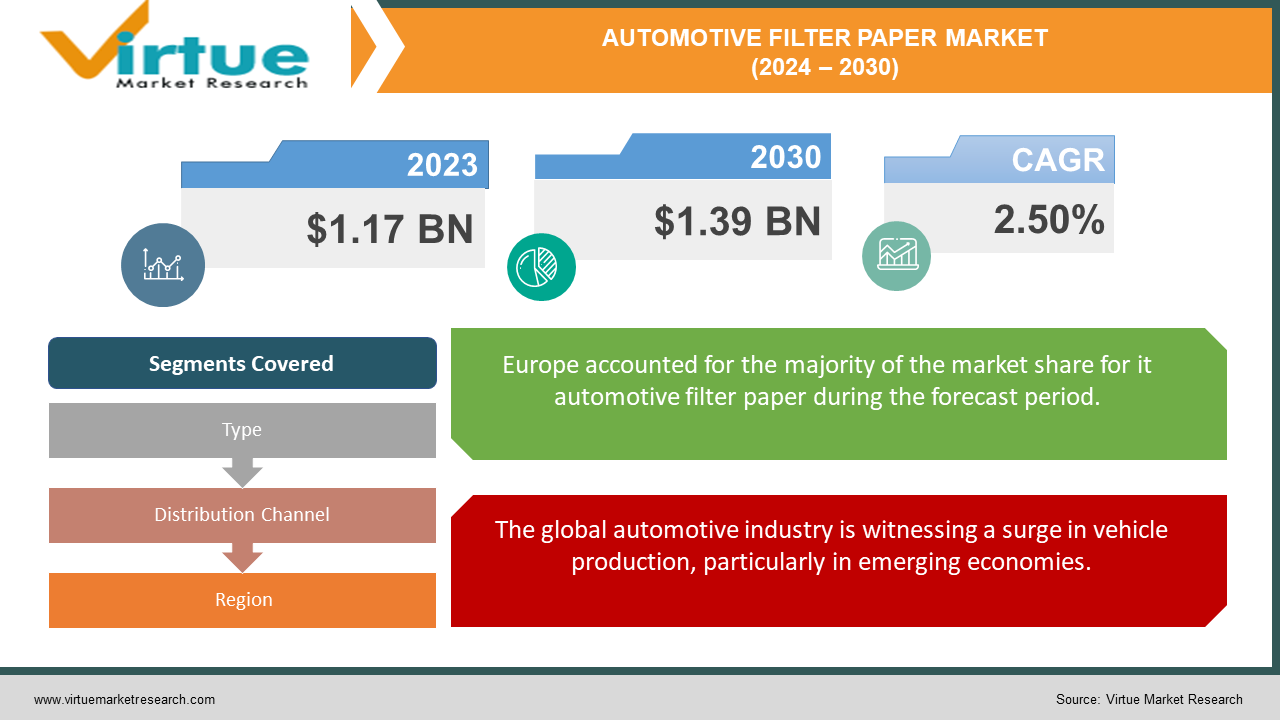

The Global Automotive Filter Paper Market was valued at USD 1.17 Billion in 2023 and is projected to reach a market size of USD 1.39 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 2.50%.

Despite its seeming simplicity, automotive filter paper is essential to maintaining the smooth and effective operation of your vehicle. These inconspicuous paper components serve as silent protectors in a variety of filtering systems, guaranteeing that impurities are trapped in the oil and that pure air enters the engine. Air filters stop dust, debris, and other airborne pollutants from getting into the engine. They are found in the engine intake system. By capturing these particles, filter paper makes sure that only clean air enters the combustion chamber, resulting in effective fuel burning. By drawing impurities such as metal shavings, dirt, and combustion byproducts out of engine oil, oil filters are essential to engine lubrication. This stops the pollutants from moving around inside the engine and wearing it down.

Key Market Insights:

Approximately 55% of the vehicle filter paper market is occupied by air filters, with oil filters coming in second at 40%.

Stricter emission laws in important markets are predicted to fuel an annual growth of more than 8% in the need for high-efficiency air filters that can capture PM2.5 particles.

While synthetic fiber air filters can last up to 18,000 miles, cellulose paper-based air filters are thought to have an average lifespan of about 12,000 miles.

More than 70% of automobile filter paper sales are made by consumers in the aftermarket sector, where they buy replacement filters for their cars.

Online sales channels for car filters are expanding quickly, already accounting for 10% of the market and providing customers with easy access to replacement filters.

Basic air filters for passenger cars typically cost between $5 and $10, but high-performance filters can cost up to $20 or more.

Oil filters normally range in price from $10 to $20, with quality filters that have longer lifespans costing closer to $30.

The cost of cabin air filters can vary from USD 15 to USD 50, contingent upon the brand, quality, and other features like activated carbon technology or odor absorption.

By 2030, it is anticipated that the world's passenger automobile production will exceed 80 million units yearly, fueling the need for replacement automotive

Automotive Filter Paper Market Drivers:

In recent years, public awareness regarding the detrimental effects of air pollution on human health has risen significantly.

Manufacturers of filter paper are always coming up with innovative ways to create air filters and new materials. Because they filter better than conventional cellulose paper, synthetic fibers like nylon and polyester are becoming more and more popular. Better PM particle capture rates are provided by these synthetic media, ensuring that cleaner air reaches the engine and lowering hazardous emissions. Research and development endeavors are examining the possibilities of nanofiber technology in the manufacturing of filter paper. Because of their incredibly small dimensions, nanofibers can collect even the smallest airborne particles. Although technology is still in its infancy, the incorporation of nanofibers has the potential to transform air filtration and produce an extremely effective filter paper medium.

The global automotive industry is witnessing a surge in vehicle production, particularly in emerging economies.

The longer-lasting formulas of contemporary engine oils and lubricants enable longer periods between oil changes. To properly capture impurities and preserve ideal oil performance, however, this calls for the usage of premium oil filters with a longer lifespan. The need for durable and effective filter paper is being driven by this development. Comfort and health in the cabin are becoming more and more important to modern consumers. As a result, there is an increasing need for high-efficiency cabin air filters. These filters can include features like activated carbon technology to absorb hazardous gases and unpleasant odors in addition to trapping dust, pollen, and allergies. Manufacturers of filter papers are therefore creating specialized media to meet these changing consumer requirements.

Automotive Filter Paper Market Restraints and Challenges:

Because electric motors in electric vehicles require less lubrication, there is a large decrease in the need for oil filters and the filter paper that is used in them. Electric vehicles (EVs) have thermal management systems to cool their batteries and electric motors even though they don't need air filters for combustion. Although filter elements might be used in these systems, they probably won't be as necessary as conventional engine air filters. Extended oil change intervals are becoming more and more popular in the car industry. Driving farther between oil changes is made possible by improvements in filter efficiency and engine oil technology. Although this results in fewer maintenance expenses for customers, it also lessens the need for filter replacements as a whole, which affects the demand for filter paper.

Automotive Filter Paper Market Opportunities:

To comply with stricter regulations, car manufacturers will require air filters capable of capturing finer particles like PM2.5 and PM10. This necessitates the development and production of high-efficiency filter paper media with improved filtration capabilities. Synthetic fibers like polyester and nylon offer superior filtration efficiency compared to cellulose paper. Investing in research and development of advanced filter media materials will allow manufacturers to cater to the growing demand for high-performance filters. Close collaboration between filter paper manufacturers and automotive filter producers is crucial to developing filter elements that meet the specific performance requirements mandated by stricter emission regulations. Developing filter paper with embedded sensors or RFID tags could enable real-time monitoring of filter performance. This data can be transmitted to the vehicle's onboard computer or a dedicated app, alerting drivers when filter replacement is necessary.

AUTOMOTIVE FILTER PAPER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2.50% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Donaldson Company, Freudenberg Filtration Technologies, Hollingsworth & Vose Company, Ahlstrom-Munksjö, MANN+HUMMEL, MAHLE GmbH, Sogefi S.p.A., Robert Bosch GmbH, Denso Corporation, Cummins Inc., Baldwin Filters, Wix Filters, Champion Laboratories |

Automotive Filter Paper Market Segmentation: By Type

-

Cellulose Paper

-

Synthetic Fibers

Cellulose Paper is the traditional and most widely used material for automotive filter paper. It is derived from wood pulp and offers a good balance of cost, efficiency, and ease of manufacture. Currently holds the dominant share of the automotive filter paper market, accounting for roughly 65-70% of the market value. This dominance is attributed to its affordability and widespread use in standard engine air and oil filters. Cellulose paper is a relatively inexpensive material to produce, making it a cost-efficient choice for filter manufacturers. This translates to lower filter prices for consumers. The production of cellulose paper filter media has well-established supply chains, ensuring consistent availability and ease of sourcing for manufacturers.

The synthetic fibers segment is projected to be the fastest-growing segment in the automotive filter paper market. As regulations governing air pollution become more stringent, the demand for filters capable of capturing finer particles like PM2.5 increases. Synthetic fibers offer superior filtration efficiency compared to cellulose paper in this regard. The growing popularity of high-performance vehicles and the increasing focus on engine longevity drive the demand for premium filters with enhanced filtration capabilities. Synthetic fibers cater to this need.

Automotive Filter Paper Market Segmentation: By Distribution Channel

-

Original Equipment Manufacturers (OEMs)

-

Distributors & Wholesalers

-

Aftermarket Sales (Repair Shops & Independent Retailers)

Original Equipment Manufacturers (OEMs) channel caters to the supply of filter paper to car manufacturers for installation in new vehicles. OEMs typically have established relationships with specific filter paper manufacturers and often have stringent quality control requirements. OEMs currently hold the dominant position in the automotive filter paper market. OEMs often have long-standing partnerships with filter paper manufacturers, ensuring a reliable supply chain and adherence to specific performance specifications. Car manufacturers prioritize quality and brand reputation. Partnering with established filter paper manufacturers. provides a level of assurance regarding the performance and reliability of the filter media.

The aftermarket segment presents a significant and fastest-growing distribution channel. As the average age of vehicles on the road increases, the demand for replacement filters grows proportionally. Online platforms offer consumers a wider selection of filter paper options at competitive prices, with convenient home delivery options. The increasing popularity of DIY car maintenance is leading to a rise in demand for readily available replacement filter paper through various aftermarket channels. Independent repair shops often offer competitive pricing for filter replacements and may source their filter paper from a wider range of aftermarket distributors.

Automotive Filter Paper Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

With a sizable 35% of the worldwide market share, Europe has emerged as the most dominating region in the automobile filter paper industry. The need for effective filtering systems has been largely driven by the region's rigorous emission standards and dedication to environmental sustainability. Germany is a prominent participant in Europe because of its robust automotive sector and emphasis on the economy and performance of vehicles. German manufacturers are renowned for their emphasis on cutting-edge engineering and stringent adherence to pollution regulations, which has made the use of premium filter sheets in their cars necessary. The dominance of the area in the automobile filter paper market has also been greatly influenced by other European nations including France, Italy, and the United Kingdom.

With a current market share of over 28%, the Asia-Pacific region has emerged as the automotive filter paper market with the quickest rate of growth. The fast industrialization, urbanization, and rising vehicle demand, especially in nations like China, India, and Japan, are all responsible for this region's rise. The largest automobile market in the world, China, has been a key factor in the expansion of the area. The nation's flourishing automobile sector and the growing focus on vehicle upkeep have increased demand for premium filter papers. Furthermore, China's initiatives to mitigate environmental issues and lower emissions have increased demand for effective filtration systems.

COVID-19 Impact Analysis on the Automotive Filter Paper Market:

The world's car manufacturing fell off dramatically as a result of lockdowns and social distancing policies. As a result, fewer new cars were coming off the assembly lines, which directly translated to a decrease in demand for automobile filters, especially those constructed using filter paper. Travel bans and lockdowns hampered the flow of raw materials needed to produce filter paper, such as wood pulp and synthetic fibers. This made it more difficult for producers to supply the demand that was already there by causing delays and shortages. The overall amount of vehicles used decreased as a result of stay-at-home limitations and economic uncertainties. By driving less, people put off necessary maintenance chores like changing filters, which further reduced the need for filter paper. The production of filter paper was compelled to slow down or possibly temporarily cease operations by manufacturers due to social distancing norms and worker safety concerns.

Latest Trends/ Developments:

Nanotechnology is making its mark on the automotive filter paper market. Nanofibers, with their incredibly small diameter, offer exceptional filtration capabilities. Filter paper incorporating nanofibers can capture even the finest contaminants, improving engine protection and potentially extending engine life. The trend is moving away from traditional single-material filter paper. Manufacturers are experimenting with composite media that combines different materials like cellulose fibers with synthetic fibers or activated carbon. This allows for tailored filtration properties, addressing specific engine needs and contaminant types. Sustainability is a major concern, and the filter paper market is embracing bio-based materials. Cellulose derived from bamboo or other fast-growing plants offers a renewable and eco-friendly alternative to traditional wood pulp. Further research is ongoing to explore the potential of other bio-based materials.

Key Players:

-

Donaldson Company

-

Freudenberg Filtration Technologies

-

Hollingsworth & Vose Company

-

Ahlstrom-Munksjö

-

MANN+HUMMEL

-

MAHLE GmbH

-

Sogefi S.p.A.

-

Robert Bosch GmbH

-

Denso Corporation

-

Cummins Inc.

-

Baldwin Filters

-

Wix Filters

-

Champion Laboratories

Chapter 1. Automotive Filter Paper Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Filter Paper Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Filter Paper Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Filter Paper Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Filter Paper Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Filter Paper Market – By Type

6.1 Introduction/Key Findings

6.2 Cellulose Paper

6.3 Synthetic Fibers

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Automotive Filter Paper Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Original Equipment Manufacturers (OEMs)

7.3 Distributors & Wholesalers

7.4 Aftermarket Sales (Repair Shops & Independent Retailers)

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Automotive Filter Paper Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Automotive Filter Paper Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Donaldson Company

9.2 Freudenberg Filtration Technologies

9.3 Hollingsworth & Vose Company

9.4 Ahlstrom-Munksjö

9.5 MANN+HUMMEL

9.6 MAHLE GmbH

9.7 Sogefi S.p.A.

9.8 Robert Bosch GmbH

9.9 Denso Corporation

9.10 Cummins Inc.

9.11 Baldwin Filters

9.12 Wix Filters

9.13 Champion Laboratories

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Governments worldwide are implementing stricter emission regulations to combat air pollution. This mandates car manufacturers to equip vehicles with high-performance filters, driving demand for advanced filter paper that captures more pollutants and reduces harmful emissions.

The globalized nature of the automotive industry makes it vulnerable to disruptions in the supply chain. Events like natural disasters, trade wars, or even pandemics can cause shortages of raw materials like wood pulp or synthetic fibers, impacting filter paper production.

Donaldson Company, Freudenberg Filtration Technologies, Hollingsworth & Vose Company, Ahlstrom-Munksjö, MANN+HUMMEL, MAHLE GmbH, Sogefi S.p.A., Robert Bosch GmbH, Denso Corporation, Cummins Inc., Baldwin Filters, Wix Filters.

With a sizable 35% of the worldwide market share, Europe has emerged as the most dominating region in the automobile filter paper industry.

With a current market share of over 25%, the Asia-Pacific region has emerged as the automotive filter paper market with the quickest rate of growth.