Automotive Electronics Market Size (2025 – 2030)

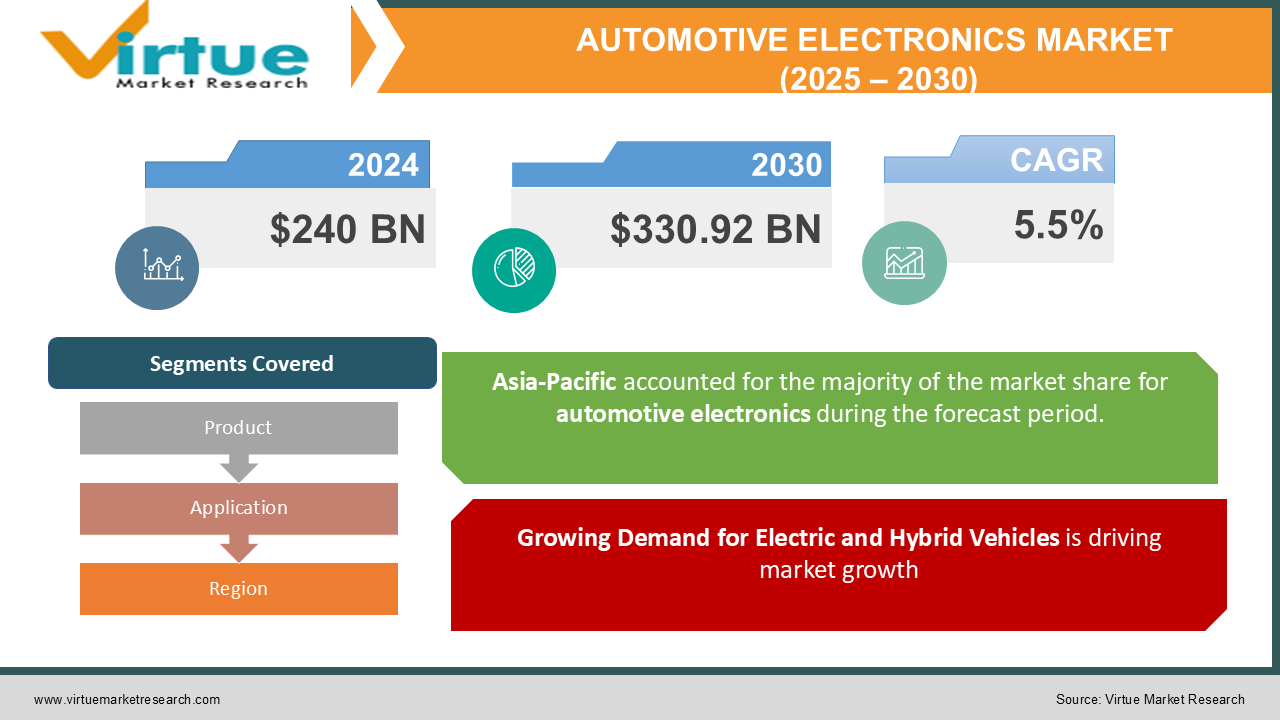

The Global Automotive Electronics Market was valued at USD 240 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030. By the end of the forecast period, the market is expected to reach USD 330.92 billion.

These systems include power electronics, in-vehicle networking, infotainment systems, advanced driver-assistance systems (ADAS), and more. Growing consumer demand for smart, connected, and energy-efficient vehicles, along with stringent regulations on safety and emissions, are key factors driving market growth. Rapid advancements in technologies such as AI, IoT, and autonomous driving are further shaping the industry’s landscape.

Key Market Insights

- The adoption of advanced driver-assistance systems (ADAS) contributes significantly, with the segment growing at a CAGR of 11.2% due to regulatory mandates and consumer demand for safety features.

- Powertrain electronics, including battery management systems (BMS) in electric vehicles (EVs), account for approximately 30% of the total market revenue.

- The increasing penetration of electric and hybrid vehicles is driving the demand for automotive power electronics, which will grow at a CAGR of over 12% during the forecast period.

- Infotainment systems, which represent 20% of the market share, are seeing growth as carmakers focus on delivering personalized in-vehicle experiences through integrated platforms and voice assistants.

- Asia-Pacific dominates the market with a 40% share, driven by the presence of major automakers and the increasing adoption of EVs in China, Japan, and South Korea.

Global Automotive Electronics Market Drivers

Growing Demand for Electric and Hybrid Vehicles is driving market growth:

The global push toward sustainable transportation is driving the adoption of electric and hybrid vehicles, which are heavily reliant on automotive electronics. Components such as battery management systems (BMS), inverters, and electric powertrains are essential for EV performance and efficiency. Governments worldwide are offering subsidies, tax benefits, and incentives to accelerate EV adoption, further fueling the demand for advanced electronics. Major automakers are investing in the development of EV models equipped with cutting-edge electronic systems to meet regulatory standards and cater to environmentally conscious consumers. As the EV market expands, the demand for automotive electronics is expected to rise significantly.

Advancements in ADAS and Autonomous Driving Technologies is driving market growth:

ADAS and autonomous driving technologies are transforming the automotive industry, with safety and convenience being top priorities. Automotive electronics enable critical functions such as adaptive cruise control, lane-keeping assist, parking assistance, and collision avoidance. Stringent safety regulations, such as Euro NCAP and NHTSA ratings, mandate the integration of advanced safety features in vehicles, boosting the adoption of ADAS systems. Moreover, the development of Level 4 and Level 5 autonomous vehicles is driving innovations in sensor fusion, AI-powered processors, and high-performance computing platforms, creating lucrative opportunities for automotive electronics manufacturers.

Rising Consumer Demand for Connected and Smart Vehicles is driving market growth:

The growing consumer preference for connected vehicles is driving the integration of sophisticated electronics in modern automobiles. Connected cars equipped with IoT-enabled infotainment systems, telematics, and navigation features enhance the overall driving experience. Vehicle-to-everything (V2X) communication systems, enabled by 5G networks, are becoming a key area of focus for automakers, allowing real-time data exchange between vehicles, infrastructure, and devices. The ability to provide personalized in-car experiences through artificial intelligence and voice-controlled systems further increases the demand for advanced automotive electronics.

Global Automotive Electronics Market Challenges and Restraints

High Costs of Advanced Automotive Electronics is restricting market growth:

The integration of advanced electronics in vehicles adds significant costs, posing challenges for manufacturers and consumers. Components such as sensors, processors, and control units are expensive, especially in EVs and high-end vehicles with advanced features like ADAS and infotainment systems. These costs can deter adoption in price-sensitive markets, particularly in developing regions. Moreover, manufacturers face challenges in balancing the need for cost-efficient solutions with high-performance requirements. The reduction of these costs through economies of scale and innovations in manufacturing processes is critical for the mass adoption of advanced automotive electronics.

Semiconductor Shortages and Supply Chain Disruptions is restricting market growth:

The automotive industry continues to face challenges due to global semiconductor shortages and supply chain disruptions. Automotive electronics rely heavily on semiconductors for their functionality, and the demand-supply gap has impacted vehicle production timelines and revenue streams for automakers. Factors such as the COVID-19 pandemic, geopolitical tensions, and increasing demand from other industries have exacerbated the situation. Although efforts are being made to ramp up semiconductor production, the shortage is expected to persist in the short term, creating uncertainties for the automotive electronics market.

Market Opportunities

The Automotive Electronics Market presents significant opportunities, particularly in emerging domains like electric vehicles, autonomous driving, and connected cars. With governments worldwide emphasizing decarbonization, the shift toward EVs is creating demand for powertrain electronics, energy management systems, and fast-charging infrastructure. Similarly, the development of Level 4 and Level 5 autonomous vehicles opens up avenues for advanced sensor technologies, AI-powered systems, and vehicle connectivity solutions. The integration of automotive electronics with 5G and edge computing technologies is set to revolutionize real-time vehicle communication and data processing. Additionally, partnerships between automakers, tech companies, and semiconductor manufacturers are driving innovations in software-defined vehicles and over-the-air (OTA) update capabilities, enhancing user experience and operational efficiency.

AUTOMOTIVE ELECTRONICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Robert Bosch GmbH, Continental AG, Denso Corporation, Aptiv PLC, Valeo, ZF Friedrichshafen AG, Infineon Technologies, Texas Instruments, NXP Semiconductors, Harman International |

Automotive Electronics Market Segmentation - By Product

-

Sensors (Image, Radar, Lidar, etc.)

-

Microcontrollers

-

Actuators

-

Infotainment Systems

-

Power Electronics

-

Others

Sensors dominate the market with a 25% share, driven by their critical role in safety systems and autonomous vehicle technologies.

Automotive Electronics Market Segmentation - By Application

-

ADAS

-

Infotainment and Communication

-

Body Electronics

-

Powertrain Electronics

-

Safety Systems

ADAS is the leading segment, accounting for 30% of the market share, due to regulatory requirements and growing consumer demand for safety features.

Automotive Electronics Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Asia-Pacific leads the market with a 40% share, driven by the presence of major automotive manufacturers, increased EV adoption, and rising investments in automotive R&D in countries like China, Japan, and South Korea. The region also benefits from cost-effective production capabilities and strong government support for EV infrastructure development.

COVID-19 Impact Analysis

The COVID-19 pandemic had a mixed impact on the Automotive Electronics Market. While the industry faced significant disruptions, including supply chain challenges and halted production activities, the pandemic also accelerated the adoption of connected and autonomous vehicle technologies. As social distancing and contactless solutions became more critical, the role of automotive electronics in ensuring vehicle safety, convenience, and functionality became more pronounced. This shift emphasized the importance of advanced electronic systems, such as driver-assistance systems and in-car connectivity, to enhance the overall driving experience. During the post-pandemic recovery phase, the growing demand for electric vehicles (EVs) and smart vehicles provided substantial growth opportunities for the automotive electronics market. Consumers' increasing preference for sustainable transportation solutions, combined with the push toward smarter, more connected vehicles, contributed to a surge in demand for advanced automotive electronics. These technologies, including battery management systems, infotainment systems, and autonomous driving features, became key enablers in the evolution of modern vehicles. Moreover, governments' economic stimulus packages aimed at boosting green mobility played a crucial role in supporting the market's resilience. Many nations introduced incentives and subsidies to promote the adoption of electric vehicles and other environmentally friendly transportation options. These initiatives further fueled the growth of automotive electronics, particularly in areas related to EV infrastructure, energy efficiency, and autonomous driving technologies. As the automotive industry adapted to the challenges brought on by the pandemic, the demand for innovative electronic solutions remained strong, ensuring the continued evolution of the sector.

Latest Trends/Developments

The Automotive Electronics Market is experiencing a surge in technological advancements, significantly transforming the automotive industry. One of the key trends is the integration of artificial intelligence (AI) and machine learning, which enhance system performance by enabling smarter, more adaptive vehicle functions. AI-powered systems are improving driver-assistance technologies, optimizing vehicle control, and personalizing in-car experiences, making driving safer and more convenient. The rise of software-defined vehicles (SDVs) is also driving the adoption of over-the-air (OTA) update capabilities, which allow manufacturers to remotely deliver new features, updates, and fixes to vehicles. This not only enhances the vehicle’s capabilities post-purchase but also provides continuous improvements, keeping vehicles up-to-date with the latest technology without requiring physical visits to service centers. In premium vehicles, advanced infotainment systems with augmented reality (AR) navigation and personalized user interfaces are becoming standard. These systems offer more immersive and intuitive user experiences, enhancing navigation, entertainment, and vehicle control. By integrating AR into navigation, drivers can receive real-time, contextually relevant information displayed on the windshield, improving safety and convenience. Another key development is the increasing use of Gallium Nitride (GaN) and Silicon Carbide (SiC) semiconductors in electric vehicle (EV) powertrains. These next-generation semiconductors are improving energy efficiency and reducing the weight of power systems, allowing EVs to achieve longer driving ranges and faster charging times, while also contributing to lighter, more efficient powertrains. Collaborative efforts between automakers, tech companies, and semiconductor manufacturers are fostering innovation in autonomous and connected vehicle technologies. These partnerships are accelerating the development of self-driving capabilities, vehicle-to-everything (V2X) communication, and other advancements that are reshaping the future of mobility and driving the growth of the automotive electronics market.

Key Players

-

Robert Bosch GmbH

-

Continental AG

-

Denso Corporation

-

Aptiv PLC

-

Valeo

-

ZF Friedrichshafen AG

-

Infineon Technologies

-

Texas Instruments

-

NXP Semiconductors

-

Harman International

Chapter 1. Automotive Electronics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Electronics Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Electronics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Electronics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Electronics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Electronics Market – By Product

6.1 Introduction/Key Findings

6.2 Sensors (Image, Radar, Lidar, etc.)

6.3 Microcontrollers

6.4 Actuators

6.5 Infotainment Systems

6.6 Power Electronics

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Automotive Electronics Market – By Application

7.1 Introduction/Key Findings

7.2 ADAS

7.3 Infotainment and Communication

7.4 Body Electronics

7.5 Powertrain Electronics

7.6 Safety Systems

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Automotive Electronics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Automotive Electronics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Robert Bosch GmbH

9.2 Continental AG

9.3 Denso Corporation

9.4 Aptiv PLC

9.5 Valeo

9.6 ZF Friedrichshafen AG

9.7 Infineon Technologies

9.8 Texas Instruments

9.9 NXP Semiconductors

9.10 Harman International

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automotive Electronics Market was valued at USD 240 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030. By the end of the forecast period, the market is expected to reach USD 330.92 billion.

Key drivers include the growing demand for EVs, advancements in ADAS, and rising consumer preference for connected vehicles.

The market is segmented by components (sensors, microcontrollers, etc.) and applications (ADAS, infotainment, body electronics, etc.).

Asia-Pacific is the leading region, accounting for 40% of the market share.

Leading players include Robert Bosch GmbH, Continental AG, Denso Corporation, Aptiv PLC, and Valeo.