Automotive Digital Key Market Size (2024 – 2030)

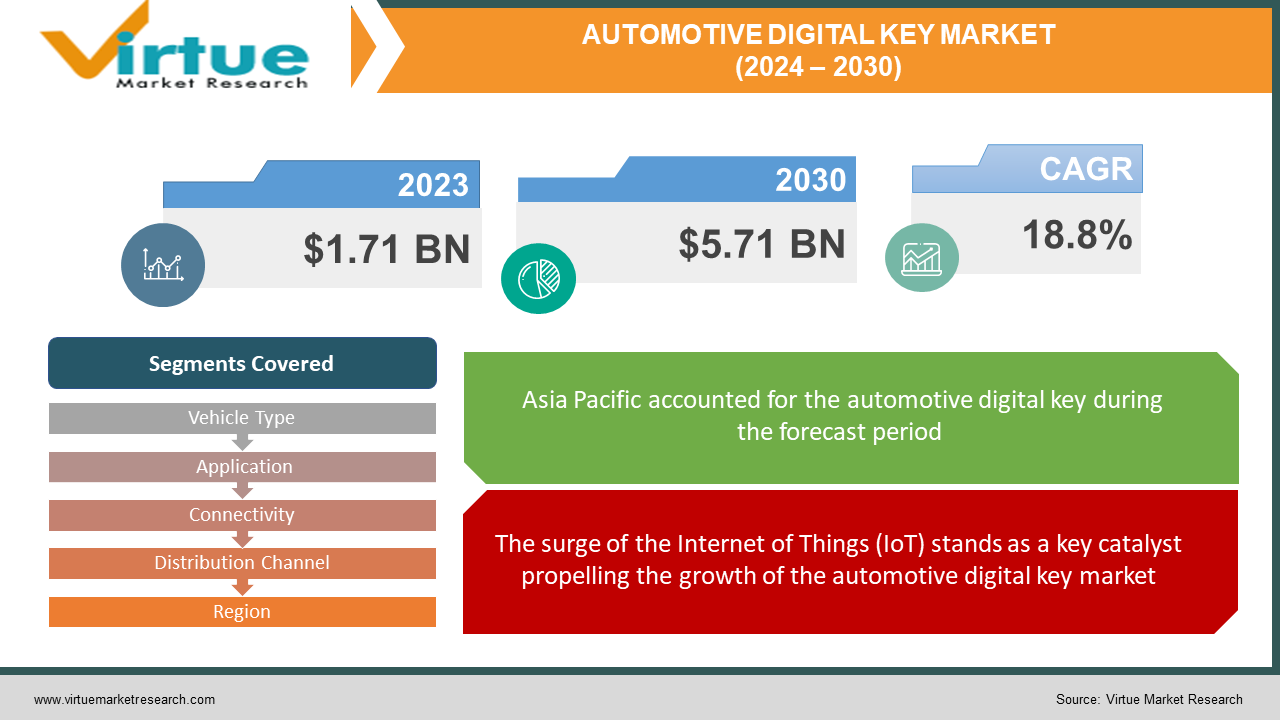

The Global Automotive Digital Key Market size was exhibited at USD 1.71 billion in 2023 and is projected to hit around USD 5.71 billion by 2030, growing at a CAGR of 18.8% during the forecast period from 2024 to 2030.

The automotive digital key, also known as a smart key, incorporates digitalization and enhanced functionality. It is furnished with microchips and sensors for automated door locking and unlocking, as well as automatic car ignition and shutdown. The standard equipment format of the automotive key varies depending on the car model. The replication of automotive digital keys is not feasible, instilling a sense of heightened security among consumers. Advanced features in automotive digital keys enable users to control multiple automobile functions through a single device, offering unparalleled convenience. Anticipated growth in the automotive digital key market within the next five years is attributed to increased disposable income and advancements in automotive technology.

Compared to traditional lock systems, automotive digital keys utilize diverse software and systems, rendering them susceptible to cyber-attacks. The escalating digitization and automation across industries have significantly enhanced business efficiency and effectiveness. In the automotive sector, manufacturers are actively seeking ways to enhance brand reputation and foster customer loyalty across production, assembly, and after-sales service. The growing consumer demand for automotive digital keys aligns with the industry's increasing digitization, contributing to the expansion of the global automotive digital key market. Nevertheless, the vulnerability of automotive digital keys to cyber-attacks, given their use of varied software and systems, raises concerns regarding consumer safety and security, hindering market growth.

Key Market Insights:

The automotive key plays a crucial role in securing vehicles through locking and unlocking mechanisms. Recent years have witnessed innovative transformations in vehicle keys due to technological advancements. The digital key stands out as a noteworthy innovation, allowing vehicle owners to share security data through smartphone applications. This technology enables smartphones to initiate vehicle engine operations, and control door locking and unlocking via near-field communication (NFC) or Bluetooth technology. Vehicle access and component control are facilitated through the digital key. The integration of automobiles into the Internet of Things (IoT) is driven by digital sensors, faster mobile connectivity, and compact, innovative devices within vehicles.

The automotive industry is undergoing significant changes, moving towards vehicle digitization. Car manufacturers are actively developing digital keys that offer advanced functions, including keyless entry, connected cars, and enhanced driver safety features. Major players in the automotive digital key market are focused on creating smart key fobs, key cards, and wearable smart keys incorporating RFID technology. In response to increased customer demand, several original equipment manufacturers (OEMs) are committed to scaling up the production of vehicles equipped with this advanced feature.

Global Automotive Digital Key Market Drivers:

The surge of the Internet of Things (IoT) stands as a key catalyst propelling the growth of the automotive digital key market.

Numerous automotive manufacturers are strategically emphasizing the integration of IoT technology into their industry, envisioning the creation of innovative applications and solutions. This concerted effort aims to enhance vehicle intelligence, offering heightened levels of comfort, efficiency, and driving safety. The adoption of IoT technology by manufacturers is particularly evident in the deployment of connected car applications, encompassing features like fuel tracking, advanced driver assistance systems (ADAS), speed control, and in-vehicle infotainment systems for drivers.

Additionally, manufacturers are actively engaged in the advancement of robust network security solutions to fortify defenses against potential hacker attacks. The National Highway Transportation and Safety Administration (NHTSA) collaborates with vehicle manufacturers, federal partners, and suppliers to address cybersecurity concerns, ensuring vehicle safety. These collective initiatives positively influence the market, making it a driving force during the forecast period.

The market is further fueled by the escalating demand for digitization.

The burgeoning desire for digitization and automation of devices is notable, especially in developing economies such as China and India, driven by the increasing disposable income of the population. As consumers experience a rise in per capita income, their expectations for more advanced features that enhance convenience and ensure safety intensify. Supportive government policies advocating the digitization of vehicles to enhance fuel efficiency and reduce carbon emissions add to the positive dynamics for the automotive digital key market. The confluence of rising demand for digitization and automation, coupled with government-driven fiscal incentives, is poised to contribute significantly to the market's growth.

Global Automotive Digital Key Market Restraints and Challenges:

A primary obstacle impeding the growth of the digital key market is the prevalence of cybersecurity issues.

The increased integration of digital technology into vehicles brings forth numerous challenges and cybersecurity concerns within the global automotive digital key market. Additionally, the automotive industry must navigate diverse regulatory frameworks about cybersecurity and data protection, presenting a substantial challenge in delivering seamless digital key solutions while complying with these regulations.

Furthermore, these systems face vulnerabilities to cybersecurity attacks, posing the risk of unauthorized access to vehicles. The exchange of sensitive data between vehicles and devices in digital key systems introduces the potential for interception, leading to privacy breaches or the theft of personal information. Consequently, these factors have the potential to exert a negative impact on market growth, serving as a hindrance during the forecast period.

The malfunctioning of automotive digital keys emerges as a significant impediment to growth.

Automotive digital keys, operating on various technologies such as Bluetooth and Wi-Fi, encounter challenges related to signal transmission. Factors like the absence of internet connectivity or physical obstructions can disrupt signal transmission, rendering digital keys nonfunctional. Vulnerabilities, such as malfunctioning when exposed to water or extreme temperatures, pose challenges to market development. However, industry players can overcome these obstacles by innovating and producing advanced digital key solutions.

The complexity of insurance claims poses a challenge to market growth.

Vehicles equipped with keyless entry systems and digital key functionalities face additional insurance requirements. Insurance providers may not cover vehicles featuring digital keys or keyless entry systems unless the driver also holds household insurance to mitigate the insurer's risk. These complexities in insurance claim processes are anticipated to hurt market growth throughout the projection period.

Global Automotive Digital Key Market Opportunities:

Innovation and Technological Advancements

The landscape of automotive digital key technology serves as an ideal collaborative platform for automotive companies, technology firms, and mobile device manufacturers. Such collaborations hold the potential to stimulate innovation, thereby elevating the functionality and accessibility of digital key technology.

The demand for contactless technologies has surged in the wake of the COVID-19 pandemic, and automotive digital key technology stands out as a significant beneficiary. As consumers increasingly prioritize reducing physical contact to ensure safety and convenience, digital key technology emerges as a secure and convenient alternative to traditional keys. Enhancing user experiences, digital key technology provides a personalized and convenient means to access and start vehicles.

Moreover, these keys can extend their utility to additional services, such as remote vehicle monitoring and control, further amplifying their benefits. Automotive digital key technology contributes to environmental sustainability by eliminating the need for physical keys, thereby reducing waste production and conserving resources for both consumers and society at large.

AUTOMOTIVE DIGITAL KEY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.8% |

|

Segments Covered |

By Vehicle Type, Application, Connectivity, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hyundai Mobis, Volkswagen AG, Denso Corporation, Samsung Electronics Co. Ltd., HELLA, Robert Bosch, GmbH, Tesla Inc., Infineon Technologies, BMW AG, STMicroelectronics, Continental AG, Daimler AG, Ericsson, Valeo SA, Other Key Players |

Global Automotive Digital Key Market Segmentation: By Vehicle Type

-

Passenger Vehicles

-

Commercial Vehicle

The segmentation of the global automotive digital key market by vehicle type comprises passenger vehicles and commercial vehicles. Within this classification, the passenger vehicles segment emerges as the most lucrative, projecting a Compound Annual Growth Rate (CAGR) of 19.2%. In 2023, passenger vehicles contribute significantly to the market, accounting for a substantial 74% of the total revenue share.

On the other hand, the commercial vehicle segment holds an estimated market share of 26.0% in 2023. The surge in demand for passenger cars featuring digital capabilities is driven by an expanding population with increased disposable income. Consumers, aiming to elevate their standard of living and social status, are increasingly investing in luxury vehicles equipped with automated systems, thereby contributing to the growth of the passenger vehicles segment within the automotive digital key market.

Global Automotive Digital Key Market Segmentation: By Application

-

Multi-Function

-

Single-Function

The automotive digital key market's application segmentation encompasses multi-function and single-function categories. The multi-function segment is anticipated to be the most lucrative, commanding a significant 55% share of the global automotive digital key market. By 2023, it is projected to exhibit a noteworthy Compound Annual Growth Rate (CAGR) of 16.8%. In contrast, the single-function segment holds 45% of the total global market share.

The dominance of the multi-function segment is attributed to the escalating demand for passenger vehicles that consolidate various features into a single device, particularly in developing economies. Successful implementation of digital key technology relies on effective network infrastructure, fostering quality and enhancing functionality and accessibility in this dynamic market segment.

Global Automotive Digital Key Market Segmentation: By Connectivity

-

Near Field Communication (NFC)

-

Bluetooth

-

Wi-Fi

-

Remote Cloud Key Access

-

Other Connectivity

The segmentation of the automotive digital key market by connectivity includes near-field communication (NFC), Wi-Fi, Bluetooth, remote cloud key access, and other connectivity options. Within this classification, the near-field communication (NFC) segment is anticipated to be the most attractive in terms of profitability. It commands the largest revenue share at 30.5% and is projected to exhibit a notable Compound Annual Growth Rate (CAGR) of 19.5% during the forecast period.

Near Field Communication (NFC) is a wireless communication technology facilitating data exchange between devices nearby. Employing encryption during transmission enhances security, making it challenging for unauthorized parties to intercept or pilfer sensitive information. The security features inherent in NFC systems provide a distinct advantage, contributing to the continued growth of this market segment.

Global Automotive Digital Key Market Segmentation: By Distribution Channel

-

Original Equipment Manufacturer (OEM)

-

Aftermarket

The distribution channels in the market are divided into original equipment manufacturer (OEM) and aftermarket segments. Among these, the original equipment manufacturer (OEM) segment stands out as the most lucrative, holding the largest revenue share at 57%. It is also projected to exhibit a notable CAGR of 17.7% during the forecast period. OEMs play a significant role in the development and sale of various automotive digital key solutions.

Customers can acquire this technology either as an optional feature or as standard equipment on new vehicles through the OEM's dealership network. In contrast, the aftermarket segment holds an estimated market share of 43% in 2023. Certain companies specialize in the development and sale of digital key technology designed for retrofitting into existing vehicles. These aftermarket suppliers may distribute their products online, through automotive retailers, or collaborations with installation service providers.

Global Automotive Digital Key Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific region emerges as the most lucrative market in the global automotive digital key landscape, commanding the largest revenue share at 37%. It is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 17.5% during the forecast period. The region's substantial growth is attributed to the escalating demand for connected cars and advanced digital technologies, particularly in developing economies such as China and India.

China leads the automotive digital key market within the Asia Pacific region. Additionally, North America stands as one of the significant automotive digital key markets, boasting prominent automotive manufacturers and technology firms heavily investing in the development of cutting-edge digital key solutions.

COVID-19 Impact on the Global Automotive Digital Key Market:

The global automotive digital key market has experienced significant disruptions in the production and distribution of key components due to the COVID-19 pandemic, causing widespread disruptions in global supply chains. Consequently, the delivery timelines for digital key solutions have been adversely affected, leading to delayed deliveries and increased pricing. The pandemic has also resulted in a notable decline in car sales, directly influencing the demand for digital key services. The reduced sales volumes have contributed to lower supplies, creating a scenario of increased prices due to diminished demand.

Amid the challenges posed by the COVID-19 outbreak, there has been a surge in demand for remote access systems for vehicles. Automotive digital key solutions, offering contactless operation of vehicles, have gained prominence. However, the long-term impact of these trends on the market remains uncertain. Despite the uncertainties, the automotive industry has witnessed substantial growth in digital technologies, a trend that is likely to persist even beyond the pandemic.

Recent Trends and Innovations in the Global Automotive Digital Key Market:

In September 2022, Hyundai introduced its digital key technology, allowing drivers to unlock and start their Hyundai vehicles using a smartphone. Leveraging near-field communication (NFC) technology, this innovation facilitates seamless communication between the smartphone and the car, and it is currently available for select Hyundai models.

In February 2022, Volkswagen announced a collaboration with Samsung to develop a digital key platform. This platform is compatible with Samsung smartwatches and smartphones equipped with NFC technology, offering users a convenient and advanced digital key solution.

Key Players:

-

Hyundai Mobis

-

Volkswagen AG

-

Denso Corporation

-

Samsung Electronics Co. Ltd.

-

HELLA

-

Robert Bosch

-

GmbH

-

Tesla Inc.

-

Infineon Technologies

-

BMW AG

-

STMicroelectronics

-

Continental AG

-

Daimler AG

-

Ericsson

-

Valeo SA

-

Other Key Players

Chapter 1. Automotive Digital Key Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Digital Key Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Digital Key Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Digital Key Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Digital Key Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Digital Key Market – By Vehicle Type

6.1 Introduction/Key Findings

6.2 Passenger Vehicles

6.3 Commercial Vehicle

6.4 Y-O-Y Growth trend Analysis By Vehicle Type

6.5 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 7. Automotive Digital Key Market – By Application

7.1 Introduction/Key Findings

7.2 Multi-Function

7.3 Single-Function

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Automotive Digital Key Market – By Connectivity

8.1 Introduction/Key Findings

8.2 Near Field Communication (NFC)

8.3 Bluetooth

8.4 Wi-Fi

8.5 Remote Cloud Key Access

8.6 Other Connectivity

8.7 Y-O-Y Growth trend Analysis By Connectivity

8.8 Absolute $ Opportunity Analysis By Connectivity, 2024-2030

Chapter 9. Automotive Digital Key Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Original Equipment Manufacturer (OEM)

9.3 Aftermarket

9.4 Y-O-Y Growth trend Analysis End-User

9.5 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Automotive Digital Key Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Vehicle Type

10.1.2.1 By Application

10.1.3 By Connectivity

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Vehicle Type

10.2.3 By Application

10.2.4 By Connectivity

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Vehicle Type

10.3.3 By Application

10.3.4 By Connectivity

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Vehicle Type

10.4.3 By Application

10.4.4 By Connectivity

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Vehicle Type

10.5.3 By Application

10.5.4 By Connectivity

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Automotive Digital Key Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Hyundai Mobis

11.2 Volkswagen AG

11.3 Denso Corporation

11.4 Samsung Electronics Co. Ltd.

11.5 HELLA

11.6 Robert Bosch

11.7 GmbH

11.8 Tesla Inc.

11.9 Infineon Technologies

11.10 BMW AG

11.11 STMicroelectronics

11.12 Continental AG

11.13 Daimler AG

11.14 Ericsson

11.15 Valeo SA

11.16 Other Key Players

11.17 Wilshire Technologies

11.18 ALB Technology Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automotive Digital Key Market size is valued at USD 1.71 billion in 2023.

The worldwide Global Automotive Digital Key Market growth is estimated to be 18.8% from 2024 to 2030.

The Global Automotive Digital Key Market is segmented By Vehicle Type (Passenger Vehicles, Commercial Vehicle); By Application (Multi-Function, Single-Function); By Connectivity (Near Field Communication (NFC), Bluetooth, Wi-Fi, Remote Cloud Key Access, and Other Connectivity); By Distribution Channel (Original Equipment Manufacturer (OEM), Aftermarket.

The Global Automotive Digital Key Market is poised for growth with increasing consumer demand for seamless and secure vehicle access. Advancements in connectivity, mobile technology, and biometrics present opportunities. Integration with smart ecosystems, enhanced cybersecurity, and personalized user experiences are potential future trends shaping this dynamic market.

The COVID-19 pandemic accelerated the adoption of contactless technologies, positively impacting the Global Automotive Digital Key Market. Heightened awareness of hygiene and safety drove increased interest in touchless entry systems, fostering innovation and growth within the automotive industry's digital key segment.