Automotive 5G Market Size (2024 – 2030)

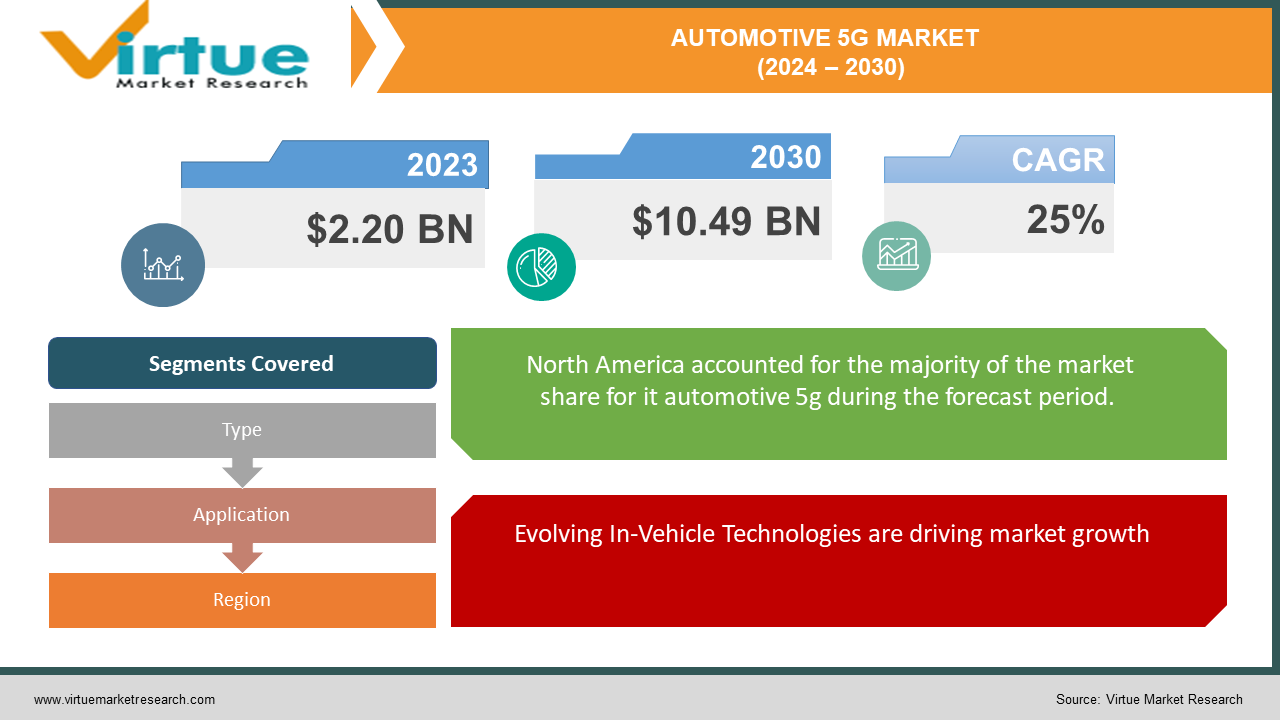

The Global Automotive 5G Market was valued at USD 2.20 billion in 2023 and will grow at a CAGR of 25% from 2024 to 2030. The market is expected to reach USD 10.49 billion by 2030.

The Automotive 5G market is booming, driven by the increasing demand for connected and autonomous vehicles. Fueled by the need for real-time communication between cars and infrastructure for safety and efficiency. This rapid expansion reflects the transformative potential of 5G technology is revolutionizing the way we drive.

Key Market Insights:

Increasing demand for connected and autonomous vehicles, 5G enables real-time communication between vehicles and infrastructure, crucial for safety features like collision avoidance and automated driving.

With features like in-car entertainment and software updates becoming more data-intensive, 5G's high speeds and capacity are essential.

Government support for smart transportation initiatives, many governments are investing in 5G infrastructure to build smarter and more efficient transportation systems.

Vehicle-to-everything (V2X) leading the segment in 2023, followed by connected car services and platooning (automated convoys).

North America held the lead in 2023, but Asia Pacific is expected to experience the fastest growth due to its large automotive industry.

Ensuring compatibility between different 5G technologies and devices needs to be addressed.

The Automotive 5G market presents a significant growth opportunity with the potential to revolutionize the automotive industry. As technology advances and challenges are addressed, we can expect even wider adoption of 5G in the coming years.

Global Automotive 5G Market Drivers:

Rise of Connected and Autonomous Vehicles are driving market growth:

The future of transportation hinges on real-time communication, and 5G is the key that unlocks it for connected and autonomous vehicles (CAVs). Unlike previous generations of cellular networks, 5G boasts ultra-low latency, meaning data travels with minimal delay. This allows CAVs to have near-instantaneous conversations with each other, traffic infrastructure like stop lights and signs, and even pedestrians. This real-time exchange is crucial for safety features like collision avoidance. Imagine a car receiving real-time warnings about a sudden braking event ahead of another vehicle – 5G's low latency makes this possible. Furthermore, 5G's high speeds act as a superhighway for the massive amount of data generated by CAVs' sensors and cameras. This continuous stream of data feeds the car's navigation system, object detection software, and real-time environment updates, allowing it to perceive its surroundings with exceptional detail and react accordingly. In essence, 5G equips CAVs with the power of real-time communication and high-speed data transfer, paving the way for a future of safer, more efficient, and intelligent transportation.

Evolving In-Vehicle Technologies are driving market growth:

Get ready to transform your car into a rolling entertainment center and personalized cockpit, thanks to 5G. Imagine passengers enjoying crystal-clear, high-definition movies and shows on long journeys, with 5G's high bandwidth eliminating buffering and lag. This same bandwidth becomes the backbone for augmented reality (AR) navigation, where virtual arrows and lane guidance are seamlessly overlaid onto the real world through the windshield. No more squinting at tiny maps – 5G ensures smooth and clear AR displays. But the benefits extend beyond entertainment. Software updates, crucial for maintaining a car's safety and performance, can now be downloaded and installed over the air in a flash with 5 G speed. This eliminates the need for time-consuming trips to dealerships. Most importantly, 5G's faster connectivity translates to a more responsive in-car experience. Voice commands will be recognized instantly, climate controls will adjust with minimal delay, and overall, the car will feel more intuitive and in sync with your needs. In short, 5G isn't just about faster internet in your car – it's about fundamentally transforming how you interact with and experience your vehicle.

Smart Transportation Initiatives are driving market growth:

Buckle up for a future of smarter cities where traffic flows like a well-oiled machine, thanks to the powerful combination of 5G and government investment. Governments are pouring resources into building robust 5G infrastructure, paving the way for "smart cities" that leverage real-time data for a more efficient and safer transportation landscape. Imagine a city where traffic lights dynamically adjust based on real-time data from vehicles, alleviating congestion and optimizing traffic flow. 5G acts as the nervous system for this intelligent system, enabling the seamless exchange of information between vehicles, sensors embedded in roads, and central traffic management software. This data goldmine also empowers authorities to proactively address potential issues. Real-time alerts about accidents or road closures can be disseminated instantly, allowing drivers to reroute and avoid delays. Furthermore, 5G facilitates the collection of data on infrastructure health. By analyzing data from sensors embedded in bridges and roads, potential problems can be identified and addressed before they escalate into major issues. In essence, 5G and government investment join forces to transform our cities into data-driven transportation ecosystems, promoting safety, efficiency, and a smoother driving experience for everyone.

Global Automotive 5G Market challenges and restraints:

High Cost and Development Complexity is a significant hurdle for Automotive 5G:

Building a strong foundation for the future of transportation with 5G comes at a hefty price tag. The extensive infrastructure required for a robust 5G network translates to significant upfront investment. Cell towers and smaller antennae (small cells) need to be strategically installed across vast areas to ensure widespread coverage, and this is a costly endeavor. Furthermore, laying fiber optic cables, the backbone of high-speed data transmission, adds another layer of expense as they need to be trenched or strung across long distances. To make matters even more complex, navigating the bureaucratic maze of obtaining permits and approvals from various governing bodies can be a time-consuming and expensive process. These regulatory hurdles can cause delays and inflate costs further, adding to the overall challenge of deploying a robust 5G network.

Standardization Issues are throwing a curveball at the Automotive 5G market:

The dream of a truly connected car ecosystem reliant on 5G hinges on achieving seamless communication between all the moving parts. This means ensuring that the various 5G technologies and devices used by different car manufacturers and service providers can talk to each other flawlessly. Imagine a scenario where a car from one brand can't receive crucial real-time traffic updates because it's incompatible with the local infrastructure's 5G network – this is a potential consequence of a lack of standardization. Without clear, unified protocols and requirements dictating how 5G interacts in the automotive world, compatibility issues can arise, creating a fragmented and unreliable experience. This not only frustrates drivers but also hinders the widespread adoption of 5G technology in the automotive industry. Standardization efforts by industry bodies and regulatory agencies are crucial to bridge these gaps and ensure a smooth, unified flow of information across the entire 5G-connected car ecosystem.

Cybersecurity Concerns are a growing nightmare for Automotive 5G:

As connected cars and infrastructure become increasingly reliant on 5G for communication, a vast web of data exchange is created. This interconnectedness, while enabling exciting advancements, also presents a vulnerability – a growing attack surface for cybercriminals. Malicious actors could exploit weaknesses in 5G networks or car software to compromise sensitive data. Imagine a hacker gaining control of a vehicle's braking system through a security flaw – this is a potential consequence if cybersecurity isn't prioritized. These attacks not only threaten driver privacy by stealing information on location and habits but could also lead to safety hazards with compromised vehicle control. To combat these risks, robust security measures are essential. This includes strong encryption protocols to safeguard data transmission, continuous software updates to patch vulnerabilities, and secure authentication processes to prevent unauthorized access. Furthermore, data protection regulations need to be established to define clear ownership and control over the data collected by connected vehicles, ensuring user privacy is respected. Only by addressing cybersecurity concerns can we unlock the full potential of 5G in the automotive industry with confidence.

Market Opportunities:

The Automotive 5G market presents a treasure trove of opportunities poised to revolutionize the way we drive. At the forefront lies the potential for enhanced safety features in connected and autonomous vehicles (CAVs). 5G's ultra-low latency enables real-time communication between vehicles and infrastructure, allowing for features like collision avoidance and automated driving decisions with exceptional speed and accuracy. Imagine cars receiving instant warnings about sudden braking events or hazardous road conditions – 5G makes this a reality. Beyond safety, 5G unlocks a world of in-car entertainment possibilities. With its high bandwidth, passengers can enjoy seamless streaming of high-definition movies and shows, while augmented reality navigation overlays virtual guidance onto the real world through the windshield. Software updates can also be downloaded and installed over the air in a flash, eliminating the need for dealership visits. Governments are also seizing the opportunity to create "smart cities" with 5G as the backbone. Real-time data from vehicles and sensors can be used to optimize traffic flow, predict potential issues like accidents, and even monitor infrastructure health for proactive maintenance. This translates to a safer, more efficient, and data-driven transportation ecosystem for everyone. Furthermore, the ever-increasing demand for mobile data traffic within cars, driven by features like real-time traffic updates and location-based services, finds perfect support in 5G's high capacity. Emerging applications like the teleoperation of vehicles and autonomous deliveries further amplify this demand, which 5G can readily accommodate. However, this exciting future hinges on overcoming challenges like the high cost of infrastructure deployment, ensuring standardization across various technologies, and addressing cybersecurity concerns. Collaboration between governments, car manufacturers, and technology developers is crucial to unlocking the full potential of the Automotive 5G market and ushering in a new era of intelligent, connected, and safer transportation.

AUTOMOTIVE 5G MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

25% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Audi AG, Robert Bosch GmbH, BMW Group, Daimler AG (Mercedes-Benz), Huawei Technologies Co., Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., Telefonica SA, Verizon Communications Inc., Vodafone Group Plc |

Automotive 5G Market Segmentation - By Type

-

Hardware

-

Software

Currently, hardware dominates the Automotive 5G market. This includes physical components like onboard units (OBUs) in vehicles and base stations that form the backbone of the 5G network. The dominance of hardware is understandable – as the technology is still in its early stages, building the physical infrastructure to support 5G connectivity in vehicles is a crucial first step. However, software is poised for significant growth. As the market matures and applications become more sophisticated, software that manages communication protocols, processes data within vehicles, and optimizes network traffic will play a critical role in unlocking the full potential of 5G for connected and autonomous vehicles. In the future, we can expect hardware and software to work hand-in-hand, creating a robust ecosystem that drives innovation and paves the way for a safer and more connected transportation landscape.

Automotive 5G Market Segmentation - By Application

-

Vehicle-to-Everything

-

Connected Car Services

While Connected Car Services offer exciting features like in-car entertainment and remote diagnostics, Vehicle-to-Everything (V2X) currently reigns supreme in the Automotive 5G market. V2X focuses on the core functionality of 5G for connected and autonomous vehicles: real-time communication with everything around them. This includes communication between vehicles (collision avoidance!), infrastructure (smart traffic lights!), and even pedestrians (enhancing safety for everyone!). V2X forms the foundation for a future of safer, more efficient, and automated transportation. While Connected Car Services will undoubtedly enhance the driving experience, V2X paves the way for a fundamental transformation of how we travel.

Automotive 5G Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

While North America currently holds the lead in the Automotive 5G market due to established automotive giants and strong technological infrastructure, Asia Pacific is expected to witness the most explosive growth. This is fueled by a booming automotive industry in countries like China and India, along with significant government investments in 5G network development. As these regions ramp up their 5G infrastructure and car manufacturers integrate the technology into their vehicles, Asia Pacific is poised to become the dominant force in the future of the Automotive 5G market.

COVID-19 Impact Analysis on the Global Automotive 5G Market

The COVID-19 pandemic threw a curveball at the Automotive 5G market, initially disrupting its growth trajectory. Factory closures due to lockdowns caused a domino effect, delaying the production of 5G-enabled vehicles and hindering hardware development. Supply chain disruptions also posed challenges. However, the pandemic also brought some unforeseen benefits. The increased focus on social distancing and remote work fueled a surge in demand for features that 5G can enable, like in-car entertainment and software updates. Additionally, the need for more efficient transportation systems became even more apparent. This has led to continued government investment in 5G infrastructure development, particularly for "smart cities" initiatives. Overall, the COVID-19 impact appears to be a short-term setback. While initial market growth projections were revised downward, analysts still predict significant expansion in the coming years. As the automotive industry recovers and 5G infrastructure continues to be built, the market is expected to gain momentum, driven by the long-term potential of connected and autonomous vehicles and the increasing demand for a safer and more data-driven transportation ecosystem.

Latest trends/Developments

The Automotive 5G market is rapidly evolving, fueled by advancements that address safety, user experience, and technological integration. V2X communication is leading the charge, with features like real-time hazard warnings and coordinated vehicle maneuvers enhancing road safety. Emerging applications like remote control of vehicles (think safer deliveries in harsh environments) are becoming possible thanks to 5G's low latency, but require further development in security and regulations. Cars are becoming smarter by connecting to the cloud via 5G, enabling features like personalized navigation based on real-time traffic, predictive maintenance, and even access to high-powered computing for autonomous vehicles. User experience is not left behind – carmakers are crafting a more engaging in-car environment with features like high-definition streaming, augmented reality navigation, and faster voice-activated controls. Finally, recognizing the importance of seamless communication, industry leaders are collaborating on standardized protocols for 5G technology, ensuring compatibility across different manufacturers and service providers. This wave of innovation, coupled with solutions for infrastructure costs and cybersecurity, paves the way for 5G to revolutionize transportation and create a smarter, safer, and more connected driving experience.

Key Players:

-

Audi AG

-

Robert Bosch GmbH

-

BMW Group

-

Daimler AG (Mercedes-Benz)

-

Huawei Technologies Co.

-

Qualcomm Technologies, Inc.

-

Samsung Electronics Co., Ltd.

-

Telefonica SA

-

Verizon Communications Inc.

-

Vodafone Group Plc

Chapter 1. Automotive 5G Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive 5G Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive 5G Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive 5G Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive 5G Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive 5G Market – By Type

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Automotive 5G Market – By Application

7.1 Introduction/Key Findings

7.2 Vehicle-to-Everything

7.3 Connected Car Services

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Automotive 5G Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Automotive 5G Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Audi AG

9.2 Robert Bosch GmbH

9.3 BMW Group

9.4 Daimler AG (Mercedes-Benz)

9.5 Huawei Technologies Co.

9.6 Qualcomm Technologies, Inc.

9.7 Samsung Electronics Co., Ltd.

9.8 Telefonica SA

9.9 Verizon Communications Inc.

9.10 Vodafone Group Plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automotive 5G Market was valued at USD 2.20 billion in 2023 and will grow at a CAGR of 25% from 2024 to 2030. The market is expected to reach USD 10.49 billion by 2030.

The rise of Connected and Autonomous Vehicles, Evolving In-Vehicle Technologies, and Smart Transportation Initiatives are the reasons which is driving the market.

Based on the Application it is divided into two segments – Vehicle-to-Everything, and Connected Car Services.

North America is the most dominant region for the luxury vehicle Market.

Audi AG, Robert Bosch GmbH, BMW Group, Daimler AG (Mercedes-Benz), Huawei Technologies Co.