Automatic Aircraft doors Market Size (2025-2030)

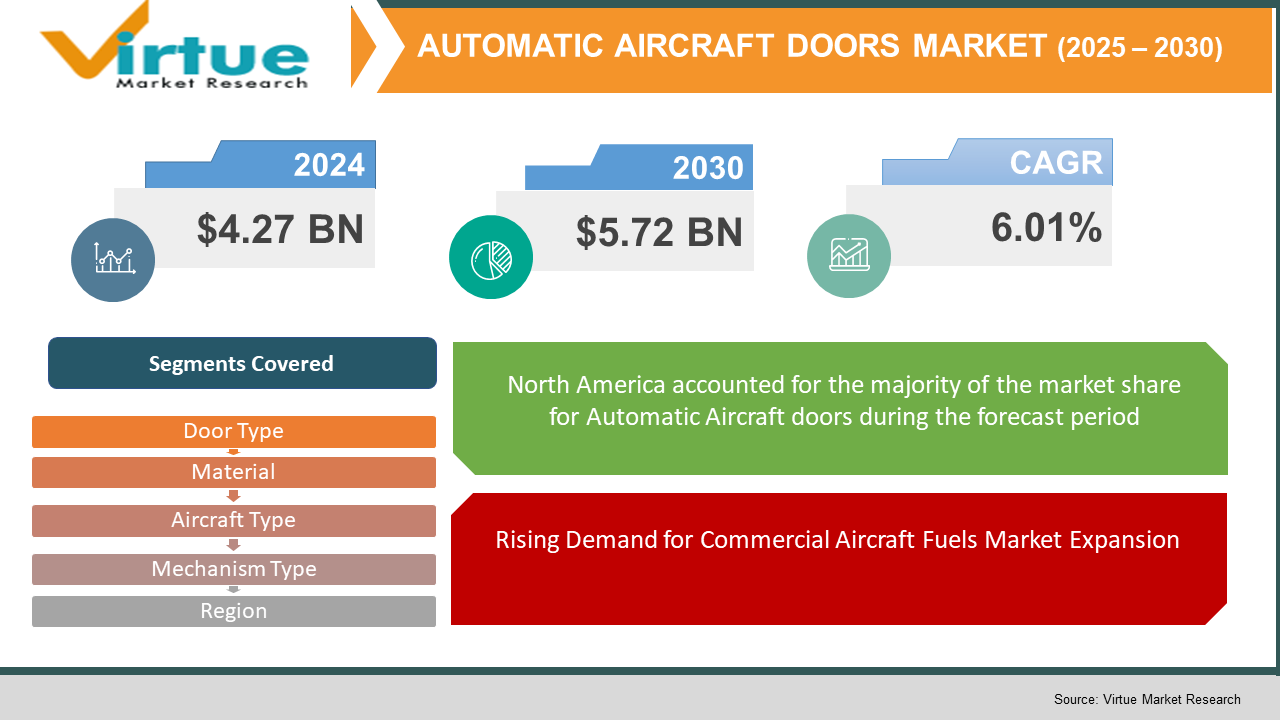

The Automatic Aircraft doors Market was valued at USD 4.27 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 5.72 billion by 2030, growing at a CAGR of 6.01%.

Key Market Insights:

The increasing demand for air travel, advancements in aerospace engineering, and a continued focus on safety and operational efficiency are key factors fueling the expansion of the aircraft doors market. As global air traffic rises, the corresponding requirement for aircraft leads to heightened demand for reliable door systems.

Moreover, innovations in production technologies and the use of advanced materials are enhancing the functionality of aircraft doors by making them more durable and lightweight. These improvements contribute to the aviation industry's broader sustainability efforts by aligning with goals to reduce fuel usage and emissions.

The expansion of low-cost carriers and regional aviation services is also stimulating the production of smaller aircraft, consequently increasing the need for specialized door systems tailored to these models.

Additionally, the growing emphasis on customization in aircraft design is providing manufacturers with new prospects to deliver tailored solutions that meet specific airline requirements.

Emerging regions, particularly in Asia-Pacific and the Middle East, are also exhibiting significant growth potential. Airlines in these areas are investing in fleet modernization and improved passenger services, thereby creating additional opportunities within the aircraft doors market.

Automatic Aircraft Doors Market Drivers:

Rising Demand for Commercial Aircraft Fuels Market Expansion.

The increasing demand for commercial aircraft stands out as a key factor driving the growth of the aircraft doors market. The aviation industry has been undergoing substantial expansion, particularly in emerging markets, owing to the surge in air travel.

As a growing number of passengers choose air transport for both business and leisure, airlines are compelled to enlarge their fleets, thereby boosting the need for manufacturing various aircraft components, including doors. Additionally, the ongoing efforts to modernize aging aircraft fleets to enhance efficiency and lower operational expenses are further contributing to the demand for advanced door systems built with improved materials and technologies.

Consequently, the aircraft doors market is witnessing heightened demand for both passenger and cargo doors, which are essential not only for operational safety and aerodynamic performance but also for ensuring passenger comfort.

Technological advancements and innovations in production techniques have led to the development of lightweight yet robust door solutions, which support overall aircraft performance. With the continuous growth of global tourism and international trade, the commercial aviation sector is expected to sustain its upward trajectory, directly influencing the increased production and sales of aircraft doors in the coming years.

Automatic Aircraft doors Market Restraints and Challenges:

Elevated Development and Maintenance Expenses Act as a Constraint on Market Growth.

The development and maintenance of advanced aircraft doors with innovative features can be both costly and time-intensive. These high expenditures pose challenges, particularly for smaller manufacturers, potentially hindering their ability to compete effectively. As a result, these financial and operational constraints may act as a barrier to overall market growth.

Stringent Regulatory Compliance Requirements Hinder Market Growth.

Aircraft doors must meet rigorous safety and performance standards due to the highly regulated nature of the aviation industry. Adhering to these stringent compliance requirements can be challenging for manufacturers, often leading to delays in the development and introduction of new products. This regulatory burden can, therefore, act as a restraint on market growth.

The Industry’s Continuous Operational Demands Pose Challenges to Market Growth.

The aviation industry is inherently cyclical and vulnerable to external factors such as economic downturns and global events like pandemics. These fluctuations can significantly influence airline operations and fleet expansion plans, thereby impacting the overall demand for aircraft and, consequently, for aircraft doors.

Automatic Aircraft doors Market Opportunities:

Innovations in Aircraft Design Drive New Opportunities within the Market.

Contemporary aircraft increasingly incorporate cutting-edge technologies that enhance overall performance while emphasizing safety and operational efficiency. Innovations such as the use of composite materials, automated door systems, and advanced sealing technologies are becoming standard in aircraft door manufacturing.

As manufacturers work to comply with stringent regulatory standards and improve passenger comfort, these technological integrations have resulted in more dependable and secure door mechanisms.

Additionally, the growing focus on environmentally sustainable designs is promoting the use of novel materials and manufacturing techniques that minimize ecological impact. This synergy of technological innovation is propelling the expansion of the aircraft doors market, as both manufacturers and airlines seek advanced solutions to satisfy evolving regulatory requirements and customer expectations.

AUTOMATIC AIRCRAFT DOORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.01% |

|

Segments Covered |

By Door Type, material, aircraft type, mechanism type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Boeing Company, Honeywell International Inc. and Parker Hannifin Corporation. |

Automatic Aircraft doors Market Segmentation:

Automatic Aircraft doors Market Segmentation By Door Type:

- Passenger Doors

- Service Doors

- Emergency Exits

- Cargo Doors

Passenger doors emerged as the leading segment within the aircraft doors market, valued at USD 1.318 billion in 2023 and anticipated to reach USD 2.41 billion by 2032. This growth underscores their significant role in enhancing passenger experience and safety.

Service doors also held a notable market share, valued at USD 0.683 billion in 2023 and projected to grow to USD 1.24 billion by 2032, driven by increasing demands for operational efficiency within the aviation sector.

This segmentation within the aircraft doors market demonstrates varied growth patterns and highlights unique opportunities and challenges across different door types. Overall, the market data reveals a complex landscape influenced by safety regulations, passenger comfort, and operational efficiency, making it essential for stakeholders to monitor these trends for informed strategic planning.

Automatic Aircraft doors Market Segmentation By Material:

- Aluminum

- Steel

- Composite Materials

- Glass Fiber Reinforced Plastic

Aluminum remains a preferred material in aircraft door manufacturing due to its lightweight nature and excellent corrosion resistance, which contribute to the development of fuel-efficient aircraft. Composite materials have also gained prominence for their superior strength-to-weight ratio, enhancing performance while reducing overall aircraft mass.

Although heavier, steel offers exceptional strength, making it suitable for specific structural components where durability is paramount. Glass fiber-reinforced plastic is appreciated for its versatility and cost-effectiveness, supporting its widespread use in aircraft door applications.

The variety of materials employed in the aircraft doors market reflects a careful balance of durability, performance, and advanced engineering—critical factors for addressing the evolving requirements of the aviation industry. As the market continues to expand, ongoing innovations in material technology are anticipated to create new opportunities for improved efficiency and design excellence.

Automatic Aircraft doors Market Segmentation By Aircraft Type:

- Commercial Aircraft

- Military Aircraft

- General Aviation Aircraft

Commercial aircraft constitute a substantial portion of the aircraft doors market, driven primarily by the rise in passenger air travel and the increasing demand for efficient aircraft operations. The military aircraft segment also holds significant importance, supported by ongoing defense spending and modernization initiatives.

At the same time, general aviation aircraft maintain relevance by addressing the needs of private and business travel, reflecting a growing preference for personalized air travel experiences.

Collectively, the aircraft doors market data highlights diverse growth drivers, including expanding air traffic, robust defense budgets, and increasing demand for private aviation. These factors, alongside challenges such as stringent regulatory requirements and material cost pressures, shape the market dynamics and competitive landscape.

Automatic Aircraft doors Market Segmentation By Mechanism Type:

- Manual Doors

- Automatic Doors

- Hydraulic Doors

Manual doors are commonly utilized in smaller aircraft, valued for their simplicity and dependable operation. Conversely, automatic doors are gaining popularity owing to technological advancements, which enhance passenger convenience and streamline boarding processes.

Aircraft doors market data indicates that growing emphasis on passenger comfort, coupled with rapid expansion in the aviation industry, is driving the adoption of more advanced door mechanisms, underscoring the need for innovative solutions in this sector.

Market trends further reveal a gradual transition toward automatic and hydraulic door systems, propelled by ongoing technological progress and shifting consumer preferences, reflecting the dynamic and evolving nature of the aircraft doors market.

Automatic Aircraft doors Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

North America has traditionally held a significant position in the global aviation sector. The region’s concentration of leading aircraft manufacturers has generated strong demand for aircraft doors. Additionally, North America’s extensive military aircraft fleet, supported by considerable defense expenditures, further stimulates market growth. The mature airline industry in the region, combined with ongoing requirements for fleet upgrades and replacements, supports a consistent growth trajectory.

The Asia Pacific region is currently experiencing rapid growth in both commercial and military aviation. Drivers such as rapid urbanization, a rising middle class, and overall economic progress have led to increased passenger traffic, fueling demand for commercial aircraft and related components, including aircraft doors. China and India, in particular, have emerged as key players in the global aviation landscape, marked by expanding fleets and growing demand. Furthermore, the region’s investments in domestic aircraft manufacturing capabilities enhance its strategic importance within the aircraft doors market.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic significantly impacted the automatic aircraft market, primarily due to a steep decline in air travel and aircraft manufacturing activities. Travel restrictions and lockdown measures resulted in diminished demand for new aircraft, subsequently affecting the production and installation of sensor systems. Moreover, financial challenges faced by airlines led to postponements in maintenance and upgrade programs dependent on advanced sensor technologies.

As the aviation sector gradually recovers, there is a renewed emphasis on safety and operational efficiency, fueling increased demand for sensor upgrades. Additionally, the pandemic expedited the integration of digital technologies, encouraging manufacturers to innovate and tailor their sensor solutions to address the changing requirements of the post-COVID aviation landscape.

Latest Trends/ Developments:

Recent developments in the aircraft doors market have been characterized by notable technological advancements and intensified competitive activity. Leading manufacturers such as Boeing, Airbus, and Bombardier are prioritizing innovative designs and advanced materials to improve the performance and safety of aircraft doors.

Companies like Spirit AeroSystems and Collins Aerospace are ramping up investments in research and development to address the growing demand for lightweight and fuel-efficient solutions. Simultaneously, significant mergers and acquisitions have taken place, with firms such as Parker Hannifin and GKN Aerospace strategically consolidating to enhance their market position and diversify their product offerings.

Furthermore, the post-pandemic recovery of the aviation sector is stimulating increased demand for new aircraft, thereby driving growth in the aircraft doors market and compelling key players to expand their production capacities. This resurgence also highlights the critical importance of regulatory compliance and safety standards, with companies including Leonardo and Safran actively ensuring conformity with international regulations.

Overall, the market is undergoing a transformation fueled by technological innovation, shifting consumer demands, and strategic collaborations among industry leaders, setting the stage for sustained growth and future innovation.

Key Players:

These are top 10 players in the Automatic Aircraft doors Market :-

- The Boeing Company

- Honeywell International Inc.

- Parker Hannifin Corporation

- Fokker Technologies

- Spirit AeroSystems Holdings, Inc.

- Leonardo S.p.A.

- Collins Aerospace

- Bombardier Inc.

- Mitsubishi Heavy Industries, Ltd.

- Triumph Group, Inc.

Chapter 1. Automatic Aircraft doors Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Automatic Aircraft doors Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Automatic Aircraft doors Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Automatic Aircraft doors Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Automatic Aircraft doors Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Automatic Aircraft doors Market– By Door Type

6.1 Introduction/Key Findings

6.2 Passenger Doors

6.3 Service Doors

6.4 Emergency Exits

6.5 Cargo Doors

6.6 Y-O-Y Growth trend Analysis By Door Type

6.7 Absolute $ Opportunity Analysis By Door Type , 2025-2030

Chapter 7. Automatic Aircraft doors Market– By Material

7.1 Introduction/Key Findings

7.2 Aluminum

7.3 Steel

7.4 Composite Materials

7.5 Glass Fiber Reinforced Plastic

7.6 Y-O-Y Growth trend Analysis By Material

7.7 Absolute $ Opportunity Analysis By Material , 2025-2030

Chapter 8. Automatic Aircraft doors Market– By Aircraft Type

8.1 Introduction/Key Findings

8.2 Commercial Aircraft

8.3 Military Aircraft

8.4 General Aviation Aircraft

8.5 Y-O-Y Growth trend Analysis Aircraft Type

8.6 Absolute $ Opportunity Analysis Aircraft Type , 2025-2030

Chapter 9. Automatic Aircraft doors Market– By Mechanism Type

9.1 Introduction/Key Findings

9.2 Manual Doors

9.3 Automatic Doors

9.4 Hydraulic Doors

9.5 Y-O-Y Growth trend Analysis Mechanism Type

9.6 Absolute $ Opportunity Analysis Mechanism Type , 2025-2030

Chapter 10. Automatic Aircraft doors Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Door Type

10.1.3. By Aircraft Type

10.1.4. By Material

10.1.5. Mechanism Type

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Door Type

10.2.3. By Aircraft Type

10.2.4. By Material

10.2.5. Mechanism Type

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Door Type

10.3.3. By Mechanism Type

10.3.4. By Material

10.3.5. Aircraft Type

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Mechanism Type

10.4.3. By Material

10.4.4. By Door Type

10.4.5. Aircraft Type

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Aircraft Type

10.5.3. By Mechanism Type

10.5.4. By Material

10.5.5. Door Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. AUTOMATIC AIRCRAFT DOORS MARKET– Company Profiles – (Overview, Portfolio, Financials, Strategies & Developments)

11.1 The Boeing Company

11.2 Honeywell International Inc.

11.3 Parker Hannifin Corporation

11.4 Fokker Technologies

11.5 Spirit AeroSystems Holdings, Inc.

11.6 Leonardo S.p.A.

11.7 Collins Aerospace

11.8 Bombardier Inc.

11.9 Mitsubishi Heavy Industries, Ltd.

11.10 Triumph Group, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The increasing demand for air travel, advancements in aerospace engineering, and a continued focus on safety and operational efficiency are key factors fueling the expansion of the aircraft doors market

The top players operating in the Automatic Aircraft doors Market are - The Boeing Company, Honeywell International Inc. and Parker Hannifin Corporation

The COVID-19 pandemic significantly impacted the automatic aircraft market, primarily due to a steep decline in air travel and aircraft manufacturing activities.

Leading manufacturers such as Boeing, Airbus, and Bombardier are prioritizing innovative designs and advanced materials to improve the performance and safety of aircraft doors.

Asia Pacific is the fastest-growing region in the Automatic Aircraft doors Market.