Automated Guided Vehicles (AGV) in Supply Chain Market Size (2023 – 2030)

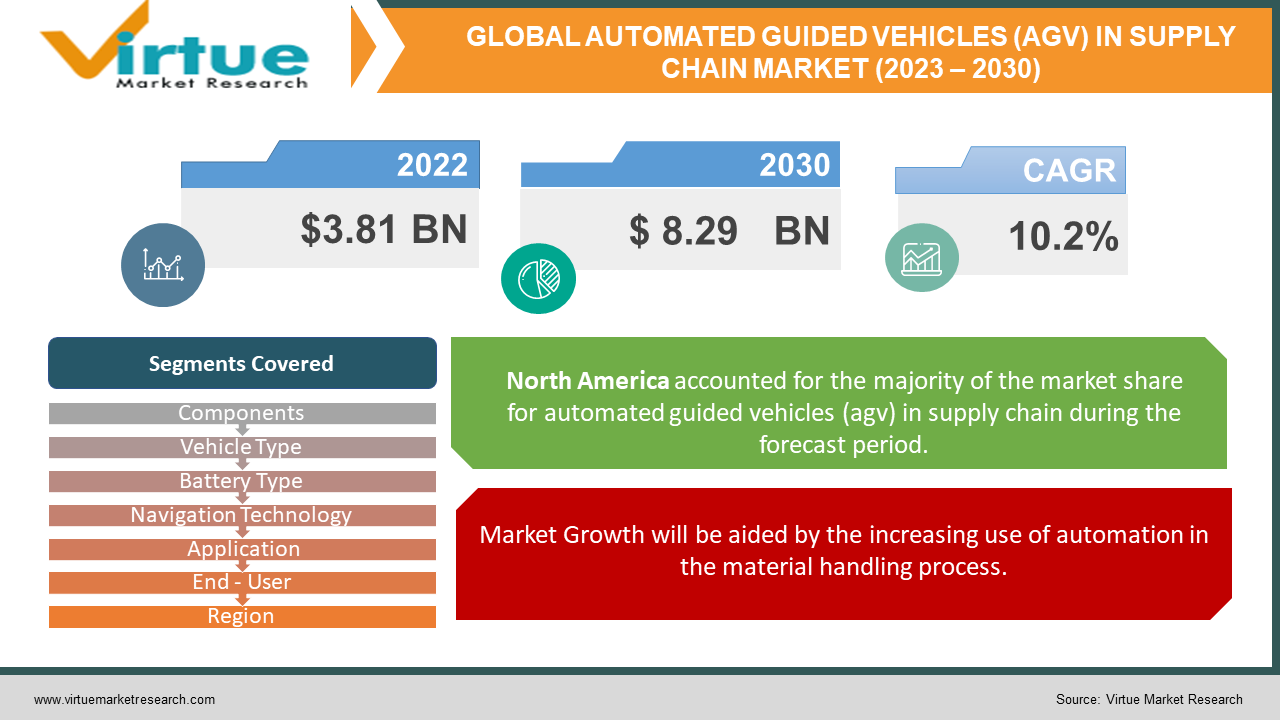

In 2022, the Global Automated Guided Vehicles (AGV) in Supply Chain Market was valued at USD 3.81 billion and is projected to reach a market size of USD 8.29 billion by 2030. The market is anticipated to witness a compound annual growth rate (CAGR) of 10.2% over the forecast period of 2023 - 2030. AGV systems help move and transfer products in industrial plants, warehouses, and distribution centres without the necessity of a fixed conveying system or user involvement. It follows adjustable guide pathways in the environment of premium space to optimise warehousing, selection, and transport operations. Growth for automation in material handling across sectors, a shift in demand from mass production to mass customisation, the rise in acceptance of e-commerce, and enhanced workplace safety norms are all driving the AGV in the supply chain industry forward.

INDUSTRY OVERVIEW:

Automated guided vehicles are material-handling equipment that is programmed to transport pallets, trolleys, and trays, among other items, between manufacturing and warehousing sites. These facilities help to increase efficiency, which leads to increased output and, as a result, a higher profit margin for the company. In today's world, industries are increasingly focusing on efficiency rather than just increasing productivity. Many industrial plants and others are exploring applying approaches like JIT (Just in Time), KANBAN, and others. AGV systems assist in the movement and transportation of products in industrial plants, warehouses, and distribution centres without the use of a fixed conveying system or user interaction. In a limited space context, it follows configurable principles to optimise storage, picking, and transportation duties. AGVs are widely employed for a variety of reasons, including decreased labour costs, reduced product damage, increased productivity, and the capacity to scale up to accommodate automated operations. Transportation and logistics organisations are encouraged to adopt AGVs to improve the efficiency of their operations because of these major benefits.

The automated guided vehicle market is growing due to a rise in demand for automation and automated guided vehicles in many industries, as well as improvements in safety, accuracy, and productivity. The automated guided vehicle market, on the other hand, is hampered by high initial investment costs and a lack of flexibility. Industry 4.0 is also expected to present lucrative growth possibilities for players in the automated guided vehicle market. The autonomous guided vehicle market has been greatly disrupted by the current COVID-19 pandemic scenario due to a lack of labour due to government-imposed lockdowns and the halting of production operations. However, due to an increase in demand for contactless and effective logistics infrastructure, the market is expected to grow at a significant rate in the future.

COVID-19 IMPACT ON AUTOMATED GUIDED VEHICLES (AGV) IN THE SUPPLY CHAIN MARKET:

Due to the COVID-19 epidemic and the resulting suspension in several sectors' operations, the AGV market size shrank in 2020. However, as a result of widespread immunisation in numerous countries, industry operations are rising. As global situations normalise and demand industrial products rises, the AGV industry is likely to regain traction in 2022 and ahead. The COVID-19 outbreak and expansion caught industries and businesses off guard, leaving them with little time to prepare or protect themselves against losses. As a result of the pandemic affecting numerous industries around the world, the AGV market in 2020 will be lower than the previous year. In most industrial units around the world, it resulted in the closure or suspension of production facilities. Many industries, including healthcare, e-commerce, and food and beverage, have seen significant changes as a result of the new normal. Global demand for both industrial and consumer goods has risen as well. As a result, compared to 2020, the AGV market is expected to expand in 2021 and ahead. As automation increases in all industries, the market size is predicted to grow faster than it was pre-pandemic in 2022, paving the path for more AGV use in 2026.

MARKET DRIVERS:

Market Growth will be aided by the increasing use of automation in the material handling process:

The demand for automation is expanding in the supply chain industries due to the overall requirement for high operational efficiency. AGV-enabled industrial facility automation can help satisfy material handling capacity requirements while also saving production time, lowering the risk of human mistakes, improving safety, ensuring high production volumes, and increasing precision and repeatability. With the use of developments such as Big Data, machine learning, and others, enhanced technology in the material handling process has enabled industries to have linked factories, leading to the adoption of automated material handling services. They can have more flexible production processes, better quality control, and better labour management as a result of this. The use of automated material handling systems is developing in tandem with the growth of the e-commerce sector around the world.

An increase in safety, accuracy, and productivity is going the propel market with positive growth:

Automated guided vehicles are built with safety in mind and are outfitted with lasers, cameras, and sensors that allow them to securely interact with workers and infrastructure. Some vehicles, such as forklifts, rely on human input and lack safety safeguards. As a result, there is always the risk of an operator becoming preoccupied or weary, resulting in an accident. As a result, the use of automated guided vehicles is on the rise to avoid such problems. Furthermore, replacing employees with AGVs reduces the risk of inaccuracy in the process, resulting in more productive and accurate output. AGV integration also provides for a constant flow of operations with improved processes. As a result, there was a boost in terms of safety, precision, and productivity.

MARKET RESTRAINTS:

AGVs' high installation, initial investment, maintenance, and switching costs can stifle market growth:

When compared to hiring people or using other human-operated equipment, the adoption of automated guided vehicles is not very profitable. The industries, on the other hand, can see the long-term benefits of adopting an autonomous guided vehicle. Furthermore, autonomous guided vehicles require routine maintenance and repair, resulting in considerable downtime. As a result, it might not be affordable for smaller businesses that don't have easy access to cash. As a result, the market for automated guided vehicles is expected to be hampered by high initial investment and maintenance expenses.

In emerging economies, the easy availability of low labour costs is limiting the deployment of AGVs:

The use of automated technologies across industries is limited in emerging economies such as India, Bangladesh, and Tanzania due to low worker pay rates. In many countries, where inexpensive labour is readily accessible, industrial automation makes little or no economic sense. Because the cost-benefit in labour trade-off with robots is lower in these emerging economies than in other industrialised countries due to the availability of inexpensive labour, automation in manufacturing facilities is less frequent. Bangladesh, Cuba, and Tanzania are among the countries with the lowest average daily salaries in the world. As a result, emerging-market companies are wary of investing in automated equipment such as AGVs. In emerging economies' manufacturing sectors, human labourers undertake a range of tasks and in combination with semiautomatic tools turn out to be an economical option for businesses.

AUTOMATED GUIDED VEHICLES (AGV) IN SUPPLY CHAIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10.2% |

|

Segments Covered |

By Components, By Vehicle Type, By Battery Type, By Navigation Technology, By Application, By End - User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Swisslog Holding AG, Egemin Automation Inc., Bastian Solutions, Inc., Daifuku Co., Ltd., Dematic, JBT, Seegrid Corporation, TOYOTA INDUSTRIES CORPORATION, Hyster-Yale Materials Handling, Inc., BALYO, E&K Automation GmbH |

This research report on Automated Guided Vehicles (AGV) in Supply Chain Market has been segmented and sub-segmented based on Components, By Vehicle Type, By Battery Type, By Navigation Technology, By Application, By End - User, and By Region.

AUTOMATED GUIDED VEHICLES (AGV) IN THE SUPPLY CHAIN MARKET- BY COMPONENTS

-

Hardware

-

Software

-

Service

Based on Components, the Automated Guided Vehicles in the supply chain industry are segmented into Hardware, Software and Services. In 2021, the hardware category dominated the market, accounting for more than 70% of total sales. The trend can be ascribed to the increased use of collaborative robots in production and distribution facilities to minimise human labour and redundant jobs. The accessibility of numerous optimization techniques in these vehicles, such as cobots, material handling equipment, gearheads, and actuators, has led to the hardware segment's greatest market share. Besides this, the services segment is poised to contribute significantly to the market growth of the Automated Guided Vehicles in the supply chain industry. The Services segment is anticipated to grow at the highest CAGR of 11.7% over the forecast period of 2023 - 2030. End-user demand for different services, including preventative and corrective maintenance, vehicle and software health checks, and training staff associated directly or indirectly with the operation of AGVs, is driving the expansion.

AUTOMATED GUIDED VEHICLES (AGV) IN THE SUPPLY CHAIN MARKET- BY VEHICLE TYPE

-

Tow Vehicle

-

Unit Load Carrier

-

Pallet Truck

-

Forklift Truck

-

Hybrid Vehicles

-

Others

Based on Vehicle Type, the Automated Guided Vehicles in the supply chain industry is segmented into Tow Vehicle Unit Load Carrier, Pallet Truck, Forklift Truck and Hybrid Vehicles among others. In 2021, the tow vehicle sector led the market, accounting for more than 40% of total sales. These vehicles are used to transport huge payloads in non-powered trailers. They are the most efficient type of AGV used for towing and pulling since they can carry larger loads with many trailers than a single fork truck.

Over the projected period, the unit load carrier category is predicted to grow at the fastest CAGR of 12.4 per cent. Pallets, huge containers, and roll handling are all delivered using unit load AGVs. It also allows for more effective work scheduling by decreasing aisle traffic and product damage. Unit load carrier AGVs are also used instead of fork trucks, which require workers to operate. As a result, these AGVs are ideal for lengthy journeys, repetitive jobs, and potentially dangerous environments. Moreover, they are autonomous robots, which minimize the need for human labour while also enhancing worker safety. Unit load carriers provide the extra benefits of trackable scheduling and product delivery, making them effective for the shipping of large items.

AUTOMATED GUIDED VEHICLES (AGV) IN THE SUPPLY CHAIN MARKET- BY BATTERY TYPE

-

Lead Battery

-

Lithium-Ion Battery

-

Nickel-based Battery

-

Others

Based on Battery Type, the Automated Guided Vehicles in the supply chain industry is segmented into Lead Battery, Lithium-Ion Battery and Nickel-based Battery among others. In 2021, the lead battery sector led the market, accounting for more than 60% of total sales. Compared to other battery varieties, these batteries are less expensive. It also has excellent reversibility, a steady voltage, a long service life, and can be used in a variety of applications. Over the forecast period, the lithium-ion battery segment is expected to grow at the fastest rate of 15.8 per cent.

AUTOMATED GUIDED VEHICLES (AGV) IN THE SUPPLY CHAIN MARKET- BY NAVIGATION TECHNOLOGY

-

Laser Guidance

-

Magnetic Guidance

-

Vision Guidance

-

Inductive Guidance

-

Natural Navigation

-

Others

Based on Navigation Technology, the Automated Guided Vehicles in the supply chain industry are categorized into Laser Guidance, Magnetic Guidance, Vision Guidance, Inductive Guidance and Natural Navigation among others. Among these, in 2021, the laser guidance category led the market, accounting for more than 35% of total revenue. Due to its role as an electronic eye to evade obstacles in the path, the laser guiding sub-segment in the logistics industries is predicted to increase. As the AGVs encounter challenges while executing operations, laser systems are appealing owing to their combination of adaptability and accuracy to evade any disruptions or obstacles.

Over the projected period, the vision guidance market is likely to develop at a healthy pace. The growing use of autonomous cars is fueled by the need for optimized and efficient routing. Developments in computer vision and associated software solutions are helping Automated vehicles to better evaluate the surroundings in real-time, increasing demand for AGVs for activities in difficult conditions such as navigating large components down small aisles. Besides this, the Natural Navigation segment is also poised to significantly contribute to the market growth. Over the projected period, the natural navigation category is predicted to grow at the fastest rate of 17.4%.

AUTOMATED GUIDED VEHICLES (AGV) IN THE SUPPLY CHAIN MARKET- BY APPLICATION

-

Logistics & Warehousing

-

Storage & Assembly

-

Packaging

-

Others

The Automated Guided Vehicle is used in a wide range of industries including Transportation & Distribution, Storage & Assembly and Packaging industries among others. In 2021, the logistics and warehousing category led the market, accounting for more than 40% of total revenue. Modern retrieval and automated storage systems, as well as other material handling equipment, are being rapidly adopted by businesses modernising existing facilities and developing new ones to save labour costs and increase efficiency and production and is consequently driving the segmental growth.

The storage and assembly segment is anticipated to expand at a CAGR of 13.1% over the forecast period. Taller racks, compact layouts, and tight lanes are being used by logistics and storage companies to stay competitive. Simultaneously, they are attempting to increase the efficiency of their operations to meet the increased demand for their services. These businesses are employing AGV solutions in particular because they can navigate correctly and effectively through small aisles and compact layouts, as well as improve the storage process's dependability. The market for AGVs in the supply chain industry is predicted to rise in response to increased demand from logistics and warehousing companies.

AUTOMATED GUIDED VEHICLES (AGV) IN THE SUPPLY CHAIN MARKET- BY END-USER

-

Automotive

-

Food & Beverage

-

E-commerce

-

Manufacturing

-

Others

Based on End Use, the Automated Guided Vehicles in the supply chain industry is widely used in the Automotive, Food & Beverage, Ecommerce and Manufacturing industry. In 2021, the manufacturing category dominated the market, accounting for more than 75% of total sales. AGVs are installed with laser heads, cameras, and other sensors to aid in their safe operation around machinery, buildings, and people. While employees in a production or distribution facility might make mistakes that lead to accidents and disasters, AGVs can assist improve workflow precision, decreasing waste and increasing efficiency. The E-Commerce segment is projected to contribute significantly to the market growth. The market growth is driven by the growth of the eCommerce giants such as Amazon, Alibaba, and others. In the e-commerce industry, AGVs assist in the proper material handling, ERP systems, high-rack storage systems, and warehouse management.

AUTOMATED GUIDED VEHICLES (AGV) IN THE SUPPLY CHAIN MARKET- BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

Based on region, the Automated Guided Vehicles in the supply chain industry are grouped into North America, Europe, Asia Pacific, Latin America, The Middle East, and Africa. North America is expected to develop rapidly as the region with the greatest automated guided vehicle market share. Key Players' Strong Presence in the United States to drive market growth during the forecast period. The increase in the number of import and export operations is driving the expansion. Warehouse operators are increasingly relying on automation technology to improve warehouse operations and increase efficiency. Companies operating in the region are developing new tools and equipment using cutting-edge technology to fulfil expanding client demands. Furthermore, being one of the world's most advanced nations, the United States is predicted to grow greatly.

The rapidly growing e-commerce business in many nations, such as China, India, and Japan, is predicted to propel the Asia Pacific to exponential growth over the forecast period. Several governments in the Asia Pacific are taking a range of efforts to help the region's manufacturing industry to thrive, which presents an appealing market expansion opportunity. Furthermore, the e-commerce industry is booming, and several e-commerce companies are thinking about expanding into these regional markets. As a result, e-commerce competition has risen, and industry incumbents are striving to differentiate themselves by lowering the time it takes to deliver things to end-users.

The European market is expected to grow steadily over the projection period. The regional market is growing due to the rising demand for material handling equipment among incumbents in the manufacturing industry. Additionally, automation has supported regional market expansion in every business. Key players are also concentrating on improving their product portfolio to promote the development of industry 4.0 and industrial automation. Furthermore, public and private sector investments in the field of sustainable development are projected to rise which is propelling market growth in the region.

AUTOMATED GUIDED VEHICLES (AGV) IN THE SUPPLY CHAIN MARKET- BY COMPANIES

Due to the presence of several market players, the industry for the automated guided vehicle is moderately fragmented and competitive. Factors like digitalization and the emergence of integrated Industry 4.0 with IoT will present significant development prospects for the autonomous guided vehicle industry. The major players are focusing on innovation, mergers and product launches to capture market share and increase their product portfolio. Major market participants include:

- Swisslog Holding AG

- Egemin Automation Inc.

- Bastian Solutions, Inc.

- Daifuku Co., Ltd.

- Dematic

- JBT

- Seegrid Corporation

- TOYOTA INDUSTRIES CORPORATION

- Hyster-Yale Materials Handling, Inc.

- BALYO

- E&K Automation GmbH

NOTABLE HAPPENING IN AUTOMATED GUIDED VEHICLES (AGV) IN THE SUPPLY CHAIN MARKET

- PRODUCT LAUNCH- Addverb Technologies Private Limited, a robotics and automation company, announced its development into the Australian, European, and Singapore markets in September 2021. This effort was launched in response to the global market's expanding demand for unit load AGVs, robotics, and automation solutions.

- PRODUCT LAUNCH- Addverb Technologies Private Limited, a robotics and automation company, announced its development into the Australian, European, and Singapore markets in September 2021. This effort was launched in response to the global market's expanding demand for unit load AGVs, robotics, and automation solutions.

- FUNDING- Seegrid Corporation has announced a USD 25 million equity fundraising round headed by G2VP Ventures. The firm claims that the investment is motivated by the COVID-19 epidemic and that the industry mandates social separation for non-essential personnel, as well as a variety of industrial positions that need individuals to be physically present.

- PRODUCT LAUNCH- In July 2021, ElephantRobotics, a Chinese firm specialising in robotics design, production, development, and intelligent manufacturing services, introduced MyAGV, a vehicle with an A-5-megapixel camera and an 8-meter recognition range that can identify obstacles and gather data.

Chapter 1. Automated Guided Vehicles (AGV) in Supply Chain Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Automated Guided Vehicles (AGV) in Supply Chain Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Automated Guided Vehicles (AGV) in Supply Chain Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Automated Guided Vehicles (AGV) in Supply Chain Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Automated Guided Vehicles (AGV) in Supply Chain Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Automated Guided Vehicles (AGV) in Supply Chain Market – By Componenets

6.1. Hardware

6.2. Software

6.3. Service

Chapter 7. Automated Guided Vehicles (AGV) in Supply Chain Market – By Vehicle Type

7.1. Tow Vehicle

7.2. Unit Load Carrier

7.3. Pallet Truck

7.4. Forklift Truck

7.5. Hybrid Vehicles

7.6. Others

Chapter 8. Automated Guided Vehicles (AGV) in Supply Chain Market – By Battery Type

8.1. Lead Battery

8.2. Lithium-Ion Battery

8.3. Nickel-based Battery

8.4. Others

Chapter 9. Automated Guided Vehicles (AGV) in Supply Chain Market – By Navigation Technology

9.1. Laser Guidance

9.2. Magnetic Guidance

9.3. Vision Guidance

9.4. Inductive Guidance

9.5. Natural Navigation

9.6. Others

Chapter 10. Automated Guided Vehicles (AGV) in Supply Chain Market – By Application

10.1. Logistics & Warehousing

10.2. Storage & Assembly

10.3. Packaging

10.4. Others

Chapter 11. Automated Guided Vehicles (AGV) in Supply Chain Market – By End-Use

11.1 Automotive

11.2. Food & Beverage

11.3. E-commerce

11.4. Manufacturing

11.5. Others

Chapter12. Automated Guided Vehicles (AGV) in Supply Chain Market- By Region

12.1. North America

12.2. Europe

12.3. Asia-Pacific

12.4. Latin America

12.5. The Middle East

12.6. Africa

Chapter 13. Automated Guided Vehicles (AGV) in Supply Chain Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

13.1. Swisslog Holding AG

13.2. Egemin Automation Inc.

13.3. Bastian Solutions, Inc.

13.4. Daifuku Co., Ltd.

13.5. Dematic

13.6. JBT

13.7. Seegrid Corporation

13.8. TOYOTA INDUSTRIES CORPORATION

13.9. Hyster-Yale Materials Handling, Inc.

13.10. BALYO

13.11. E&K Automation GmbH

Download Sample

Choose License Type

2500

4250

5250

6900