Automated Compounding Devices (Oncology) Market Size (2024 – 2030)

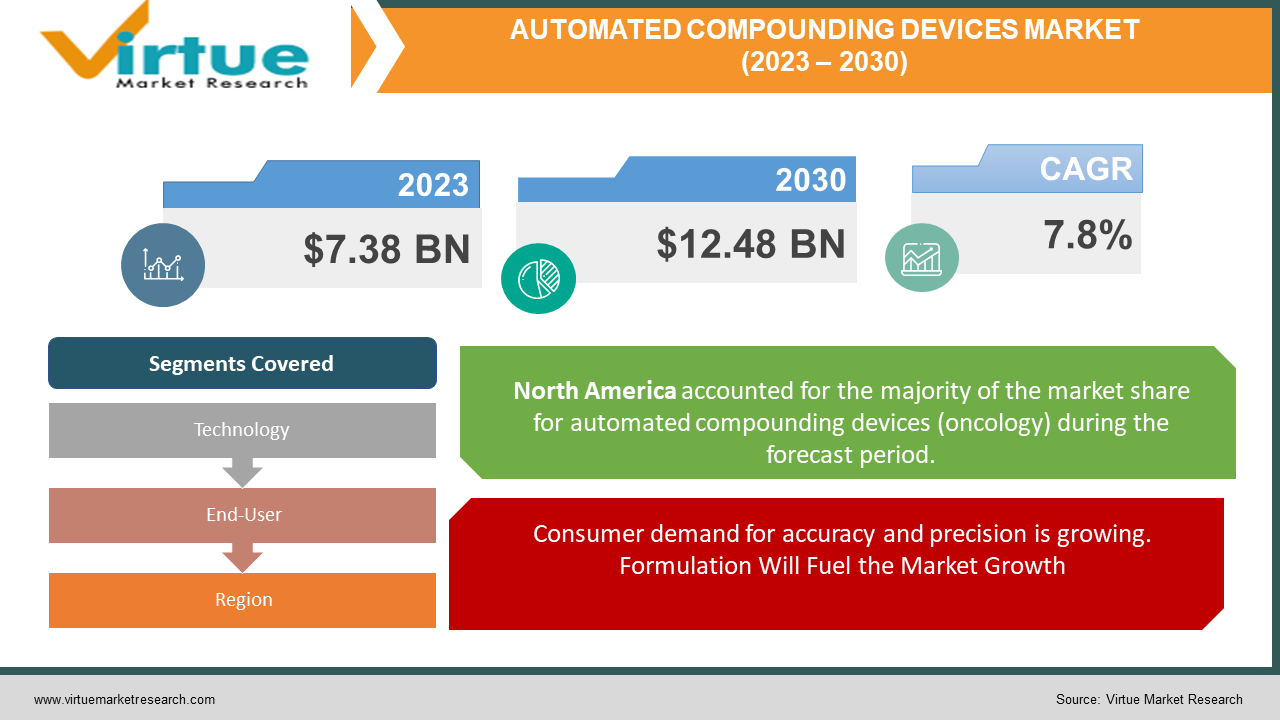

The market for automated compounding devices was valued at USD 7.38 billion in 2023 and is projected to reach a market size of USD 12.48 billion by the end of 2030. The market is projected to grow at a CAGR of 7.8%.

Within the broader healthcare industry, the automated compounding device oncology market is rapidly evolving. These devices can be used to automate the preparation of sterile medications for cancer patients.As precision and accuracy are critical in cancer treatments, automated compounding devices play a vital role in enhancing patient safety. The automated compound device oncology market has continuous technological improvements. These innovations are designed to help healthcare professionals deliver better patient outcomes. Increasing awareness about automated compounding systems and the introduction of novel robotic technology in compounding systems are likely to increase the growth of the automated compounding systems market during the forecast period.

Key Market Insights:

The Automated Compounding Devices (ACD) market is driven by several key trends. The ACD market has some key market insights. The prevalence of cancer is increasing. An estimated 19.3 million new cases were diagnosed all over the world in 2020. This rising prevalence of cancer is a significant driver of demand for ACDs, as these devices can safely and accurately compound hazardous oncology drugs. Adoption of personalized medicine. Personalize machine, which tailors treatment to the individual patient's needs, is gaining traction. ACDs can be used to compound medications that are specifically designed for the patient's genetic makeup and other factors. There is a demand for safer and more efficient compounding methods. Concerns about patient safety can be raised by traditional compounding methods. ACDs offer a more precise and controlled approach to compounding, reducing the risk of errors. The elderly population is growing. The aging population is at an increased risk of developing cancer, which contributes to the demand for ACD’s. As the elderly population grows, the need for safe and effective oncology treatments will increase.

Automated Compounding Devices (Oncology) – Market Drivers:

Consumer demand for accuracy and precision is growing. Formulation Will Fuel the Market Growth.

Automated compounding systems to measure and distribute pharmaceuticals. Errors in the manual mixing of medications are possible. On the other hand, automated compounding systems use technology to ensure that the right dosage is administered each time. This can lower the likelihood of drug mistakes due to the potential for major patient repercussions.

This can lower the likelihood of drug mistakes due to the potential for major patient repercussions. The effectiveness of the manufacture of medications can be increased by automated compounding systems. healthcare practitioners can save time and money by using automated measuring and administering prescriptions. The automated compounding system market is growing because of the rising need for precision and accuracy in the manufacture of medications, the requirement to adhere to rules and accreditation requirements, and the opportunity for increased efficiency.

The Rising Incidence of Chronic Conditions Including Cancer, Diabetes, And Heart Disease Is Propelling Market Growth.

The demand for ACD’s is being driven by the increasing prevalence of cancer. Accurate and safe compounding of oncology medications is crucial as cancer diagnoses rise. ACDs offer a precise and controlled approach to compounding, reducing the risk of errors and ensuring consistent drug dosing.

Automated Compounding Devices (Oncology) – Market Restraints and Challenges:

Large Initial Capital Expenditures to Impede Market Expansion.

Some healthcare providers and experts are hesitant to implement IT-based pharmacy management strategies. This can be seen in emerging economies when cultural barriers are present. Since they don’t want help, many pharmacists don’t use pharmacy automation systems as part of their regular procedures. Although there are many advantages to automated pharmacy systems, only high-volume pharmacies and hospitals have been able to demonstrate the returns on investment (ROIs) from putting these automated systems in place.

Additionally, the regulatory landscape for ACDs is constantly evolving. It's difficult for companies to develop and market ACDs because they have to comply with a lot of regulations.

Automated Compounding Devices (Oncology) – Market Opportunities:

The rising prevalence of cancer, the adoption of personalized medicine, and the demand for safer compounding methods are some of the reasons why the Automated Compounding Devices (ACD) market is poised for significant growth. Enhancing restraining factors expanding market reach, and fostering collaborative partnerships will further accelerate the adoption of ACDs, making them a cornerstone of improving patient safety and treatment outcomes in oncology care.

AUTOMATED COMPOUNDING DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Technology, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Baxter, COMECER, ICU Medical, Omnicell Grifols, Equashield, B. Braun Holding ARxIUM, Weibond Technology, Newlcon |

Automated Compounding Devices (Oncology) Market Segmentation: By Technology

-

Gravimetric Compounding System

-

Volumetric Compounding System

Automated compounding systems use a balance to accurately measure the weight of each ingredient, ensuring precise dosing and minimizing the risk of errors. The high level of accuracy and reliability of these systems makes them a good choice for compounding hazardous oncology drugs. The weight of the ingredients is measured by placing them on a balance. The system will put the correct amount of each ingredient into a compounding bag. The precise method ensures that patients receive the correct amount of medication. A wide range of medications can be compounded with gravimetric compounding systems. They are a valuable asset to any pharmacy or healthcare facility. Volumetric Compounding Systems (VCS) use pumps to deliver the exact volume of each ingredient, ensuring consistency and reducing the risk of errors. These systems are more cost-effective than gravimetric systems and can provide faster compounding speeds. The volume of each ingredient can be transferred into a compounding bag by using pumps. The pumps are adjusted to ensure that the correct amount of each ingredient is given out, and the system adjusts for factors such as temperature and pressure.

Automated Compounding Devices (Oncology) Market Segmentation: By End-User

-

Hospitals

-

Chemotherapy Centers

-

Others

In 2023, Hospitals dominated the global market and accounted for the highest market share of around 65% and is further anticipated to be the fastest-growing segment. There is a high demand for safe and accurate compounding of oncology medications. Hospitals with large volumes of oncology medications and the need for sterility can integrate ACDs into their systems to streamline compounding processes and enhance patient safety. Chemotherapy centers use ACDs to ensure the safety and precision of their treatments. Increasing applications in pharmacies, ambulatory clinics, and home healthcare settings are being found by ACDs. As the prevalence of cancer and the adoption of personalized medicine continue to rise, the demand for ACDs is poised to surge, making them an indispensable tool for improving patient safety, treatment outcomes, and overall healthcare quality. Chemotherapy Centers are the fastest growing in terms of users.

Automated Compounding Devices (Oncology) Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, North America will be the largest market for ACDs, accounting for 42% of the global market in 2023. This is due to the high prevalence of cancer, the early adoption of new technologies, and the strong presence of key ACD manufacturers in the region.

Europe is the second-largest market for ACDs. The growing demand for safer and more efficient compounding methods is driving the growth of the ACD market in Europe. The Asia Pacific region is expected to be the fastest-growing market for ACDs. The growth is being driven by the large and growing population, rising disposable incomes, and increasing awareness of cancer. The markets are expected to grow due to the increasing prevalence of cancer and the growing adoption of ACDs. This segment in the coming years, is expected to evolve. The Asia Pacific region is expected to see the fastest growth, while the North American and European markets are expected to mature.

COVID-19 Impact Analysis on the Global Automated Compounding Devices (Oncology) – Market:

As hospitals and clinics work to boost productivity and lower the chance of human mistakes while preparing pharmaceuticals, the demand for automated compounding systems has grown significantly. Hospitals are under a lot of pressure to treat a lot of patients. The rising demand for automated compounding systems is motivated by the desire to reduce the risk of contamination, as these systems are made to limit human contact with pharmaceuticals. This is important since the virus can spread through contact. The need for automated compounding systems in retail and ambulatory care settings has grown as a result of the COVID-19 pandemic, which has sparked a move toward virtual and telemedicine consultations.

Latest Trends/ Developments:

Artificial intelligence and machine learning are some of the advanced technologies incorporated into smart ACDs. The ACDs can alert users to potential errors, improve patient safety, and automatically identify medications. The integration of ACDs with electronic health records is streamlining the compounding process. Real-time data exchange between ACDs and EHRs allows for a reduction in the need for manual data entry and ensures accurate patient medication records.

Real-time tracking of device performance and identifying potential issues before they cause downtime or affect patient care are being integrated into ACDs. Proactive scheduling of maintenance activities and minimizing disruptions to medication compounding services can be achieved with this remote monitoring.

Closed system ACDs provide a sterile environment for compounding, which reduces the risk of contamination and improves patient safety. The closed system ACDs are important for compounding drugs that need aseptic conditions.

Key Players:

-

Baxter

-

COMECER

-

ICU Medical

-

Omnicell

-

Grifols

-

Equashield

-

B. Braun Holding

-

ARxIUM

-

Weibond Technology

-

Newlcon

Chapter 1. Automated Compounding Devices (Oncology) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automated Compounding Devices (Oncology) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automated Compounding Devices (Oncology) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automated Compounding Devices (Oncology) Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automated Compounding Devices (Oncology) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automated Compounding Devices (Oncology) Market – By Technology

6.1 Introduction/Key Findings

6.2 Gravimetric Compounding System

6.3 Volumetric Compounding System

6.4 Y-O-Y Growth trend Analysis By Technology

6.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Automated Compounding Devices (Oncology) Market – By End-User

7.1 Introduction/Key Findings

7.2 Hospitals

7.3 Chemotherapy Centers

7.4 Others

7.5 Y-O-Y Growth trend Analysis By End-User

7.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Automated Compounding Devices (Oncology) Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Technology

8.1.3 By End-User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Technology

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Technology

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Technology

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Technology

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Automated Compounding Devices (Oncology) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Baxter

9.2 COMECER

9.3 ICU Medical

9.4 Omnicell

9.5 Grifols

9.6 Equashield

9.7 B. Braun Holding

9.8 ARxIUM

9.9 Weibond Technology

9.10 Newlcon

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automated Compounding Devices (Oncology) – Market was valued at USD 7.38 billion and is projected to reach a market size of USD 12.48 billion by the end of 2030. The market is projected to grow at a CAGR of 7.8%.

Growing Consumer Demand for Accuracy and Precision in Pharmaceuticals and Rising Incidence of Chronic Conditions Including Cancer, Diabetes, And Heart Disease.

Based on End-User, the Global Automated Compounding Devices (Oncology) – Market is segmented into Hospitals and Chemo centers.

North America is the most dominant region for the Global Automated Compounding Devices (Oncology) – Market.

Baxter; B. Braun SE; COMECER S.p.A.; ARxIUM; Omnicell; Grifols, S.A.; Weibond Technology; EQUASHIELD; ICU Medical, Inc; and NewIcon. in the Global Automated Compounding Devices (Oncology) – Market.