Global Automated Blood Culture Tests Market Size (2024-2030)

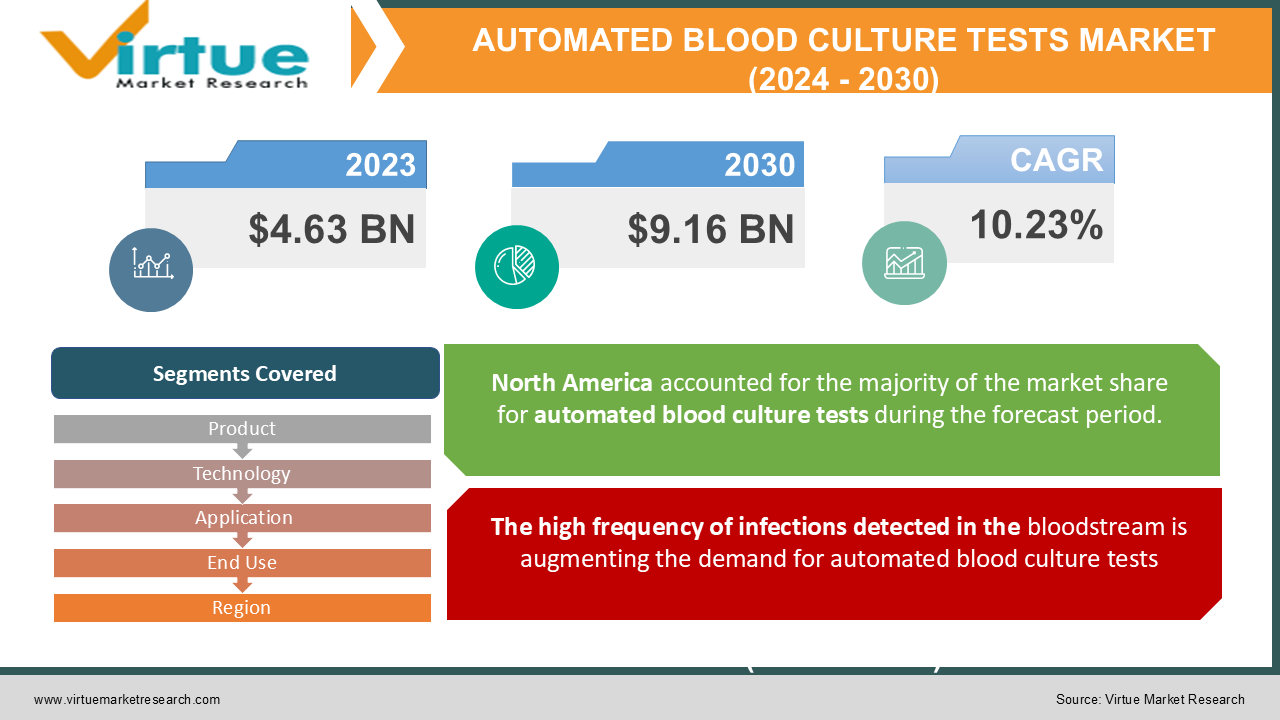

The Global Automated Blood Culture Tests Market is valued at USD 4.63 Billion in 2023 and is projected to reach a market size of USD 9.16 Billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.23%.

Market Overview:

An Automated Blood Culture Test is a procedure for associating the presence of microorganisms in the blood, such as fungi or bacteria. It determines the fundamental cause of bloodstream infection and provides an appropriate course of treatment. The total blood count and chemical analysis are two diagnostic tests that are customarily performed simultaneously with automated blood culture testing. Tests using blood cultures are significantly important in the diagnosis of many infectious diseases. Growth in the market is anticipated to boost by the increasing prevalence of infectious disorders and advancements in diagnostic technologies. Additionally, it is predicted that an aging geriatric population and the demand for quick diagnosis and treatment will augment the automated blood culture testing market. According to a report by the World Health Organization, over 17.1 million people globally pass away each year as a result of infectious disorders.Moreover, it is predicted that an increase in R&D investments and rising public awareness of early diagnosis will aid market growth in the forecast period. The market for automated blood culture tests has been showcasing northward growth owing to the increasing demand for speedy diagnoses. It is more frequently advised as a result of increasing rates of hospital-acquired infections, infectious illnesses, and lowered immunity due to high pollution levels. Stringent rules and laws in places like North America and Europe, however, are some of the restraining factorshampering the growth of the market.

COVID-19 Impact on the Automated Blood Culture Tests Market:

The COVID-19 outbreak started inChina in December 2019, and since then, it has out stretched worldwide at a very rapid pace. China, Italy, Iran, Spain, the Republic of Korea, France, Germany, and the US are among the worst-hit countries in terms of the number of positive cases and reported deaths. The COVID-19 outbreak has significantly affectedindustries in various countries due to lockdowns and businesses shutting down. The global healthcare sector was the major sector that faced serious disturbances such as supply chain disruptions, technology events, and office shutdowns as a result of this outbreak. It hampered the overall growth in three main ways: by affecting production and demand, its financial impact on the manufacturing industry, by supply-chain disruptions. The prevalence of bloodstream infections and diseases concerned with it has increased substantially over the past few years. Also, due to shutdowns and the restrictive lifestyle that followed the lockdown, the body’s rhythm got disrupted by reduced physical activity, poor sleeping patterns, unhealthy eating habits, and stress. The overall market shutdown due to COVID-19 also affected growth due to the shutting down of factories, disruptions in the supply chain, and a downturn in the world economy.

Market Drivers:

The high frequency of infections detected in the bloodstream is augmenting the demand for automated blood culture tests:

Bloodstream infections or healthcare-associated infections are among the major causes of death globally. There are over 255,000 hospital-acquired Bloodstream infection cases each year in the United States. Around 33 million individuals are affected by bloodstream infections globally every year, out of which 3 million infants and 1.2 million kids develop sepsis,and the rest 6.1 million result in fatal death. In Eastern Africa, bloodstream infections are estimated to affect anywhere between 11% to 28% of patients. According to the Journal of Tropical Medicine, 2019, bloodstreaminfections in Ghana are between 9.3% to 11.2%. These high rates of infection prolong hospital stays and raiseoverall treatment costs. These factors are estimated to aid the demand for automated blood culture tests and increase the market size in the forecasted years.

The increasing government initiatives and investments are fostering the market growth rate:

The growing government initiatives for the R&D and manufacture of automated blood culture test products, the rise in healthcare awareness to reduce the risk of diseases, and the growing demand for blood culture tests all contribute to the market’s growth. Also, the installation of regulatory frameworks for the R&Ds associated with advanced diagnostic devices and technologies is estimated to boost the market growth.

Growing investments in R&D and new technology in the Healthcare sector is boosting the market growth:

Private capital investment and spending on pharmaceutical R&D and the approval and launch of new therapies and technologies have both increased remarkably in recent years, renewing a decades-long trend that was disrupted in 2008 as the 2007–2009 recession occurred. Particularly, spending on Research and Development in the field elevated by nearly 65% between 2017 and 2020. Therefore, increased competition and constant innovations in the pharmacy industry are escalating the automated blood culture tests market.

Market Restraints:

The high costs of automated instruments and technologies related to the blood culture tests is hampering the market growth size:

Automated blood culture test equipment is expensive as it has more advanced and sophisticated features and functions. Additionally, its maintenance costs and other indirect expenditure lead to increased overall costs involved. Thus, creating a significant barrier among small end users to uptake automated blood culture tests.

Increased technological advancements in the market are slowing down the growth of the global market size:

Several companies are introducing new cutting-edge technologies to compete with traditional items such as polystainers and microscopes. Key players are adopting and investing in new technologies to widen their product and services portfolio to maintain their market position. This is estimated to de-escalate the growth of the global market size for automated blood culture tests.

AUTOMATED BLOOD CULTURE TESTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.23% |

|

Segments Covered |

By Product, Technology, Application, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Becton Dickenson and Company, Thermo Fisher Scientific, bioMérieux SA, Luminex Corporation, Danaher Corporation, Bruker Corporation, IRIDICA, Roche Diagnostics, T2 Biosystems, Anaerobe Systems, OpGen, Meditech Technologies India Private Limited, Carl Zeiss AG, Nikon Corporation, BINDER GmbH, Biobase Biotech, Scenker Biological Technology Co., Bulldog Bio, Axiom Laboratories, HiMedia Laboratories |

This research report on the Automated Blood Culture Tests Market has been segmented and sub-segmented based on the Product, Technology, Application, End-Use, Region, and Companies.

Automated Blood Culture Tests Market – Product.

• Consumables

o Bacterial Infections

o Fungal Infections

o Mycobacterial Infections

o Assay, Kits, and Reagents

o Blood Culture Accessories

o Blood Culture Media

Aerobic

Anaerobic

Fungi/Yeast

Others

• Instruments

o Bacterial Infections

o Fungal Infections

o Mycobacterial Infections

o Automated Blood Culture Systems

o Laboratory Equipment

Incubators

Colony counters

Microscopes

Gram stainers

• Software & Services

o Bacterial Infections

o Fungal Infections

o Mycobacterial Infections

Based on the product, the automated blood culture tests market is segmented into 3 segments – Consumables, Instruments, and Software & Services.

Consumables account for the largest share of the revenue in 2022. The high purchasing rate of consumables is primarily propelling the growth of the segment.

The Instrument segment is anticipated to project a significant CAGR during the forecast period. In hospitals, clinics, and other diagnostic labs, automated systems, incubators, microscopes, and gram strainers are frequently used. Companies providing diagnostic services and technologies are concentrating on introducing cutting-edge technologies to meet customer demand.Modern automated techniques fabricatevery accurate findings quickly and efficiently with little chance of contamination.

Automated Blood Culture Tests Market – Technology.

- Culture-based Technology

- Proteomic technology

- Molecular Technology

o PCR

o Microarray

o PNA-FISH

Based on technology, the automated blood culture tests market is segmented into 3 segments – Culture-based Technology, Proteomic Technology, and Molecular Technology.

The technology segment drives the largest market share revenue and dominates the market.

Molecular Technology is anticipated to drive the segment and project the highest CAGR in the forecasted years, 2023-2028.Rapid diagnostic method advancements for identifying bacterial or fungal infections in the blood are in demand due to increasing manufacturers' R&D expenditures and growth in the prevalence of infectious disorders. The market is predicted to grow as a result of rising demand for cutting-edge diagnostic tools including microarray, PCR, and Peptide Nucleic Acid. The PNA-FISH technology sub-segment is predicted to grow at the highest CAGR during the forecast timeline as a result of its advantages, including improved accuracy, shorter test times, and increased test efficiency.

Automated Blood Culture Tests Market – Application.

- Bacterial Infections

- Fungal Infections

- Mycobacterial Infections

Based on application, the automated blood culture tests market is segmented into 3 segments – Bacterial Infections, Fungal Infections, and Mycobacterial Infections.

As bacterial infection is the most frequently occurring cause of BSI and other infections, the bacterial infections segment holds the largest market share in terms of revenue in 2022. Also, the segment is estimated to have the highest CAGR during the forecast period. The segment's growth is predicted to be propelled by increasing healthcare awareness and improved healthcare infrastructure in developing nations like South Africa, Tanzania, China, India, and Argentina. The governments of these economies are working to provide higher-quality medical facilities and diagnostic tools.

Automated Blood Culture Tests Market – End-Use.

- Hospital Laboratories

- Reference Laboratories

- Others

Based on end-use, the automated blood culture tests market is segmented into 3 segments – Hospital Laboratories, Reference Laboratories, and Others.

Hospital Laboratories dominate the global market share. This is due to arise in thenumber of infections that are acquired in hospitals (HAIs). The WHO estimates that developing nations have an infection ratetwo to three times higher than that of industrialized nations.Additionally, throughout the forecast timeline, the hospital laboratory segment is estimated to grow at the highest CAGR. The primary driver of the growth is increasing public awareness of healthcare issues together with initiatives taken by the government and non-governmental organizations to prevent and control infectious diseases.

Due to a rise in hospitals outsourcing their blood culture testing to reference laboratories, the reference laboratories market sector is estimated to witness profitable growth throughout the forecast period. The reference laboratories are sourced with cutting-edge diagnostic tools that deliver faster, more accurate, and more efficient results.

Automated Blood Culture Tests Market – Region.

- North America

- Europe

- South America

- Asia-Pacific

- Middle-East and Africa

Based on region, the automated blood culture tests market is segmented into 5 major regions – North America, Europe, South America, Asia-Pacific, Middle-East, and Africa.

North America dominates the global market with the highest revenue market in 2022. Owing to the presence of several significant healthcare organizations like Becton, Dickinson and Company, bioMérieux SA, Thermo Fisher Scientific, Inc., and Roche Diagnostics.

The availability of advanced diagnostics technologies and the presence of greatly developed healthcare infrastructure in European nations like Germany, the U.K., Switzerland, and France are anticipated to augment market growth in Europe. Additionally, manufacturers' rising R&D investments for the creation of new products are predicted to fuel growth.

Because of its high prevalence of infectious disorders and increasing healthcare infrastructure, Asia Pacific is anticipated to witness the highest CAGR during the forecast period. For economic growth, many businesses are focusing on Asian economies like China and India. Some of the major drivers of the regional market in the Asia Pacific include the availability of a huge base of target consumers and rising disposable income.

Automated Blood Culture Tests Market – Companies.

- Becton Dickenson and Company

- Thermo Fisher Scientific

- bioMérieux SA

- Luminex Corporation

- Danaher Corporation

- Bruker Corporation

- IRIDICA

- Roche Diagnostics

- T2 Biosystems

- Anaerobe Systems

- OpGen

- Meditech Technologies India Private Limited

- Carl Zeiss AG

- Nikon Corporation

- BINDER GmbH

- Biobase Biotech

- Scenker Biological Technology Co.

- Bulldog Bio

- Axiom Laboratories

- HiMedia Laboratories

Key Recent Industry Developments:

- In May 2022, Biomérieux Sa Bruker Corporation, a key leader in in-vitro diagnostics acquired Specific Diagnostics.

Chapter 1. Automated Blood Culture Tests Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Automated Blood Culture Tests Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Automated Blood Culture Tests Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Automated Blood Culture Tests Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.Automated Blood Culture Tests Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Automated Blood Culture Tests Market – By Product

6.1. Consumables

6.1.1. Bacterial Infections

6.1.2. Fungal Infections

6.1.3. Mycobacterial Infections

6.1.4. Assay, Kits and Reagents

6.1.5. Blood Culture Accessories

6.1.6. Blood Culture Media

6.1.6.1. Aerobic

6.1.6.2. Anerobic

6.1.6.3. Fungi/Yeast

6.1.6.4. Others

6.2. Instruments

6.2.1. Bacterial Infections

6.2.2. Fungal Infections

6.2.3. Mycobacterial Infections

6.2.4. Automated Blood Culture Systems

6.2.5. Laboratory Equipment

6.2.5.1. Incubators

6.2.5.2. Colony counters

6.2.5.3. Microscopes

6.2.5.4. Gram stainers

6.3. Software & Services

6.3.1. Bacterial Infections

6.3.2. Fungal Infections

6.3.3. Mycobacterial Infections

Chapter 7. Automated Blood Culture Tests Market – By Technology

7.1. Culture-based Technology

7.2. Proteomic technology

7.3. Molecular Technology

7.3.1. PCR

7.3.2. Microarray

7.3.3. PNA-FISH

Chapter 8. Automated Blood Culture Tests Market – By Application

8.1. Bacterial Infections

8.2. Fungal Infections

8.3. Mycobacterial Infections

Chapter 9. Automated Blood Culture Tests Market – By End Use

9.1. Hospital Laboratories

9.2. Reference Laboratories

9.3. Others

Chapter 10. Automated Blood Culture Tests Market – By Region

10.1. North America

10.2. Europe

10.3.The Asia Pacific

10.4.South America

10.5. Middle-East and Africa

Chapter 11. Automated Blood Culture Tests Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. Becton Dickenson and Company

11.2. Thermo Fisher Scientific

11.3. bioMérieux SA

11.4. Luminex Corporation

11.5. Danaher Corporation

11.6. Bruker Corporation

11.7. IRIDICA

11.8. Roche Diagnostics

11.9. T2 Biosystems

11.10. Anaerobe Systems

11.11. OpGen

11.12. Meditech Technologies India Private Limited

11.13. Carl Zeiss AG

11.14. Nikon Corporation

11.15. BINDER GmbH

11.16. Biobase Biotech

11.17. Scenker Biological Technology Co.

11.18. Bulldog Bio

11.19. Axiom Laboratories

11.20. HiMedia Laboratories

Download Sample

Choose License Type

2500

4250

5250

6900