Augmented Reality For Surgical Applications Market Size (2024 –2030)

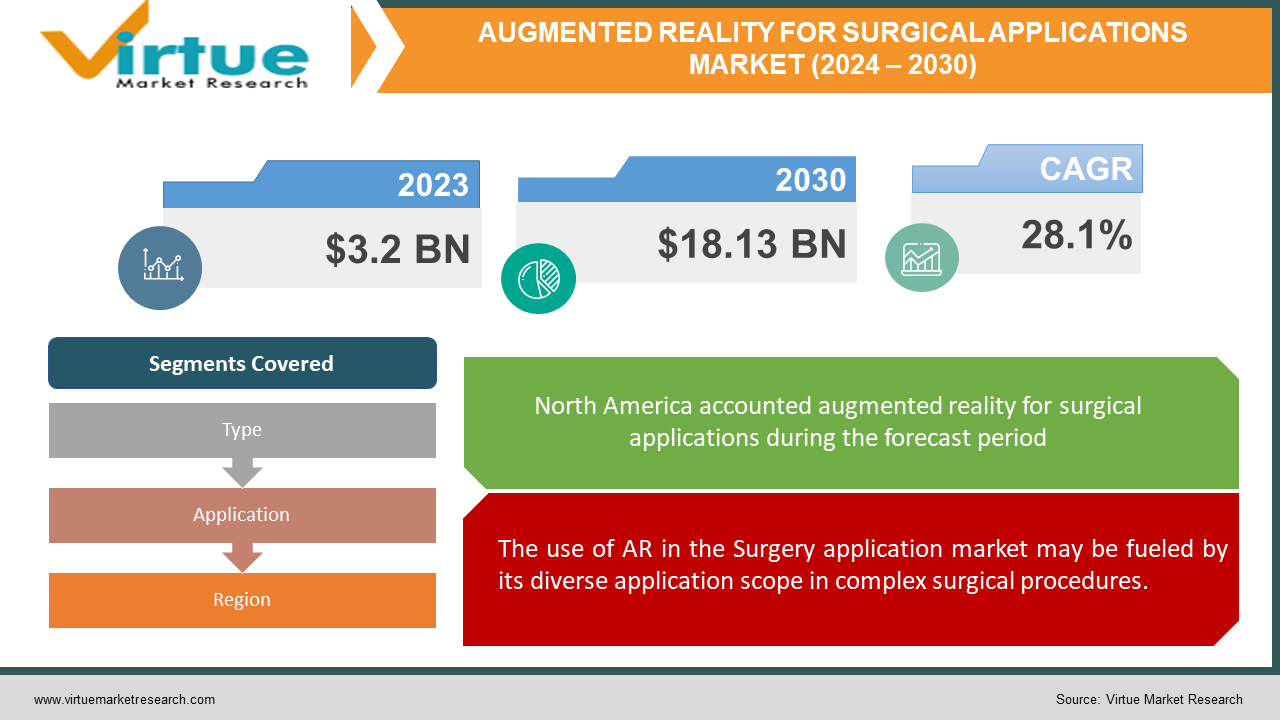

In 2023, the Global Augmented Reality for Surgical Applications Market was valued at USD 3.2 billion and is projected to reach a market size of USD 18.13 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 28.1%.

When computer-generated images or data are displayed to surgeons during an operation, this is known as augmented reality (AR) in surgery. This aids in their comprehension of the patient's anatomy and medical background. AR is everywhere, from games to shopping, but in surgery, it's particularly unique because it has the potential to save lives and advance medical treatment. AR allows surgeons to see inside the patient's body before surgery, improving safety and accuracy of planning. It assists them in avoiding damaging healthy areas, which reduces complications for patients. AR also expedites and reduces the amount of invasiveness of surgeries, resulting in quicker recovery and less pain for patients.

Key Market Insights:

The use of augmented reality (AR) technology is transforming surgical navigation, simplifying difficult procedures, and enhancing patient results. These AR systems are already having a significant impact on surgery all over the world, improving and saving lives. AR has the potential to revolutionize global healthcare in the future. These augmented reality devices help surgeons perform surgeries with greater precision and a better view by fusing computer technology and medicine. By superimposing holographic pictures, annotations, measurements, and digital instruments on the patient's body, they give surgeons instantaneous direction and enhanced viewpoint.

Augmented Reality For Surgical Applications Market Drivers:

The use of AR in the Surgery application market may be fueled by its diverse application scope in complex surgical procedures.

In the field of healthcare, augmented reality (AR) is gaining popularity, particularly for surgical training and simulations. Doctors can better understand complex procedures by seeing the inside of the body in three dimensions thanks to computer-generated images. In addition to making anatomy lessons simpler, this enables students to practice surgeries on fictitious bodies. AR also gives medical professionals new avenues for skill development, increasing the accessibility and interactivity of healthcare education.

The advantages of augmented reality in surgical applications have the potential to significantly expand the market.

Through the improvement of surgical techniques and medical education, augmented reality (AR) is transforming the healthcare industry. During surgeries, it facilitates communication between medical professionals, lowering mistakes and enhancing teamwork. Moreover, AR provides immersive training environments that lower expenses and errors. AR helps surgeons plan and perform procedures more precisely and safely by displaying digital images of the patient's anatomy overlaid onto the actual surgery site. All things considered, AR improves patient outcomes while saving time, money, and resources.

Augmented Reality For Surgical Applications Market Challenges and Restraints:

Image registration aligns virtual data from scans with the patient's real body, much like piecing together a puzzle. The surgical instruments and AR gadgets are calibrated for precise projection. Using sensors or markers, tracking maintains an eye on the AR gadget and surgical instruments. On the AR device, rendering generates and presents virtual information. The success of the surgery is at risk if any of these steps go wrong because the virtual information won't match reality. For instance, the virtual information will not line up with the real anatomy if image registration is off. While tracking keeps everything in its proper place during surgery, calibration makes sure everything is the right size and position. The virtual information may be ambiguous or delayed if a step is done incorrectly, which could impact the surgical outcome.

Augmented Reality For Surgical Applications Market Opportunities:

The use of augmented reality (AR) technology in surgery has many advantages. In the first place, it improves surgical precision by giving doctors the ability to view intricate images of a patient's anatomy superimposed on their field of vision. This allows doctors to make more precise incisions and avoid important structures. Second, augmented reality (AR) enhances surgical education by giving medical practitioners access to virtual settings where they can rehearse procedures and build confidence before carrying them out on actual patients. This lowers the possibility of errors and raises general competency. Last but not least, augmented reality (AR) facilitates collaboration and remote help during surgery, connecting surgeons with experts in different places who can offer on-the-spot direction and support. This improves patient outcomes and raises the standard of surgical care by providing instant access to knowledge from around the globe.

AUGMENTED REALITY FOR SURGICAL APPLICATIONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

28.1% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Novarad, Centerline Biomedical, Pixee Medical, Philips, GE Healthcare, Stryker, Augmedics, VOSTARS |

Global Augmented Reality for Surgical Applications Market Segmentation: By Type

-

Video Perspective (VST)

-

Optical Perspective (OST)

Two major system types that are gaining traction in the augmented reality space are Video Perspective (VST) and Optical Perspective (OST). OST systems create a highly immersive experience by superimposing virtual data onto the real world using optical tools like mirrors or transparent displays. They do, however, present certain technical difficulties, such as precisely rendering the virtual content, monitoring motion, and guaranteeing correct calibration. The more popular VST systems, on the other hand, use video cameras to record the actual environment and display it on a screen with virtual elements. In comparison to OST systems, VST systems are typically less expensive and simpler to set up, despite potential drawbacks like a limited field of view, content display lag, and problems with objects obstructing the view.

Global Augmented Reality for Surgical Applications Market Segmentation: By Application

-

Neurosurgery

-

Spinal Surgery

-

Orthopedic Surgery

-

Otolaryngology Surgery

-

Other

Neurosurgery and orthopedic surgery are two main medical specialties where augmented reality (AR) is advancing rapidly. Orthopedic surgery is the treatment of problems involving the bones and muscles, including fractures, joint replacements, and injuries sustained during sports. Surgeons can now visualize anatomical structures, place implants more accurately, and perform surgeries with better results thanks to augmented reality technology. Due to the rising incidence of orthopedic disorders and the use of augmented reality (AR) in the medical industry, this market is expanding quickly. Conversely, neurosurgery treats diseases of the nervous system, such as neurological disorders, spinal cord injuries, and brain tumors. Enhanced visualization, accurate navigation, and real-time guidance during complex surgeries are made possible by AR technology for neurosurgeons. Because neurosurgical procedures are complex and require the highest level of precision, AR is essential to this field, which contributes to the Neurosurgery category's market dominance.

Global Augmented Reality for Surgical Applications Market Segmentation: By Region

-

North America

-

Asia Pacific

-

Europe

-

South America

-

Middle East and Africa

Due to its excellent healthcare facilities, cutting-edge technological advancements, and significant research investments, North America is currently leading the world market for augmented reality in surgical applications. North America also hosts a large number of significant players in this field, contributing to its dominance. In the meantime, the fastest growth in this market is anticipated to occur in the Asia Pacific region. This is because of things like the increase in chronic illnesses, the cost of healthcare, and the emphasis on medical technology. China, Japan, and South Korea are among the nations making significant investments in the development and application of augmented reality in surgery. Because the FDA is in favor of using AI in surgery, North America is in the lead. Investments in healthcare and technological advancements are driving the rapid growth of the Asia Pacific market.

COVID-19 Impact on the Global Augmented Reality For Surgical Applications Market:

The COVID-19 pandemic has altered the global need for AR and VR in surgery as a result of lockdowns in important nations. With lockdowns and social distancing measures, hospitals and healthcare facilities faced great challenges in maintaining regular surgical procedures. This situation led to a surge in demand for remote surgical solutions. This includes AR-assisted surgeries. AR technology enables surgeons to perform procedures remotely with the assistance of real-time guidance and visualization. This also reduces the need for physical presence in the operating room.

Latest Trend/Development:

Numerous important trends are contributing to the market's notable expansion and development of augmented reality in surgical applications. The growing use of augmented reality surgical navigation systems, which give surgeons real-time guidance and visualization during procedures and improve results, is one significant trend. Improvements in image registration and tracking capabilities, among other technological developments, are improving the usability and effectiveness of augmented reality systems. Furthermore, the market is growing as a result of AR technology's expansion into more surgical specialties, such as orthopedics, neurosurgery, and cardiovascular surgery. Companies are collaborating to accelerate product development and market reach, which is leading to an increase in strategic partnerships and investments. Additionally, there is an increasing emphasis on the use of augmented reality (AR) in surgical education and training, with 3D models and virtual simulations becoming standard components of medical education curricula. In general, these tendencies are influencing how augmented reality will develop in the surgical field, emphasizing the use of cutting-edge technology and teamwork to enhance surgical results and patient care.

Key Players:

-

Novarad

-

Centerline Biomedical

-

Pixee Medical

-

Philips

-

GE Healthcare

-

Stryker

-

Augmedics

-

VOSTARS

Market News:

-

Although costs are still an issue, Meta's virtual reality technology is being used in September 2023 to support surgeon training and patient care.

-

Augmedics, a startup creating AR surgical navigation technology, closed a USD 82.5 million Series D funding round in July 2023. Dallas-based CPMG led the transaction, and Evidity Health Capital joined as a syndicate partner. Participating investors included Almeda Ventures, Revival Healthcare Capital, and H.I.G. Capital.

-

A $20 million Series A fundraising round was announced in June 2023 by Medivis, a startup that wants to make augmented reality for surgical navigation more widely used. Thrive Capital led the investment, with support from Initialized Capital and Mayo Clinic among others.

Chapter 1. AUGMENTED REALITY FOR SURGICAL APPLICATIONS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. AUGMENTED REALITY FOR SURGICAL APPLICATIONS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. AUGMENTED REALITY FOR SURGICAL APPLICATIONS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. AUGMENTED REALITY FOR SURGICAL APPLICATIONS MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. AUGMENTED REALITY FOR SURGICAL APPLICATIONS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. AUGMENTED REALITY FOR SURGICAL APPLICATIONS MARKET – By Type

6.1 Introduction/Key Findings

6.2 Video Perspective (VST)

6.3 Optical Perspective (OST)

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. AUGMENTED REALITY FOR SURGICAL APPLICATIONS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Neurosurgery

7.3 Spinal Surgery

7.4 Orthopedic Surgery

7.5 Otolaryngology Surgery

7.6 Other

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. AUGMENTED REALITY FOR SURGICAL APPLICATIONS MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. AUGMENTED REALITY FOR SURGICAL APPLICATIONS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Novarad

9.2 Centerline Biomedical

9.3 Pixee Medical

9.4 Philips

9.5 GE Healthcare

9.6 Stryker

9.7 Augmedics

9.8 VOSTARS

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Augmented Reality for Surgical Applications Market was estimated to be worth USD 3.2 billion in 2023 and is projected to reach a value of USD 18.13 billion by 2030, growing at a CAGR of 28.1% during the forecast period 2024-2030

The use of computer-generated pictures, data, text, or other information superimposed over a surgeon's field of view (FOV) during a surgical operation is known as augmented reality (AR) in surgery.

Diverse application scope in complex surgical procedures and benefits of Augmented Reality in surgical applications are driving factors in the Global Augmented Reality for Surgical Applications Market.

The demand for augmented reality in the surgical application industry may be hampered by the accuracy and dependability of the AR system in surgery.

Globally, COVID-19 will have a substantial influence on AR & VR in the surgical industry since demand has changed as a result of lockdowns in important countries throughout the world. Due to the FDA's growing support for the commercialization of the use of AI technologies in surgical procedures, North America would be in the lead. Because of the rapid technological improvement in the healthcare sector and the significant financial investment made by the medical community to utilize the most up-to-date instruments during surgery, the Asia Pacific market will expand at the quickest rate.