Auditing Services Market Size (2024 – 2030)

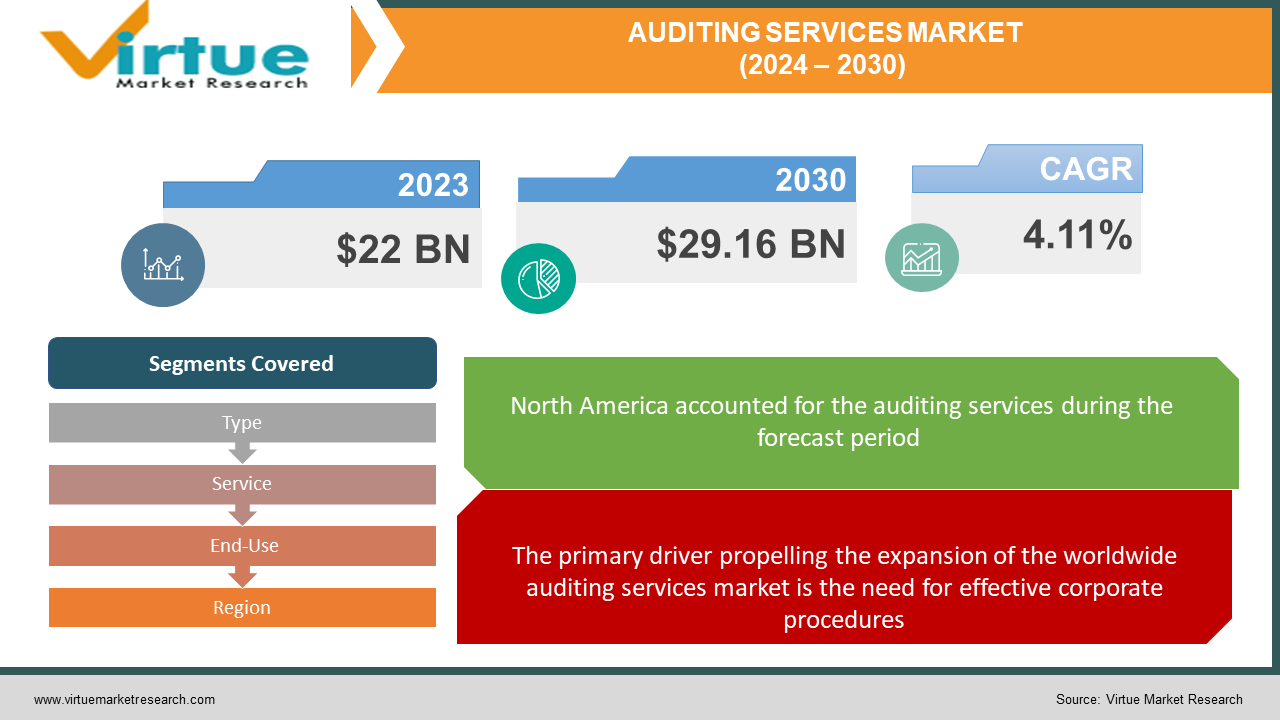

The Global Auditing Services Market was valued at USD 22 Billion and is projected to reach a market size of USD 29.16 Billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 4.11% between 2024 and 2030.

Auditing is defined as the process of evaluating the reliability and correctness of both financial and non-financial data, together with the systems and procedures used to record and compile it. To address issues and opportunities that impact a company's long-term value, audit companies offer integrated, strategic, and expanded audit reports. To ensure that the financial statements are accurate and satisfy regulators, investors, directors, and management, auditing services are independent reporting procedures that impartially assess a company's financial records and other financial activities. Audit firms may be able to work with businesses that specialise in digital technologies including big data, analytics, machine learning, mobile computing, and business intelligence through shared service delivery models. Data analytics services have the potential to become new revenue streams to augment auditing firms' current ones. The more stringent government regulations about financial transparency and reporting are anticipated to drive growth in the worldwide auditing services market throughout the projected period. Additionally, market consolidation has been a notable trend in the auditing services industry. As a result, big accounting companies have acquired a large number of auditing firms to enhance or broaden their current auditing services. Market expansion is being driven by rising corporate spending on financial audits and recording, which incentivizes new players to select auditing services. In addition, the growing need for auditing services to manage organisations' workflow across a variety of industries, including BFSI, IT & telecommunications, healthcare, and others, is anticipated to drive the auditing services market's growth throughout the projected year. The auditing services industry is expanding thanks to technological developments in audit services that help auditors obtain actionable insights by utilising financial data and graphs from organisations. Throughout the projection period, the global market's expansion is expected to be restricted by a significant issue: people's lack of understanding regarding financial auditing services. An additional factor that is expected to hinder the growth of the auditing services market during the projected period is the growing trend of automation and artificial intelligence (AI) in a variety of industries.

Key Market Insights:

The main trend in the enterprise indoor global auditing services market is the proper administration of inventory systems and working capital. Over the previous five years, there has been an improvement in inventory management, which has led to better working capital management and an increase in cash flow. Any business unit's balance sheet depends on its inventory. For instance, a company needs to keep enough inventory on hand to meet demand if it hopes to prevent losses. Because of this, companies need to concentrate on preserving optimal inventory levels by putting in place systems that use various internal procedures to effectively manage and maintain inventory. Such a system will enable an organisation to oversee its suppliers and customers. Additionally, it will support the tracking of inventory performance, the monitoring of demand trends, the maintenance of accurate inventory counts, and the guarantee that suppliers fulfil their commitments during the projection period. These factors will further support the expansion of the worldwide auditing services market throughout the forecast period.

Global Auditing Services Market Drivers:

The primary driver propelling the expansion of the worldwide auditing services market is the need for effective corporate procedures.

It is crucial for businesses to constantly improve their procedures in the fiercely competitive business world of today. In addition to putting profits at risk, not doing so raises expenses, demoralises staff, and lowers customer satisfaction. The increasing use of audit services is being driven by the growing pressure on corporate leaders to reduce costs while maintaining quality standards, increasing productivity, and streamlining procedures. These services are essential for increasing organisational agility and efficiency since they give insight into current operations and make it easier to make wise adjustments that will increase output and profitability. Audit services help decision-makers by identifying inefficiencies, bottlenecks, and areas that are ready for improvement through careful inspection. This allows decision-makers to optimise processes, allocate resources wisely, and implement focused improvements. They also guarantee regulatory compliance, reducing the possibility of fines and legal problems and promoting an environment of openness and accountability. In the end, the incorporation of audit services into organisational structures is critical to long-term success as it provides businesses with the knowledge and resources they need to overcome obstacles and realise long-term success.

Increasing Efficiency to Drive Business Growth in the Function of Auditing Services.

By seamlessly integrating technological and management capabilities, auditing services not only optimise processes but also play a significant role in aligning the business objectives of organisations with client expectations. Using ‘sophisticated and all-encompassing management platforms, auditing services improve the technical integration and flexibility of company operations, leading to increased corporate efficiency. In the end, this integration strengthens customer happiness and loyalty by facilitating easier collaboration, communication, and response to changing client needs. Additionally, by identifying strategic prospects for innovation and expansion, businesses can position themselves effectively in the market thanks to the insights gained from auditing services. Throughout the forecast period, the value proposition provided by auditing services is anticipated to propel substantial expansion in the worldwide auditing services market, as organisations prioritise agility and adaptability more and more in response to dynamic market conditions.

Global Auditing Services Market Restraints and Challenges:

One of the biggest obstacles to the expansion of the global auditing services industry is the high cost and upkeep of auditing services. Auditing is seen as a costly procedure that necessitates the use of numerous controls to guarantee adherence. Using outside audit companies, subcontracting specific tasks, and regularly checking the outcomes are a few examples of these actions. The price of auditing services can go so high that it might become impractical to use the procedure regularly. Nonprofit audit fees, for example, can range from USD 10,000 for small organisations to over USD 20,000 for major foundations. Any organisation or corporation that wants to continue auditing must have experts. In general, auditing is a crucial procedure that calls for a great deal of expertise. Larger companies or organisations require time-consuming and expensive auditing services. Accounting businesses have access to unprotected client data, which makes them likely to demand exorbitant fees. This is a serious issue since it implies that workers may utilise this information to steal or commit fraud at work. Thus, it is anticipated that the high expense and upkeep of auditing services will have a detrimental effect on the expansion of the worldwide auditing services market throughout the forecast year.

Global Auditing Services Market Opportunities:

A complex web of interrelated factors, including stricter government regulations requiring higher financial reporting standards, growing demand from a variety of industries, including IT and healthcare, and the quick uptake of disruptive technologies like blockchain and data analytics, are driving the growth of auditing firms. These advancements present auditing organisations with enormous prospects to diversify their offerings and increase audit efficiency by using new technologies, especially in cybersecurity. Auditors may ensure continued growth and relevance in a dynamic business climate by diversifying their products and embracing innovative solutions. This allows them to satisfy the changing needs of their clients and position themselves to take advantage of emerging market trends.

AUDITING SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.11% |

|

Segments Covered |

By Type, Service, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

CliftonLarsonAllen LLP, CohnReznick LLP, Crowe LLP, Deloitte Touche Tohmatsu Ltd., Eide Bailly LLP, Ernst and Young Global Ltd., Evelyn Partners Group Ltd., Grant Thornton International Ltd., JPMorgan Chase and Co., KPMG International Ltd. |

Global Auditing Services Market Segmentation: By Type

-

Internal Audit

-

External Audit

The Global Auditing Services Market Segmented by Type, Internal Audit held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Because of its major focus on risk mitigation and regulatory compliance, internal audit is well-positioned to continue leading the worldwide auditing services industry. Internal audits have become essential in a world where businesses are placing a greater emphasis on managing fraud, safeguarding their interests, and adhering to strict requirements. Internal auditors provide a methodical and thorough way to assess risk controls and make sure regulations are followed. Internal audit functions help management, board members, and stakeholders make informed decisions and implement proactive risk management strategies by thoroughly evaluating internal processes, controls, and financial systems. Internal audits also work as a preventative measure to find weaknesses and strengthen organisational defences against new dangers. Internal audit services will continue to be in high demand as companies come under increasing pressure to maintain integrity and transparency in their operations. Internal audit operations are essential in protecting organisational assets and advancing sustainable business practices in a constantly changing regulatory environment because of their proficiency in risk assessment, fraud detection, and regulatory compliance.

Global Auditing Services Market Segmentation: By Service

-

Operational Audits

-

Financial Audits

-

Advisory & Consulting

-

Investigation Audit

The Global Auditing Services Market Segmented by Services, Financial Audits held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The market for auditing services worldwide is expected to continue to be dominated by financial audits. Their prominence is a result of the vital function they serve in guaranteeing the dependability and correctness of financial statements. Financial audits are required by strict legislation all around the world, which creates a steady demand for this service. Furthermore, a thorough review by certified auditors is required due to the growing complexity of financial instruments and business activities. This provides stakeholders with peace of mind regarding an organization's financial stability, including creditors, investors, and government agencies. Financial audits continue to be the industry leader since they are essential to preserving financial accountability and transparency, even while other services such as operational audits are becoming more popular.

Global Auditing Services Market Segmentation: By End-Use

-

BFSI

-

Government

-

Manufacturing

-

Healthcare

-

Retail & Consumer

-

IT & Communications

The Global Auditing Services Market Segmented by End-use, BFSI held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The industry that uses auditing services the most is the banking, financial services, and insurance (BFSI) sector. This supremacy is the result of several variables coming together. First of all, BFSI institutions have to adhere to strict accounting standards and operate under a microscope of regulations. Frequent audits preserve public confidence by ensuring adherence to these standards. Second, to ensure accuracy and reduce risks, the complex financial products and transactions in this industry require careful scrutiny. Additionally, due to the enormous volume of financial data that these organisations handle, audits are necessary to ensure data integrity and offer unbiased confirmation of financial reporting. Last but not least, building investor confidence is vital, and audits are essential to this goal since they encourage openness and confidence in the financial stability of BFSI firms. These elements reinforce the BFSI industry's standing as the top user of auditing services, especially when combined with the sector's inherent financial concerns.

Global Auditing Services Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Global Auditing Services Market Segmented by Region, North America held the largest market share last year and is poised to maintain its dominance throughout the forecast period. North America is expected to hold a dominant revenue share in the worldwide auditing services market due to favourable regulatory frameworks, a large number of multinational firms, and the growing adoption of effective internal auditing and reporting procedures. By 2030, the auditing services market in the United States is forecasted to account for 28.85% of the global market share, while the market in Canada is anticipated to increase at an annual pace of 3.3 percent. During the analysed period, a growth rate of 3.2 percent is anticipated for Latin America. China is predicted to reach $50.3 billion in the Asia-Pacific area by 2027 at a compound annual growth rate of 6.7 percent, followed by Japan at 2.4 percent. The Big 4 firms control a substantial portion of the audit business in India, making it difficult for smaller auditors to get into the highest echelons of the industry. By 2026, it is anticipated that the Asia-Pacific market as a whole will reach US$38.5 billion, driven mostly by nations like Australia, India, and South Korea. Germany's market is expected to develop at a compound annual growth rate (CAGR) of 3%, helping Europe as a whole reach $50.3 billion by 2026.

COVID-19 Impact Analysis on the Global Auditing Services Market:

Due to the installation of strong lockdown limitations, the COVID-19 pandemic caused significant disruption to market growth in the first half of 2020, particularly in the US and Canada. The lockdown restrictions were lifted, nevertheless, because of the region-wide implementation of the COVID-19 vaccination campaign in the second half of 2020. This allowed industries and businesses to resume operations while strictly adhering to safety regulations, allowing business operations to resume as usual. Additionally, there was a change in auditing services towards digitalization, which made economic management, workflow, communication, and future-proofing easier. The benefits of digital auditing services, including reduced manual labour and a more automated workflow that boosts efficiency and customer support, are anticipated to propel the regional auditing services market's expansion during the forecast year.

Latest Trends/ Developments:

Technological improvements are driving a fundamental revolution in the global auditing market. By enabling more efficient data analysis and strengthening security protocols, innovations like blockchain and data analytics are completely transforming conventional audit procedures. Furthermore, the growing importance of protecting digital assets against developing threats is reflected in the industry's emergence of cybersecurity audits as a burgeoning niche. Furthermore, there has been a discernible shift in emphasis from merely complying to offering value-added services like risk management optimisation and internal control enhancement. In response to the ever-changing needs of organisations in a dynamic market, auditing firms are evolving and providing complete solutions targeted at improving operational efficiency and resilience against the rapid advancements in technology.

Key players:

-

CliftonLarsonAllen LLP

-

CohnReznick LLP

-

Crowe LLP

-

Deloitte Touche Tohmatsu Ltd.

-

Eide Bailly LLP

-

Ernst and Young Global Ltd.

-

Evelyn Partners Group Ltd.

-

Grant Thornton International Ltd.

-

JPMorgan Chase and Co.

-

KPMG International Ltd.

Chapter 1. Auditing Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Auditing Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Auditing Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Auditing Services Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Auditing Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Auditing Services Market – By Type

6.1 Introduction/Key Findings

6.2 Internal Audit

6.3 External Audit

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Auditing Services Market – By Service

7.1 Introduction/Key Findings

7.2 Operational Audits

7.3 Financial Audits

7.4 Advisory & Consulting

7.5 Investigation Audit

7.6 Y-O-Y Growth trend Analysis By Service

7.7 Absolute $ Opportunity Analysis By Service, 2024-2030

Chapter 8. Auditing Services Market – By End-Use

8.1 Introduction/Key Findings

8.2 BFSI

8.3 Government

8.4 Manufacturing

8.5 Healthcare

8.6 Retail & Consumer

8.7 IT & Communications

8.8 Y-O-Y Growth trend Analysis By End-Use

8.9 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 9. Auditing Services Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Service

9.1.4 By By End-Use

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Service

9.2.4 By End-Use

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Service

9.3.4 By End-Use

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Service

9.4.4 By End-Use

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Service

9.5.4 By End-Use

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Auditing Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 CliftonLarsonAllen LLP

10.2 CohnReznick LLP

10.3 Crowe LLP

10.4 Deloitte Touche Tohmatsu Ltd.

10.5 Eide Bailly LLP

10.6 Ernst and Young Global Ltd.

10.7 Evelyn Partners Group Ltd.

10.8 Grant Thornton International Ltd.

10.9 JPMorgan Chase and Co.

10.10 KPMG International Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Auditing Services market is expected to grow at a 4.11% CAGR through 2030.

The market is expected to reach USD 22 Billion by 2030.

The Internal audit sector drives the Global Auditing Services market.

By 2023, the Global Auditing Services market is expected to be valued at USD 29.16 Billion.

North America dominates the Global Auditing Services market.