Audio Conferencing Market Size (2024 – 2030)

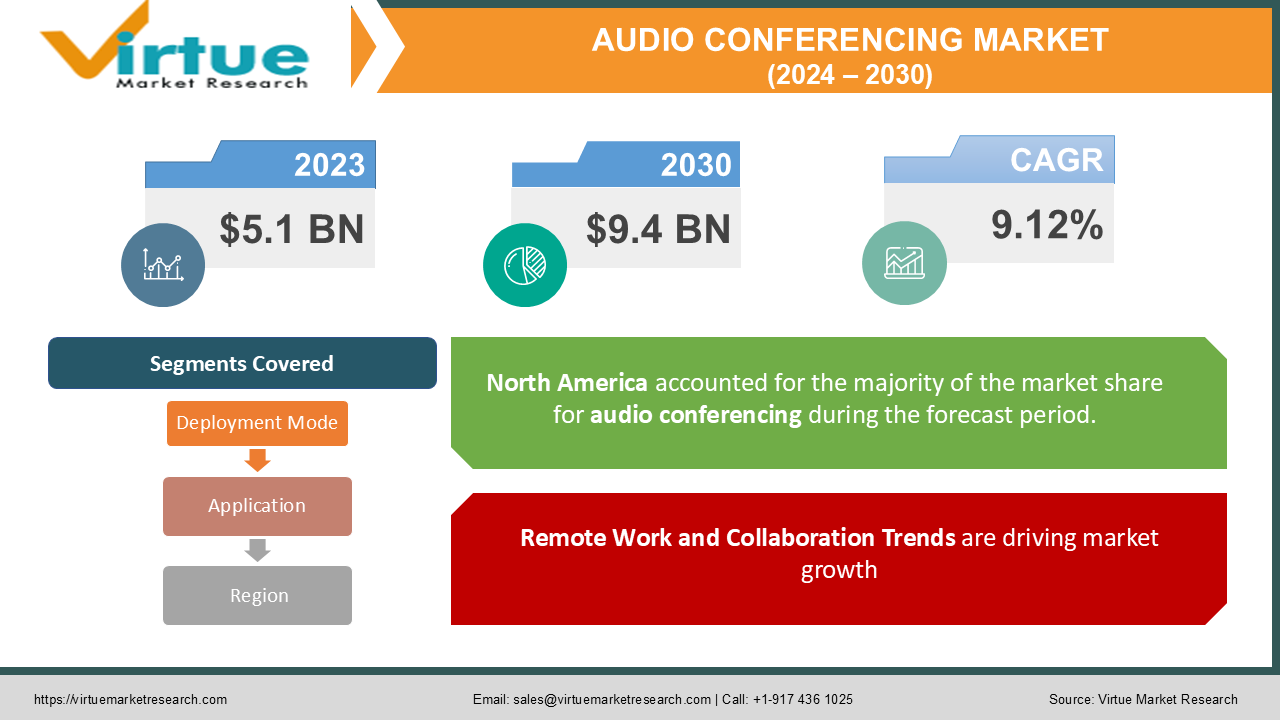

The Global Audio Conferencing Market was valued at USD 5.1 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.12% from 2024 to 2030. The market is projected to reach USD 9.4 billion by 2030.

The Audio Conferencing Market encompasses the technology and platforms that facilitate remote communication through audio channels, enabling individuals and businesses to hold meetings, discussions, and collaborations over long distances. The demand for audio conferencing solutions is driven by the increasing trend of remote work, globalization, and the need for real-time communication in various sectors such as corporate enterprises, healthcare, education, and government.

Key Market Insights:

The increasing reliance on remote work and virtual meetings has led to a significant surge in the adoption of audio conferencing solutions, with over 50% of companies worldwide integrating audio conferencing systems as part of their daily operations by 2023.

Cloud-based audio conferencing solutions have witnessed rapid growth, accounting for more than 45% of the market share in 2023, as they offer scalability, flexibility, and seamless integration with other enterprise communication tools.

The Asia-Pacific region is expected to show the highest growth rate, with a CAGR of 10.5% from 2024 to 2030, driven by the increasing adoption of technology in emerging economies such as India, China, and Southeast Asian countries.

The healthcare sector is rapidly adopting audio conferencing systems for telemedicine and remote consultations, contributing to a 12% increase in demand within this industry in 2023.

Small and medium enterprises (SMEs) are adopting audio conferencing tools at an accelerated rate, contributing to nearly 35% of the market demand, as these solutions help reduce travel costs and enable flexible working environments.

Integration of AI-powered features such as real-time transcription, voice recognition, and language translation in audio conferencing platforms has enhanced user experience, with AI-based conferencing solutions projected to grow by 15% annually from 2024 onwards.

Data privacy and security concerns remain significant, with over 40% of enterprises highlighting the importance of secure communication channels, leading to an increased demand for end-to-end encryption and secure platforms in audio conferencing solutions.

Global Audio Conferencing Market Drivers:

Remote Work and Collaboration Trends are driving market growth: One of the primary drivers of the Audio Conferencing Market is the increasing adoption of remote work and virtual collaboration across industries. The COVID-19 pandemic triggered a massive shift in work culture, leading organizations to embrace virtual communication tools. Even post-pandemic, businesses are expected to continue with hybrid work models, where employees work both from home and in office settings. Audio conferencing tools have become indispensable in such setups, enabling teams to collaborate seamlessly regardless of geographic location. This trend is further supported by the growing adoption of flexible working policies, reducing the need for physical meetings and enhancing productivity. Companies, especially in the IT, consulting, and finance sectors, rely on audio conferencing to manage global operations and reduce travel expenses. Additionally, the rise of gig economy workers and freelancers has led to increased demand for efficient communication solutions like audio conferencing.

Cost Efficiency and Scalability is driving market growth: Audio conferencing solutions are significantly more cost-effective than traditional in-person meetings or video conferencing. This cost advantage makes them a preferred choice for businesses, especially SMEs that need to optimize their operational expenses. Audio conferencing eliminates the need for travel, accommodation, and venue costs associated with face-to-face meetings, providing a budget-friendly alternative for organizations. Furthermore, the scalability of modern cloud-based conferencing platforms enables companies to easily expand their conferencing capabilities without significant capital investment. As businesses continue to look for ways to reduce operational costs while maintaining efficient communication systems, the demand for audio conferencing solutions is expected to rise. The ability to integrate audio conferencing with other tools like calendars, CRM systems, and workflow platforms adds to the convenience and scalability of these solutions.

Technological Advancements and Integration with AI is driving market growth: The integration of advanced technologies such as artificial intelligence (AI), machine learning, and voice recognition in audio conferencing solutions is driving market growth. AI-powered tools can enhance the conferencing experience by offering features such as real-time transcription, language translation, and noise cancellation, which improve overall meeting efficiency. These advanced features are especially useful for multinational organizations that require seamless communication between teams speaking different languages. Furthermore, AI-based analytics can provide insights into meeting patterns, helping businesses optimize their collaboration strategies. The adoption of 5G technology is also expected to bolster the performance of audio conferencing systems, offering faster, more reliable connections with high-definition audio quality. These technological advancements not only improve user experience but also open up new opportunities for businesses to enhance their communication infrastructure.

Global Audio Conferencing Market Challenges and Restraints:

Data Security and Privacy Concerns are restricting market growth: One of the significant challenges faced by the Audio Conferencing Market is the growing concern over data security and privacy. As more organizations transition to cloud-based conferencing solutions, the risk of data breaches and cyber-attacks increases. Sensitive information exchanged during audio conferences, such as business strategies, client details, and proprietary data, can be vulnerable to hacking if not adequately protected. Many businesses, especially those in regulated industries like healthcare, finance, and government, are hesitant to fully adopt cloud-based solutions due to these concerns. Companies are increasingly demanding platforms that offer end-to-end encryption, secure access controls, and compliance with global data protection regulations such as GDPR. Despite these measures, maintaining the integrity of sensitive data during remote communications remains a challenge, and vendors must continuously invest in enhancing security protocols to gain the trust of potential customers.

Limited Access to High-Speed Internet in Developing Regions is restricting market growth: The effectiveness of audio conferencing solutions depends heavily on the availability of reliable and high-speed internet connectivity. In regions where internet infrastructure is underdeveloped, such as certain parts of Africa, South Asia, and Latin America, users may experience poor audio quality, delays, and frequent disconnections during conferences. This lack of reliable connectivity can hinder the adoption of audio conferencing solutions in these regions, limiting the market’s growth potential. While 5G networks are expected to alleviate some of these issues by providing faster and more stable connections, the rollout of 5G technology is still in its early stages in many countries. Until internet infrastructure improves, particularly in rural and underdeveloped areas, the adoption of audio conferencing tools will be slower, creating a gap in market penetration between developed and developing regions.

Market Opportunities:

The Audio Conferencing Market presents several growth opportunities, particularly as businesses worldwide continue to embrace digital transformation and hybrid work models. One of the key opportunities lies in the healthcare sector, where telemedicine has seen significant growth due to the COVID-19 pandemic. Audio conferencing is playing a crucial role in enabling remote consultations between doctors and patients, especially in areas where access to medical professionals is limited. The rising demand for telemedicine solutions is expected to drive the adoption of audio conferencing systems in healthcare, with significant investments from both public and private sectors. Another promising opportunity is the education sector. The increasing adoption of e-learning platforms and virtual classrooms has created a demand for reliable and user-friendly audio conferencing tools. Educational institutions are leveraging audio conferencing for conducting lectures, student-teacher interactions, and group discussions, providing a flexible learning environment. This trend is particularly evident in higher education and professional training programs, where the need for real-time communication is paramount. The growing demand for AI-powered features in conferencing solutions also offers substantial opportunities. Vendors can focus on integrating advanced functionalities such as real-time transcription, sentiment analysis, and multilingual support, catering to the needs of multinational corporations and remote teams. Additionally, as businesses become more conscious of their environmental footprint, audio conferencing offers a sustainable alternative to frequent travel, aligning with corporate sustainability goals and reducing carbon emissions.

AUDIO CONFERENCING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.12% |

|

Segments Covered |

By Deployment Mode, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cisco Systems, Microsoft Corporation, Zoom Video Communications, Avaya Inc., Polycom (Plantronics), Google LLC, Mitel Networks Corporation, Huawei Technologies Co., Ltd., BT Group, West Corporation |

Audio Conferencing Market Segmentation: By Deployment Mode

-

Cloud-based Audio Conferencing

-

On-premise Audio Conferencing

-

Hybrid Audio Conferencing Solutions

Cloud-based audio conferencing is the most dominant segment due to its scalability, cost-effectiveness, and ease of integration with other communication tools. It accounted for more than 45% of the market share in 2023 and is expected to grow significantly as businesses continue to prioritize remote and hybrid work setups.

Audio Conferencing Market Segmentation: By Application

-

Corporate Enterprises

-

Healthcare

-

Education

-

Government

-

Others

Corporate enterprises are the dominant application segment, holding the largest share of the market. Companies in various industries rely on audio conferencing solutions to facilitate internal and external communication, reduce travel costs, and maintain global operations.

Audio Conferencing Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the dominant region in the Audio Conferencing Market, owing to the widespread adoption of advanced communication technologies, a large number of multinational corporations, and a high concentration of remote workers. The region accounted for over 35% of the market share in 2023 and is expected to maintain its dominance, driven by continued investments in communication infrastructure and the growing trend of hybrid work environments.

COVID-19 Impact Analysis on the Audio Conferencing Market:

The COVID-19 pandemic significantly impacted the global Audio Conferencing Market, driving a surge in demand for remote communication solutions. With lockdowns, travel restrictions, and social distancing measures in place, businesses across the globe had to transition to remote work, leading to a dramatic increase in the use of audio conferencing platforms. The healthcare sector saw rapid adoption of audio conferencing tools for telemedicine services, while educational institutions leveraged these solutions to facilitate online learning. Although video conferencing also gained popularity during the pandemic, audio conferencing remained a preferred option for many organizations due to its lower bandwidth requirements and ease of use. Post-pandemic, the trend of remote and hybrid work is expected to continue, ensuring sustained demand for audio conferencing solutions in the coming years.

Latest Trends/Developments:

The Audio Conferencing Market is witnessing several key trends and developments. One of the most notable trends is the integration of artificial intelligence (AI) into conferencing platforms. AI-powered features such as real-time transcription, voice recognition, and natural language processing are enhancing the overall user experience, making meetings more efficient and accessible. Additionally, the adoption of 5G technology is set to revolutionize the market by providing faster and more reliable audio quality, even in areas with poor internet connectivity. Another emerging trend is the focus on security and privacy, with many vendors offering end-to-end encryption and compliance with data protection regulations to address growing concerns over data breaches. The demand for cloud-based solutions continues to rise, with businesses preferring flexible and scalable platforms that can easily integrate with other enterprise tools.

Key Players:

-

Cisco Systems

-

Microsoft Corporation

-

Zoom Video Communications

-

Avaya Inc.

-

Polycom (Plantronics)

-

Google LLC

-

Mitel Networks Corporation

-

Huawei Technologies Co., Ltd.

-

BT Group

-

West Corporation

Chapter 1. Audio Conferencing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Audio Conferencing Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Audio Conferencing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Audio Conferencing Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Audio Conferencing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Audio Conferencing Market – By Deployment Mode

6.1 Introduction/Key Findings

6.2 Cloud-based Audio Conferencing

6.3 On-premise Audio Conferencing

6.4 Hybrid Audio Conferencing Solutions

6.5 Y-O-Y Growth trend Analysis By Deployment Mode

6.6 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 7. Audio Conferencing Market – By Application

7.1 Introduction/Key Findings

7.2 Corporate Enterprises

7.3 Healthcare

7.4 Education

7.5 Government

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Audio Conferencing Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Deployment Mode

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Deployment Mode

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Deployment Mode

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Deployment Mode

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Deployment Mode

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Audio Conferencing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cisco Systems

9.2 Microsoft Corporation

9.3 Zoom Video Communications

9.4 Avaya Inc.

9.5 Polycom (Plantronics)

9.6 Google LLC

9.7 Mitel Networks Corporation

9.8 Huawei Technologies Co., Ltd.

9.9 BT Group

9.10 West Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Audio Conferencing Market was valued at USD 5.1 billion in 2023 and is expected to reach USD 9.4 billion by 2030, growing at a CAGR of 9.12% during the forecast period.

Key drivers include the growing trend of remote work, the cost-efficiency of audio conferencing solutions, and advancements in AI and 5G technology.

The market is segmented by product (cloud-based, on-premise, hybrid) and by application (corporate enterprises, healthcare, education, government, and others).

North America is the most dominant region, accounting for over 35% of the market share, driven by the high adoption of advanced communication technologies.

Leading players include Cisco Systems, Microsoft Corporation, Zoom Video Communications, Avaya Inc., and Polycom (Plantronics).