Asset Management Market Size (2024 – 2030)

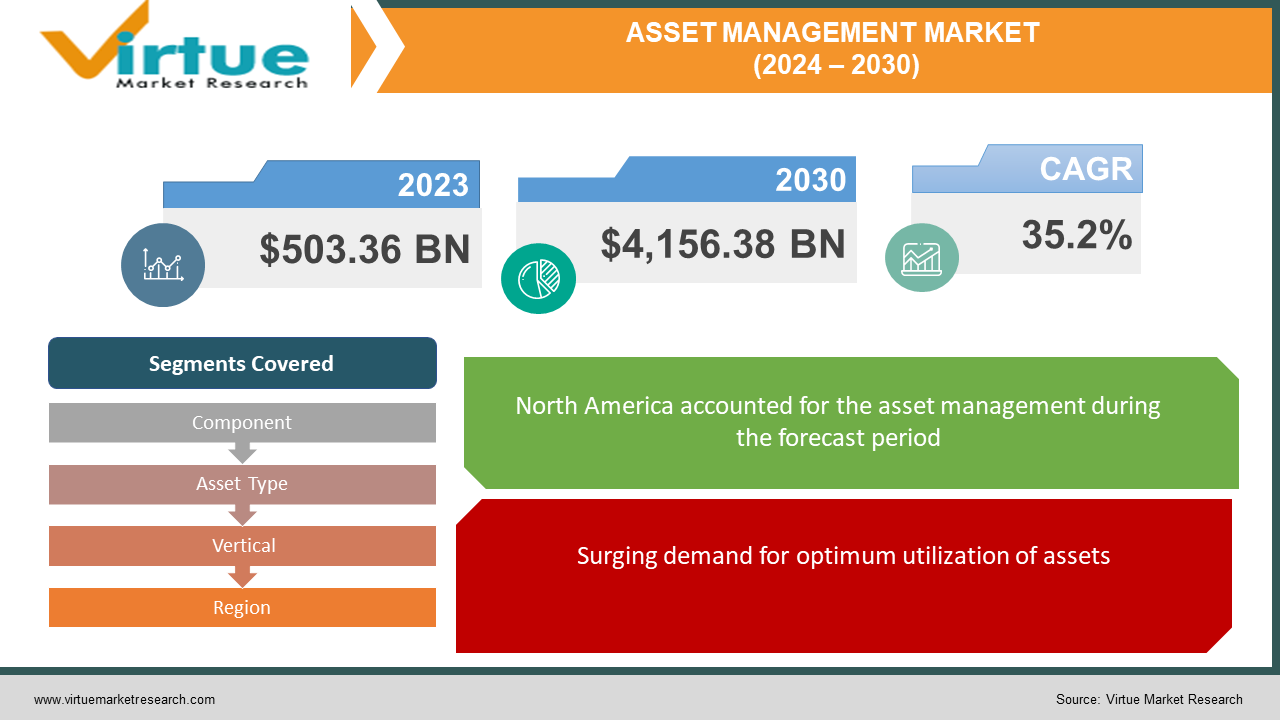

The Asset Management Market approximately achieved a value of USD 503.36 billion in 2023 and is anticipated to reach a market size of USD 4,156.38 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 35.2%.

Asset management solutions are defined as a set of tools, processes, and strategies employed by businesses to effectively track, organize, and optimize their assets throughout their lifecycle. These assets constitute of physical resources such as equipment, machinery, vehicles, and infrastructure, as well as intangible assets such as software licenses and intellectual property. Asset management solutions particularly involve the usage of specialized software systems that offer comprehensive visibility, control, and analysis of assets, enabling companies to make informed decisions associated with maintenance, utilization, procurement, and disposal. The asset management market is propelled by several factors that involve a rising need for optimum utilization of assets, which has resulted in organizations seeking effective asset management solutions. Additionally, the growing adoption of cloud-based IT asset management solutions offers increased flexibility, scalability, and approachability for businesses.

Key Market Insights:

-

The enhanced integration of blockchain technology for tracking assets will strengthen the asset management industry. Blockchain technology is being explored for its ability to offer a secure and transparent ledger for asset tracking and management, especially in real estate and medical, where data integrity and provenance are significant.

-

As a notable real estate investment trust (REIT) manager, Media Asset Management (MAM) enhances a substantial portfolio with assets under management summing up to ¥508.8 billion. The move is a fragment of MAM's strategy to widen its funding sources. Additionally, the usage of Digital Twin Technology, permitting organizations to create virtual duplicates of physical assets, will ensure the asset management industry's growth.

-

Organizations across the globe are emphasising maximizing the usage and performance of their physical assets, constituting machinery, equipment, vehicles, and infrastructure. Enterprise asset management (EAM) aids in optimizing asset use and minimizing downtime. Moreover, various industries are subject to stringent regulatory requirements, and EAM systems help ensure that assets stick to compliance standards, lowering the risk of fines and legal liabilities.

Asset Management Market Drivers:

Surging demand for optimum utilization of assets

The asset management organization is observing a considerable growth in the demand for optimal asset utilization. Organizations in diverse industries recognize the value of successfully managing their assets to enhance operational efficiency and lead to cost savings. Companies can heighten their value and lower costs by ensuring efficient asset utilization.

Additionally, the focus on cost optimization is a key driver of this trend. Organizations are actively searching for ways to cut unnecessary expenses on asset maintenance, repairs, and replacement. Companies can save money by rightly managing assets and widening their lifespan through good maintenance. Due to this, there is a bigger need for asset management solutions that offer insights into asset performance, maintenance schedules, and utilization trends. Moreover, another element propelling the enhanced demand for optimal asset utilization is the growing complexity of asset ecosystems. Assets are increasingly interlinked through digital networks as technology advances and the Internet of Things (IoT) spreads. Managing and optimizing the usage of these linked assets requires sophisticated asset management solutions capable of gathering and analyzing real-time data. These technologies provide preventive maintenance, predictive analytics, and greater decision-making based on data insights.

Asset Management Market Restraints and Challenges:

Expensive initial costs of Asset Management System

One of the major restraints to implementing an asset management system is the high initial costs involved. There is the expense of purchasing or setting up the asset management system's software or technology. The software itself might be quite expensive, depending on the system's complexity and scope. Additionally, organizations may invest in the investment of specialized hardware or infrastructure to encourage the system, raising the initial expenses even greater. Furthermore, implementing an asset management system usually necessitates substantial personalisation and modification to meet the particular objectives and processes of the Companies. This personalisation process can be time-consuming and costly, necessitating specialized people or outside consultants.

Lack of Consciousness in SMEs and Budget issues

Many SMEs have restricted awareness of the advantages and importance of asset management. They often believe asset management practices to be complex, time-taking, and only relevant to bigger organizations. Resultantly, they fail to realize the potential advantages of effective asset management to their functions, such as enhanced efficiency, cost cuttings, and better decision-making. This lack of awareness and comprehension reasons SMEs to be reluctant to set up asset management solutions or implement best techniques, stifling market development. In addition, one reason for lesser knowledge is that asset management is often associated with larger companies or industries that deal with complicated and high-value assets. SMEs may consider asset management as insignificant to their daily functions, summarizing that it is restricted to large-scale industrial, infrastructure, or energy sectors.

Asset Management Market Opportunities:

Widening of Interconnected IT Infrastructure

Several attractive opportunities for the asset management market have emerged due to the rapid interlinking of IT Infrastructure. With the growing digitization of organizations across several industries, the number of equipment, systems, and networks that constitute the modern IT ecosystem has risen significantly. Because of this interlinking, these assets create a huge amount of data, including information on their performance, health, and utilization.

Moreover, organizations are transforming to advanced asset management systems to rightly manage these assets and increase their value. These solutions take the help of cutting-edge technology like the Internet of Things (IoT), artificial intelligence (AI), and big data analytics to monitor, track, and maximize asset performance in real time. They offer organizations a comprehensive perspective of their assets, letting them make data-driven decisions about maintenance, upgrades, and substitutes. Additionally, the development of networked IT infrastructure surges the demand for asset management. The amount and unique assets within organizations’ ecosystems develop quickly as they continue to employ cloud computing, edge computing, and hybrid IT environments. This constitutes not only conventional IT assets like servers, storage devices, and networking equipment, but also a wide range of Internet of Things (IoT) devices, sensors, and endpoints. Hence, the widening of interconnected IT infrastructure offers lucrative opportunities for the asset management market value.

ASSET MANAGEMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

35.2% |

|

Segments Covered |

By Component, Asset Type, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IBM Corporation, Morgan Stanley, SAP SE, BlackRock, Inc., ABB, FMR LLC., J.P. Morgan Chase & Co., Oracle Corporation Charles Schwab Investment Management Inc., Rockwell Automation Inc. |

Asset Management Market Segmentation: By Component

-

Solutions

-

Services

Based on solutions, the Solutions segment is expected to hold the greatest market share in 2023. Asset Strategy Management (ASM) is a structured process that facilitates organizations to earn control and effectively manage asset strategies, remove inconsistencies, and ensure assets are up and running at their maximum potential in the company widely for narrowing the gap between current asset performance and optimal asset performance. Employing an ASM program makes sure that reliability strategies are optimized to deliver the best balance of risk, expense, and performance. It also facilitates strategies that are continually updated based on real data, appropriate analysis and justification are offered, and effective review and approval processes are provided.

Asset Management Market Segmentation: By Asset Type

-

Digital Assets

-

Returnable Transport Assets

-

In-transit Assets

-

Manufacturing Assets

-

Personnel/ Staff

Based on Asset Type, the Digital Asset segment attained the greatest growth. This is dedicated to the fact that investors are searching for the latest avenues to diversify their portfolios and make higher returns. Digital assets, such as cryptocurrencies, tokenized securities, and digital tokens, provide substitute investment opportunities beyond traditional asset classes such as stocks and bonds. The capacity for high returns and the allure of creative technologies gain traction from investors in the digital assets segment.

However, the In-Transit assets segment is dedicated to being the fastest-growing sector during the future period. This is because it is observing significant development due to globalization and supply chain complexity, technological advancements, cost optimisation, and efficiency improvement, regulatory compliance and risk reduction, demand for improved customer service, and increasing security concerns.

Asset Management Market Segmentation: By Vertical

-

Energy & Utilities

-

Manufacturing

-

Government & Defence

-

Chemicals

-

Telecommunications

-

Healthcare & Pharmaceuticals

-

Consumer Goods, Food & Beverages

Based on vertical, Chemicals vertical to grow at the largest CAGR during the anticipated period. The Chemical and Pharmaceutical industry alone credits a huge value to the global economy every year. This, in turn, makes it significant to not only increase the reliability of chemical machinery but also maintain it to keep manufacturing running at an optimal stage. The major restraints faced by the chemical vertical constitute unplanned downtime of mission-critical equipment, high maintenance, and repair prices owing to caustic substances, and safety issues around harmful chemical inventory. The consistent expense of maintenance and the growing costs of materials have pushed various chemical producers into the process of searching for new technologies to handle, maintain, and improve production. Asset performance management solutions give importance to works orders, automate inventory control, better safety and compliance throughout the making plant, and build cost-saving preventive maintenance.

Asset Management Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is one of the most technologically modern regions in the world and hence expected to dominate the market. It accounts for the biggest share of the global asset performance management market owing to the early setup of cloud and digital technologies with Industry 4.0 capabilities in the US. North American nations have green and well-established countries, which facilitate them to invest strongly in R&D activities, thereby adding to the development of new technologies. Due to the early employment of trending technologies, such as IoT, big data, AI, and ML, manufacturers are stubborn about integrating industrial IoT technologies with their production processes to simplify asset management and facilitate predictive and prescriptive maintenance across asset-intensive companies.

COVID-19 Impact Analysis on the Asset Management Market:

The COVID-19 pandemic majorly affected the demand for asset management across numerous sectors. It exposed weaknesses in infrastructure, IT, real estate, and healthcare systems, stressing on the need for resilient asset management. Economic instability and budget restrictions influenced organizations to prioritize budget-friendly, data-driven strategies, escalating the adoption of asset management solutions for maximizing resources, increasing preparedness, and ensuring business continuity in the face of unexpected disturbances.

Latest Trends:

Asset performance management with Industrial IoT, predictive and prescriptive analytics

Predictive analytics is a method to interpret historical behavior and, based on that analysis, guess future outcomes. When performed rightly, predictive analytics can precisely portray asset lifecycle and dependability and highlight the early root causes of degradation rather than later-stage detection of damage. The insights taken from intense multi-variate and temporal pattern analysis offer accurate, important lead times. This permits time for decisions that can minimize damage and maintenance or, at the very least, offer preparation time to lower the time to repair and curb consequences. Resultantly, predictive/prescriptive abilities enable asset lifecycle dependability and facilitate decisions on when and how to improve production while proactively avoiding asset and output risks. Such real-time analytics guide maintenance scheduling and asset optimization, removing guesswork on future production and asset concerns.

Key Players:

-

IBM Corporation

-

Morgan Stanley

-

SAP SE

-

BlackRock, Inc.

-

ABB, FMR LLC.

-

J.P. Morgan Chase & Co.

-

Oracle Corporation

-

Charles Schwab Investment Management Inc.

-

Rockwell Automation Inc.

Recent Developments

In January 2022, Ambit Asset Management officially confirmed the launch of ‘Ambit TenX Portfolio’ for high-net-worth investors to develop the businesses and lower the cost.

Chapter 1. Asset Management Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Asset Management Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Asset Management Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Asset Management Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Asset Management Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Asset Management Market – By Component

6.1 Introduction/Key Findings

6.2 Solutions

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Component

6.5 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Asset Management Market – By Asset Type

7.1 Introduction/Key Findings

7.2 Digital Assets

7.3 Returnable Transport Assets

7.4 In-transit Assets

7.5 Manufacturing Assets

7.6 Personnel/ Staff

7.7 Y-O-Y Growth trend Analysis By Asset Type

7.8 Absolute $ Opportunity Analysis By Asset Type, 2024-2030

Chapter 8. Asset Management Market – By Vertical

8.1 Introduction/Key Findings

8.2 Energy & Utilities

8.3 Manufacturing

8.4 Government & Defence

8.5 Chemicals

8.6 Telecommunications

8.7 Healthcare & Pharmaceuticals

8.8 Consumer Goods, Food & Beverages

8.9 Y-O-Y Growth trend Analysis By Vertical

8.10 Absolute $ Opportunity Analysis By Vertical, 2024-2030

Chapter 9. Asset Management Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Asset Type

9.1.4 By By Vertical

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Asset Type

9.2.4 By Vertical

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Asset Type

9.3.4 By Vertical

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Asset Type

9.4.4 By Vertical

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Asset Type

9.5.4 By Vertical

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asset Management Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 IBM Corporation

10.2 Morgan Stanley

10.3 SAP SE

10.4 BlackRock, Inc.

10.5 ABB, FMR LLC.

10.6 J.P. Morgan Chase & Co.

10.7 Oracle Corporation

10.8 Charles Schwab Investment Management Inc.

10.9 Rockwell Automation Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Asset Management Market approximately achieved a value of USD 503.36 billion in 2023 and is anticipated to reach a market size of USD 4,156.38 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 35.2%.

The surging demand for handling assets is propelling the Asset Management Market.

Asset Management Market is segmented based on Component, Asset Type, Vertical, and Region.

North America is the most dominant region for the Asset Management Market.

IBM Corporation, Morgan Stanley, SAP SE, BlackRock, Inc., ABB, FMR LLC., J.P. Morgan Chase & Co., Oracle Corporation, Charles Schwab Investment Management, Inc., and Rockwell Automation Inc. are a few of the key players operating in the Asset Management Market.