Aspartame Market Size (2024 – 2030)

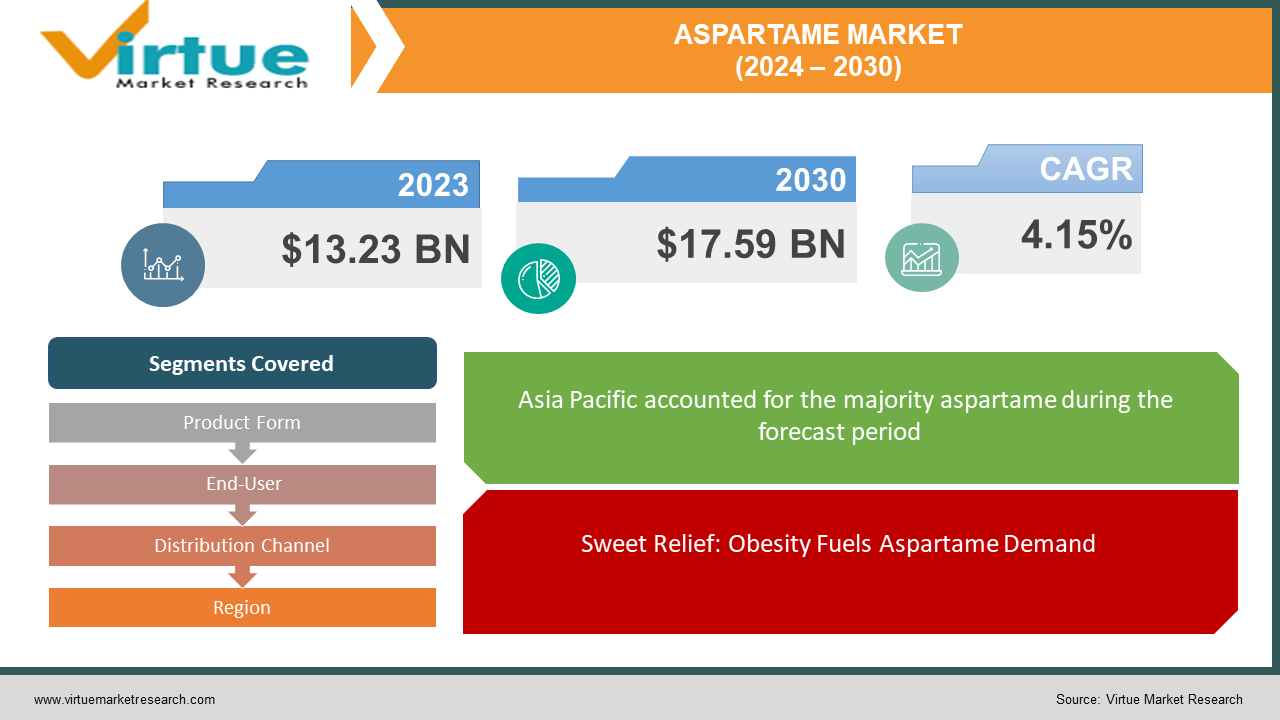

The Global Aspartame Market was valued at USD 13.23 billion in 2023 and is projected to reach a market size of USD 17.59 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.15%.

Aspartame is a sweetener that is approximately 200 times sweeter than sugar and is used to increase the sweetness of foods. Because it is sweeter than sugar, it is used in many foods and beverages. A small amount can be used to ensure the same level of sweetness. Aspartame is often used as a sweetener in foods and beverages and foods that do not need much heat. It can be used as a sweetening agent in some medicines.

Aspartame is used in food products and nutraceuticals due to its low-calorie value. Eating too much can lead to health problems such as diabetes, dental disease, obesity, and more. Accordingly, people need low or zero-calorie products to protect themselves from health problems and control diabetes. Additionally, the government's policy to reduce consumption in the food and beverage sector is expected to boost market growth during the forecast period.

Key Market Insights:

Increasing consumption of healthy food among consumers worldwide is one of the key factors leading to the growth of the aspartame market. The development of the government's policy of encouraging companies to use special ingredients, especially sweeteners and colorants, and the popularity of non-food sweeteners and amino acids obtained through genetic modification have led to economic growth. The increasing use of sucrose substitutes in products, including food products, due to its sweetening properties, is further influencing the market. Additionally, increasing demand for energy-efficient food and beverages, changing personal lifestyles, simplification of production processes, and disposable income are beneficial to the aspartame market.

The global aspartame market is expected to expand during the forecast period due to the increasing number of health-conscious individuals preferring sugar-free foods and beverages across the world. Aspartame has a lower content than sugar, which has contributed to the growth of the aspartame industry. The approval of the use of aspartame in various industries by major food authorities such as the US Food and Drug Administration (FDA) is expected to contribute to the growth of the aspartame market during the forecast period.

The negative effects of aspartame on human health and the existence of products derived from products such as stevia prevent the growth of this sector. Instead of sugary products, use molasses, fruit juice, honey, etc. The adoption of sugary products will also negatively impact the business in the coming years

Aspartame Market Drivers:

Sweet Relief: Obesity Fuels Aspartame Demand

People constantly working and consumers' rising incomes lead to weight gain and obesity, forcing consumers to deal less with sugar intake. According to data from the World Health Organization (WHO), more than 2.4 billion adults will be obese in 2022; Of these, 43% of people over the age of 18 were overweight and about 15% were obese.

Most of the world's people are in countries where obesity causes premature deaths. According to ADA standards, the use of aspartame helps reduce calorie intake and plays an important role in weight loss. Additionally, aspartame can be eaten in small amounts because it contains more sugar than similar products.

As consumers shun sugary products, sugar substitutes see explosive growth.

Sugary foods and drinks are known to have negative health effects and increase the overall healthcare costs of diabetes, tooth decay, and heart disease. Global diabetes spending in 2019 was estimated at US$760 billion, accounting for 10% of all adult spending. Increasing stress on healthcare in many countries has forced the government to take measures to reduce healthcare costs. The World Health Organization (WHO) estimates that the average drink contains ten teaspoons of sugar.

According to the data announced by the American Diabetes Association, approximately 12.5% of 330 million Americans were diagnosed with diabetes in 2022. Additionally, statistics from the International Diabetes Federation (IDF) show that more than 515 million people have diabetes in 2022 the number of people suffering from diabetes will increase to 750 million by 2045 and the need for aspartame will also increase.

Aspartame Market Restraints and Challenges:

Increased availability of natural options may constrain market development.

A variety of artificial sweeteners are offered to consumers in the aspartame market. The growing demand for natural and organic foods has encouraged workers to innovate and produce stevia leaf sweeteners. Consumers today are looking for organic, low-calorie plant-based foods and beverages. This factor should limit revenue from the aspartame business.

For years, people have been expressing concerns about the health problems caused by desserts. Experts say aspartame has the potential to cause cancer and long-term genetic damage. However, many regulatory agencies, such as the US Food and Drug Administration (FDA) and the World Health Organization, support the use of aspartame.

The volatility in Aspartame's price brings a challenge to market growth.

Global Aspartame prices fluctuate significantly due to factors like currency fluctuations, and speculation. This uncertainty can discourage investment and harm smaller players.

Aspartame Market Opportunities:

Despite some controversy, the global aspartame industry still exists. The sugar-conscious lifestyle offers great opportunities for both established and newcomers. As awareness of sugar shortages grows, consumers, especially in developing countries, are turning to the appeal of low-calorie aspartame. This trend has spread to emerging markets, where rising incomes and processed desserts have created fertile ground for aspartame's sweet taste.

Innovation thrives at the heart of this market. From sugar-free versions of favorite classics to the sweet new aspartame, the possibilities are endless. Think guilt-free desserts flavored with exotic spices or sweet protein treats with a taste of nature that harness the magic of aspartame. These innovations can conquer not only health-conscious palates but also regional taste buds by adapting desserts to different tastes.

The outside world is calling a business. As urban industry carves out new territory in Asia and Africa, diabetics in these regions provide abundant input for aspartame production. Cheap and effective sweeteners have become an important tool, paving the way for aspartame to replace sugar-rich foods. Learning about a culture of open communication and leadership can address the following concerns and pave the way for this broad customer base.

But the shadow of competition and conflict remains. Natural sweeteners like Stevia are raising their green hands to get a piece of the pie. While rumors about safety concerns are often unsubstantiated, clarity and scientific evidence are needed to dispel them. Strict regulation can be a gatekeeper and caution should be exercised in entering the market.

But there is the beauty of time in these competitions. By encouraging innovation, understanding trends, and solving problems, the aspartame market can thrive. For those who dare to reform, the market offers sweet gifts, an opportunity to write the story of sugar, and a chance to gain a foothold in a world increasingly hungry for healthy pleasures.

ASPARTAME MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.15% |

|

Segments Covered |

By Product Form, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

HSWT, Anant Pharmaceuticals, Whole Earth Brands, Foodchem International Corporation, GELERIYA PRODUCTS, Hermes Sweeteners Ltd., Taj Pharmaceuticals Limited, Vitasweet Co. Ltd., Prakash Chemicals Agencies, Ajinomoto Co., Inc. |

Aspartame Market Segmentation: by Product Form

-

Powder

-

Granular

In 2023, based on the Product Form, the Powder segment is projected to grow at a CAGR of 3.86% and is currently leading the charts followed by the Granular segment. This is because the powder form is commonly used by food, pharmaceutical, and dairy manufacturers. The Granular segment is expected to witness a CAGR of 3.2% during the forecasting period.

Aspartame Market Segmentation: by End-User

-

Food & Beverages

-

Pharmaceutical

-

Table-Top Sweeteners

-

Others

In 2023, based on End-User, the Food and beverages segment accounted for the largest revenue share with approximately 45% of the market and registered a CAGR of 4.53%. The food and beverage segment is further segmented into beverages, bakery and confectionery, food products, and dairy products. Aspartame is widely used in the food and beverage industry due to consumption and demand by people worldwide.

Aspartame Market Segmentation: by Distribution Channel

-

Offline

-

Online

In 2023, based on Distribution Channel, the Offline segment accounted for the largest revenue share with approximately 65% of the market and is expected to show a CAGR of 3.7% during the forecasting period. The Online segment is expected to progress at a higher CAGR of 4.1% during the forecasting period.

Aspartame Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The aspartame market in Asia Pacific is expected to witness high growth, especially in India and China. The region hosts more than half of the world's population and is rich in geographical resources. The changing demographic structure of the region and the millennial population are expected to increase the demand for aspartame. Extensive research shows that Millennials spend more money than Baby Boomers to try new foods and drinks and choose healthier and nutritional options.

Asia has one of the highest rates of diabetes in the world. Diabetic and obese people in Asia have a potential market for aspartame. More than 60% of Asians have diabetes; This rate is higher in India and China. More than 138 million people in the Western Pacific region are living with diabetes, and this number is expected to reach 201 million by 2035. In response to the increasing cases of diabetes in Asia, many international health organizations are promoting alternative health practices, further strengthening the economy. growth.

Demand for aspartame in Europe is increasing due to changing consumer preferences and the retail market. The British Soft Drinks Association says more than 60% of soft drinks consumed in the region are low-calorie products. The existence of aspartame and its approval by European organizations helps food and beverage manufacturers fulfill their ambition to improve public health while providing alternatives. The British soft drinks maker has increased advertising spend on soft drinks by 70% in a bid to boost sales.

The North American region stands third in the queue in the Global Aspartame Market followed by the Middle East & Africa and South America.

COVID-19 Impact Analysis on the Global Aspartame Market:

The COVID-19 pandemic has also affected the aspartame industry, as many countries have determined that the sweetener is not necessary during the pandemic. For example, Mexico declared one or more brewers "non-critical" during the pandemic, according to Ingredion's annual report. The government's actions affected consumers as they were unable to purchase goods during the government shutdown, thus affecting consumer demand for goods. In addition, government stay-at-home orders have limited the ability of end consumers to purchase certain foods or beverages in the United States and other markets due to restrictions on the operations of restaurants, bars, and specialty retail areas.

Latest Trends/ Developments:

Consumers have turned their sugar cravings to lower-calorie alternatives, and aspartame, which is 200 times sweeter than sugar, remains a strong contender. This trend is particularly strong in developed countries, but awareness is also spreading in emerging markets. Imagine a healthy millennial keeping a soda next to his gym bag, and imagine a similar scenario playing out in India's major cities.

Aspartame doesn't stay put. Manufacturers are creating new combinations with other sweeteners like stevia to achieve a natural, subtle sweetness. Consider all-sugar-free ice cream with a touch of caramel or a fruit-rich protein. Not only would this make a difference, but it would also address some safety concerns about aspartame.

Key Players:

-

HSWT

-

Anant Pharmaceuticals

-

Whole Earth Brands

-

Foodchem International Corporation

-

GELERIYA PRODUCTS

-

Hermes Sweeteners Ltd.

-

Taj Pharmaceuticals Limited

-

Vitasweet Co. Ltd.

-

Prakash Chemicals Agencies

-

Ajinomoto Co., Inc.

-

In May 2022, GSweet Biotech focus on new aspartame and environmentally friendly production processes. Their futuristic lab doesn't just produce desserts, they also produce healthy desserts that appeal to healthy consumers who want their snacks to be guilt-free. Picture Gsweet's gleaming facilities, where scientists in lab coats ponder the future of aspartame.

-

In September 2022, NutraSweet, a veteran of the game, is leveraging its brand knowledge and distribution to stay ahead of the trend. Classic American favorites like cookies and pie feature sugar, proving that "light" doesn't have to affect food. Picture a retro NutraSweet packet next to a sugar-free cookie on a grocery store shelf.

Chapter 1. Aspartame Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aspartame Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aspartame Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aspartame Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aspartame Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aspartame Market – By Product Form

6.1 Introduction/Key Findings

6.2 Powder

6.3 Granular

6.4 Y-O-Y Growth trend Analysis By Product Form

6.5 Absolute $ Opportunity Analysis By Product Form, 2024-2030

Chapter 7. Aspartame Market – By End-User

7.1 Introduction/Key Findings

7.2 Food & Beverages

7.3 Pharmaceutical

7.4 Table-Top Sweeteners

7.5 Others

7.6 Y-O-Y Growth trend Analysis By End-User

7.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Aspartame Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Offline

8.3 Online

8.4 Y-O-Y Growth trend Analysis By Distribution Channel

8.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Aspartame Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Form

9.1.3 By End-User

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Form

9.2.3 By End-User

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Form

9.3.3 By End-User

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Form

9.4.3 By End-User

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Form

9.5.3 By End-User

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Aspartame Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1 HSWT

10.2 Anant Pharmaceuticals

10.3 Whole Earth Brands

10.4 Foodchem International Corporation

10.5 GELERIYA PRODUCTS

10.6 Hermes Sweeteners Ltd.

10.7 Taj Pharmaceuticals Limited

10.8 Vitasweet Co. Ltd.

10.9 Prakash Chemicals Agencies

10.10 Ajinomoto Co., Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aspartame Market was valued at USD 13.23 billion in 2023 and is projected to reach a market size of USD 17.59 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.15%.

The segments under the Global Aspartame Market by Product Form as Powder and Granular.

The Asia-Pacific region is the dominant Global Aspartame Market.

HSWT, Anant Pharmaceuticals, Whole Earth Brands, Foodchem International Corporation, GELERIYA PRODUCTS, Hermes Sweeteners Ltd., Taj Pharmaceuticals Limited, Vitasweet Co. Ltd., Prakash Chemicals Agencies, Ajinomoto Co., Inc., etc.

The COVID-19 pandemic has also affected the aspartame industry, as many countries have determined that the sweetener is not necessary during the pandemic.