Asia Pacific Wine Market Size (2024-2030)

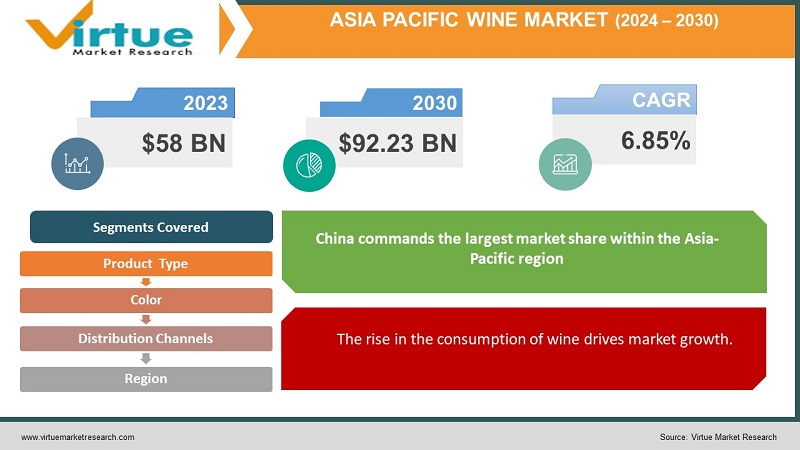

The Asia Pacific Wine Market was valued at USD 58 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 92.23 billion by 2030, growing at a CAGR of 6.85%.

Wine represents an alcoholic beverage crafted from the fermentation of grapes, wherein yeast and sugars interact to produce alcohol and carbon dioxide. This fermentation process, facilitated by the presence of yeast and sugar, typically yields an alcohol content of approximately 15.0%. Within the market, three primary classifications of wine are recognized: table wine, sparkling wine, and fortified wine.

Key Market Insights:

Historically, France and Spain have held the position of leading wine exporters globally. However, nations within the Asia-Pacific region, including China, Japan, and India, have recently emerged as significant contributors to the wine market, with their domestic production and sales gaining momentum. This trend has notably fueled the growth of the wine industry in the region. Furthermore, there is a growing trend of equal interest in wine among both men and women, particularly evident in countries like China and Japan.

Asia Pacific Wine Market Drivers:

The rise in the consumption of wine drives market growth.

The wine market is poised for growth, largely driven by the rising trend of wine consumption attributed to its perceived health benefits and the increasing premiumization of wine products. With a growing emphasis on health-conscious consumerism, winemakers are adapting their offerings accordingly. In Asian markets, red wine holds particular favor due to its reputed health advantages. Notably, Australia stands out for its production of high-quality red wines, notably derived from Shiraz grapes indigenous to the region. The consumption of Shiraz-based wines is associated with various documented health benefits, including cancer risk reduction and stroke prevention, contributing to the expansion of the wine market in the area.

In nations such as Japan, Hong Kong, and South Korea, there has been a notable uptick in the frequency of wine consumption.

Asia Pacific Wine Market Restraints and Challenges:

Alternative drinks hinder market growth.

The demand for certain wine styles or varietals may experience fluctuations due to evolving consumer trends and preferences. Competing alcoholic beverage alternatives such as beer, spirits, and non-alcoholic drinks also vie for consumer attention within the market landscape. Additionally, wine, often regarded as a luxury commodity, is susceptible to counterfeiting, posing a threat to brand reputation and consumer trust. Such challenges underscore the importance for wine producers to remain vigilant and adaptable in navigating the dynamic market environment while maintaining stringent measures to safeguard product authenticity and consumer confidence.

Asia Pacific Wine Market Opportunities:

The burgeoning consumer demand for organic and sustainable products presents a ripe opportunity for wineries to embrace environmentally conscious practices and cater to a discerning market segment. This trend not only aligns with ecological stewardship but also fosters brand loyalty among environmentally conscious consumers.

Moreover, the proliferation of online platforms facilitates broader market reach for wineries, enabling them to transcend geographical barriers and tap into previously inaccessible markets. This digital expansion proves especially beneficial in regions with limited physical accessibility, thereby expanding the scope of market penetration and customer engagement.

Furthermore, technological advancements in the wine industry offer avenues for enhancing both quality and efficiency across the production process. Innovations such as precision viticulture and advanced quality control mechanisms empower wineries to optimize cultivation practices, improve grape quality, and elevate overall wine production standards. Embracing these technological innovations not only enhances competitiveness but also underscores a commitment to delivering exceptional quality wines to consumers.

ASIA-PACIFIC WINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|||

|

Market Size Available |

2023 - 2030 |

|||

|

Base Year |

2023 |

|||

|

Forecast Period |

2024 - 2030 |

|||

|

CAGR |

6.85% |

|||

|

Segments Covered |

By Product Type, Colour, Distribution Channel and Region |

|||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|||

|

Regional Scope |

|

|||

|

Key Companies Profiled |

The Wine Group, Accolade Wines, Davide Campari-Milano N.V., Constellation Brands, E. & J. Gallo Winery. Inc., Compagnia del Vino , John Distilleries, TREASURY WINE ESTATES, Castel, BACARDI. |

Asia Pacific Wine Market Segmentation:

Asia Pacific Wine Market Segmentation By Product Type:

- Still Wine

- Sparkling Wine

- Fortified Wine

- Vermouth

Still, wine stands as the foremost favored product type within the wine industry. Embracing both red and white variations, still, wine boasts a rich and extensive heritage spanning centuries, deeply ingrained in numerous cultural practices and customs. This longstanding tradition solidifies its appeal among consumers, rendering it a trusted and beloved choice.

Moreover, the versatility of still wine further enhances its allure, as it seamlessly adapts to a myriad of settings, from informal gatherings to formal affairs. Its compatibility with a diverse array of cuisines underscores its adaptability, making it a versatile accompaniment for both everyday dining and special occasions alike.

Furthermore, still, wine offers a broad spectrum of flavor profiles, ranging from the robust and intense characteristics of red wines to the crisp and invigorating qualities of white wines. This diverse array of flavors caters to a wide spectrum of preferences, ensuring that there exists a still wine option to suit virtually every discerning palate.

Asia Pacific Wine Market Segmentation By Color:

- Red Wine

- Rose Wine

- White Wine

Red wine commands the lion's share of the market, owing to its widespread appeal among consumers. Renowned for its flavor profile, characterized by nuances of dark fruits, spices, and frequently oak undertones, red wine caters to a broad demographic. Its harmonious blend of sweetness, acidity, and tannins creates a gratifying sensory experience that resonates with many aficionados.

Additionally, red wine's versatility in food pairing significantly contributes to its popularity. Its ability to complement a diverse range of dishes, including red meats, pasta, cheeses, and Mediterranean fare, enhances culinary experiences both at home and in dining establishments.

Furthermore, the aging potential of many red wines adds another layer of allure. Wine enthusiasts are drawn to the complexity and evolution of flavors exhibited by aged red wines, prompting investment in cellar-worthy vintages. This appreciation for the maturation process further solidifies red wine's status as a preferred choice among collectors and connoisseurs alike.

Asia Pacific Wine Market Segmentation By Distribution Channel:

- On-trade

- Off-trade

The distribution of wines through off-trade channels holds significant prominence within the market, constituting the largest segment. These channels offer consumers a convenient and easily accessible avenue for procuring wine. Whether purchasing alongside regular groceries or during planned shopping excursions, individuals benefit from the convenience and efficiency afforded by off-trade outlets, thereby saving time and streamlining their shopping experiences.

The ubiquitous presence of retail stores and supermarkets further amplifies accessibility, catering to a broad spectrum of consumers across diverse geographic regions. This widespread availability ensures that wines are within reach of both urban and rural clientele, fostering inclusivity within the market.

Moreover, off-trade channels boast a diverse array of wine selections, encompassing various varieties, regions, and price points. This comprehensive assortment empowers consumers to explore a wide range of options, enabling them to make informed decisions aligned with their preferences and budgetary considerations.

Asia Pacific Wine Market Segmentation- By Region

- China

- India

- Japan

- Australia

- Rest of Asia Pacific

China commands the largest market share within the Asia-Pacific region, driven by several key factors. Rapid urbanization coupled with the emergence of a vibrant nightlife culture in cities has spurred an increased inclination among Chinese consumers towards wine consumption. Furthermore, there is a growing trend of gifting wine to acquaintances, reflecting shifting social norms and preferences.

Additionally, there is a notable openness among Chinese consumers to explore and experiment with new varieties of alcohol, contributing to the dynamic growth of the wine market in the region. Imported wines, in particular, are in high demand, with their consumption accounting for nearly half of the total wine consumed in China.

Moreover, the rise of community group buying has become increasingly prevalent in China. This model, conducted in physical, offline communities where a designated home or store manager serves as the central distribution hub for products purchased by community members, has gained traction. Companies are strategically embracing this community-driven approach to expand their market reach and enhance consumer engagement.

COVID-19 Pandemic: Impact Analysis

The onset of the COVID-19 pandemic significantly influenced market dynamics, prompting notable shifts in consumer behavior. Lockdown measures necessitated the adoption of online and e-commerce platforms as primary channels for wine purchases, leading to a surge in market growth. Consumers increasingly turned to these platforms for convenient and safe options, driving the expansion of the market.

Furthermore, heightened awareness of the health benefits associated with wine consumption has spurred increased demand. Younger demographics, in particular, have embraced the trend of socializing at restaurants and bars, further fueling market growth.

Moreover, wine brands have intensified their marketing and promotional endeavors to resonate with a broader audience, thereby providing additional impetus to the market's expansion. These concerted efforts aim to capture consumer interest and foster brand loyalty amidst evolving market dynamics.

Latest Trends/ Developments:

- In July 2022, Milestone Beverages is set to unveil the revamped Blowfish Australian wine brand in China, featuring a fresh design. Blowfish holds special significance as Milestone's inaugural brand, conceived by founder and managing director Joe Milner as a tribute to his Australian heritage.

- Similarly, in May 2022, Juvé Camps forged a strategic partnership with Nimbility, a Hong Kong-based market expert and export management company, to bolster its presence across the Asia Pacific region. The collaboration initially targets expansion efforts in Greater China and South Korea.

- Furthermore, March 2022 witnessed the launch of Mercian Wines by Mercian Corporation, a prominent wine importer and producer in Japan. The inaugural collection from Mercian Wines showcases a series of multi-country blends, featuring wines sourced from Spain and Australia, marking a significant addition to the company's portfolio.

Key Players:

These are the top 10 players in the Asia Pacific Wine Market:-

- The Wine Group

- Accolade Wines,

- Davide Campari-Milano N.V.,

- Constellation Brands

- E. & J. Gallo Winery. Inc.

- Compagnia del Vino

- John Distilleries,

- TREASURY WINE ESTATES

- Castel

- BACARDI.

Chapter 1. Asia Pacific Wine Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Wine Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Wine Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Wine Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Wine Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Wine Market– By Product Type

6.1. Introduction/Key Findings

6.2. Still Wine

6.3. Sparkling Wine

6.4. Fortified Wine

6.5. Vermouth

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2023-2030

Chapter 7. Asia Pacific Wine Market– By Color

7.1. Introduction/Key Findings

7.2. Red Wine

7.3. Rose Wine

7.4. White Wine

7.5. Y-O-Y Growth trend Analysis By Color

7.6. Absolute $ Opportunity Analysis By Color , 2023-2030

Chapter 8. Asia Pacific Wine Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2 On-trade

8.3. Off-trade

8.4. Y-O-Y Growth trend Analysis Distribution Channel

8.5. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. Asia Pacific Wine Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.2.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Product Type

9.1.3. By Color

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Wine Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 The Wine Group

10.2. Accolade Wines,

10.3. Davide Campari-Milano N.V.,

10.4. Constellation Brands

10.5. E. & J. Gallo Winery. Inc.

10.6. Compagnia del Vino

10.7. John Distilleries,

10.8. TREASURY WINE ESTATES

10.9. Castel

10.10. BACARDI.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The wine market is poised for growth, largely driven by the rising trend of wine consumption attributed to its perceived health benefits and the increasing premiumization of wine products

The top players operating in the Asia Pacific Wine Market are - The Wine Group, Accolade Wines, Davide Campari-Milano N.V., Constellation Brands, E. & J. Gallo Winery. Inc., Compagnia del Vino, John Distilleries, TREASURY WINE ESTATES, Castel, ACARDI.

The onset of the COVID-19 pandemic significantly influenced market dynamics, prompting notable shifts in consumer behavior. Lockdown measures necessitated the adoption of online and e-commerce platforms as primary channels for wine purchases, leading to a surge in market growth.

In July 2022, Milestone Beverages is set to unveil the revamped Blowfish Australian wine brand in China, featuring a fresh design. Blowfish holds special significance as Milestone's inaugural brand, conceived by founder and managing director Joe Milner as a tribute to his Australian heritage

. China commands the largest market share within the Asia-Pacific region, driven by several key factors