Asia-Pacific Synthetic & Bio-based Adipic Acid Market Size (2024-2030)

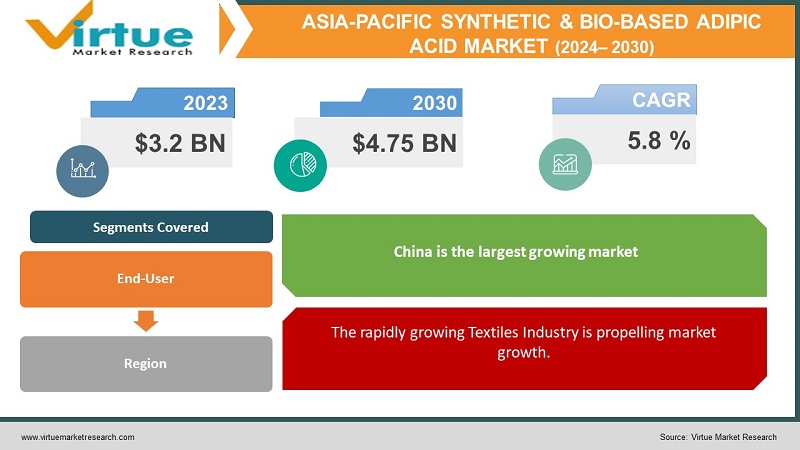

The Asia-Pacific synthetic and bio-based adipic acid industry is projected to grow from USD 3.2 billion in 2023 to USD 4.75 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 5.8% during 2024-2030.

Adipic acid, a crucial building block for nylon and other materials, comes in two flavors: synthetic and bio-based. Traditionally, synthetic adipic acid reigns supreme, produced from petroleum-based sources like cyclohexane. While cost-effective, it raises concerns about carbon footprint and resource depletion. Bio-based adipic acid, the eco-warrior. Derived from renewable sources like plant oils or sugar, it boasts a greener production process and aligns with sustainability goals. Both varieties offer similar functionality, but bio-based adipic acid commands a higher price tag due to its nascent production methods. Despite this, the market expects it to grow faster as sustainability concerns rise and technology advances. In essence, it's a battle between cost-effective tradition and eco-friendly innovation, both vying to meet the ever-growing demand for this versatile industrial workhorse.

Key Market Insights:

Asia Pacific reigns supreme, consuming a third of the market, and is projected to expand at 5.8% due to its booming economies, rising population, and government support for sustainable bio-based options. The driving force behind this growth is nylon 6.6 production, devouring 60% of adipic acid globally. However, bio-based adipic acid, though still nascent, is gaining traction due to environmental concerns and government incentives, offering exciting opportunities for players who can address affordability and scale production. Overall, the market thrives on the balance between established synthetic demand and the burgeoning bio-based segment, presenting lucrative prospects for innovators who cater to sustainability and cost-effectiveness.

Asia-Pacific Synthetic & Bio-based Adipic Acid Market Drivers:

The rapidly growing Textiles Industry is propelling market growth.

Imagine a bustling Asian factory churning out vibrant fabrics for the world. This scene symbolizes the textile engine driving the region's Synthetic and bio-based Adipic Acid Market. Giants like China, India, and Vietnam lead the charge, fueled by a growing middle class and urbanization. Disposable incomes rise, translating to more wardrobes bursting with new apparel. Sportswear and technical textiles join the party, demanding lightweight, durable materials – guess what's a key ingredient? Nylon is heavily reliant on adipic acid. This textile boom isn't just about fashion; it's about economic growth and a rising demand for the versatile adipic acid. It's a story woven with threads of prosperity, innovation, and the ever-evolving needs of a dynamic region.

Expansion of the Automotive Industry is propelling the market growth.

The roar of engines across Asia echoes a rising demand for a surprising ingredient: adipic acid. As automotive giants in China, India, and beyond ramp up production, their hunger for lightweight, durable materials translates directly into increased demand for adipic acid, a key component in nylon. From the sturdy treads of tires to the vital hoses under the hood, nylon's strength and flexibility make it a go-to choice for various automotive components. But the story doesn't end there. The global push for fuel efficiency has manufacturers seeking lighter materials and nylon, thanks to its remarkable strength-to-weight ratio, steps up to the challenge. This eco-conscious shift further propels the use of adipic acid, demonstrating its role in both performance and sustainability. So, the next time you see a sleek car cruise down the Asian highway, remember, it might owe its smooth ride and lighter footprint, in part, to the silent power of adipic acid.

Asia-Pacific offers cost-competitive production advantages for both synthetic and bio-based adipic acid is propelling the market growth

In the global game of adipic acid production, Asia-Pacific holds the trump card of cost-competitiveness. Picture this: readily available raw materials like benzene for synthetic adipic acid or sugar for bio-based alternatives, both found in abundance across the region. Add to that lower labor costs compared to other players, and you have a winning formula for affordability. This competitive edge isn't just a hunch; it's a reality attracting manufacturers seeking to optimize production expenses. It's not just about cost, though. Asia-Pacific offers a readily available skilled workforce and established chemical production infrastructure, creating a conducive environment for both established and emerging adipic acid producers. This cost advantage isn't limited to synthetic production either. With ample access to bio-based feedstocks like palm oil and sugar cane, the region holds immense potential for cost-effective bio-adipic acid production, catering to the growing demand for sustainable alternatives. So, whether it's the traditional or the eco-conscious route, Asia-Pacific stands out as a cost-effective hub for adipic acid production, poised to fuel its own and global market demands.

Asia-Pacific Synthetic & Bio-based Adipic Acid Market challenges and restraints

Fluctuations in Crude Oil Prices are hindering the market growth

The synthetic adipic acid industry rides a roller coaster of crude oil prices. Imagine a factory churning out this versatile chemical, heavily reliant on petroleum-based ingredients. Suddenly, oil prices surge, throwing a wrench in the cost calculations. Production costs spike, squeezing profit margins and potentially leading to price hikes for end products. This volatility creates uncertainty for both producers and consumers, making market stability a balancing act. The challenge lies in mitigating this dependence on fluctuating oil prices. Exploring alternative feedstocks or investing in production methods less susceptible to such volatility are crucial steps to ensure a smoother ride for the synthetic adipic acid industry.

Stringent Regulations and Certification Requirements are hindering the market growth

Bio-based adipic acid, the eco-warrior, faces a regulatory hurdle. Governments and certification bodies, while aiming to ensure sustainability and quality, create a labyrinth of regulations. Imagine navigating a complex web of paperwork, proving your bio-based claim's traceability and environmental impact. This adds layers of complexity and cost to production, slowing down market penetration for this promising alternative. The challenge lies in striking a balance: robust regulations essential for protecting consumers and the environment, but streamlined enough to avoid hindering the growth of this sustainable option. Collaboration between regulators, producers, and independent bodies is key to finding this sweet spot, allowing bio-based adipic acid to reach its full potential.

Lack of Awareness and Infrastructure for Bio-based Products is hindering the market growth

Consumers and companies in the region might not be fully aware of the benefits and availability of bio-based adipic acid, limiting its demand compared to the traditional synthetic option. Additionally, infrastructure for collecting, processing, and distributing bio-based feedstocks might need further development in some regions

Market Opportunities:

The synthetic & and bio-based adipic acid market in Asia brims with potential, offering a CAGR of 5.8% until 2030. This growth is fueled by the region's economic might, with China and India leading the charge. Their expanding populations and booming textile, automotive, and construction industries create an insatiable demand for nylon 6.6, the primary consumer of adipic acid. Additionally, government support for bio-based alternatives, driven by environmental awareness, unlocks significant opportunities. Companies that embrace sustainability and cost-effectiveness can tap into this segment's immense potential. Furthermore, advancements in biotechnology and fermentation processes can reduce production costs and enhance bio-based adipic acid's competitiveness. Strategic collaborations between international players and regional manufacturers can accelerate innovation and expand market reach. By addressing affordability concerns and tailoring solutions to specific regional needs, market players can unlock a goldmine of opportunities in Asia's dynamic adipic acid landscape.

ASIA-PACIFIC SYNTHETIC & BIO-BASED ADIPIC ACID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, India, Japan, rest of asia-pacific |

|

Key Companies Profiled |

Elantas GmbH (Germany), Axalta Coating Systems (the U.S.), Von Roll Holdings AG (Switzerland), Hitachi Chemicals Company Ltd. (Japan), 3M Company (the U.S.), and Kyocera Corporation (Japan) |

Asia-Pacific Synthetic & Bio-based Adipic Acid Market Segmentation

Asia-Pacific Synthetic & Bio-based Adipic Acid Market Segmentation by End User

- Textile Industry

- Construction Industry

- Automotive Industry

- Packaging Industry

The textile industry reigns supreme, devouring adipic acid for clothes and carpets that adorn our lives. But adipic acid's versatility goes beyond wardrobes. The automotive industry craves it for lightweight, fuel-efficient nylon components, while construction relies on it for sturdy flooring and coatings. Packaging needs films and coatings made with adipic acid to keep food fresh. Electronics, furniture, and even diverse consumer goods utilize its diverse properties. Each industry contributes, but textiles hold the crown, weaving a story of comfort, fashion, and the ever-present demand for this versatile building block.

Asia-Pacific Synthetic & Bio-based Adipic Acid Market Segmentation Market Segmentation: Regional Analysis:

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Rest of APAC

China, the undisputed champion, boasts massive production and manufacturing muscle. But watch out for India, the fastest-growing contender, fueled by rising incomes and a booming population. Southeast Asia, like Vietnam and Thailand, pirouettes with exciting potential, while Japan and South Korea, the seasoned performers, and showcase established yet mature markets. This diverse stage reflects the market's dynamism, with China leading the pack, India emerging as the rising star and Southeast Asia poised for a breakout performance.

COVID-19 Impact Analysis on the Synthetic & Bio-based Adipic Acid Market in the Asia-Pacific region

The COVID-19 pandemic delivered a mixed bag for the Asia-Pacific synthetic & and bio-based adipic acid market. Initial lockdowns and economic disruptions sent shockwaves, causing a temporary decline in demand for nylon 6.6, a major adipic acid consumer. However, the rebound in the construction and automotive sectors, particularly in China, fueled a demand resurgence. Moreover, concerns about hygiene and healthcare during the pandemic boosted the use of adipic acid in pharmaceuticals and medical devices, offering unexpected growth opportunities. Interestingly, bio-based adipic acid saw increased interest due to its perceived health and environmental benefits, attracting government support and investment. However, supply chain disruptions and manpower shortages posed challenges during the peak, impacting production and delivery timelines. The long-term impact of COVID-19 on disposable incomes and infrastructure development remains uncertain. Nevertheless, Asia's resilience and focus on sustainability suggest a promising future for the adipic acid market. Companies that adapt to changing consumer preferences, invest in bio-based alternatives and ensure supply chain resilience are well-positioned to thrive in the post-pandemic landscape.

Latest trends/Developments

The synthetic & and bio-based adipic acid market pulsates with exciting developments. Innovation focuses on sustainability, driven by rising environmental concerns and government incentives. Bio-based adipic acid is gaining ground, with advancements in fermentation processes reducing production costs and enhancing its competitiveness. Companies like BASF and INVISTA are investing heavily in this segment. Technological advancements like continuous fermentation and strain optimization promise further efficiency gains. On the synthetic side, the focus is on circular economy initiatives, with players like UBE and Toray exploring the use of recycled raw materials. Additionally, demand diversification beyond nylon 6.6 is underway, with adipic acid finding applications in biodegradable plastics, lubricants, and food additives. These trends, coupled with regional growth in Asia and increased focus on affordability, paint a dynamic picture for the future of the synthetic & bio-based adipic acid market, offering ample opportunities for innovative and adaptable players.

Key Players:

- Mitsui Chemicals

- Sumitomo Chemical

- Shangdong Haili

- Invista

- Liaoyang Petrochemical Co., Ltd.

- Shangdong Haili (Bohui) Chemical Co., Ltd.

- Rennovia Inc.

- Rodenburg Biopolymers N.V

- Verdezyne Inc.

Chapter 1. Asia-Pacific Synthetic and bio-based Adipic Acid Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific Synthetic and bio-based Adipic Acid Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific Synthetic and bio-based Adipic Acid Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Synthetic and bio-based Adipic Acid Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific Synthetic and bio-based Adipic Acid Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Synthetic and bio-based Adipic Acid Market– By End-User

6.1. Introduction/Key Findings

6.2. Textile Industry

6.3. Construction Industry

6.4. Automotive Industry

6.5. Packaging Industry

6.6. Y-O-Y Growth trend Analysis By End-User

6.7. Absolute $ Opportunity Analysis By End-User , 2024-2030

Chapter 7. Asia-Pacific Synthetic and bio-based Adipic Acid Market, By Geography – Market Size, Forecast, Trends & Insights

7.1. Asia-Pacific

7.1.1. By Country

7.1.1.1. India

7.1.1.2. china

7.1.1.3. Japan

7.1.1.4. South korea

7.1.1.5. Australia

7.1.1.6. Rest of MEA

7.2.1. By End-User

7.2.2. Countries & Segments - Market Attractiveness Analysis

Chapter 8. Asia-Pacific Synthetic and bio-based Adipic Acid Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Mitsui Chemicals

8.2. Sumitomo Chemical

8.3. Shangdong Haili

8.4. Invista

8.5. Liaoyang Petrochemical Co., Ltd.

8.6. Shangdong Haili (Bohui) Chemical Co., Ltd.

8.7. Rennovia Inc.

8.8. Rodenburg Biopolymers N.V

8.9. Verdezyne Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Asia-Pacific synthetic and bio-based adipic acid industry is projected to grow from USD 3.2 billion in 2023 to USD 4.75 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 5.8% during 2024-2030.

Rapidly Growing Textiles Industry, Expansion of the Automotive Industry, Asia-Pacific offers cost-competitive production advantages for both synthetic and bio-based adipic acid these are the reasons that are driving the market.

Based on end-user it is divided into four segments – Textile Industry, Construction Industry, Automotive Industry, and Packaging Industry.

China is the most dominant country for the luxury vehicle Market.

Mitsui Chemicals, Sumitomo Chemical, Shangdong Haili, etc.