Asia Pacific Smoothies Market Size (2024-2030)

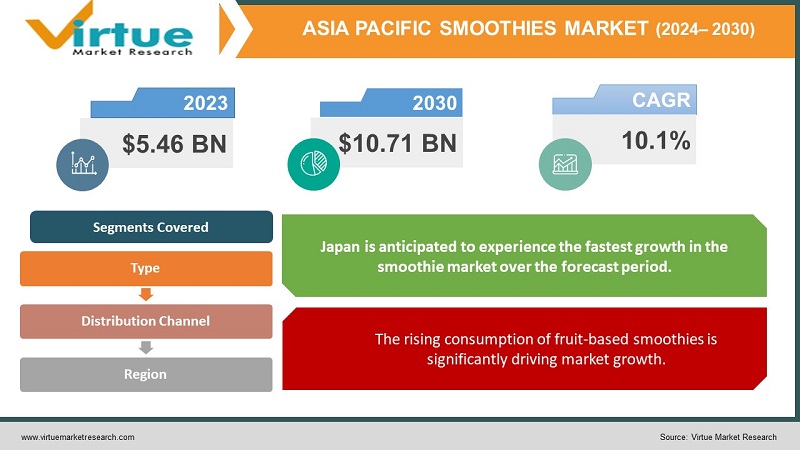

The Asia Pacific Smoothies Market was valued at USD 5.46 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 10.71 billion by 2030, growing at a CAGR of 10.1%.

A smoothie is a dense beverage made by blending fruits, vegetables, fruit juice, and milk. Additional components, including whey protein, nuts, seeds, as well as herbal and nutritional supplements, are often incorporated to enhance taste and increase consistency. As chronic diseases become more prevalent, the demand for smoothies has surged in the Asia Pacific region. The intake of smoothies is commonly linked to numerous health advantages, such as maintaining balanced blood sugar and cholesterol levels, along with a general boost to the immune system.

Key Market Insights:

The Asia Pacific region is one of the largest markets for smoothies. A key factor propelling this market is the growing inclination towards healthy beverage options in countries like India, China, and Australia.

This trend is attributed to increasing health awareness and the fast-paced lifestyles of individuals in the area. Additionally, the rising demand for convenient meal solutions has led to a greater number of cafes and restaurants offering smoothies, positively influencing market growth. Furthermore, major manufacturers are introducing innovative product variations, such as gluten-free smoothies, to expand their customer reach.

Asia Pacific Smoothies Market Drivers:

The health and wellness trend is a significant driver of market growth.

The emphasis on health and wellness is a significant factor driving the growth of the smoothies market. Consumers are becoming more conscious of their dietary selections, actively seeking nutritious options. Smoothies, which are typically crafted from fresh fruits, vegetables, and other wholesome ingredients, provide a convenient way to integrate essential nutrients into daily diets. Surveys indicate a strong consumer preference for healthier food and beverage choices; for example, a Nielsen study found that 48% of participants actively seek products with health benefits, including those derived from whole foods like smoothies.

Additionally, McKinsey & Company reports that consumer expenditure on wellness has reached unprecedented levels, with the wellness industry expanding at an annual rate of 5 to 10%. This market has also seen a rise in the incorporation of functional ingredients in smoothies, which are recognized for their health advantages. Ingredients such as turmeric, known for its anti-inflammatory effects, and probiotics, which support digestive health, are increasingly popular additions. This trend is anticipated to continue influencing the industry as consumers place greater importance on well-being and nutrition in their food and beverage selections.

The rising consumption of fruit-based smoothies is significantly driving market growth.

Smoothies, which contain generous portions of fruits, are often recommended as part of a healthy diet. The increasing health awareness among consumers, coupled with evolving lifestyles and dietary habits, is contributing to the growth of the fruit-based smoothie market. Currently, many individuals tend to skip meals, opting for snack foods as substitutes. Smoothies typically have a low carbohydrate content, especially when prepared without added sugars. As a result, many fitness trainers advocate for smoothies as a weight-loss aid. Consequently, smoothies have positioned themselves as ideal meal replacement options. Additionally, they are healthier than many other snack products, providing a combination of good taste, convenience, and portability.

Asia Pacific Smoothies Market Restraints and Challenges:

The rise in homemade smoothies is hindering market growth.

The increasing trend of homemade smoothies presents a challenge to the commercial smoothie market. Many consumers opt to prepare smoothies at home, allowing for ingredient customization, which can negatively impact the sales of pre-packaged smoothies. This shift underscores the appeal of tailored recipes and the cost advantages associated with DIY smoothies.

Common ingredients used in homemade smoothies, such as fresh fruits, vegetables, yogurt, and protein powders, are witnessing strong sales. This trend reflects consumers' willingness to invest in the components necessary for crafting their own smoothies. Furthermore, there has been a notable rise in online searches and social media activity focused on smoothie recipes and tips for making homemade versions. Consumers are actively looking for inspiration and guidance to create their personalized smoothie concoctions.

Asia Pacific Smoothies Market Opportunities:

Sustainable packaging solutions offer considerable opportunities for market expansion.

Addressing environmental concerns can be effectively achieved by implementing sustainable and eco-friendly packaging for smoothies. By investing in recyclable or biodegradable containers, brands can significantly reduce plastic waste and align with the preferences of environmentally conscious consumers. As various regions implement regulations and bans on single-use plastics, there exists both a regulatory obligation and a business opportunity for companies to transition to more sustainable packaging solutions.

A survey conducted by Trivium Packaging found that 74% of consumers are willing to pay a premium for environmentally friendly packaging. Brands that embrace sustainable practices can attract and retain eco-conscious customers. Additionally, companies that prioritize sustainability

are increasingly viewed as responsible corporate citizens. As a result, brands that take the lead in sustainable packaging are likely to gain a competitive advantage and effectively address the growing consumer demand for environmentally responsible practices.

ASIA PACIFIC SMOOTHIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.1% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

china, Japan, India, South Korea, Rest of Asia-Pacific |

|

Key Companies Profiled |

Barfresh Food Group, Inc., Jamba Juice LL and CElla’s Kitchen Ltd, etc., innocent ltd, Bolthouse Farms, Maui Wowi Hawaiian Coffees & Smoothies Smoothie King, Suja Juice, Tropical Smoothie Café , The Smoothie Company |

Asia Pacific Smoothies Market Segmentation:

Asia Pacific Smoothies Market Segmentation By Type:

- Fruit-based

- Dairy-based

- Other product-based types

Fruit-based smoothies dominate the market, primarily characterized by fruit as the main ingredient. These smoothies often include a mix of fruits such as berries, bananas, mangoes, and citrus fruits, delivering natural sweetness and a refreshing taste. Additional components like yogurt, ice, or fruit juice may also be incorporated. This segment accounts for over 55% of the market share. Expected increases in investment within the food and beverage sector, particularly for organic fruit-based smoothies, are anticipated to drive market demand in the coming years. The growing demand for vitamins and the trend toward reducing sugar intake are projected to further enhance the sales of fruit-based products throughout the forecast period.

Conversely, dairy-based smoothies utilize dairy products as a primary ingredient, typically incorporating yogurt or milk. These smoothies often blend dairy with fruits, vegetables, and other additives, resulting in a creamy texture and a subtle tangy flavor.

Asia Pacific Smoothies Market Segmentation By Distribution Channel:

- Supermarkets and hypermarkets

- Smoothie- elated bars

- Convenience stores

Market growth has been significantly driven by supermarkets and hypermarkets, which are large retail outlets offering a diverse array of products, including pre-packaged smoothies. Bottled or canned smoothies are typically found in the chilled or beverage sections of these stores, making them easily accessible for customers during their regular shopping trips. Together, supermarkets and convenience stores account for over half of the revenue generated in the smoothies market. This growth can be attributed to effective cold chain management practices and the availability of a wide variety of smoothie options at competitive prices. With their established presence and extensive reach, supermarkets and convenience stores hold a substantial share of the market.

In contrast, smoothie bars focus on providing a selection of freshly made smoothies and similar offerings. These establishments allow customers to choose from a range of ingredients, enabling them to customize their orders according to personal preferences, often showcasing a menu of freshly prepared smoothies.

Asia Pacific Smoothies Market Segmentation- by Region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific (APAC)

The influence of Western dietary patterns, along with the growing popularity of fitness and wellness trends, is driving the regional acceptance and consumption of smoothies in the Asia Pacific. Recently, fruit-based smoothies have seen a significant increase in popularity across the

region. This trend can be attributed to various factors that resonate with the diverse preferences and health-conscious mindset of the population. A major factor contributing to the high consumption of fruit-based smoothies is the rising awareness of health and wellness. As individuals become more mindful of their lifestyles and dietary choices, there is a growing preference for nutritious and wholesome options.

China, as the world's second-largest economy, is projected to see substantial growth in the smoothie market. The adoption of convenience foods is being driven by increasing health awareness and busy lifestyles, particularly in countries like India and China. Additionally, the demand for organic smoothies and high-fiber options with added health benefits has risen significantly.

Japan is anticipated to experience the fastest growth in the smoothie market over the forecast period. The market in Japan has seen remarkable expansion in recent years, fueled by several key factors. Firstly, the heightened focus on health and wellness has led to increased consumer demand for nutritious food options. As a result, many people are turning to smoothies as a convenient means to incorporate fruits, vegetables, and other wholesome ingredients into their diets. The rise of fitness culture and the desire for effective post-workout recovery options have also contributed to the surge in smoothie consumption.

Moreover, growing awareness of dietary restrictions, such as veganism and lactose intolerance, has spurred the development of dairy-free and plant-based smoothie alternatives. Consequently, the market has diversified to meet a wider range of dietary needs and preferences. The convenience factor plays a significant role, as hectic lifestyles have driven demand for on-the-go meal replacements. The portability and quick preparation of smoothies make them an appealing choice for modern consumers.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has had far-reaching effects across various sectors globally, with the food and beverage industry facing notable challenges. Within this industry, the smoothie sector encountered significant obstacles. However, an intriguing trend emerged during this period, as consumers began to increasingly favor organic and natural food options, resulting in substantial growth for the smoothie market.

Smoothies, recognized for their organic and nutritious ingredients, gained popularity as individuals sought healthier dietary choices in response to the pandemic. This time also saw a rise in the experimentation with new and nutritious smoothie recipes, as people became more health-conscious and aimed to incorporate healthier options into their diets.

Latest Trends/ Developments:

In October 2023, Smoothie King, recognized as the world's largest smoothie company, introduced two new indulgent Smoothie Bowls: Açai Cocoa Haze™ and Coco Pitaya-Yah™.

In September 2023, Sainsbury's announced an additional investment of £6 million annually in its dairy farmers, reaffirming its commitment to providing long-term support for the dairy industry. In November 2022, Barfresh Food Group launched a range of environmentally friendly 7.6oz Smoothie Cartons. Designed with both economic and ecological advantages in mind, this ready-to-drink packaging was engineered to deliver improved profit margins compared to the company’s previous bottle format. Specifically tailored for schools, it offers an alternative to single-use plastics for larger school districts.

In February 2022, PepsiCo's juice and smoothie brand Naked Juice expanded its smoothie offerings by introducing new flavors, orange vanilla crème and key lime. These plant-based smoothies, sweetened with monk fruit and blended with almond and coconut milk, serve as an excellent source of vitamin C.

Key Players:

These are top 10 players in the Asia Pacific Smoothies Market :-

- Barfresh Food Group, Inc.

- Jamba Juice LL

- CElla’s

- Kitchen Ltd

- innocent ltd

- Bolthouse Farms

- Maui Wowi Hawaiian Coffees & Smoothies Smoothie King

- Suja Juice

- Tropical Smoothie Café

- The Smoothie Company

Chapter 1. Asia Pacific Smoothies Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Smoothies Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Smoothies Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Smoothies Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Smoothies Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Smoothies Market– By Type

6.1. Introduction/Key Findings

6.2. Fruit-based

6.3. Dairy-based

6.4. Other product-based types

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Asia Pacific Smoothies Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets and hypermarkets

7.3. Smoothie- elated bars

7.4. Convenience stores

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Asia Pacific Smoothies Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Smoothies Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Barfresh Food Group, Inc.

9.2. Jamba Juice LL

9.3. CElla’s 9.4. Kitchen Ltd

9.5. innocent ltd

9.6. Bolthouse Farms

9.7. Maui Wowi Hawaiian Coffees & Smoothies Smoothie King

9.8. Suja Juice

9.9. Tropical Smoothie Café

9.10. The Smoothie Company

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

As chronic diseases become more prevalent, the demand for smoothies has surged in the Asia Pacific region.

The top players operating in the Asia Pacific Smoothies Market are - Barfresh Food Group, Inc., Jamba Juice LL and CElla’s Kitchen Ltd, etc.

The COVID-19 pandemic has had far-reaching effects across various sectors globally, with the food and beverage industry facing notable challenges.

Addressing environmental concerns can be effectively achieved by implementing sustainable and eco-friendly packaging for smoothies. By investing in recyclable or biodegradable containers, brands can significantly reduce plastic waste and align with the preferences of environmentally conscious consumers.

Japan is anticipated to experience the fastest growth in the smoothie market over the forecast period.