Asia-Pacific PTFE membrane Market size (2024-2030)

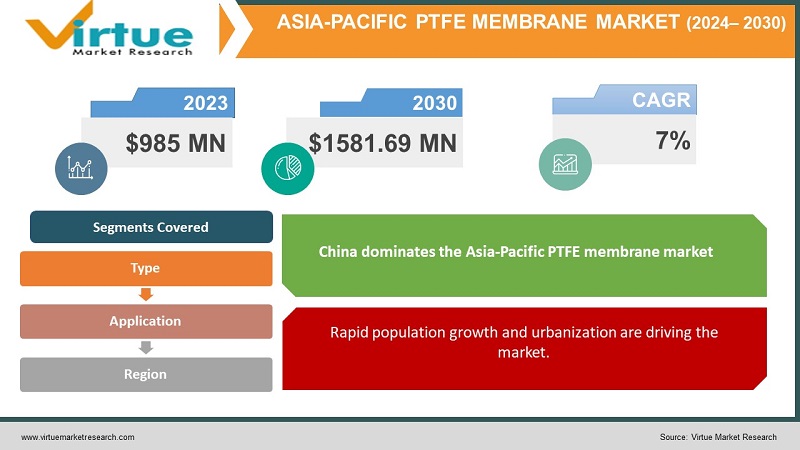

The Asia-Pacific PTFE membrane market is the largest globally, and its size is estimated to be around USD 985 million as of 2023. This figure is expected to grow at a significant CAGR of 7% in the coming years, reaching USD 1581.69 million by 2030.

PTFE membranes are microscopic sieves with unique properties. Highly resistant to harsh chemicals and heat, they excel at filtering liquids and gases. While water beads off due to their water-repellent nature, air flows freely through, making them ideal for applications like air vents and battery microfilters. From filtering aggressive solutions in labs to protecting sensitive equipment, these versatile membranes play a crucial role in various industries.

Key Market Insights:

Water scarcity, booming industries like pharmaceuticals and textiles, and stricter environmental regulations are driving demand. China leads with over 50% share, but India, South Korea, and Japan have significant growth potential. While hydrophobic membranes dominate, hydrophilic options gain traction. Industrial filtration is the largest application, followed by water & wastewater treatment. High initial costs, competition, and fluctuating raw material prices pose challenges, but technological advancements and rising awareness of PTFE's benefits offer promise. Overall, this market presents a lucrative opportunity for manufacturers and investors, fueled by the region's growing need for clean water, industrial development, and adherence to regulations.

Asia-Pacific PTFE Membrane Market Drivers:

Rapid population growth and urbanization are driving the market.

The surge in population and urbanization in the Asia-Pacific region is creating pressure for clean water resources and effective wastewater management. This is where PTFE membranes step in as game-changers. Their exceptional filtration capabilities tackle various challenges head-on. They efficiently remove contaminants from drinking water, ensuring access to safe hydration for millions. In wastewater treatment, their superior chemical resistance allows them to handle complex industrial effluents, minimizing environmental impact. They excel in diverse industrial applications, from filtering ultra-pure water in electronics manufacturing to separating valuable chemicals in the food & beverage industry. As urbanization intensifies, air quality becomes a rising concern. PTFE membranes play a crucial role here too, filtering pollutants in air ventilation systems for healthier homes and workplaces. With every innovation in membrane technology, their potential expands, making them an indispensable tool for navigating the complex water and environmental challenges of a booming Asia-Pacific region.

The booming medical and pharmaceutical industries are facilitating the expansion.

From targeted drug delivery minimizing side effects to high-precision filtration ensuring patient safety, the booming healthcare scene in Asia-Pacific is fueling the demand for versatile PTFE membranes. These microscopic elements encapsulate drugs for targeted delivery, sterilize biological fluids during bioprocessing, and separate crucial biomolecules for advancements in regenerative medicine. Their biocompatibility and low friction even make them ideal for catheters and implants, offering both patient comfort and long-term functionality. As Asia-Pacific prioritizes high-quality healthcare, PTFE membranes are poised to be a valuable tool for developing innovative and effective medical treatments.

Growing industrialization is propelling the market.

The industrial engine of the Asia-Pacific region is in demand for high-performance filtration solutions. This is where PTFE membranes rise to the challenge, with their exceptional chemical resistance and durability making them invaluable across diverse industries. In the chemical industry, they handle harsh, corrosive chemicals with ease, ensuring product purity and protecting sensitive equipment. They work tirelessly in the electronics industry, filtering ultra-pure water vital for delicate chip manufacturing. The food & beverage sector relies on their precision to separate valuable components while ensuring food safety. Their unique properties even extend to air and gas filtration, safeguarding sensitive processes and protecting workers' health in various industrial settings. As industrialization in the region accelerates, the need for reliable and efficient filtration grows, and PTFE membranes, with their versatility and resilience, are perfectly positioned to meet this demand, contributing to a cleaner, safer, and more productive industrial landscape.

Asia-Pacific PTFE Membrane Market Challenges and Restraints:

The high cost of raw materials is a barrier.

PTFE's hefty price tag throws a wrench in its widespread adoption, especially in cost-conscious applications. This high barrier to entry limits its potential in markets where affordability reigns supreme. However, resourceful players are tackling this challenge head-on. They're streamlining production processes to squeeze out inefficiencies and drive down costs. Additionally, they're exploring alternative materials that offer similar performance at a more attractive price point. These potential substitutes, while still under development, could unlock new opportunities for PTFE membranes in cost-sensitive sectors. For instance, modified versions of nylon or polyethersulfone membranes are being investigated as viable alternatives in specific applications. By finding ingenious ways to shave off costs, either through production tweaks or material innovation, PTFE membranes can shed their luxury label and become accessible to a wider range of industries, ultimately fueling market growth.

Competition from alternative membranes is hindering market growth.

The PTFE membrane market is subjected to intense competition. Rivals like polyamide and polyethersulfone membranes are lurking, offering enticing value propositions in terms of cost and performance for specific applications. This fierce competition calls for PTFE manufacturers to innovate and differentiate their offerings. They're constantly working on improving permeability, selectivity, and chemical resistance to maintain their edge. Additionally, they're exploring specialized functionalities like self-cleaning properties or unique pore sizes to cater to niche demands. Collaboration with research institutions and strategic partnerships with end-users are also crucial weapons in this battle. By understanding specific customer needs and developing customized solutions, PTFE manufacturers can ensure their membranes remain the go-to choice for applications where their unique properties truly shine. This constant innovation and customer focus are critical for PTFE to retain its value in the competitive world of filtration technologies.

Stringent environmental regulation is posing a big challenge.

While stricter environmental regulations are a boon for the PTFE membrane market, driving demand for their advanced filtration capabilities, they also present many challenges. Meeting these stringent standards often adds complexity and cost to the manufacturing process, creating a hurdle for some players. Manufacturers need to invest in cleaner production processes, implement stricter waste management protocols, and comply with evolving regulations, all of which impact their bottom line. Additionally, these regulations may necessitate modifications to membrane compositions or production methods, further increasing research and development expenses. Smaller manufacturers, lacking the resources of larger players, might struggle to adapt, potentially hindering their market share. However, this challenge also presents an opportunity for innovation. Manufacturers who find ways to optimize production while meeting environmental standards can gain a competitive edge. Investing in sustainable practices and developing eco-friendly PTFE membranes can not only address regulatory concerns but also resonate with environmentally conscious consumers, ultimately shaping the future of the market.

Market Opportunities:

The Asia-Pacific PTFE membrane market presents manufacturers and investors with several exciting opportunities. Soaring demand for clean water across the region creates openings for advanced filtration solutions like PTFE membranes. The booming industrial sector in pharmaceuticals, textiles, and chemicals further fuels the demand for high-performance filtration. Additionally, stringent environmental regulations are pushing industries towards eco-friendly technologies like PTFE membranes, offering lucrative prospects. While China is the current leader, countries like Indonesia, Thailand, and Malaysia hold immense growth potential, waiting to be tapped into. The rise of hydrophilic membranes alongside established hydrophobic options provides further avenues for innovation and niche market targeting. Despite challenges like initial cost, competition, and fluctuating raw material prices, advancements in technology and growing awareness of PTFE's unique benefits paint a positive future. For those astute enough to capitalize, the Asia-Pacific PTFE membrane market promises a rewarding journey driven by clean water needs, industrial development, and a commitment to sustainability.

ASIA-PACIFIC PTFE MEMBRANE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, South Korea, India, Rest of the Asia-Pacific |

|

Key Companies Profiled |

Saint-Gobain Performance Plastics, Gore, Pall Corporation, Merck Millipore, Dow Chemical Company, Asahi Kasei Corporation, Toray Industries, Inc, Sumitomo Electric Industries, Ltd., Gujarat Fluorochemicals Limited , LG Chem |

Asia-Pacific PTFE Membrane Market Segmentation

Asia-Pacific PTFE Membrane Market Segmentation: By Type

- Hydrophobic

- Hydrophilic

Due to its many advantages over other segments of the PTFE membrane market, including its high chemical compatibility, inertness, ease of handling and sealing, excellent particle retention, high flow rates, filtration efficiency, and compatibility with sterilization, the hydrophobic segment is anticipated to have a larger revenue share in the market. Throughout the projection period, the hydrophilic sector is expected to grow at the fastest rate. This is because of its use in several industries, including chemical processing, electronic chemicals, and pharmaceutical and medical applications. They are thin, unsupported, and extremely capable of filtering both organic and aqueous liquids. When wet, they have good chemical and pH resistance and are optically transparent.

Asia-Pacific PTFE Membrane Market Segmentation: By Application

- Industrial Filtration

- Water and Wastewater Treatment

- Medical and Pharmaceutical

- Textiles

Industrial filtration reigns supreme in the Asia-Pacific PTFE membrane market, serving oil & gas, chemicals, food & beverages, and pharmaceuticals. For size-selective samplers, PTFE filters are a flexible option. Because of its special qualities, the material is perfect for microscopic, chemical, and/or gravimetric examination of sample particles. Gas filtering, air venting, and aerosol sampling are applications for PTFE filters. The fastest-growing market is for water and wastewater treatment, which is caused by the expansion of water treatment programs worldwide as well as the rising treatment and purification of industrial effluent. The medical & pharmaceutical segments are experiencing explosive growth due to their use in blood filtration, drug delivery, and tissue engineering. Textiles boast a steady demand for waterproof fabrics and filtration media, while other niche applications like battery separators and architectural membranes are showing promising growth potential.

Asia-Pacific PTFE Membrane Market Segmentation: Asia-Pacific Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia and New Zealand

- Rest of Asia-Pacific

China dominates the Asia-Pacific PTFE membrane market, fueled by rising incomes and healthcare needs. In addition, bulk manufacturing is done in this region. Increased earnings are a result of the global presence of well-known businesses like Ningbo ChangQi Fluorine Plastic Products Co., Ltd., Ningbo Kaxite Sealing Materials Co., Ltd., Zhejiang Juhua Co., Ltd., and Sichuan Chuanhuan Technology Co., Ltd. The region with the fastest growth is India, with its expanding middle class. In India, the water and wastewater treatment industry is growing, which boosts earnings. Furthermore, the advancement of the economy has resulted in significant growth in investments and finances.

COVID-19 Impact Analysis on the Asia-Pacific PTFE Membrane Market

The COVID-19 pandemic sent shockwaves through the Asia-Pacific PTFE membrane market, impacting it in both positive and negative ways. Initial lockdowns disrupted supply chains, halted production, and dampened demand across key end-user industries like textiles and industrial filtration. This led to a temporary decline in market growth. Besides, there was economic uncertainty, due to which many people lost their jobs. However, the pandemic also presented unexpected opportunities. Increased hygiene awareness and healthcare needs fueled demand for medical-grade PTFE membranes used in personal protective equipment (PPE) and medical filtration applications. This segment witnessed significant growth, partially offsetting the decline in other sectors. Governments, focusing on post-pandemic recovery, prioritized infrastructure development and water treatment projects, creating a demand surge for PTFE membranes in these areas. Additionally, environmental concerns remained crucial, with regulations continuing to drive the adoption of eco-friendly filtration solutions like PTFE membranes.

Latest trends/Developments

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

The Asia-Pacific PTFE membrane market is brimming with exciting trends and developments. Hydrophilic membranes are gaining traction for their superior performance in specific applications like medical filtration and high-purity water treatment. Nanofiber membranes are emerging as game-changers due to their enhanced filtration efficiency and potential for personalized filtration solutions. Sustainability reigns supreme, with manufacturers developing bio-based PTFE membranes and membranes with improved recyclability. Integration with smart technologies like Internet-of-Things (IoT) sensors is enabling real-time monitoring and performance optimization, pushing the boundaries of process efficiency. Additionally, regional governments are actively supporting domestic membrane production, aiming to reduce dependence on imports and foster innovation. These trends, coupled with rising awareness of PTFE's benefits, indicate a vibrant future for the Asia-Pacific PTFE membrane market, poised for significant growth and advancements in the years to come.

Key Players:

- Saint-Gobain Performance Plastics

- Gore

- Pall Corporation

- Merck Millipore

- Dow Chemical Company

- Asahi Kasei Corporation

- Toray Industries, Inc

- Sumitomo Electric Industries, Ltd.

- Gujarat Fluorochemicals Limited

- LG Chem

Chapter 1. Asia-Pacific PTFE Membrane Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific PTFE Membrane Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific PTFE Membrane Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific PTFE Membrane Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific PTFE Membrane Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific PTFE Membrane Market– By Type

6.1. Introduction/Key Findings

6.2. Hydrophobic

6.3. Hydrophilic

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Asia-Pacific PTFE Membrane Market– By Application

7.1. Introduction/Key Findings

7.2. Industrial Filtration

7.3. Water and Wastewater Treatment

7.4. Medical and Pharmaceutical

7.5. Textiles

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Asia-Pacific PTFE Membrane Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Type

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia-Pacific PTFE Membrane Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Saint-Gobain Performance Plastics

9.2. Gore

9.3. Pall Corporation

9.4. Merck Millipore

9.5. Dow Chemical Company

9.5. Asahi Kasei Corporation

9.6. Toray Industries, Inc

9.7. Sumitomo Electric Industries, Ltd.

9.8. Gujarat Fluorochemicals Limited

9.9. LG Chem

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Asia-Pacific PTFE membrane market is the largest globally, and its size is estimated to be around USD 985 million as of 2023. This figure is expected to grow at a significant CAGR of 7% in the coming years, reaching USD 1581.69 million by 2030.

Rapid population growth and urbanization, booming medical and pharmaceutical industries, and growing industrialization are the reasons that are driving the market.

Based on application, the market is divided into four segments: industrial filtration, water and wastewater treatment, medical and pharmaceutical, and textiles.

China is the most dominant region for the PTFE membrane market.

Saint-Gobain Performance Plastics, Gore, Pall Corporation, Merck Millipore, Dow Chemical Company, Asahi Kasei Corporation, Toray Industries, Inc., Sumitomo Electric Industries, Ltd., Gujarat Fluorochemicals Limited, and LG Chem are the major players