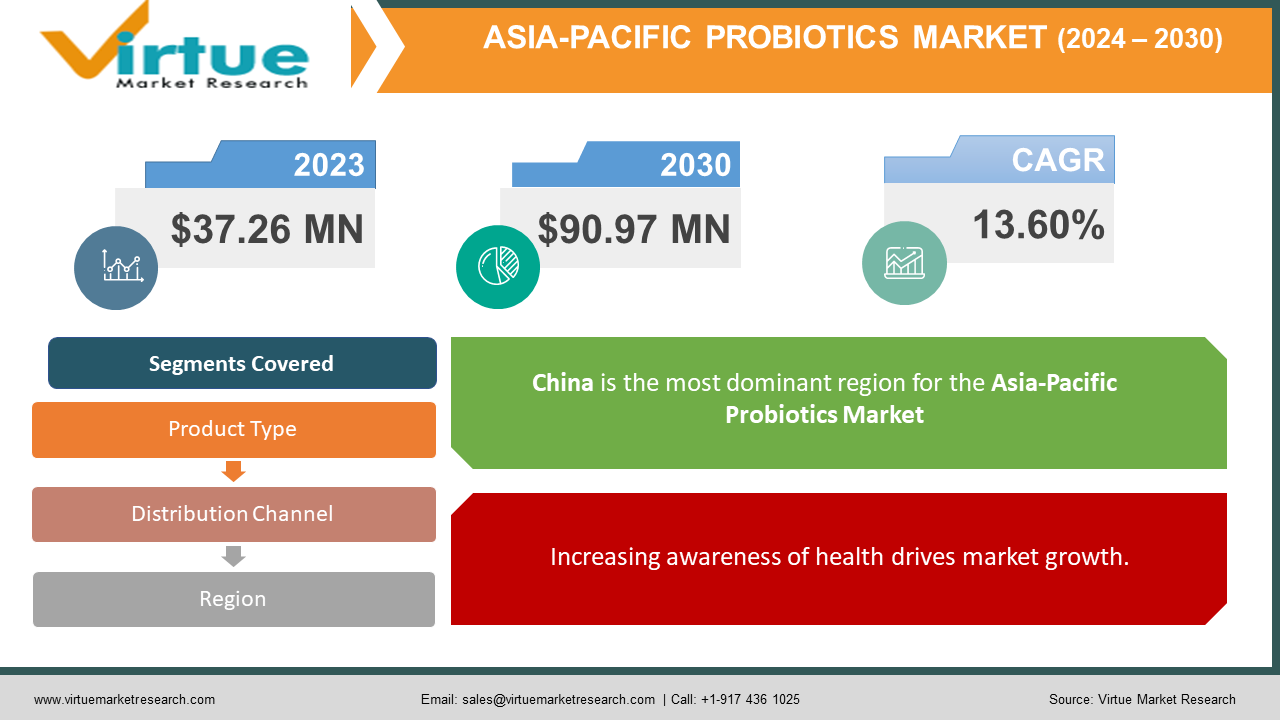

Asia Pacific Probiotics Market Size (2024-2030)

The Asia Pacific Probiotics Market was valued at USD 37.26 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 90.97 million by 2030, growing at a CAGR of 13.60%.

Probiotics consist of beneficial live bacteria and yeasts that naturally reside in the body, aiding in food digestion, vitamin production, and the breakdown and absorption of medications, among other functions. Furthermore, rising acidity, gastrointestinal issues, and indigestion problems in the region are driving the demand for foods containing probiotics.

Key Market Insights:

The rise in consumer preference for natural products significantly influences market growth. Growing concerns about preventive healthcare and the health benefits of probiotic bacteria are driving market expansion. The demand for probiotics has surged due to the increased consumption of functional foods, which not only provide basic nutrition but also have the potential to enhance health.

Asia Pacific Probiotics Market Drivers:

Increasing awareness of health drives market growth.

Probiotics are gaining popularity among consumers of all ages and are a key element in the rapidly growing digestive health supplements industry in the Asia Pacific region. The majority of consumption is observed among millennials due to their increased awareness of health and wellness, driven by multi-channel PR campaigns that significantly influence their consumption patterns. Health concerns and the early onset of gastrointestinal issues have heightened the focus on maintaining gut flora and gut health among regional consumers. This has led to a substantial increase in demand for probiotic foods and beverages, propelling the market's CAGR.

Additionally, there is a rising demand for functional beverages in the region, catering to consumers seeking more than just thirst-quenching options. These beverages must meet expectations for being naturally sourced, well-balanced, and nutritious. This shift provides an opportunity for brands and start-ups to offer products that not only refresh and hydrate but also nourish. For instance, the Indian start-up Ginger Rage offers probiotic products such as Kombucha, which is marketed as calorie-efficient, a cocktail mixer, gut-friendly, and immune-boosting. The company's products are available through its online retail store and other social media channels. Such innovations and the variety of products being offered are expected to further support the market's growth during the forecast period, driving the Asia Pacific probiotics market revenue.

Asia Pacific Probiotics Market Restraints and Challenges:

Limited Scientific knowledge restrains the market.

Many probiotic strains offer distinct health benefits, but the exact mechanisms by which they operate are not fully understood. This ambiguity complicates the decision-making process for both consumers and healthcare professionals in selecting the most appropriate probiotics for specific health issues.

Scientific studies on probiotics can yield contradictory results due to differences in strains, dosages, and study populations. This inconsistency may cause confusion among consumers and healthcare professionals regarding which probiotics to prescribe or use.

Additionally, there have been relatively few long-term studies on probiotics. The lack of long-term data makes it difficult to assess the potential risks and benefits associated with prolonged probiotic use.

Asia Pacific Probiotics Market Opportunities:

Increased Use of Probiotics in the Mental Health Sector Creates Opportunities.

The link between gut health and mental health is gaining increasing recognition. As awareness of the mental health benefits of probiotics grows, these products are becoming more popular among consumers.

Probiotics have been researched for their potential to reduce anxiety, stress, and depressive symptoms. Consumers dealing with these conditions may use probiotics as a supplemental treatment or a preventive measure.

Increasing Plant-based Probiotics creates opportunities.

Many consumers are choosing vegetarian, vegan, or plant-based diets for health, environmental, or ethical reasons. Plant-based probiotics offer an option that fits these dietary preferences.

Offering plant-based probiotics allows businesses to reach a broader customer base, including vegans, vegetarians, and individuals with lactose intolerance or dairy allergies. This wider distribution can lead to increased sales.

Combining probiotics with plant-based foods creates products that support intestinal health while providing the nutritional benefits of plant-based diets.

ASIA PACIFIC PROBIOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.60% |

|

Segments Covered |

By Product Type, , Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, South Korea, India, Australia & New Zealand, Rest of Asia-Pacific |

|

Key Companies Profiled |

Yakult Honsha Co. Ltd, Nestle SA, Danone SA, Groupe Danone, PepsiCo Inc., Bio-K Plus International, Cell Biotech, Amway Corp., Now Foods, Anand Milk Union Limited. |

Asia Pacific Probiotics Market Segmentation:

Asia Pacific Probiotics Market Segmentation- By Product Type

- Probiotic Foods

- Probiotic Drinks

- Dietary Supplements

The probiotic drinks segment led the market, with liquid prebiotic demand expected to increase as consumer awareness of a balanced, high-fiber diet and the desire for organically derived functional ingredients grows. Additionally, the lower price of liquid prebiotics compared to powder or crystal forms is likely to attract more customers, boosting the liquid-based prebiotics market.

Millennials, influenced by multi-channel publicity campaigns that significantly shape their consumption habits, are the primary consumers. With rising health concerns and the early onset of gastric and gut-related issues, regional consumers have become more aware of maintaining gut health and gut flora. As probiotics are ideal for addressing or preventing these problems, the demand for probiotic beverages and foods is rapidly increasing.

Asia Pacific Probiotics Market Segmentation- By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies and Health Stores

- Convenience Stores

- Online Retail Stores

- Other Distribution Channels

The supermarkets/hypermarkets category generated the highest revenue. The expansion of supermarkets and hypermarkets, especially in Asia Pacific, presents significant growth opportunities for probiotic producers in the coming years. Consumers are willing to visit these stores and pay premium prices for products with nutritional benefits. The growing popularity of healthy living, despite the cost of groceries, attracts young people to supermarket shopping.

Online distribution channels have seen significant growth in the probiotics industry due to several key factors. The convenience and accessibility of online shopping have boosted the popularity of purchasing probiotics online. Consumers can browse and compare a wide range of probiotic products from the comfort of their homes, eliminating the need to visit physical stores.

Asia Pacific Probiotics Market Segmentation- by region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific (APAC)

China is experiencing a rise in its aging population, leading to a greater awareness of preventive health, immunity, cognitive health, and skincare, which is driving probiotics sales in the country. Due to increasing demand, many manufacturers are expanding their probiotic product ranges, targeting specific consumer groups, and gaining a competitive edge in terms of price and product portfolio.

Conversely, Japan is an innovation hub for new trends in food and beverages. The geriatric population also contributes to the increased consumption of probiotic products, driving the sales of dietary supplements. The market growth for probiotics in Japan is further propelled by the prevention and treatment of inflammatory bowel disease, lactose intolerance, and wider access to probiotic dietary supplements, along with rising health-consciousness levels. Advanced technologies that maintain high counts of live bacteria in beverages are expected to attract consumers due to the high-potency, quick-acting, and long-lasting effects of these probiotic drinks. The Japanese brand Yakult, widely prevalent with higher revenues, serves its products as part of school lunches and delivers them to homes, bolstering its growth in the country.

In addition, rising acidity, stomach, and gut issues, and indigestion problems in the region are increasing the demand for probiotics-incorporated foods. A large-scale survey by GOQii in 2021 found that about 30% of female respondents in India reported acidity and indigestion problems, while about 29% of male respondents had gut-related issues. The Indian start-up Ginger Rage offers probiotic products like Kombucha, marketed as low-calorie, a cocktail mixer, gut-friendly, and an immunity booster. The company sells its products through its online retail store and social media platforms. Such innovations and the diversity of products in the region are expected to further boost market growth during the forecast period.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has shifted consumer purchasing habits, significantly impacting dietary choices. Consumers now prefer high-nutritional-value products over junk or processed foods. Since the pandemic began, probiotics in various forms have been increasingly available in pharmacies and retail stores. The fear of infection has driven the adoption of healthier lifestyles, boosting demand in the sector. To address the risk of viral infection across all age groups, manufacturers are developing probiotics that can provide positive outcomes for everyone.

Latest Trends/ Developments:

August 2023: ADM, a leader in nutrition solutions, and Lallemand Health Solutions, a top probiotic company, announced a new distribution partnership. This deal allows ADM customers in over 200 countries to access Lallemand's probiotic products.

September 2022: Nestle Health Science's Garden of Life brand introduced two new probiotic drinks in China's offline retail market. These drinks are designed to promote immune system health and growth in children.

January 2022: gniu launched Youyi C, a probiotic solid drink targeting Chinese consumers. The drink includes three Chinese proprietary star bacteria: Bifidobacterium lactis V9, Lactobacillus plantarum Lp-6, and Lactobacillus paracasei PC-01, marketed under "Daily Health."

Key Players:

These are the top 10 players in the Asia Pacific Probiotics Market: -

- Yakult Honsha Co. Ltd

- Nestle SA

- Danone SA

- Groupe Danone

- PepsiCo Inc.

- Bio-K Plus International

- Cell Biotech

- Amway Corp.

- Now Foods

- Anand Milk Union Limited

Chapter 1. Asia Pacific Probiotics Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Probiotics Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Probiotics Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Probiotics Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Probiotics Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Probiotics Market– By Product Types

6.1. Introduction/Key Findings

6.2. Probiotic Foods

6.3. Probiotic Drinks

6.4. Dietary Supplements

6.5. Y-O-Y Growth trend Analysis By Product Types

6.6. Absolute $ Opportunity Analysis By Product Types, 2024-2030

Chapter 7. Asia Pacific Probiotics Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3. Pharmacies and Health Stores

7.4. Convenience Stores

7.5. Online Retail Stores

7.6. Other Distribution Channels

7.7. Y-O-Y Growth trend Analysis By Distribution Channel

7.8. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Asia Pacific Probiotics Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Product Types

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Probiotics Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Yakult Honsha Co. Ltd

9.2. Nestle SA

9.3. Danone SA

9.4. Groupe Danone

9.5. PepsiCo Inc.

9.6. Bio-K Plus International

9.7. Cell Biotech

9.8. Amway Corp.

9.9. Now Foods

9.10. Anand Milk Union Limited

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The rise in consumer preference for natural products significantly influences market growth. Growing concerns about preventive healthcare and the health benefits of probiotic bacteria are driving market expansion. The demand for probiotics has surged due to the increased consumption of functional foods, which not only provide basic nutrition but also have the potential to enhance health.

The top players operating in the Asia Pacific Probiotics Market are - Yakult Honsha Co. Ltd, Nestle SA, Danone SA, Groupe Danone, PepsiCo Inc., Bio-K Plus International, Cell Biotech, Amway Corp., Now Foods, Anand Milk Union Limited.

The COVID-19 pandemic has shifted consumer purchasing habits, significantly impacting dietary choices. Consumers now prefer high-nutritional-value products over junk or processed foods.

August 2023: ADM, a leader in nutrition solutions, and Lallemand Health Solutions, a top probiotic company, announced a new distribution partnership. This deal allows ADM customers in over 200 countries to access Lallemand's probiotic products.

China is experiencing a rise in its aging population, leading to a greater awareness of preventive health, immunity, cognitive health, and skincare, which is driving probiotics sales in the country. Due to increasing demand, many manufacturers are expanding their probiotic product ranges, targeting specific consumer groups, and gaining a competitive edge in terms of price and product portfolio.