Asia-Pacific Polyurethane Elastomers Market Size (2024 – 2030)

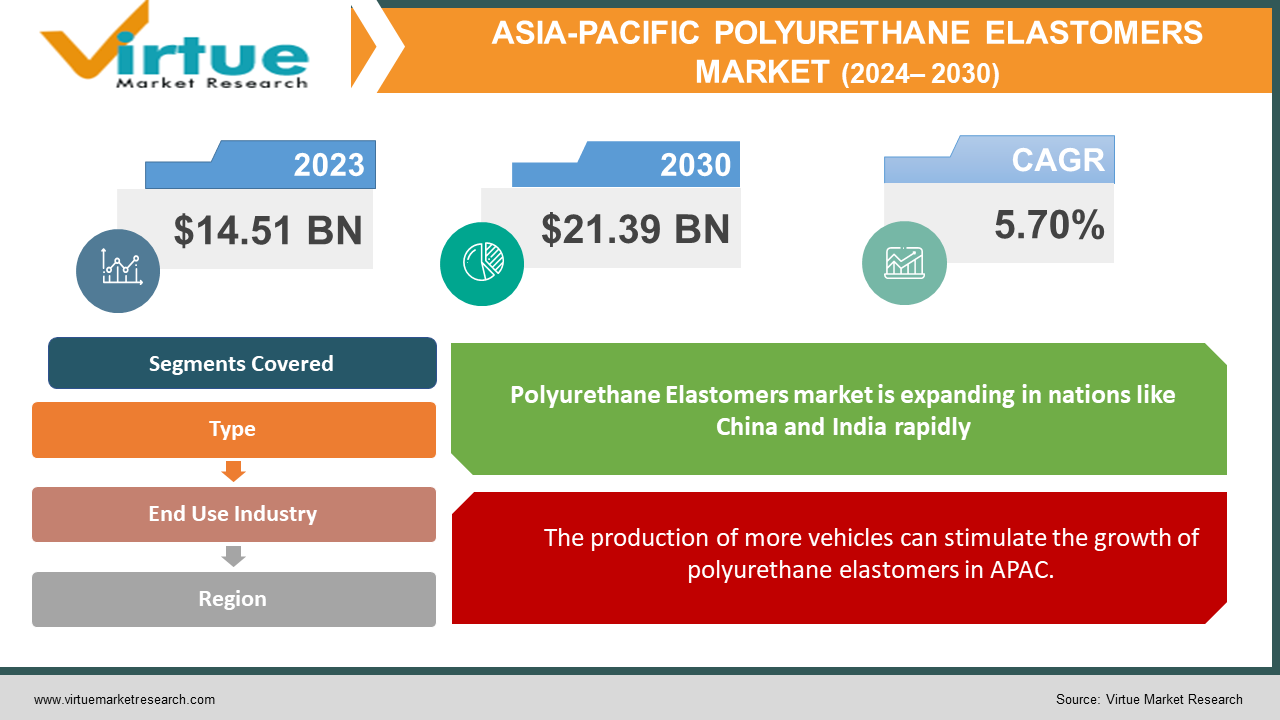

According to the report published by Virtue Market Research in Asia-Pacific Polyurethane Elastomers Market was valued at USD 14.51 Billion and is projected to reach a market size of USD 21.39 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.70%.

Because there are more people with money to spend in the world, there is a greater need for goods like cars, houses, and shoes. This indicates that the materials used to make these items, such as polyurethane elastomers, are in greater demand. The reason polyurethane elastomers are so popular is that they are strong, long-lasting, and simple to work with. However, polyurethane elastomers are not the only materials that can be substituted with more biodegradable and environmentally friendly materials. Also, using polyurethane elastomers may come with some health risks. Nonetheless, the market for polyurethane elastomers may continue to expand because of their lower cost of use.

Key Market Insights:

- About 65% of the market is occupied by thermoset polyurethane elastomers, with thermoplastic polyurethane elastomers making up the remaining 35%.

- Depending on the grade and application, polyurethane elastomers can cost anywhere from $3.5 to $6 per kg on average.

- Over 1.2 million metric tons of polyurethane elastomers are thought to be consumed annually in the Asia-Pacific area.

- China alone is responsible for almost half of the demand for polyurethane elastomers in the Asia-Pacific region, which is fueled by the construction, automotive, and footwear sectors.

Global Asia-Pacific Polyurethane Elastomers Market Drivers:

The production of more vehicles can stimulate the growth of polyurethane elastomers in APAC.

Tires and automotive body panels are made of polyurethane elastomers because of their extreme strength and resistance to wear and tear. Ford is constructing a new factory in Germany to produce electric vehicles, and demand for polyurethane elastomers is predicted to rise due to their utility in the automotive industry. This suggests that in the upcoming years, there will probably be a larger market for polyurethane elastomers.

Polyurethane elastomers will probably become more and more necessary, particularly in the buildings sector.

In construction, polyurethane elastomers are frequently utilized, particularly for bridge filling. In buildings, they are also utilized for a variety of purposes, including wall coverings, carpets, waterproofing, windows, and doors. At great financial expense, YIT Corporation began constructing apartment buildings in Finland, other European nations, and Russia. Since polyurethane elastomers are utilized in these kinds of construction projects, there will probably be an increase in demand for them when these projects are completed by the end of 2023. Thus, it is anticipated that the market for polyurethane elastomers will expand in the upcoming years.

Asia-Pacific Polyurethane Elastomers Market Challenges and Restraints:

Crude oil is a source of some of the ingredients used to make polyurethane elastomers. However, the price of crude oil has fluctuated widely. It fell to extremely low levels in 2020—the lowest in a long time. The cost to manufacture polyurethane elastomers is impacted by this volatility in crude oil prices. This could make it more difficult for the polyurethane elastomers industry to grow as anticipated in the future because of the unpredictable fluctuations in the prices of the materials required for their production.

Asia-Pacific Polyurethane Elastomers Market Opportunities:

Growth opportunities abound in the Asia-Pacific Polyurethane Elastomers Market. Because Asia's countries are expanding quickly, more infrastructure—such as roads and buildings—is required. These are made of polyurethane elastomers because they are robust and flexible. Environmental concerns have led to an opportunity for companies to switch from using oil to producing polyurethane elastomers made from plants or recycled materials. These substitutes function just as well and are more environmentally friendly. Businesses are constantly coming up with new methods to improve polyurethane elastomers. Their goal is to make them more resilient, powerful, and able to function in extreme environments. This implies that new concepts and innovations are welcome. There are many applications for polyurethane elastomers, including footwear, electronics, and even medicine. Companies have more opportunities to produce and market these materials as new ideas emerge. To produce more polyurethane elastomers, large corporations are constructing new factories. More jobs and opportunities for business expansion result from this. Many people in nations like China and India are becoming increasingly well-off. This indicates that they are increasing their purchases, which raises the need for polyurethane elastomers. All things considered, the Asia-Pacific Polyurethane Elastomers Market offers a plethora of chances for businesses to flourish, particularly if they prioritize innovation, eco-friendly materials, and catering to the demands of expanding sectors.

ASIA-PACIFIC POLYURETHANE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.70% |

|

Segments Covered |

By Type, End Use Industry, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

India, China, Japan, Australia, South korea |

|

Key Companies Profiled |

Tosoh Corporation, INOAC CORPORATION, Huntsman Corp, Mitsui Chemicals. ln, Wanhua Chemical Group Co. Ltd. |

Asia-Pacific Polyurethane Elastomers Market Segmentation

Asia-Pacific Polyurethane Elastomers Market Segmentation: By Type

- Thermoplastic PU Elastomers

- Thermoset PU Elastomers

Stretchy materials composed of weakly linked polymers are called elastomers. Thermoset PU elastomers are predicted to account for a significant portion (roughly 44%) of the market shortly due to their high elasticity and ability to withstand low temperatures. They are adaptable and can take on various forms. Because they are durable and able to withstand extreme conditions, these thermoset polyurethane elastomers are widely used in the mining industry for items like rollers, screens, and pump wheels. They are also employed as adhesives, coatings, and insulators. It is anticipated that all of this will lead to future growth in their market. Moreover well-liked, thermoplastic polyurethane PU elastomers account for roughly 34% of the market in 2022. They are used extensively in transportation for lightweight and effective products because they are elastic, flexible, and resistant to radiation and the elements. As a result, there are now additional regulations regarding their use, but demand is still rising.

Asia-Pacific Polyurethane Elastomers Market Segmentation: By End Use Industry

- Automotive

- Building & Construction

- Footwear

- Machinery

Shoes made of polyurethane elastomers are incredibly strong, flexible, and aesthetically pleasing. They are frequently used to create the uppers, soles, and other components of shoes. These materials are also used in hiking boots and sports shoes because they are lightweight and offer good cushioning. It is anticipated that the production of footwear will account for approximately 24% of the global market for polyurethane elastomers in the future. This is because they provide exceptional resistance to wear and wrinkles while also aiding in maintaining the quality and appearance of shoes. On the other hand, the automotive sector is anticipated to grow at the fastest rate in the upcoming years. This implies that there will be a greater need for polyurethane elastomers to produce automotive interior and exterior components, such as vibration control components.

Asia-Pacific Polyurethane Elastomers Market Segmentation: By Region

- China

- South Korea

- India

- Japan

- Rest of the Asia-Pacific

Because polyurethane elastomers are used to make shoes, leather goods, and automobiles, the market for them is expanding in nations like China and India. These materials are in high demand in India, where a large amount of leather and footwear are produced. Polyurethane elastomers are also utilized in high-stress environments such as automobiles and machinery. They also serve as a barrier against corrosion and damage to surfaces. They are essential in cars because they are robust and able to withstand high levels of stress. Polyurethane elastomers are also used in the production of bedding and furniture, which are among the home furnishings that an increasing number of Asians are purchasing. They are also utilized in the production of comfort and support foams. Given all of these applications, Asia's need for polyurethane elastomers is predicted to continue expanding.

COVID-19 Impact on the Global Asia-Pacific Polyurethane Elastomers Market:

The economy slowed down when lockdowns occurred. This indicated a decline in the market share of products containing polyurethane elastomers, such as consumer goods, building materials, and automobiles. Fewer COVID-19 cases and initiatives from governments and other organizations are anticipated to be the primary drivers of growth in the future, which will aid in the recovery of businesses.

Latest Trend/Development:

The expanding building and automotive industries in the Asia-Pacific area are the main drivers of the demand for polyurethane elastomers. Because of their strength and adaptability, these elastomers are utilized in many different applications, including automotive components, sealants, adhesives, and insulation. There is a discernible trend toward the use of environmentally friendly materials as sustainability becomes more and more important. As a result, there is now more interest in bio-based or recycled polyurethane elastomers as businesses try to satisfy both customer demands and environmental regulations. Further, new and improved polyurethane elastomers have been created as a result of technological breakthroughs. These include enhanced adaptability, resilience to abrasive conditions, and durability, satisfying the changing demands of diverse industries. To remain competitive and satisfy the increasing demand for premium elastomers, businesses in the area are spending money on research and development. Companies such as Covestro AG are setting up new plants to increase their production capacities in response to the growing demand. One example of Covestro AG's commitment to meeting global demand, especially in the Asia-Pacific region, is the company's plan to construct a new polyurethane elastomer systems plant in Shanghai. Additionally, the consumption of polyurethane elastomers is significantly increasing due to the fast industrialization and urbanization of developing nations like China and India.

Key Players:

- Tosoh Corporation

- INOAC CORPORATION

- Huntsman Corp

- Mitsui Chemicals. ln

- Wanhua Chemical Group Co. Ltd.

- BASF SE

- Covestro AG

- The Dow Chemical Company

- Chemtura Corporation

- Era Polymers Pty Ltd

Market News:

- To meet the growing demand for polyurethane elastomers, particularly in the Asia-Pacific area, Covestro AG is constructing a new plant in Shanghai. The larger site that opens in 2023 will include this plant.

Chapter 1. Asia-Pacific Polyurethane Elastomers Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific Polyurethane Elastomers Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific Polyurethane Elastomers Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Polyurethane Elastomers Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific Polyurethane Elastomers Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Polyurethane Elastomers Market– By Type

6.1. Introduction/Key Findings

6.2. Thermoplastic PU Elastomers

6.3. Thermoset PU Elastomers

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Asia-Pacific Polyurethane Elastomers Market– By End Use Industry

7.1. Introduction/Key Findings

7.2. Automotive

7.3. Building & Construction

7.4. Footwear

7.5. Machinery

7.6. Y-O-Y Growth trend Analysis By End Use Industry

7.7. Absolute $ Opportunity Analysis By End Use Industry, 2024-2030

Chapter 8. Asia-Pacific Polyurethane Elastomers Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Type

8.1.3. By End Use Industry

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia-Pacific Polyurethane Elastomers Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Tosoh Corporation

9.2. INOAC CORPORATION

9.3. Huntsman Corp

9.4. Mitsui Chemicals. ln

9.5. Wanhua Chemical Group Co. Ltd.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

According to the report published by Virtue Market Research in Asia-Pacific Polyurethane Elastomers Market was valued at USD 14.51 Billion and is projected to reach a market size of USD 21.39 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.70%.

The production of more vehicles can stimulate the growth of polyurethane elastomers and Polyurethane elastomers will probably become more and more necessary, particularly in the building industry.

The market for polyurethane elastomers may have growth restraints due to fluctuating raw material prices

Tosoh Corporation, INOAC CORPORATION, Huntsman Corp, Mitsui Chemicals. Ln, Wanhua Chemical Group Co. Ltd., BASF SE, Covestro AG, The Dow Chemical Company, Chemtura Corporation, Era Polymers Pty Ltd

Thermoset PU Elastomers account for the largest in the segment having 44% of the portion.