Asia-Pacific Polypropylene Plastic Tube Market Size (2024-2030)

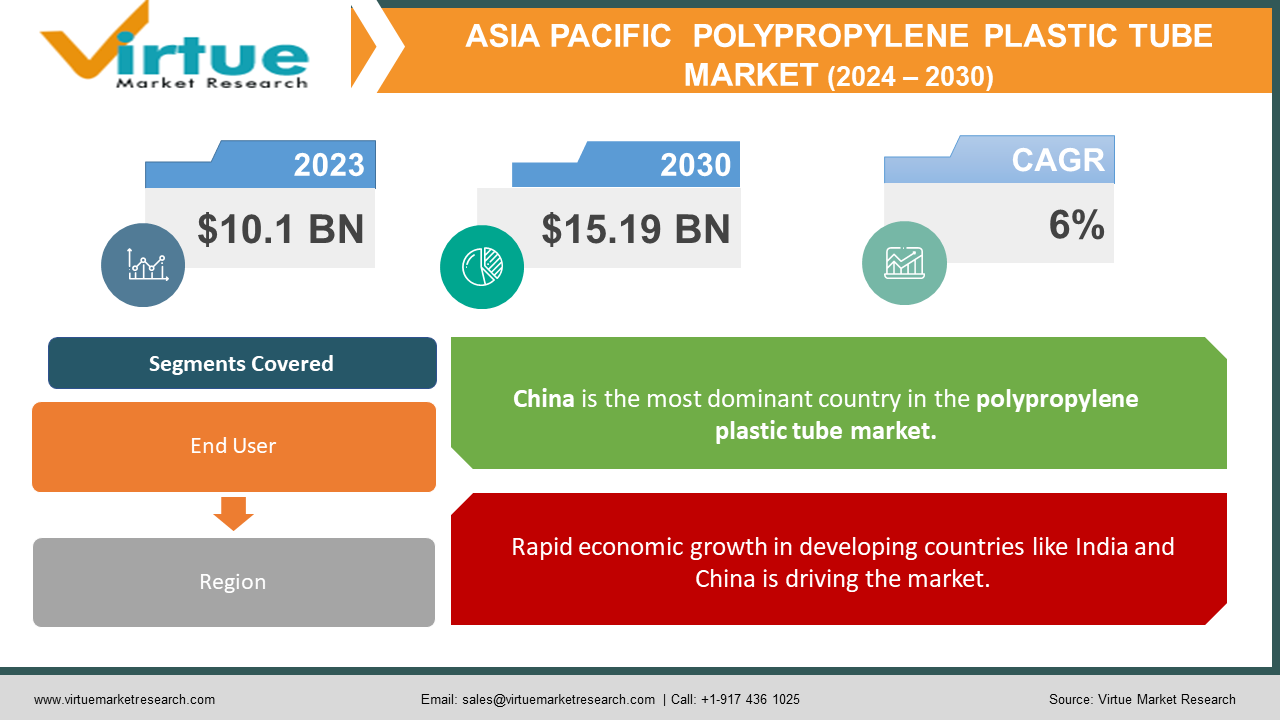

The APAC polypropylene plastic tube market is projected to grow from USD 10.1 billion in 2023 to USD 15.19 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 6% during 2024–2030.

Polypropylene plastic tubes are versatile materials made from lightweight, tough, and chemically resistant plastic. Often translucent and rigid, they handle both hot (up to 275°F) and cold liquids while resisting corrosion and punctures. Popular in plumbing, construction, and industry, they transfer fluids, create drainage lines, and even house electrical wires. Their affordability and flexibility make them a go-to choice for diverse applications.

Key Market Insights:

The Asia-Pacific polypropylene plastic tube market, estimated at USD 10.1 billion in 2023, is predicted to witness a robust 6% CAGR until 2030. This growth is fueled by a booming automotive and packaging industry, particularly in China, India, and Indonesia. The market benefits from polypropylene's lightweight, durable, and chemical-resistant properties, making it ideal for flexible pipes, food containers, and medical applications. However, volatile propylene prices and concerns over plastic waste remain challenges.

Asia-Pacific Polypropylene Plastic Tube Market Drivers:

Rapid economic growth in developing countries like India and China is driving the market.

The economic ascent of developing giants like India and China paints a lucrative picture for the polypropylene plastic tube market. As disposable incomes swell, aspirations rise, and the desire for convenience thrives. Consumers splurge on an array of personal care products, cosmetics, medicines, and even food items, many of which rely on plastic tubes for efficient packaging and single-use application. This surge in demand translates to a booming market for plastic tubes, catering to the evolving needs of a growing middle class. From sleek toothpaste tubes to vibrantly colored cosmetic applicators, these versatile containers offer portability, hygiene, and affordability, perfectly aligning with the changing consumer landscape. This trend isn't limited to urban centers; even rural areas are witnessing a rise in packaged goods, further fueling the market's expansion. In essence, the economic metamorphosis of developing nations is directly linked to the growing demand for conveniently packaged goods, creating a fertile ground for the polypropylene plastic tube industry to flourish.

Expanding infrastructure in major economies like China and India is propelling market growth.

As megacities in China and India rise, driven by relentless economic growth, so too does the need for robust infrastructure. This translates into a massive demand for construction and plumbing materials, where polypropylene plastic tubes emerge as a cost-effective and durable champion. From sprawling housing complexes to intricate transportation networks, these adaptable tubes find diverse applications. They efficiently channel water through plumbing systems, provide insulation for electrical wires, and serve as conduits for drainage in buildings and roads. Their lightweight nature makes them easier to transport and install compared to heavier alternatives, while their resistance to corrosion and harsh weather conditions ensures longevity. Moreover, compared to metal pipes, plastic tubes offer significant cost advantages, especially when considering large-scale infrastructure projects. This affordability factor, coupled with their ease of installation and flexibility, makes them a preferred choice for builders and developers striving for efficiency and cost-effectiveness. As these developing nations continue their ambitious infrastructure expansion plans, the demand for polypropylene plastic tubes is poised to remain strong, playing a crucial role in building the future of Asia's megacities.

The growing focus on lightweight and sustainability, which encourages the adoption of recyclable and thinner-walled plastic tubes, is fueling the market growth.

The plastic tube industry is undergoing a green makeover. Growing concerns about sustainability are pushing manufacturers towards lighter and more eco-friendly designs. Recyclable materials are gaining traction, offering a second life to used tubes and minimizing landfill waste. Additionally, "thin-walling" techniques are being implemented, reducing plastic usage without compromising functionality. This delicate balance ensures tubes remain strong and effective while shedding unnecessary weight, leading to lower transportation emissions and resource consumption. This shift towards sustainable practices not only appeals to environmentally conscious consumers but also presents cost-saving opportunities for producers. As regulations on plastic waste tighten, lightweight and recyclable tubes are emerging as the future of the industry, harmonizing convenience with environmental responsibility.

Asia-Pacific Polypropylene Plastic Tube Market Challenges and Restraints:

Growing public awareness and regulatory pressure regarding plastic pollution are hindering market growth.

The growing public outcry against plastic pollution, especially single-use items, is translating into concrete action. Governments are implementing bans or restrictions on specific plastic products, and consumers are increasingly opting for sustainable alternatives. This shift in sentiment can significantly impact market growth as demand for traditional plastic tubes dwindles. Further exacerbating the problem is the lack of robust waste management infrastructure in many developing countries. Even with recycling initiatives in place, inadequate collection and processing systems lead to plastic tubes ending up in landfills or polluting the environment. This not only negates the potential environmental benefits of recycling but also fuels public opposition to plastic use. To navigate these challenges, market players must embrace sustainable practices. This includes developing recyclable and biodegradable tube materials, promoting responsible waste management, and educating consumers about proper disposal methods.

Polypropylene prices are susceptible to fluctuations in crude oil prices, impacting market growth.

The price of polypropylene, their key ingredient, is tightly linked to crude oil, known for its fluctuations. These swings ripple through the production chain, forcing manufacturers to absorb cost changes or adjust prices, impacting their profitability and potentially end-user costs. Further complicating matters, some regions rely heavily on imported polypropylene. This exposes the market to external factors like global trade tensions and currency fluctuations, adding another layer of price instability and potential supply chain disruptions. These uncertainties can create challenges for both manufacturers and end users, making it difficult to plan and budget effectively.

Stringent regulations regarding food safety, product labeling, and recycling standards pose a challenge to market growth.

Stringent regulations on food safety, product labeling, and recycling aim to protect consumers and the environment, but they come at a cost. Manufacturers face increased compliance expenses for testing, implementing new equipment, and ensuring quality control. Non-compliant products risk hefty fines, recalls, and even market bans, posing a significant threat, especially for smaller players. Adding to the complexity, regulations often differ across countries within the region. This creates a regulatory labyrinth for manufacturers operating in multiple markets, requiring them to navigate diverse labeling requirements, recycling standards, and food safety protocols. This translates to increased administrative burdens, operational complexity, and potential delays in product launches.

Market Opportunities:

The Asia-Pacific polypropylene plastic tube market brims with opportunities. Its booming packaging sector, driven by e-commerce and rising disposable incomes, presents a goldmine for innovative, lightweight, and sustainable tube solutions. The burgeoning medical device industry offers potential for high-purity, biocompatible tubes. Rising automation in automotive and construction demands robust, lightweight tubes, while infrastructure development paves the way for corrosion-resistant piping solutions. Additionally, the focus on circular economy creates openings for eco-friendly tubes made from recycled materials and designed for easy end-of-life management. By addressing sustainability concerns and catering to diverse end-use applications, the Asia-Pacific polypropylene plastic tube market can unlock significant growth potential.

ASIA-PACIFIC POLYPROPYLENE PLASTIC TUBE MARKET MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By End User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, India, Japan, rest of asia-pacific |

|

Key Companies Profiled |

Amcor, China National Chemical Engineering Group Corporation, Reliance Industries Limited, Huhtamaki PWP, Kao Kim Hong Plastic Industries, Vietnam Plastic Packaging Group, Silgan Holdings, Inc. , Alpla Werke Alwin Lehner GmbH & Co KG, Teijin Limited , Nippon Steel & Sumitomo Metal Corporation, Asahi Kasei Corporation |

Asia-Pacific Polypropylene Plastic Tube Market Segmentation

Asia-Pacific Polypropylene Plastic Tube Market Segmentation: By End-User

- Food & Beverage Industry

- Pharmaceutical & Healthcare Industry

- Packaging Industry

- Automotive Industry

- Construction Industry

The packaging industry has the largest market share in the Asia-Pacific polypropylene plastic tube market. Its diverse use in tubes for food, beverages, cosmetics, and pharmaceuticals drives the highest demand. However, the pharmaceutical & healthcare industries are experiencing the fastest growth, fueled by rising hygiene awareness and increasing medical device use. The automotive and construction sectors follow, each with specific needs for fluid transfer and durable applications. So, while each industry plays a critical role, packaging currently reigns supreme, with healthcare rapidly catching up.

Asia-Pacific Polypropylene Plastic Tube Market Segmentation: Asia-Pacific Analysis:

- China

- Japan

- South Korea

- India

- Australia and New Zealand

- Rest of Asia-Pacific

The Asia-Pacific polypropylene plastic tube market thrives on regional diversity. China is the largest growing market due to its massive population and economic boom. As such, their consumption is significant. This area funds and invests in many projects in the construction and packaging sectors where this material is used. Furthermore, bulk manufacturing takes place, contributing to greater revenue. Besides, many companies in China have a global presence. Prominent ones include Berry Global Group, Inc., Albéa S.A., Essel Propack Limited, and Huhtamäki Oyj. India, fueled by rising disposable income and rapid urbanization, is the fastest-growing market. The economy of this region has seen tremendous progress. Research and developmental activities are being prioritized to improve the existing materials. Many emerging startups are coming up with innovative solutions emphasizing sustainability. In contrast, Japan, a mature market, demands technologically advanced and innovative tubes, but its growth is slower due to market saturation. South Korea, Australia, New Zealand, and the rest of the Asia-Pacific region provide a bright future with enormous development potential because of the progress in their economies, shifting consumer tastes, and large populations.

COVID-19 Impact Analysis on the Asia-Pacific Polypropylene Plastic Tube Market

The outbreak of the virus hurt the market. Lockdowns, social isolation, and movement restrictions were the new norm. This disrupted the supply chain, transportation, and other logistics. There was economic uncertainty, and many people lost their jobs. However, the impact was uneven across segments. The medical sector saw a surge in demand for tubes for diagnostic kits and personal protective equipment, partially offsetting the decline in other applications. Besides, since most of the investments were towards healthcare applications, the demand in this sector saw an upsurge. The packaging segment faced challenges due to reduced consumption in specific sectors like food service and travel retail. However, the e-commerce boom fueled demand for tubes for online deliveries. As economies recovered, the market saw a rebound in the latter half of the pandemic and is expected to reach pre-pandemic levels by 2024. Going forward, the long-term impact of COVID-19 remains uncertain. Increased hygiene awareness could bolster demand for medical and hygiene-related tubes.

Latest trends/Developments

The Asia-Pacific polypropylene plastic tube market is experiencing a wave of innovation. Sustainability is being prioritized, with bio-based materials and closed-loop recycling gaining traction. Smart tubes with sensors are transforming industries, offering real-time monitoring and improved safety. Advanced barrier technologies are enhancing shelf life and hygiene, while customization allows manufacturers to meet diverse needs. Even 3D printing is making its mark, creating complex tubes for personalized medical devices and niche applications.

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Key Players:

- Amcor

- China National Chemical Engineering Group Corporation

- Reliance Industries Limited

- Huhtamaki PWP

- Kao Kim Hong Plastic Industries

- Vietnam Plastic Packaging Group

- Silgan Holdings, Inc.

- Alpla Werke Alwin Lehner GmbH & Co KG

- Teijin Limited

- Nippon Steel & Sumitomo Metal Corporation

- Asahi Kasei Corporation

Chapter 1. Asia-Pacific Polypropylene Plastic Tube Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific Polypropylene Plastic Tube Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific Polypropylene Plastic Tube Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Polypropylene Plastic Tube Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific Polypropylene Plastic Tube Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Polypropylene Plastic Tube Market– By End-User

6.1. Introduction/Key Findings

6.2. Food & Beverage Industry

6.3. Pharmaceutical & Healthcare Industry

6.4. Packaging Industry

6.5. Automotive Industry

6.6. Construction Industry

6.7. Y-O-Y Growth trend Analysis By End-User

6.8. Absolute $ Opportunity Analysis By End-User , 2024-2030

Chapter 7. Asia-Pacific Polypropylene Plastic Tube Market, By Geography – Market Size, Forecast, Trends & Insights

7.1. Asia-Pacific

7.1.1. By Country

7.1.1.1. India

7.1.1.2. china

7.1.1.3. Japan

7.1.1.4. South korea

7.1.1.5. Australia

7.1.1.6. Rest of MEA

7.1.2. By End-User

7.1.3. Countries & Segments - Market Attractiveness Analysis

Chapter 8. Asia-Pacific Polypropylene Plastic Tube Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Amcor

8.2. China National Chemical Engineering Group Corporation

8.3. Reliance Industries Limited

8.4. Huhtamaki PWP

8.5. Kao Kim Hong Plastic Industries

8.6. Vietnam Plastic Packaging Group

8.7. Silgan Holdings, Inc.

8.8. Alpla Werke Alwin Lehner GmbH & Co KG

8.9. Teijin Limited

8.10. Nippon Steel & Sumitomo Metal Corporation

8.11. Asahi Kasei Corporation

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The polypropylene plastic tube market industry is projected to grow from USD 10.1 billion in 2023 to USD 15.19 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 6% during 2024–2030.

Rapid economic growth in developing countries like India and China is driving the market; expanding infrastructure in major economies like China and India; and a growing focus on lightweight and sustainability are the reasons that are driving the market

Based on end-users, the market is divided into five segments: the food & beverage industry, the pharmaceutical and healthcare industry, the packaging industry, the automotive industry, and the construction industry

China is the most dominant country in the polypropylene plastic tube market.

Amcor, China National Chemical Engineering Group Corporation, Reliance Industries Limited, Huhtamaki PWP, Kao Kim Hong Plastic Industries, Vietnam Plastic Packaging Group, Silgan Holdings Inc., Alpla Werke Alwin Lehner GmbH & Co. KG, Teijin Limited, Nippon Steel & Sumitomo Metal Corporation, and Asahi Kasei Corporation are the major players