Asia Pacific Pigeon Peas Market Size (2024-2030)

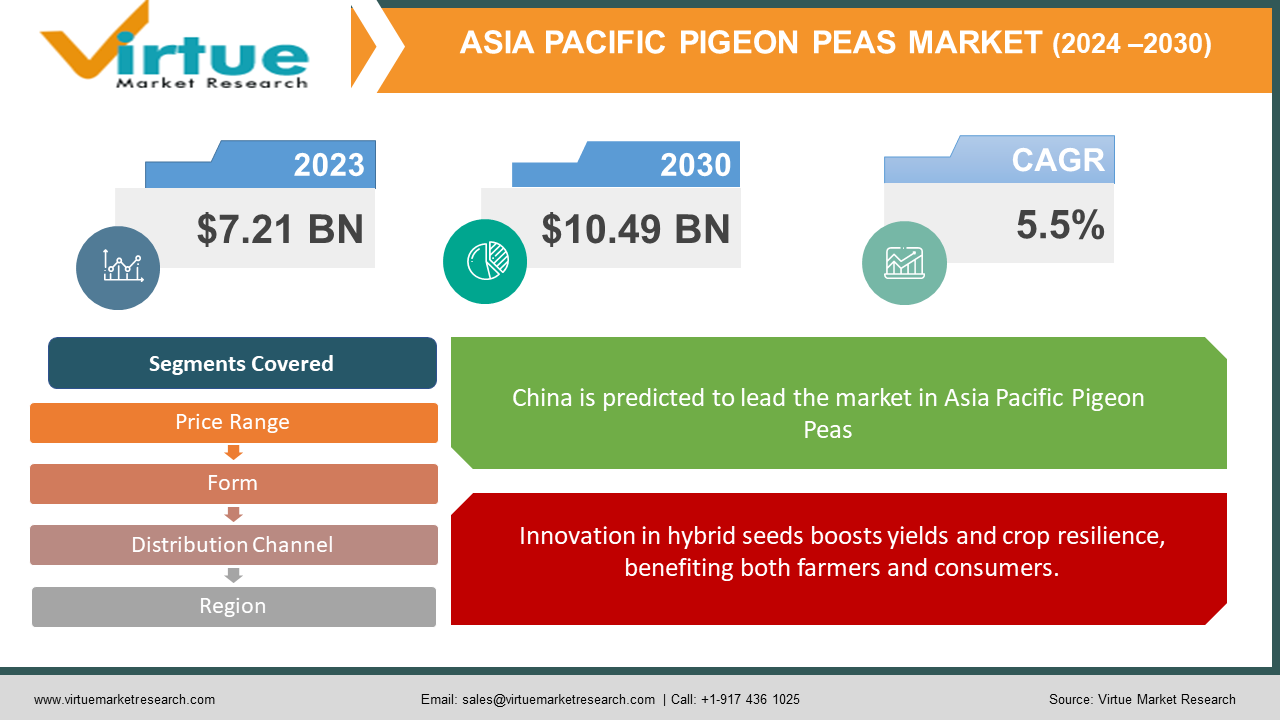

The Asia Pacific Pigeon Peas Market was valued at USD 7.21 billion in 2023 and is projected to reach a market size of USD 10.49 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.5%.

The Asia Pacific pigeon pea market is thriving, driven by several factors. Affordability, long shelf life, and advancements in seed technology are making pigeon peas an attractive crop. Consumers are also increasingly seeking out processed pigeon pea products like dals and flours, expanding the market. Improved production and distribution infrastructure are ensuring wider availability of these nutritious legumes.

Key Market Insights:

- The Asia Pacific pigeon pea market thrives on affordability and innovation. Pigeon peas offer a budget-friendly protein source with a long shelf life, lasting around a year. This makes them a valuable staple food, especially in regions with limited resources. Advancements in seed technology are also propelling the market forward. Hybrid seed production is estimated to boost yields by up to 20% while improving the crop's resilience to pests and diseases. This translates to higher profits for farmers and a more stable supply for consumers.

- Consumer preferences are another key driver. The region is experiencing a growing demand for convenience and variety in their food choices. This is reflected in the rising popularity of processed pigeon pea products like dals, flours, and snacks. The market for these convenient options is projected to grow by a promising 8% annually. This trend creates new opportunities for manufacturers and further expands the pigeon pea market.

The Asia Pacific Pigeon Peas Market Drivers:

Pigeon peas' budget-friendly protein and year-long storage make them a dependable food source.

Pigeon peas offer a double advantage for consumers. They are a budget-friendly source of plant-based protein, particularly valuable in regions with limited resources. Additionally, their extended shelf life of around a year translates to greater food security and reduced spoilage. This affordability and long storage life make pigeon peas a dependable staple food for many households in the Asia Pacific region.

Innovation in hybrid seeds boosts yields and crop resilience, benefiting both farmers and consumers.

Innovation in hybrid seed production is playing a transformative role in the pigeon pea market. These advancements are estimated to boost yields by up to 20%, leading to a more abundant harvest for farmers. Hybrid seeds also improve the crop's resilience to pests and diseases, reducing crop loss and ensuring a more stable supply for consumers. Ultimately, these advancements in seed technology benefit both farmers with higher profits and consumers with a more reliable source of this nutritious legume.

Growing demand for convenience fuels the rise of processed pigeon pea products like dals, flours, and snacks.

The Asia Pacific region is experiencing a significant shift in consumer preferences towards convenience and variety in their food choices. This trend is driving the rising popularity of processed pigeon pea products like dals, flours, and snacks. These convenient options cater to busy lifestyles and offer new ways to incorporate the nutritional benefits of pigeon peas into everyday meals. The market for these processed products is projected to grow by a promising 8% annually, reflecting the growing demand for convenience and innovation in the pigeon pea market.

Increased production capacity and better logistics ensure wider availability of pigeon peas throughout the region.

Increased production capacity and better logistical networks are playing a crucial role in expanding the reach of pigeon peas. By investing in infrastructure, the market is ensuring wider availability of these legumes throughout the region. This robust infrastructure acts as a bridge between farmers and consumers, allowing for a more efficient distribution system and ultimately driving the continued growth of the pigeon pea market.

India's leadership and contributions from Myanmar, Thailand, and Australia create a strong and growing market.

The Asia Pacific market benefits from the presence of strong regional players. India remains the undisputed leader, holding the top spot for the production, consumption, and import of pigeon peas. This leadership role fosters stability and growth in the market. Additionally, other countries like Myanmar, Thailand, and Australia are making significant contributions with their steadily increasing production of pigeon peas. This strong regional presence ensures a robust and growing market for pigeon peas in the Asia Pacific.

The Asia Pacific Pigeon Peas Market Restraints and Challenges:

The Asia Pacific pigeon pea market, though promising, faces a few challenges. Limited varietal diversity poses a risk, as dependence on a few dominant types makes the crop susceptible to widespread disease outbreaks. Additionally, a gap exists between potential and actual yields. This can be attributed to factors like inadequate farming practices and limited access to irrigation systems, hindering overall production. Price fluctuations further complicate matters for farmers, creating uncertainty and discouraging investment in pigeon pea cultivation.

The market for processed pigeon pea products like dals and flours also faces hurdles. A lack of adequate processing facilities, particularly in remote areas, restricts the development and wider availability of these convenient options. Finally, consumer awareness remains a work in progress. While knowledge about pigeon peas is on the rise, some consumers in the region might not be fully convinced of their versatility and the nutritional value they offer. Overcoming these challenges through investment in research for new varieties, improved farming techniques, and better infrastructure will be crucial for the sustained growth of the Asia Pacific pigeon pea market.

The Asia Pacific Pigeon Peas Market Opportunities:

The future of the Asia Pacific pigeon pea market is brimming with opportunities. Several trends are converging to create a perfect storm for growth. Rising urbanization, increasing disposable incomes, and a growing focus on health are all driving demand for protein-rich and nutritious foods, perfectly aligning with the benefits of pigeon peas. Innovation in processing holds immense potential. Developing exciting new products like ready-to-eat meals, innovative snacks, and fortified flour can attract entirely new consumer segments and expand the market's reach. Looking outwards, the global demand for plant-based proteins presents a lucrative export opportunity for Asia Pacific pigeon pea producers, particularly with a focus on organic and high-quality products. Investment in value-added products like pigeon pea protein isolates can tap into the growing demand for plant-based protein supplements, not just regionally but globally. Finally, promoting sustainable farming practices can attract environmentally conscious consumers and create a premium market segment for pigeon peas. By embracing technological advancements like precision farming and improved storage solutions, the market can further optimize yield, reduce spoilage, and elevate its overall efficiency.

ASIA-PACIFIC PIGEON PEAS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

|

Market Size Available |

2023 - 2030 |

|

|

Base Year |

2023 |

|

|

Forecast Period |

2024 - 2030 |

|

|

CAGR |

5.5% |

|

|

Segments Covered |

By Form, price range, Distribution Channel and Region |

|

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

|

Regional Scope |

|

|

|

Key Companies Profiled |

India, SYMAF Co Ltd, Sun Impex, Interamsa Agroindustrial SAC, A.B.agro Company, Arvind Limited, Taj Foods, Pulses Splitting & Processing Industry Pvt Ltd, Unitex Tanzania Limited |

The Asia Pacific Pigeon Peas Market Segmentation:

The Asia Pacific Pigeon Peas Market Segmentation: By Form

- Fresh

- Dried

- Frozen

- Canned

The dried pigeon peas segment dominates the Asia Pacific market due to their long shelf life and ease of storage, making them readily available throughout the region. However, the processed pigeon pea segment is experiencing the fastest growth. This is driven by the rising demand for convenience and innovative products like dals, flours, and snacks.

The Asia Pacific Pigeon Peas Market Segmentation: By Price Range

- Low

- Mid

- Premium

The dominant price range segment in the Asia Pacific Pigeon Peas Market is likely the "Mid" segment. This segment offers a balance between affordability and quality, making it suitable for everyday consumption by a large portion of the population. On the other hand, the fastest-growing segment is expected to be the "Premium" segment. This growth is driven by rising health consciousness and a growing preference for organic and specialty pigeon pea products.

The Asia Pacific Pigeon Peas Market Segmentation: By Distribution Channel

- Supermarkets and Hypermarkets

- Independent Grocery Stores

- E-commerce

- Other Distribution Channels

By distribution channel, traditional grocery stores likely hold the dominant position in the Asia Pacific pigeon pea market, catering to local communities and established buying habits. However, e-commerce is experiencing the fastest growth due to its convenience and ability to reach a wider audience, particularly in urban areas. This trend is expected to continue as internet penetration and online shopping become increasingly popular in the region.

The Asia Pacific Pigeon Peas Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

While not a major producer of pigeon peas, China presents a potential growth market. Driven by rising incomes and a growing health-conscious population, there's an increasing interest in plant-based protein sources. However, consumer awareness about pigeon peas remains relatively low, and import regulations might pose challenges.

Like China, pigeon peas are not a traditional part of the Japanese diet. However, there's a growing openness to new food experiences, and the nutritional benefits of pigeon peas could spark interest. The market is likely to focus on imported, high-quality, and possibly value-added products like pigeon pea protein isolates.

Following a similar trend to China and Japan, South Korea presents an emerging market for pigeon peas. The focus here would likely be on innovative and convenient processed products like snacks or fortified flours to cater to busy lifestyles. Educational campaigns about the health benefits of pigeon peas could be instrumental in driving consumer adoption.

The undisputed king of pigeon peas in Asia Pacific, India boasts the dominant position in terms of production, consumption, and import. Pigeon peas are a staple food in many regions, and the market offers a wide variety, from fresh to processed options. Continued innovation and a focus on organic and high-quality production can further solidify India's leadership in the market.

COVID-19 Impact Analysis on the Asia Pacific Pigeon Peas Market:

The COVID-19 pandemic's impact on the Asia Pacific pigeon pea market was a mixed bag. Lockdowns and movement restrictions disrupted the supply chain, causing temporary shortages and price fluctuations. Additionally, reduced demand from the food service industry due to restaurant closures impacted bulk purchases. Early concerns about affordability might have also put a damper on sales of higher-priced processed pigeon pea products.

However, the pandemic also presented some silver linings. The rise in home cooking during lockdowns likely boosted demand for pigeon peas as a household staple. Furthermore, heightened awareness of health and immunity during the pandemic could have benefitted pigeon peas due to their protein and nutrient content. The surge in e-commerce platforms provided a convenient way for consumers to purchase pigeon peas and related products, offering a new avenue for market growth.

Overall, while the pandemic brought initial challenges, the Asia Pacific pigeon pea market seems to be recovering. The long shelf life and affordability of pigeon peas likely helped mitigate some negative impacts. With a focus on innovation, expanding distribution channels, and capitalizing on growing health and wellness trends, the market is well-positioned for future success.

Latest Trends/ Developments:

The Asia Pacific pigeon pea market is buzzing with exciting developments. Consumers are increasingly seeking organic, high-quality pigeon peas, aligning with the growing focus on health and sustainable farming. This creates a prime opportunity for innovative plant-based products like protein isolates, flours, and meat alternatives made from pigeon peas. Busy lifestyles are fueling the demand for convenient options like pre-cooked meals, snacks, and microwaveable meals. E-commerce is booming, offering wider access for producers and consumers alike. Technology is also playing a role, with advancements in precision farming and storage solutions aiming to optimize yield, reduce waste, and boost overall market efficiency. Sustainability initiatives are gaining traction, attracting environmentally conscious consumers and potentially creating a premium market segment. Finally, producers are looking outwards, exploring export opportunities for organic and high-quality pigeon peas to capitalize on the global plant-based protein surge. These trends showcase the dynamic nature of the Asia Pacific pigeon pea market, well-positioned for continued growth and success by embracing innovation, sustainability, and adapting to evolving consumer preferences.

Key Players:

- India

- SYMAF Co Ltd

- Sun Impex

- Interamsa Agroindustrial SAC

- A.B.agro Company

- Arvind Limited

- Taj Foods

- Pulses Splitting & Processing Industry Pvt Ltd

- Unitex Tanzania Limited

Chapter 1. Asia Pacific Pigeon Peas Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Pigeon Peas Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Pigeon Peas Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Pigeon Peas Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Pigeon Peas Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Pigeon Peas Market– By Form

6.1. Introduction/Key Findings

6.2. Fresh

6.3. Dried

6.4. Frozen

6.5. Canned

6.6. Y-O-Y Growth trend Analysis By Form

6.7. Absolute $ Opportunity Analysis By Form , 2023-2030

Chapter 7. Asia Pacific Pigeon Peas Market– By Price Range

7.1. Introduction/Key Findings

7.2. Low

7.3. Mid

7.4. Premium

7.5. Y-O-Y Growth trend Analysis By Price Range

7.6. Absolute $ Opportunity Analysis By Price Range , 2023-2030

Chapter 8. Asia Pacific Pigeon Peas Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2 Supermarkets and Hypermarkets

8.3. Independent Grocery Stores

8.4. E-commerce

8.5. Other Distribution Channels

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. Asia Pacific Pigeon Peas Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.2.1. China

9.1.2.2. Japan

9.1.2.3. South Korea

9.1.2.4. India

9.1.2.5. Australia & New Zealand

9.1.2.6. Rest of Asia-Pacific

9.1.2. By Form

9.1.3. By Price Range

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Pigeon Peas Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 India

10.2. SYMAF Co Ltd

10.3. Sun Impex

10.4. Interamsa Agroindustrial SAC

10.5. A.B.agro Company

10.6. Arvind Limited

10.7. Taj Foods

10.8. Pulses Splitting & Processing Industry Pvt Ltd

10.9. Unitex Tanzania Limited

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia Pacific Pigeon Peas Market was valued at USD 7.21 billion in 2023 and is projected to reach a market size of USD 10.49 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.5%.

Affordability and Long Shelf Life, Seed Technology Advancements, Shifting Consumer Preferences, Improved Infrastructure, Regional Powerhouses

Supermarkets and Hypermarkets, Independent Grocery Stores, E-commerce, and Other Distribution Channels

India is the undisputed leader in the Asia Pacific Pigeon Peas Market, holding the top spot for production, consumption, and import of pigeon peas.

India, SYMAF Co Ltd, Sun Impex, Interamsa Agroindustrial SAC, A.B.agro Company, Arvind Limited, Taj Foods, Pulses Splitting & Processing Industry Pvt Ltd, Unitex Tanzania Limited