Asia-Pacific Phosphatic Fertilizers Market Size (2024-2030)

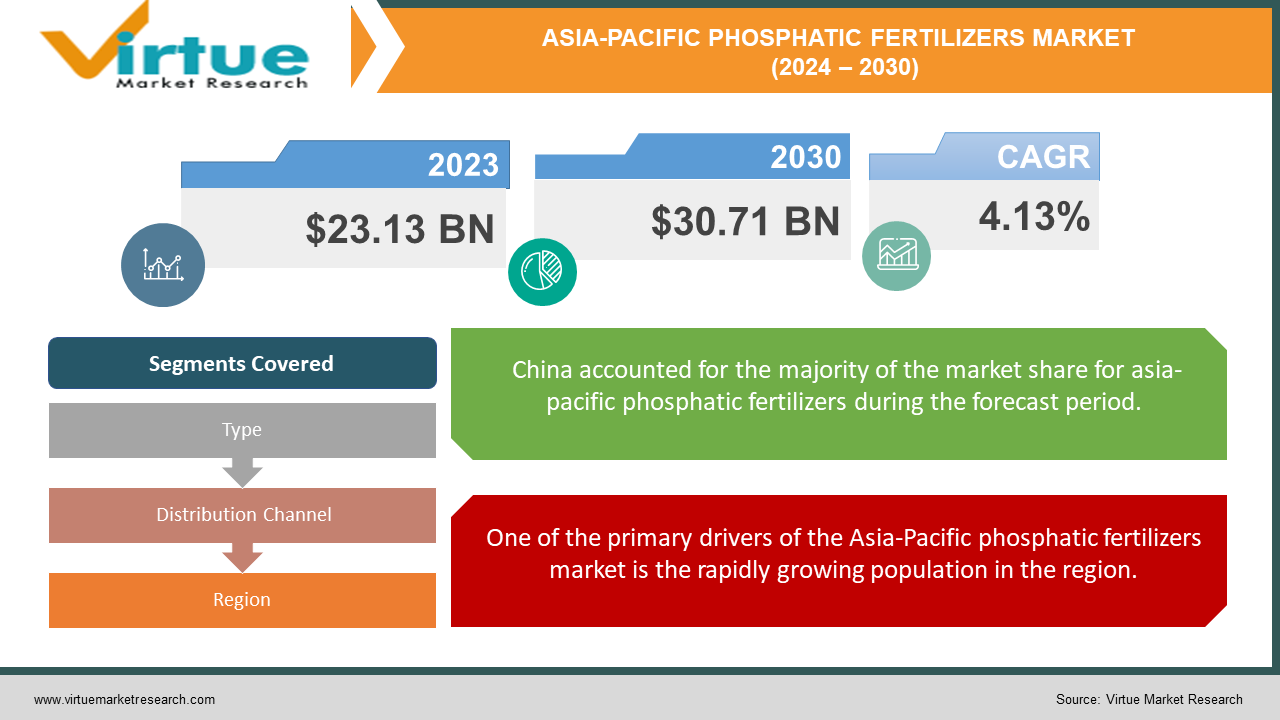

The Asia-Pacific Phosphatic Fertilizers Market was valued at USD 23.13 Billion in 2023 and is projected to reach a market size of USD 30.71 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.13%.

The Asia-Pacific region is witnessing a substantial rise in the demand for phosphatic fertilizers, driven by the growing agricultural needs of its diverse economies. Phosphatic fertilizers, crucial for the growth and development of plants, are rich in phosphorus, a vital nutrient that promotes root development, flowering, and seed production. The increasing population in countries like China, India, and Indonesia has amplified the need for enhanced agricultural productivity, further propelling the demand for phosphatic fertilizers. Agriculture is a pivotal sector in the Asia-Pacific region, supporting the livelihoods of millions and contributing significantly to the GDP of many countries. As traditional farming methods evolve to incorporate modern agricultural practices, the adoption of fertilizers has become more prevalent. The phosphatic fertilizers market in this region is characterized by a diverse range of products, including diammonium phosphate (DAP), monoammonium phosphate (MAP), and single superphosphate (SSP), each catering to specific crop requirements and soil conditions.

Key Market Insights:

In the Asia-Pacific area, diammonium phosphate (DAP) dominates with a market share of more than 74.47% because of its high concentration of easily obtainable phosphorus. Single Superphosphate (SSP), with a projected market value of 2.93 billion USD in 2024, also commands a sizeable portion of the market.

With an emphasis on nutrient efficiency, the market for slow-release phosphatic fertilizers is anticipated to expand at a promising CAGR of more than 8% shortly.

The market is anticipated to be impacted by the rising demand for organic food; in the Asia-Pacific area, biofertilizer sales are anticipated to reach a value of more than USD 2.4 billion by 2027.

Concerns about rock phosphate depletion are pushing for alternative sources, with the recycled phosphate market in the region anticipated to reach USD 1.7 billion by 2025.

With a growing population and rising food security concerns, Southeast Asian nations like Vietnam and Thailand are expected to witness a CAGR of over 6% in their phosphatic fertilizer markets by 2030.

Precision farming practices utilizing soil testing are projected to see a significant rise, with an estimated 25% of farms in developed Asian economies adopting these methods by 2027.

Government subsidies for fertilizers play a major role, with India allocating an estimated USD 12.6 billion in fertilizer subsidies in the 2023-2024 fiscal year.

However, concerns exist regarding subsidy-driven over-fertilization. Studies suggest that over 30% of applied fertilizers in some Asian regions are wasted due to inefficient application practices. To address this, regulations promoting soil testing and balanced fertilization are being implemented. In China, for instance, mandatory soil testing programs cover over 70% of cultivated land.

Asia-Pacific Phosphatic Fertilizers Market Drivers:

One of the primary drivers of the Asia-Pacific phosphatic fertilizers market is the rapidly growing population in the region.

Arable land is disappearing as urbanization grows, which increases pressure on the agriculture industry to produce more food on less land. Due to this situation, agricultural techniques have gotten more intensive and fertilizer use is now necessary. For crops like grains, fruits, and vegetables—which are staples in the diets of the people in the Asia-Pacific region—phosphorus fertilizers are especially important. In addition, the region's shifting dietary habits and growing disposable incomes are driving up demand for a wide range of food items. This change is increasing the demand for phosphatic fertilizers by creating a need for a wider variety of agricultural products. Modern agricultural practices and farmers' increasing knowledge of the advantages of balanced fertilization are also factors.

Government policies and initiatives play a significant role in the growth of the phosphatic fertilizers market in the Asia-Pacific region.

Governments around the area are putting different policies in place to promote the agricultural sector because they understand how important agriculture is to both economic stability and food security. These programs include investments in rural infrastructure, financial support for farmers, and fertilizer subsidies. For example, phosphatic fertilizers are subsidized by several governments to lower their cost for farmers. These subsidies support farmers in using fertilizers to increase crop output and lessen their financial burden. Governments are also encouraging balanced fertilizing techniques to minimize nutrient imbalances and enhance soil health. By ensuring that crops receive the proper quantity of nutrients, these methods promote sustainable agriculture practices and higher yields.

Asia-Pacific Phosphatic Fertilizers Market Restraints and Challenges:

The environmental effect of fertilizer use is one of the major difficulties facing the Asia-Pacific phosphatic fertilizers industry. Overuse of phosphatic fertilizers can cause ecological disturbance, water pollution, and soil deterioration. Fertilizers containing too much phosphorus can contaminate water bodies by generating eutrophication, which encourages the growth of algae and eventually depletes the oxygen content of the water. The algal bloom phenomena have the potential to destroy aquatic life and lower water quality. The price volatility of raw materials has an impact on the market for phosphatic fertilizers as well. Phosphatic fertilizers are mostly made from phosphate rock, which is subject to price and availability fluctuations based on several factors including market demand, mining laws, and geopolitical concerns. Furthermore, energy-intensive procedures are used in the creation of phosphatic fertilizers, and energy costs might differ greatly. The whole cost of producing fertilizer can be impacted by changes in the price of electricity, natural gas, and other energy sources, which can increase market volatility. The ongoing use of chemical fertilizers can result in the loss of vital soil nutrients and microbial activity, which raises concerns about the health of the soil. Over time, this may lead to decreased soil fertility and production. To lessen these negative consequences, farmers must implement balanced fertilization and sustainable farming methods.

Asia-Pacific Phosphatic Fertilizers Market Opportunities:

The Asia-Pacific phosphatic fertilizers market has a lot of potential due to technological developments in agriculture. Fertilizer management and application are being revolutionized by technology such as remote sensing, soil testing, and precision farming. With the use of these technologies, farmers can apply fertilizer more effectively, cutting down on waste and increasing crop yields. GPS, sensors, and data analytics are used in precision farming approaches to track and control field variability. Farmers may maximize the use of phosphatic fertilizers, improve nutrient absorption, and reduce environmental effects by accurately applying fertilizers depending on soil nutrient levels and crop requirements. This lowers farmers' fertilizer costs while also increasing crop yield. The market for phosphatic fertilizers has a lot of potential due to the expanding trend of organic farming in the Asia-Pacific area. The market for organic food items is growing as customers become more environmentally concerned and health sensitive. To preserve soil fertility and advance sustainable agriculture, organic farming techniques place a strong emphasis on the use of natural fertilizers, such as compost, manure, and organic phosphatic fertilizers.

ASIA-PACIFIC PHOSPHATIC FERTILIZERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

4.13% |

||

|

Segments Covered |

By Type, Distribution Channel and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Sinochem Corporation (China), Yara International ASA (Norway), The Mosaic Company (US), Euro Chem Group (Switzerland), Israel Chemicals Limited (Israel), Indian Farmers Fertilizer Cooperative Limited (IFFCO) (India), Krishak Bharati Cooperative Limited (KRIBHCO) (India), CF Industries Holdings, Inc. (US), PJSC PhosAgro (Russia), OCP Group (Morocco) |

Asia-Pacific Phosphatic Fertilizers Market Segmentation:

Asia-Pacific Phosphatic Fertilizers Market Segmentation: By Types:

- Diammonium phosphate (DAP)

- Monoammonium phosphate (MAP)

- Single superphosphate (SSP)

Diammonium Phosphate (DAP) is the most dominant sub-type in the phosphatic fertilizers market, accounting for the largest market share. DAP is widely used due to its high solubility, ease of application, and ability to provide a balanced supply of phosphorous and nitrogen to plants. It is suitable for a variety of crops, including cereals, fruits, vegetables, and oilseeds. The dominance of DAP can be attributed to its effectiveness in improving crop yields and its widespread availability in the market.

Monoammonium Phosphate (MAP) is expected to be the fastest-growing sub-type in the phosphatic fertilizers market. The demand for MAP is driven by its high nutrient content, versatility, and suitability for a wide range of crops. MAP is particularly effective in soils with low pH levels, as it provides both phosphorous and nitrogen in a readily available form. The increasing adoption of precision farming practices and the growing focus on optimizing nutrient use efficiency are expected to drive the demand for MAP in the Asia-Pacific region.

Asia-Pacific Phosphatic Fertilizers Market Segmentation: By Distribution Channel:

- Direct Sales

- Online Platforms

- Retail stores

In the Asia-Pacific area, retail establishments hold a prevailing position in the distribution chain for phosphatic fertilizers. Retail establishments give farmers a more individualized presence and advice based on their unique requirements. They serve a broad spectrum of clients, including small and medium-sized farms, and make fertilizers easily accessible in both urban and rural locations. Retail stores are dominant because they have a well-established presence, are trusted by farmers, and provide a wide range of goods and services.

It is anticipated that the fastest-growing distribution route for phosphatic fertilizers would be online sales. The trend toward online shopping is being driven by the expansion of e-commerce platforms' popularity and the internet's penetration rate. Online sales channels are a desirable alternative for farmers because they provide ease of use, low prices, and access to a large variety of items. Farmers are looking for contactless purchasing solutions, which has further expedited the development of online sales due to the COVID-19 epidemic.

Asia-Pacific Phosphatic Fertilizers Market Segmentation: Regional Analysis:

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific

With about 40% of the market for phosphatic fertilizers in the Asia-Pacific region, China has the biggest share. One major factor contributing to China's dominance in the phosphatic fertilizers industry is the country's extensive agricultural sector. With one of the greatest agricultural areas in the world, the nation needs a lot of fertilizer to keep the soil fertile and increase crop yields. China's main crops include soybeans, rice, wheat, corn, and maize; phosphatic fertilizers are very beneficial to all of these crops.

With a 30% market share, India is the Asia-Pacific region's fastest-growing market for phosphatic fertilizers. The core of the Indian economy is agriculture, which employs a sizable section of the workforce and significantly boosts GDP. The demand for phosphatic fertilizers is primarily driven by the desire to increase agricultural output to feed the world's expanding population. India's main crops—rice, wheat, sugarcane, and cotton—rely significantly on fertilizers to grow and yield at their best.

COVID-19 Impact Analysis on the Asia-Pacific Phosphatic Fertilizers Market:

Before the pandemic, the APAC phosphatic fertilizer market was on a steady growth trajectory. Factors like rising populations, increasing disposable incomes, and a growing emphasis on food security fueled the demand for fertilizers. Additionally, government initiatives promoting agricultural modernization and improved farming practices further bolstered the market. Lockdowns and movement restrictions hampered the movement of raw materials and finished fertilizers, leading to shortages and price fluctuations. Farm labor shortages due to travel restrictions and health concerns impacted fertilizer application and crop yields, creating a domino effect on demand. The pandemic highlighted the vulnerability of relying solely on imports. Countries like India are exploring options to increase domestic rock phosphate production to lessen dependence on foreign suppliers. With a focus on optimizing resource utilization, precision farming techniques that involve targeted fertilizer application based on soil testing are gaining ground. This not only reduces fertilizer waste but also enhances crop yields.

Latest Trends/ Developments:

Although China, India, and Indonesia have a dominant position in the industry, countries in Southeast Asia such as Vietnam, Thailand, and the Philippines are showing signs of encouraging development. Rising disposable incomes, urbanization, and the expansion of the middle class in these nations are driving up demand for meat and dairy products, which in turn drives up demand for animal feed and, ultimately, phosphatic fertilizers for the manufacture of feedstock. The challenge for the Asia-Pacific area is to maximize agricultural productivity while reducing its negative environmental effects. Targeted fertilizer application and soil testing are two increasingly popular precision farming techniques. This method guarantees that crops receive the appropriate quantity of phosphorus required for healthy growth while optimizing fertilizer use and minimizing waste. Rock phosphate is a finite resource, and concerns regarding its long-term availability are driving the exploration of alternative phosphate sources like wastewater treatment sludge and animal manure.

Key Players:

- Sinochem Corporation (China)

- Yara International ASA (Norway)

- The Mosaic Company (US)

- Euro Chem Group (Switzerland)

- Israel Chemicals Limited (Israel)

- Indian Farmers Fertilizer Cooperative Limited (IFFCO) (India)

- Krishak Bharati Cooperative Limited (KRIBHCO) (India)

- CF Industries Holdings, Inc. (US)

- PJSC PhosAgro (Russia)

- OCP Group (Morocco)

Chapter 1. Asia-Pacific Phosphatic Fertilizers Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific Phosphatic Fertilizers Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific Phosphatic Fertilizers Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Phosphatic Fertilizers Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific Phosphatic Fertilizers Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Phosphatic Fertilizers Market– By Types

6.1. Introduction/Key Findings

6.2. Diammonium phosphate (DAP)

6.3. Monoammonium phosphate (MAP)

6.4. Single superphosphate (SSP)

6.5. Y-O-Y Growth trend Analysis By Types

6.6. Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Asia-Pacific Phosphatic Fertilizers Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Direct Sales

7.3. Online Platforms

7.4. Retail stores

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Asia-Pacific Phosphatic Fertilizers Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Types

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia-Pacific Phosphatic Fertilizers Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Sinochem Corporation (China)

9.2. Yara International ASA (Norway)

9.3. The Mosaic Company (US)

9.4. Euro Chem Group (Switzerland)

9.5. Israel Chemicals Limited (Israel)

9.6. Indian Farmers Fertilizer Cooperative Limited (IFFCO) (India)

9.7. Krishak Bharati Cooperative Limited (KRIBHCO) (India)

9.8. CF Industries Holdings, Inc. (US)

9.9. PJSC PhosAgro (Russia)

9.10. OCP Group (Morocco)

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia-Pacific Phosphatic Fertilizers Market was valued at USD 23.13 Billion in 2023 and is projected to reach a market size of USD 30.71 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.13%.

Subsidies and a lack of awareness can lead to excessive fertilizer application, exceeding crop requirements. This not only wastes resources but also contributes to environmental problems such as water pollution due to fertilizer runoff.

Sinochem Corporation (China), Yara International ASA (Norway), The Mosaic Company (US), Euro Chem Group (Switzerland), Israel Chemicals Limited (Israel), Indian Farmers Fertilizer Cooperative Limited (IFFCO) (India), Krishak Bharati Cooperative Limited (KRIBHCO) (India), CF Industries Holdings, Inc. (US), PJSC PhosAgro (Russia).

With about 40% of the market for phosphatic fertilizers in the Asia-Pacific region, China has the biggest share.

With a 30% market share, India is the Asia-Pacific region's fastest-growing market for phosphatic fertilizers.