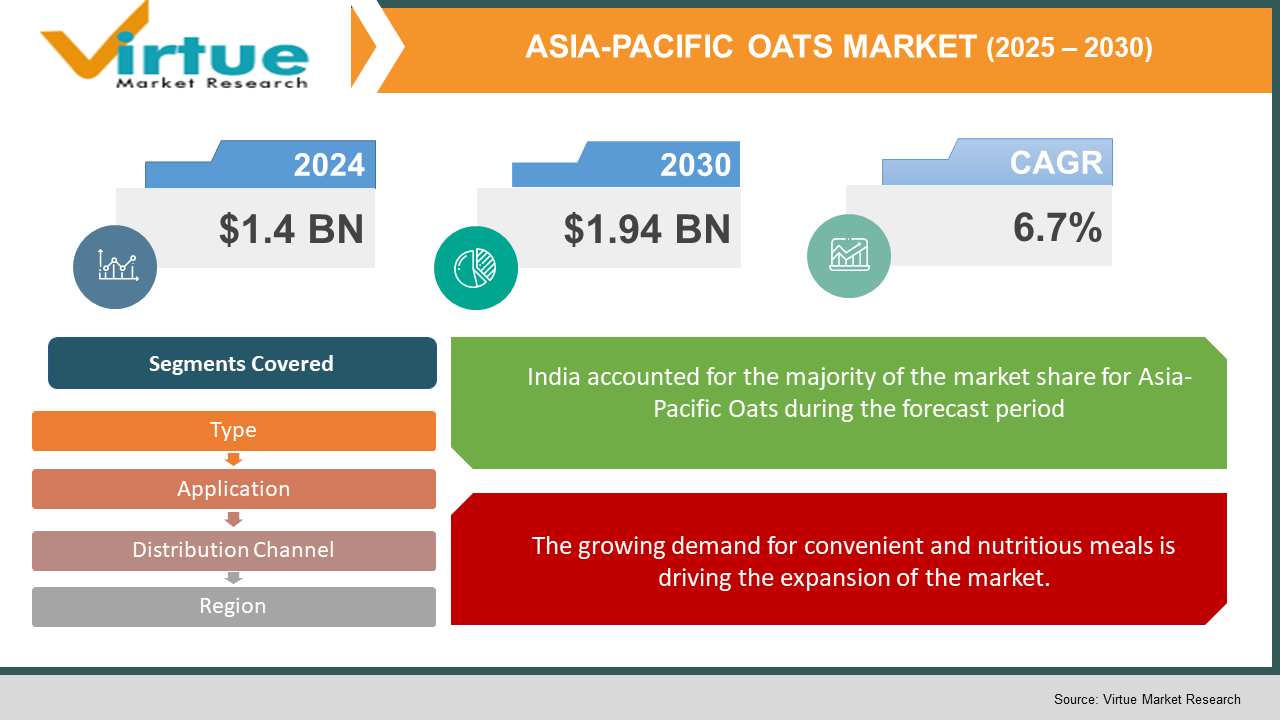

Asia-Pacific Oats Market Size (2025-2030)

The Asia-Pacific Oats Market was valued at USD 1.4 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 1.94 billion by 2030, growing at a CAGR of 6.7%.

Oats are a type of cereal cultivated in temperate climates, making them an ideal option for individuals with celiac disease or gluten sensitivity. These grains are packed with vital vitamins, dietary fiber, minerals, and antioxidant-rich plant compounds. Oats are commonly incorporated into a variety of breakfast cereals, snacks, and baked goods, including cakes, cookies, and bread. Additionally, they are valued for their ability to retain moisture, enhance flavor, and improve the overall nutritional profile of food products.

Key Market Insights:

- The Asia Pacific gluten-free oats market is mainly fueled by the increasing prevalence of celiac disease and gluten intolerance.

- In addition, the growing awareness about health and the rising demand for nutritious, high-quality food options are encouraging individuals to choose gluten-free products to prevent potential complications associated with gluten consumption.

- Gluten-free oats are also favored in healthy diets due to their low calorie content and favorable glycemic index, which supports effective weight management. Moreover, with the fast-paced nature of modern lifestyles, consumers are increasingly opting for convenient and nutritious breakfast choices, such as gluten-free oats, thereby significantly driving market growth.

Asia-Pacific Oats Market Drivers:

The growing demand for convenient and nutritious meals is driving the expansion of the market.

The oats market is experiencing significant growth, driven by increasing health awareness and the rising demand for convenient, nutritious meal options. Consumers are increasingly turning to oats for their high fiber, protein, and beta-glucan content, which promote heart health, weight management, and improved digestion. Innovations such as flavored oats, instant oats, and oat-based snacks like granola bars and oat milk are gaining popularity. The market is also seeing a shift towards clean-label and organic oats to cater to the growing preference for natural and sustainable products. Gluten-free oats are in high demand among consumers with dietary restrictions. Additionally, the trend of fortified oats, enriched with added vitamins, minerals, and superfoods, is gaining traction. The expansion of emerging markets in the Asia-Pacific region, along with the rise of plant-based diets, is further fueling the growth of the oats market.

Asia-Pacific Oats Market Restraints and Challenges:

Cultural preferences and dietary habits may hinder the growth of the market.

Cultural preferences play a significant role in shaping food choices, and oats are not considered a staple in many regions, limiting their market potential in those areas. In cultures where grain like rice, wheat, or corn are the primary dietary staples, oats are not commonly consumed or incorporated into traditional dishes. For instance, in many Asian and Latin American countries, rice is the preferred source of carbohydrates, while wheat predominates in parts of Europe and the Middle East. As a result, oats may struggle to gain widespread popularity, particularly if local culinary traditions do not support oat-based products. Additionally, traditional recipes in these regions often focus on more familiar grains, making oats seem unfamiliar or inconvenient. To overcome these cultural barriers, it is essential to implement awareness campaigns, adapt products to local preferences, and carry out targeted marketing efforts to position oats as a versatile and viable alternative for consumers in these markets.

Asia-Pacific Oats Market Opportunities:

The growing consumer demand for healthier and more nutritious meal options presents a significant opportunity in the market.

The global oats market presents significant growth potential in the future, driven by the increasing consumer demand for healthier, nutritious food alternatives. Oats are gaining popularity due to their numerous health benefits, including being a rich source of fiber, antioxidants, and heart-healthy nutrients. As plant-based diets and convenience eating trends rise, oats are being incorporated into a wide range of products, such as breakfast cereals, snacks, and plant-based beverages. Moreover, innovations in flavored oats, functional ingredients, and ready-to-eat foods provide new opportunities for market expansion. The growing awareness of oats' benefits for weight management and gut health further enhances the market's growth potential.

ASIA-PACIFIC OATS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Type, application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

APAC, |

|

Key Companies Profiled |

General Mills, Inc., B&G Foods, Inc. and Thrive Market, Inc. |

Asia-Pacific Oats Market Segmentation:

Asia-Pacific Oats Market Segmentation By Type:

- Whole Oats

- Rolled Oats

- Steel Cut

- Instant Oats

- Others

Rolled oats have captured the largest revenue share in the market, owing to their versatility and convenience. They are simple to prepare and can be incorporated into a wide range of food products, including breakfast cereals, baked goods, and snacks. With a quicker cooking time compared to steel-cut oats, rolled oats are a preferred option for consumers seeking nutritious, easy-to-make meals. Additionally, rolled oats maintain much of the nutritional value of whole oats while offering a more desirable texture, making them appealing to a wide consumer audience.

Steel-cut oats are expected to experience significant market growth as consumers become more aware of their health benefits. Being minimally processed, steel-cut oats preserve more of their natural nutrients and fiber compared to other oat varieties. As health-conscious consumers increasingly opt for whole, less-processed foods, steel-cut oats are gaining popularity. Their hearty texture and rich, nutty flavor also cater to those seeking a more substantial and satisfying meal.

Asia-Pacific Oats Market Segmentation By Application:

- Food & Beverage

- Personal Care and Cosmetics

- Animal Feed

- Others

Animal feed holds the largest revenue share in the oats market, driven by the high nutritional value of oats for livestock. Rich in essential nutrients and fiber, oats are an excellent feed ingredient for horses, poultry, and other animals. They are also relatively easy to cultivate and harvest, offering farmers a cost-effective and nutritious feed option. The strong demand from the agricultural sector, where oats are widely used in animal feed, ensures a consistent market.

The food and beverage sector is expected to experience significant growth, fueled by the rising demand for healthy and natural food products. As consumers become more health-conscious, the popularity of oats in products such as breakfast cereals, snacks, baked goods, and oat-based beverages continues to increase. Innovations in oat-based items, including oat milk and gluten-free oat snacks, are broadening their market appeal. Additionally, the growing trend toward plant-based and sustainable food options further supports growth in this sector. The versatility of oats across various food applications and their well-recognized health benefits are driving the rapid expansion of the food and beverage market.

Asia-Pacific Oats Market Segmentation By Distribution Channel:

-

Offline

-

Retailers

-

Distributors

-

Online

-

Direct-to-Consumer

Supermarkets and hypermarkets hold a significant share of the market, as they provide a wide range of oat products under one roof, offering consumers both convenience and variety. These large retail outlets benefit from extensive distribution networks and the ability to purchase in bulk, often resulting in competitive pricing for consumers. The availability of multiple oat brands and types in supermarkets and hypermarkets appeals to a diverse customer base, from budget-conscious buyers to those seeking premium health-focused products. Their prominent shelf space and regular promotional activities further reinforce their dominant position in the oats market.

Online channels are expected to experience the highest compound annual growth rate (CAGR), driven by the increasing trend of e-commerce and the growing consumer preference for the convenience of online shopping. The COVID-19 pandemic accelerated the shift toward digital platforms, with more consumers opting to purchase groceries and health foods online. Online retailers offer a broader selection of products, easy price comparisons, and the convenience of home delivery, making them particularly appealing to busy consumers. Additionally, the ability to access customer reviews and detailed product information online boosts consumer confidence and satisfaction, further propelling the growth of online oat sales.

Asia-Pacific Oats Market Segmentation- by Region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific (APAC)

The Asia Pacific region is expected to experience significant growth during the forecast period, driven by the increasing demand for plant-based protein alternatives. With a growing population and rising incomes, there is an increasing need for sustainable and environmentally friendly protein-rich food options. Oats, being a versatile ingredient, are finding applications in various plant-based products, including oat milk, oat-based meat alternatives, and oat-based snacks.

China stands as the largest producer of oats in the Asia Pacific region, supported by its large population, mass production capabilities, expanding food industry, globalization, major industry players, high demand, widespread farming practices, and the integration of oats into local diets. India is one of the fastest-growing markets in the region, spurred by recent health trends, a large population, emerging innovative startups, a diversification of flavors, collaborations, lifestyle changes, urbanization, dual-income households, increasing demand for health-conscious products, and a rising prevalence of chronic diseases. Additionally, the growing popularity of dairy alternatives, such as oat milk, is further driving market growth. India is projected to hold a market share of approximately 22%. Japan is also experiencing rapid growth due to increased health consciousness and the adoption of oat-based products.

The oats market in India is anticipated to grow steadily in the coming years. As more Indians adopt healthier lifestyles, oats are being incorporated into traditional diets due to their high fiber, protein, and nutrient content. The rise in disposable income and the expansion of the middle class further support oats consumption, especially in urban areas where time-strapped consumers seek convenient and nutritious breakfast options. Additionally, the proliferation of modern retail channels and e-commerce platforms has improved the accessibility and availability of a wide variety of oat products, contributing to market expansion.

COVID-19 Pandemic: Impact Analysis

The imposition of lockdowns, movement restrictions, and social isolation led to significant disruptions in supply chains, transportation, and logistics, affecting the import-export trade. Manufacturing units and companies were forced to close, resulting in delays in operations.

However, amidst these challenges, there was a shift towards healthier food options and home-cooked meals. Oats emerged as a convenient food choice due to their ease of preparation, and their nutritional benefits further contributed to their rising popularity.

Additionally, the pandemic saw a surge in the popularity of veganism, with sales of dairy alternatives increasing by more than 300%, including oat milk, which became widely accepted. In the latter half of the pandemic, particularly in 2021, there was a notable rise in online activity related to oat-based foods and beverages, further boosting market growth.

Latest Trends/ Developments:

In April 2023, Tirlán expanded its oat product range by introducing Organic Oat-Standing Functional Oat Flour. This flour is produced using organic oats grown in Ireland without the use of synthetic pesticides, herbicides, or fertilizers. It offers consistent viscosity during both heating and cooling processes, delivering functional benefits such as clean labeling, whole grain advantages, and a distinctive oaty flavor. This flour helps manufacturers meet the increasing demand for organic and natural oat products while enhancing the taste and texture of plant-based food and beverages, particularly in dairy alternative applications.

In June 2023, SunOpta and Seven Sundays collaborated to launch a new cereal made with upcycled oat protein powder. The Oat Protein Cereal is crafted with SunOpta's OatGold, a byproduct of oat milk production. This partnership aims to reduce food waste and provide a sustainable solution for oat protein powder. The cereal, which is available in four flavors, is both gluten-free and Non-GMO Project Verified. It can be found at major retailers nationwide and ordered directly from the Seven Sundays website.

In November 2023, Quaker, the official oatmeal sponsor of the NFL, joined forces with NFL Legend Eli Manning and chef Carla Hall to promote food security for children. The initiative, called the Quaker Pregrain Tour, features a tailgate truck visiting select NFL stadiums and a digital Quaker Playbook offering 32 team-inspired recipes. Quaker, part of PepsiCo, offers a variety of products, including Quaker Oats and Quaker Chewy Granola Bars, while GENYOUth focuses on promoting youth health and wellness.

Key Players:

These are top 10 players in the Asia-Pacific Oats Market :-

- Bob’s Red Mill Natural Foods, Inc.

- PepsiCo, Inc. (The Quaker Oats Company)

- General Mills, Inc.

- B&G Foods, Inc.

- Thrive Market, Inc.

- Glebe Farm Foods Limited

- Cargill, Incorporated Purely

- Elizabeth, LLC

- Bakery On Main

- Nature’s Path Foods, Inc.

Chapter 1. Asia-Pacific Oats Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific Oats Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific Oats Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Application Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Oats Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Asia-Pacific Oats Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Oats Market – By Type

6.1 Introduction/Key Findings

6.2 Whole Oats

6.3 Rolled Oats

6.4 Steel Cut

6.5 Instant Oats

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Asia-Pacific Oats Market – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverage

7.3 Personal Care and Cosmetics

7.4 Animal Feed

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Asia-Pacific Oats Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Offline

8.3 Retailers

8.4 Distributors

8.5 Online

8.6 Direct-to-Consumer

8.7 Y-O-Y Growth trend Analysis Distribution Channel

8.8 Absolute $ Opportunity Analysis Distribution Channel , 2025-2030

Chapter 9. Asia-Pacific Oats Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Application

9.3.3. By End-Use Industry

9.3.4. By Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia-Pacific Oats Market – Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

10.1 Bob’s Red Mill Natural Foods, Inc.

10.2 PepsiCo, Inc. (The Quaker Oats Company)

10.3 General Mills, Inc.

10.4 B&G Foods, Inc.

10.5 Thrive Market, Inc.

10.6 Glebe Farm Foods Limited

10.7 Cargill, Incorporated

10.8 Purely Elizabeth, LLC

10.9 Bakery On Main

10.10 Nature’s Path Foods, Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia Pacific gluten-free oats market is mainly fueled by the increasing prevalence of celiac disease and gluten intolerance.

The top players operating in the Asia-Pacific Oats Market are - General Mills, Inc., B&G Foods, Inc. and Thrive Market, Inc.

The imposition of lockdowns, movement restrictions, and social isolation led to significant disruptions in supply chains, transportation, and logistics, affecting the import-export trade.

The global oats market presents significant growth potential in the future, driven by the increasing consumer demand for healthier, nutritious food alternatives.

India is the fastest-growing region in the Asia-Pacific Oats Market.